Public corporations play a significant role in the insurance industry, particularly in the ownership of cash value life insurance policies. This type of insurance offers both death benefits and a cash value component that can be borrowed against or withdrawn. Many large corporations utilize these policies as a financial tool for various purposes, such as providing employee benefits, securing loans, or as part of their overall investment strategy. Understanding which public corporations own cash value life insurance can provide valuable insights into the corporate financial landscape and the insurance industry's role in supporting business operations.

What You'll Learn

- Corporate Insurance Policies: Companies own policies for employee benefits and financial security

- Investment Strategies: Cash value is invested in stocks, bonds, and other assets

- Tax Advantages: Life insurance offers tax benefits for corporations and shareholders

- Risk Management: Corporations use insurance to manage financial risks and protect assets

- Employee Incentives: Cash value policies can be used as incentives and rewards for employees

Corporate Insurance Policies: Companies own policies for employee benefits and financial security

Many public corporations utilize cash value life insurance as a strategic tool to secure their financial future and provide benefits to their employees. This type of insurance offers a dual advantage: it provides a financial safety net for the company and its employees while also serving as a valuable asset for the corporation.

When a company owns a cash value life insurance policy, it typically means the corporation is the policyholder, and the employee is the insured individual. The primary purpose is to ensure financial stability for the company in the event of an employee's untimely passing. In the unfortunate scenario of an employee's death, the insurance company pays out a death benefit to the corporation, which can be used to cover various expenses, such as outstanding debts, payroll, or even as a financial cushion for the business's future. This arrangement is particularly beneficial for public corporations, as it allows them to manage risks and plan for potential financial disruptions.

For employees, this type of insurance can provide a sense of security and peace of mind. The cash value component of the policy allows employees to build up a savings account within the insurance policy, which can be borrowed against or withdrawn in the event of financial emergencies. This feature is especially attractive to employees as it offers a form of financial security that can be used for personal or professional development. Over time, the cash value can accumulate, providing a substantial financial resource that can be utilized for various purposes, such as retirement planning or funding education.

Furthermore, cash value life insurance policies can be tailored to meet the specific needs of the corporation and its employees. Companies can choose the amount of coverage, the term of the policy, and various other options to ensure the policy aligns with their financial goals. This flexibility allows corporations to design a comprehensive benefits package that attracts and retains top talent while also ensuring the long-term financial health of the organization.

In summary, public corporations often own cash value life insurance policies as a strategic move to protect their financial interests and provide valuable benefits to their employees. This arrangement offers a win-win situation, where the company gains financial security and employees receive a valuable financial tool, ultimately contributing to the overall success and stability of the business.

Farmers Life Insurance: Is It a Participating Whole Life Policy?

You may want to see also

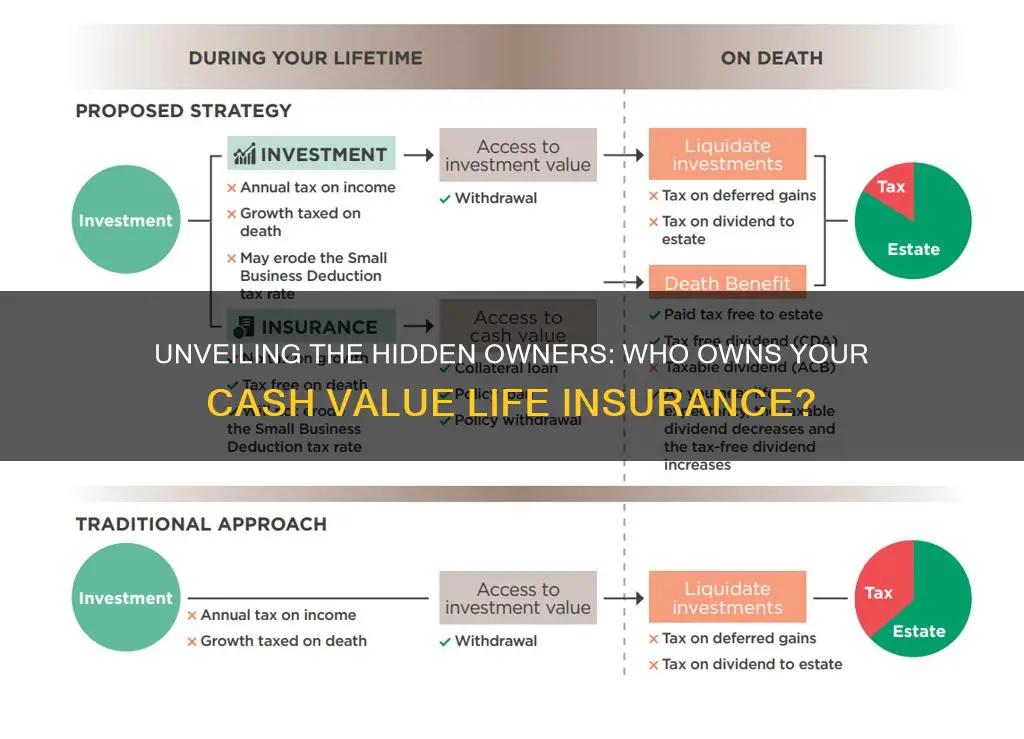

Investment Strategies: Cash value is invested in stocks, bonds, and other assets

The concept of investing cash value in life insurance policies is an intriguing strategy for public corporations, offering both financial security and potential growth. When a corporation owns a cash value life insurance policy, it can leverage the policy's investment component to diversify its portfolio and potentially generate returns. Here's an exploration of investment strategies related to this concept:

Diversification and Asset Allocation: Cash value life insurance policies provide a unique opportunity for corporations to diversify their investment portfolios. The cash value of the policy can be invested in various assets, including stocks, bonds, and other securities. By allocating funds across different asset classes, corporations can reduce risk and potentially increase returns. For instance, a corporation might choose to invest a portion of the cash value in stocks to capitalize on the growth potential of the equity market. Simultaneously, they could allocate a part of it to bonds for a more stable and secure investment. This strategic allocation ensures that the corporation's investments are not overly exposed to any single asset class, thus managing risk effectively.

Equity Investments: Investing in stocks is a popular choice for cash value life insurance policies. Corporations can utilize the policy's cash value to purchase shares in various companies, allowing them to benefit from the growth of the stock market. This strategy enables corporations to potentially increase their wealth over time, especially if they invest in a well-diversified portfolio of stocks. For instance, they might invest in a mix of large-cap, mid-cap, and small-cap companies across different sectors to gain exposure to various industries and market segments.

Fixed-Income Securities: Bonds are another attractive investment option for cash value life insurance. Corporations can invest in government bonds, corporate bonds, or a combination of both. These fixed-income securities offer a steady stream of income through regular interest payments. By investing in bonds, corporations can ensure a more consistent return on their cash value, providing financial stability. Government bonds are often considered low-risk investments, while corporate bonds might offer higher yields, allowing corporations to balance risk and reward.

Alternative Investments: Beyond stocks and bonds, cash value life insurance policies can also be invested in alternative assets. This includes investments in real estate, commodities, or even private equity. Alternative investments can provide unique opportunities for growth and diversification. For instance, a corporation might invest in a real estate investment trust (REIT) to gain exposure to the real estate market without directly owning property. Alternatively, they could explore private equity investments, which can offer higher returns but also come with higher risks.

In summary, investing the cash value of life insurance policies in stocks, bonds, and other assets provides public corporations with a strategic approach to wealth management. By diversifying their investments, corporations can navigate market fluctuations and potentially enhance their financial performance. This strategy allows them to make the most of their insurance policies while also growing their assets over time. It is essential for corporations to carefully consider their risk tolerance and investment goals when allocating funds in this manner.

Retrieving Life Insurance: A Guide to Claiming Your Benefits

You may want to see also

Tax Advantages: Life insurance offers tax benefits for corporations and shareholders

Life insurance, particularly cash value life insurance, provides significant tax advantages for both corporations and their shareholders. This financial tool is a valuable asset for businesses, offering a range of benefits that can enhance their financial health and stability.

For corporations, the tax treatment of life insurance can be advantageous in several ways. Firstly, the cash value of a life insurance policy can be utilized as a tax-efficient investment vehicle. When a corporation pays premiums on a life insurance policy, it can claim the premium payments as a business expense, reducing its taxable income. This is particularly beneficial for high-profit companies, as it allows them to lower their tax liability and retain more capital for business operations. Over time, the cash value of the policy can grow, providing a tax-deferred investment opportunity. This means that the corporation can benefit from potential investment gains without incurring immediate tax consequences, allowing for long-term wealth accumulation.

Shareholders of these corporations can also benefit from the tax advantages of life insurance. When a corporation owns a life insurance policy, the cash value can be used to secure loans or provide collateral. This enables shareholders to access funds for various business purposes, such as expansion, research, or debt repayment. By leveraging the cash value, shareholders can enhance their financial flexibility and potentially increase the overall value of their investment in the company. Additionally, the tax-efficient nature of life insurance can result in higher after-tax returns for shareholders, as the growth and earnings from the policy are not subject to immediate taxation.

Furthermore, the tax benefits of life insurance can extend to estate planning for corporations. The cash value of a life insurance policy can be used to provide financial security for key executives or employees, ensuring their families' financial well-being. This can be structured as a tax-efficient way to transfer wealth, as the death benefit of the policy may be exempt from certain taxes, providing a seamless transition of assets to beneficiaries.

In summary, life insurance, especially cash value life insurance, offers a range of tax advantages for public corporations and their shareholders. From tax-efficient investment opportunities to enhanced financial flexibility and estate planning benefits, this financial instrument can contribute to the overall financial health and success of businesses. Understanding and utilizing these tax benefits can be a strategic move for corporations to optimize their financial resources and provide long-term value to their stakeholders.

Understanding Life Insurance Warranties: A Comprehensive Guide

You may want to see also

Risk Management: Corporations use insurance to manage financial risks and protect assets

Insurance is a vital tool for corporations to manage financial risks and safeguard their assets, and one of the ways they achieve this is by utilizing cash value life insurance. This type of insurance provides a safety net for companies, offering both financial protection and a means to build long-term wealth. Public corporations, in particular, often own cash value life insurance policies as a strategic risk management strategy.

The primary purpose of cash value life insurance is to provide a financial cushion in the event of unforeseen circumstances. For corporations, this can mean protecting their assets, ensuring business continuity, and maintaining financial stability. When a company purchases a life insurance policy, it essentially creates a reserve of cash that can be used to cover various financial obligations. This is especially crucial for public corporations, as they often have complex financial structures and large-scale operations. In the event of a key executive's untimely death, the insurance payout can be utilized to cover business-critical expenses, such as debt repayment, payroll, or even the acquisition of another company. This ensures that the corporation can continue its operations without facing financial distress or the need to liquidate assets.

Moreover, cash value life insurance offers a unique opportunity for corporations to build and grow their financial resources. Over time, the cash value of the policy accumulates, providing a substantial financial asset. This can be particularly beneficial for public companies, as they often have long-term financial goals and investment strategies. The cash value can be used to secure loans, provide funding for expansion projects, or even as a source of capital for mergers and acquisitions. By utilizing the insurance policy as a financial tool, corporations can enhance their overall financial health and flexibility.

In addition to risk management, cash value life insurance can also serve as a strategic planning instrument. Corporations can use the policy to secure key executives' compensation, ensuring that their top talent is adequately rewarded and retained. This is especially important in competitive business environments where attracting and retaining skilled professionals is crucial. By integrating life insurance into their compensation packages, companies can provide a sense of security and financial stability to their executives, fostering a more motivated and loyal workforce.

In summary, public corporations often own cash value life insurance as a strategic risk management approach. It provides financial protection, ensures business continuity, and offers a means to build long-term wealth. The cash value of the policy can be utilized for various financial purposes, including debt management, business expansion, and strategic investments. Additionally, life insurance can be a valuable tool for executive compensation, contributing to a company's overall financial stability and success. This insurance product is a powerful asset in a corporation's financial toolkit, enabling them to navigate risks and secure their long-term prosperity.

Weight's Impact on Life Insurance Rates: Understanding the Connection

You may want to see also

Employee Incentives: Cash value policies can be used as incentives and rewards for employees

The concept of using cash value life insurance as an employee incentive is an innovative and strategic approach to recognizing and rewarding staff. This method can significantly impact employee motivation and retention, especially in competitive industries. Here's how it can be implemented:

Performance-Based Rewards: Cash value life insurance policies can be structured as performance-based incentives. For instance, a company could offer a policy to top-performing employees, providing them with a financial benefit upon reaching specific milestones or after a certain period of service. This approach not only rewards high-achieving individuals but also encourages a culture of excellence and healthy competition among staff. The cash value of the policy can grow over time, allowing for substantial rewards, and the policy can be tailored to fit the company's budget and the desired incentive structure.

Long-Term Service Recognition: Recognizing long-term service is essential for fostering a sense of loyalty and commitment. Companies can provide cash value life insurance policies to employees who have completed a significant number of years with the organization. This gesture can be a powerful way to show appreciation and can even be a tax-efficient method to provide a substantial benefit to employees. The policy can be structured to mature over time, ensuring a substantial cash value accumulation, which can be a significant incentive for employees to stay with the company.

Incentivizing New Hires: Onboarding new employees and providing them with a sense of belonging and value is crucial. Offering a cash value life insurance policy as a welcome package can be an attractive benefit. This incentive can help new hires feel appreciated and motivated from the start. The policy can be structured to provide immediate financial security, ensuring that new employees understand the value of their role within the company.

Team-Based Incentives: Encouraging teamwork and collaboration can be achieved by implementing team-based incentives. For example, a company could offer a group policy to teams that meet specific targets or achieve collective goals. This strategy not only rewards the team's efforts but also promotes a collaborative environment. The cash value of the group policy can be distributed among team members, providing a financial bonus that recognizes their collective achievements.

Implementing these strategies can create a powerful incentive structure, fostering a motivated and loyal workforce. It is a unique and effective way to show appreciation to employees, providing them with a financial benefit that can have a lasting impact on their financial well-being. This approach can also contribute to a positive company culture, where employees feel valued and understood.

Life Insurance Claims: Time Limits and Your Rights

You may want to see also

Frequently asked questions

Many public corporations, especially those with a significant number of employees, often have group life insurance policies that include a cash value component. These policies are typically provided as a benefit to employees and can be owned by the corporation as an asset on their balance sheet.

Cash value life insurance offers several advantages to public corporations. Firstly, it provides a source of funds that can be borrowed against, allowing corporations to access capital for various purposes, such as business expansion or debt management. Secondly, the cash value accumulates over time, providing a financial reserve that can be used to secure loans or provide financial security for the company.

Yes, certain industries are more likely to utilize cash value life insurance. For instance, financial institutions, such as banks and insurance companies, often have substantial group life insurance policies due to the high number of employees and the potential for significant financial losses in the event of key-person deaths. Similarly, large corporations in industries with high employee turnover or those with a focus on long-term growth may also benefit from cash value life insurance.

Absolutely. Public corporations can offer cash value life insurance as part of their employee benefit packages. This can help attract and retain talent, as it provides financial security and peace of mind for employees and their families. Additionally, the corporation can contribute to the policy, ensuring that the cash value grows over time, which can be a valuable asset for the company.

The tax treatment of cash value life insurance can vary. In some cases, the corporation may be able to deduct premium payments as a business expense, reducing their taxable income. However, the cash value accumulation within the policy may be subject to certain tax rules, and the corporation might need to consider the potential tax implications when borrowing against the policy's cash value. It is essential to consult tax professionals for specific guidance.