Term coverage life insurance is a type of life insurance that provides financial protection for a specific period, known as the term. It is a straightforward and cost-effective way to secure coverage for a predetermined duration, typically ranging from 10 to 30 years. This insurance policy offers a death benefit if the insured individual passes away during the term, ensuring financial security for beneficiaries. Unlike permanent life insurance, term coverage is designed to meet short-term needs, such as covering mortgage payments, providing education funds, or supporting a family during a specific life stage. It is a popular choice for individuals seeking affordable coverage with the flexibility to adjust as their needs change over time.

What You'll Learn

- Definition: Term coverage life insurance provides protection for a specific period

- Cost: Premiums are typically lower than permanent life insurance

- Duration: Policies last for a set term, e.g., 10, 20, or 30 years

- Benefits: Offers financial security during the term if the insured dies

- Renewal: May be renewable or convertible to permanent coverage

Definition: Term coverage life insurance provides protection for a specific period

Term coverage life insurance is a type of life insurance that offers financial protection for a predetermined period, known as the "term." This insurance is designed to provide coverage for a specific duration, such as 10, 20, or 30 years, and it becomes inactive once the term ends. During the term, the policyholder pays regular premiums to the insurance company, and in return, the insurer promises to pay a death benefit to the policyholder's beneficiaries if the insured individual passes away during that term.

The key feature of term coverage is its simplicity and affordability. It is a straightforward insurance product that focuses solely on providing coverage for a defined period. Unlike permanent life insurance, which offers lifelong coverage, term insurance is a more cost-effective option for individuals who need protection for a specific time frame, such as covering mortgage payments, providing for children's education, or ensuring financial stability during a particular phase of life.

When purchasing term coverage, the policyholder selects the term length that aligns with their needs. For example, a young professional buying their first home might opt for a 20-year term to ensure mortgage protection. As the term progresses, the individual can reassess their insurance needs and decide whether to continue the policy, convert it to a permanent plan, or allow it to lapse.

One of the advantages of term coverage is its predictability. The premiums remain consistent throughout the term, making it easier for policyholders to budget and plan their finances. Additionally, term insurance typically has no cash value accumulation, which means the policyholder doesn't build up a savings component within the policy. This feature makes term insurance more affordable compared to permanent life insurance policies with cash value.

In summary, term coverage life insurance provides a focused and cost-effective solution for individuals seeking protection for a specific period. It offers a straightforward approach to life insurance, allowing policyholders to manage their finances effectively while ensuring their loved ones are financially secure during the chosen term. Understanding the term length and its implications is crucial for making informed decisions about life insurance coverage.

Life Insurance: Understanding Accumulated Value and Its Benefits

You may want to see also

Cost: Premiums are typically lower than permanent life insurance

Term coverage life insurance is a type of life insurance that provides coverage for a specific period, or "term," typically ranging from 10 to 30 years. One of the key advantages of this type of insurance is its cost-effectiveness compared to permanent life insurance.

The lower premiums of term coverage life insurance are primarily due to the limited duration of the policy. Since the coverage is only valid for a specific term, the insurance company takes on a lower risk compared to permanent life insurance, where coverage remains in force for the entire life of the insured individual. With term life insurance, the risk is contained within the specified period, allowing the insurer to offer more competitive rates.

When considering the cost, it's essential to understand that term life insurance is designed to provide coverage for a particular need or goal. For example, it might be used to cover mortgage payments, provide financial security for children's education, or ensure a certain level of income replacement during a specific period. By aligning the policy term with these specific needs, individuals can often find more affordable premiums.

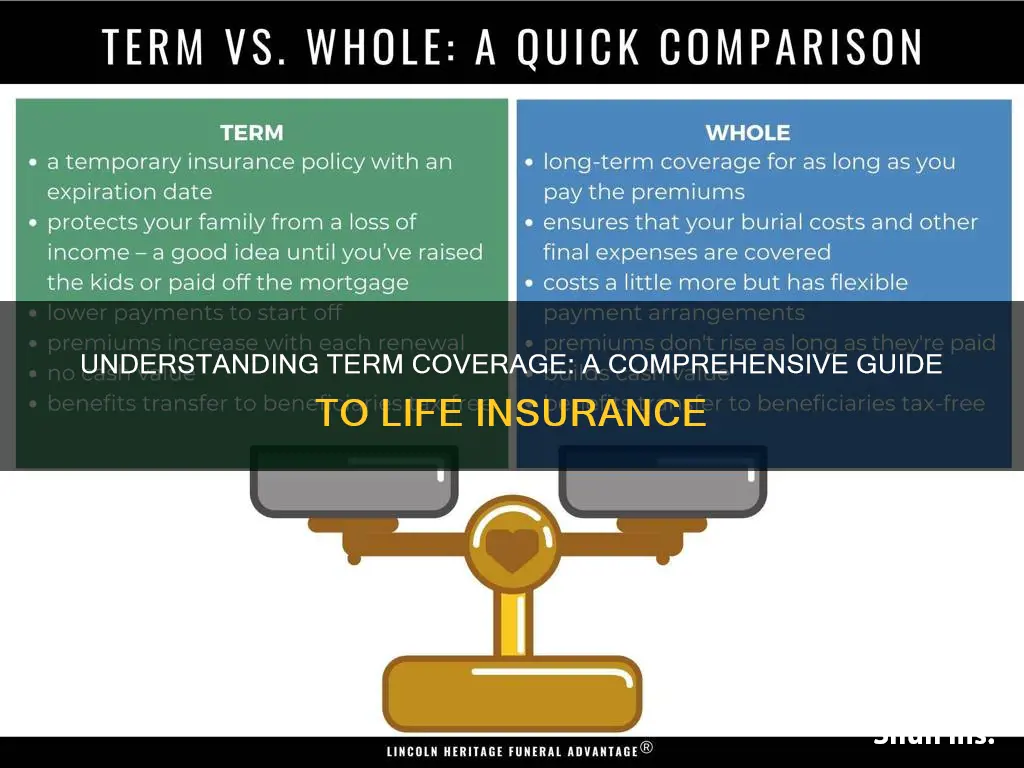

In contrast, permanent life insurance, such as whole life or universal life, offers lifelong coverage and includes an investment component. While this provides long-term security, it also results in higher premiums due to the extended coverage period and the accumulation of cash value over time. The investment aspect of permanent life insurance can be beneficial for those seeking long-term financial growth, but it comes at a higher cost.

Term coverage life insurance is an excellent option for individuals who want affordable coverage for a defined period without the long-term financial commitment of permanent life insurance. By understanding the relationship between the term length and premium costs, individuals can make informed decisions about their insurance needs and find the most suitable and cost-effective solution.

Life Insurance: Asset or Liability?

You may want to see also

Duration: Policies last for a set term, e.g., 10, 20, or 30 years

Term coverage life insurance is a type of life insurance that provides financial protection for a specific period, known as the "term." This term can vary, typically lasting for 10, 20, or 30 years, and it is a straightforward and cost-effective way to secure your loved ones' financial future during a defined period. During this term, the policyholder (the person who takes out the insurance) pays a fixed premium to the insurance company, and in return, the insurer promises to pay a death benefit to the policyholder's beneficiaries if the insured individual passes away during that term.

The beauty of term coverage lies in its simplicity and predictability. Since the policy has a set duration, the premium payments are also fixed, making it easier for individuals to plan and budget. For example, if someone purchases a 20-year term life insurance policy, they will pay the same premium amount every month or year for the entire 20 years, ensuring financial stability for their family during that time. This predictability is particularly attractive to those who want to provide long-term financial security without the complexity of permanent life insurance.

One of the key advantages of term coverage is its affordability. Because the policy is only in force for a specific period, the insurance company assumes less risk compared to permanent life insurance. As a result, the premiums are generally lower, making it an excellent option for individuals who want to maximize their coverage without breaking the bank. This affordability factor allows people to allocate their financial resources more efficiently, ensuring they can adequately provide for their families without sacrificing other financial goals.

When choosing a term duration, several factors come into play. For instance, a 10-year term might be suitable for those who want coverage until their children are financially independent or a specific financial goal is achieved. On the other hand, a 30-year term could be more appropriate for individuals who want long-term financial security, ensuring their beneficiaries are protected throughout their working years. The decision should be based on personal circumstances, financial goals, and the level of risk one is willing to take.

In summary, term coverage life insurance offers a straightforward and cost-effective solution for individuals seeking financial protection for a defined period. With fixed premiums and a set term, it provides peace of mind and flexibility, allowing people to adapt their coverage as their life circumstances change. Whether it's a 10, 20, or 30-year term, this type of insurance ensures that your loved ones are financially secure during the years that matter most.

Window Washers: Life Insurance Options and Challenges

You may want to see also

Benefits: Offers financial security during the term if the insured dies

Term coverage life insurance is a type of life insurance that provides financial protection for a specific period, known as the "term." This insurance is designed to offer a straightforward and cost-effective way to secure your loved ones' financial future in the event of your untimely death. Here's a detailed breakdown of its benefits:

When you purchase term coverage, you select a term length that aligns with your specific needs and goals. This term can range from a few years to several decades, providing a clear timeframe for the insurance's coverage. The primary advantage is the simplicity and predictability it offers. During the chosen term, if the insured individual (the person whose life is insured) passes away, the insurance company will pay out a predetermined death benefit to the designated beneficiaries. This financial payout ensures that your family or dependents receive the monetary support they need during a challenging time.

The beauty of term coverage lies in its affordability. Compared to permanent life insurance, term insurance is generally more budget-friendly because it only provides coverage for a limited period. This cost-effectiveness makes it an attractive option for individuals who want to secure their family's financial well-being without breaking the bank. Moreover, the coverage amount is typically fixed, providing certainty and ease of budgeting.

In the event of the insured's death, the beneficiaries can use the death benefit to cover various expenses, such as mortgage payments, children's education, outstanding debts, or everyday living costs. This financial security can help ease the burden on the surviving family members and ensure that their long-term financial goals remain on track. Additionally, term coverage often offers the option to convert the policy to a permanent life insurance plan at the end of the term, allowing for continued coverage beyond the initial period.

Term coverage life insurance is an excellent choice for those seeking a focused and affordable way to provide financial protection for their loved ones. It offers a clear-cut solution during a specific period, ensuring that your family's financial future remains secure even in the face of unforeseen circumstances. With its straightforward nature and potential for long-term coverage, term insurance is a valuable tool in the realm of personal finance.

MetLife Insurance: Covering Spouses, Understanding the Policy

You may want to see also

Renewal: May be renewable or convertible to permanent coverage

Term coverage life insurance is a type of life insurance that provides coverage for a specific period, or "term," which is typically 10, 15, 20, or 30 years. One of the key features of this insurance is the option for renewal, which allows the policyholder to extend their coverage beyond the initial term. This renewal provision is a significant advantage, offering flexibility and peace of mind to those who want to ensure their loved ones are protected for an extended period.

When it comes to renewal, the policyholder can choose to continue their term coverage without any medical exams or additional health assessments, provided they are still in good health. This process is often straightforward and convenient, allowing individuals to maintain their insurance coverage without any disruptions. The insurance company may offer a guaranteed renewal option, ensuring that the policyholder can secure the same coverage terms at a potentially higher premium if they decide to renew.

Renewal is a valuable aspect of term life insurance, especially for those who have built a substantial financial plan around their current coverage. It provides continuity and ensures that the insurance remains relevant as the policyholder's life circumstances change. For instance, a young professional might initially purchase a 10-year term policy to cover their mortgage payments. If they decide to extend their coverage, they can renew the policy, providing protection for their growing family or other long-term financial commitments.

In addition to renewal, some term life insurance policies offer the option to convert to permanent coverage. This conversion feature allows policyholders to switch from a term policy to a whole life or universal life policy, providing lifelong coverage. Permanent coverage is more expensive but offers a range of benefits, including a cash value component that can be borrowed against or withdrawn. This conversion option provides flexibility, allowing individuals to start with a term policy and then enhance their coverage as their needs evolve.

Understanding the renewal and conversion options in term coverage life insurance is essential for making informed financial decisions. It empowers individuals to take control of their insurance needs, ensuring that they have the right level of protection at the right time. By exploring these options, policyholders can create a comprehensive financial strategy that adapts to their changing circumstances, providing security and peace of mind for the long term.

Life Insurance Payments: Tax Write-Off or Not?

You may want to see also

Frequently asked questions

Term coverage life insurance, also known as level term life insurance, is a type of life insurance that provides coverage for a specific period, or "term," typically ranging from 10 to 30 years. It offers a straightforward and cost-effective way to secure financial protection for a defined period, ensuring that your loved ones are financially secure in the event of your passing during that term.

This insurance policy provides a death benefit to the policyholder's beneficiaries if the insured individual passes away during the specified term. The death benefit is a lump sum payment that can be used to cover various expenses, such as mortgage payments, children's education, or any other financial obligations left behind by the policyholder. The policyholder pays a fixed premium for the duration of the term, and the coverage remains in effect as long as the premium is paid on time.

Term coverage life insurance offers several benefits. Firstly, it is generally more affordable than permanent life insurance because it provides coverage for a limited time. This makes it an excellent choice for individuals who want to secure financial protection for a specific period, such as until their children are financially independent or a mortgage is paid off. Additionally, term life insurance is easy to understand and offers straightforward coverage, making it a popular choice for those seeking simple and transparent insurance solutions.