When considering life insurance, it's crucial to understand the components of a comprehensive contract provision package. This package typically includes essential provisions that outline the terms and conditions of the policy, ensuring both the insurer and the policyholder are on the same page. Key elements often encompass the policy's coverage amount, premium payments, and the duration of the policy. Additionally, the contract should detail the beneficiary's rights, the process for making claims, and the insurer's obligations upon a policyholder's death. Other important aspects may include provisions for policy modifications, termination, and the handling of any outstanding premiums or claims. A well-structured provision package is vital for clarity, protection, and a smooth claims process.

What You'll Learn

- Coverage Amounts: Specify death benefit, policy limits, and options for increasing/decreasing coverage

- Premiums: Outline payment schedules, methods, and adjustments for premium changes

- Beneficiary Designations: Detail procedures for naming beneficiaries and changing them

- Policy Loans/Withdrawals: Explain loan terms, interest rates, and withdrawal rules

- Conversion Options: Describe rights to convert to permanent insurance and associated conditions

Coverage Amounts: Specify death benefit, policy limits, and options for increasing/decreasing coverage

When drafting a life insurance contract provision package, it is crucial to clearly outline the coverage amounts and provide options for policyholders to customize their insurance according to their needs. The 'Coverage Amounts' section should be comprehensive and detailed, ensuring that all relevant information is readily available to the policyholder.

The death benefit is a fundamental aspect of life insurance. It represents the monetary amount paid to the beneficiaries upon the insured individual's death. This benefit should be clearly defined in the contract, specifying the exact amount that will be paid out. For instance, the contract might state, "The death benefit for this policy is $500,000, payable to the designated beneficiaries upon the insured's passing." It is essential to provide a fixed amount to ensure that the beneficiaries receive the intended financial support.

In addition to the death benefit, the policy limits should be clearly defined. These limits refer to the maximum amount that can be claimed under the policy and any restrictions or conditions associated with it. For example, the policy might have a limit on the maximum age at which the insured can purchase the policy or a cap on the coverage amount for certain health conditions. These limits ensure that the insurance company's risk is managed while providing the policyholder with a fair and transparent offer.

To cater to individual preferences, the contract should offer options for increasing or decreasing coverage. Policyholders may want to adjust their coverage amounts based on various factors, such as life changes, financial goals, or evolving family circumstances. The contract could provide a mechanism for policyholders to request adjustments, such as a review period during which they can opt for higher coverage to cover significant financial commitments or a reduction in coverage if their needs change. This flexibility empowers individuals to make informed decisions and ensures that their insurance remains relevant and adequate over time.

Furthermore, the contract should outline the process for increasing or decreasing coverage, including any fees or penalties associated with such changes. It is essential to provide clear instructions on how to initiate the adjustment process, ensuring that policyholders can easily exercise their options. By offering these customization options, the life insurance provider demonstrates a commitment to meeting the diverse needs of its customers.

In summary, the 'Coverage Amounts' section of a life insurance contract provision package should meticulously specify the death benefit, policy limits, and provide options for policyholders to adjust their coverage. This ensures that the policy is tailored to the individual's needs, offering financial security and peace of mind. Clear and transparent communication regarding coverage amounts is vital to building trust and ensuring a positive customer experience.

Life Insurance: Am I Entitled to Benefits?

You may want to see also

Premiums: Outline payment schedules, methods, and adjustments for premium changes

When it comes to life insurance, the term 'premiums' refers to the regular payments made by the policyholder to the insurance company to maintain coverage. These premiums are a crucial aspect of the contract and should be clearly outlined in the provision package. Here's a detailed breakdown of what should be included regarding premium payments:

Payment Schedules: The contract should specify the frequency of premium payments, which can be monthly, quarterly, semi-annually, or annually. For instance, if the policyholder chooses monthly payments, the document should indicate the due date for each month and the amount to be paid. It is essential to provide a clear and consistent schedule to ensure policyholders are aware of their financial obligations.

Payment Methods: Different insurance companies may offer various payment options, and this flexibility should be communicated to the policyholder. Common methods include direct debit from the policyholder's bank account, electronic funds transfer, or paying by check. The provision package should list these methods, ensuring that the insured individual can choose the most convenient and secure option for them.

Premium Adjustments: Life insurance premiums are often calculated based on factors such as the insured individual's age, health, lifestyle, and the coverage amount. The contract should outline how and when these premiums might change. For instance, if the insured person's health improves, the premium may decrease, and the policyholder should be informed of this potential adjustment. Conversely, if there are changes in the policy's terms or the insured's circumstances, the premium could increase, and the policyholder should be made aware of this possibility.

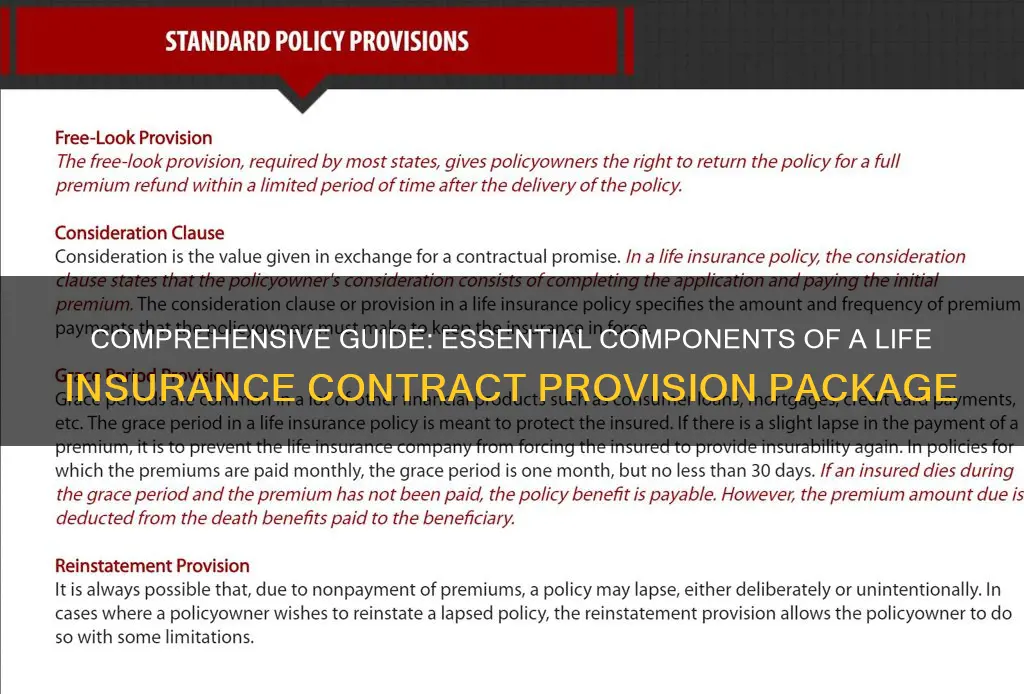

Additionally, the provision package should clarify any late payment fees and the grace period offered by the insurance company. It is a good practice to provide a summary of premium-related terms and conditions, ensuring that the policyholder understands their responsibilities and the insurance company's expectations.

By providing a comprehensive overview of premium-related matters, the life insurance contract provision package ensures that both the policyholder and the insurance company are on the same page, fostering a transparent and mutually beneficial relationship.

Does USAA Offer Life Insurance to Marijuana Users?

You may want to see also

Beneficiary Designations: Detail procedures for naming beneficiaries and changing them

When it comes to life insurance, beneficiary designations are a crucial aspect of ensuring your loved ones are taken care of according to your wishes. Here's a detailed guide on how to navigate this process:

Naming Beneficiaries: When you purchase a life insurance policy, you'll typically be asked to identify the individuals or entities you want to receive the death benefit upon your passing. This is a critical step as it determines who will inherit your insurance proceeds. You can choose to name primary and contingent beneficiaries. Primary beneficiaries are the first in line to receive the payout, and if they are deceased or unable to claim the benefit, the contingent beneficiaries step in. It's important to provide accurate and up-to-date contact information for all designated beneficiaries to ensure smooth processing of the claim.

The process of naming beneficiaries usually involves filling out a beneficiary designation form provided by your insurance company. This form may be available online or can be requested from your insurance provider. Carefully review the form to ensure you have the correct information for each beneficiary, including their full name, relationship to you, and contact details. Sign the form to validate your choices.

Changing Beneficiaries: Life circumstances can change, and sometimes it becomes necessary to update your beneficiary designations. Here's how you can do it: If you have a term life insurance policy, you may have the option to change beneficiaries during the policy term. Contact your insurance company and request the necessary forms to update your beneficiary information. For permanent life insurance policies, the process might be slightly different. You may need to contact your insurance agent or broker to initiate the change. They will guide you through the process and ensure the necessary documentation is completed.

It's essential to understand the implications of changing beneficiaries. When you modify the list, any previously named beneficiaries will be removed from the policy. Make sure to review the policy's terms and conditions to understand the specific requirements and limitations for changing beneficiaries. In some cases, there may be restrictions on who can be added or removed, especially if the policy has been in force for a significant period.

Remember, keeping your beneficiary information current is vital to ensure that your insurance proceeds go to the intended recipients. Regularly review and update your beneficiary designations to reflect any life changes, such as marriages, births, or deaths in your family. This proactive approach will provide peace of mind, knowing that your loved ones are protected according to your wishes.

Universal Life Insurance: Excess Credits Explained

You may want to see also

Policy Loans/Withdrawals: Explain loan terms, interest rates, and withdrawal rules

When it comes to life insurance, policyholders often have the option to access the cash value of their policy through loans or withdrawals. These provisions can provide financial flexibility, but it's crucial to understand the terms and conditions associated with them. Here's a breakdown of what you need to know about policy loans and withdrawals:

Loan Terms: Life insurance policies typically offer a loan feature, allowing policyholders to borrow money against the cash value of their policy. The loan amount is usually limited to a percentage of the policy's cash value, and the terms can vary. Typically, the loan is secured by the policy itself, meaning if the borrower defaults, the insurance company can use the policy's cash value to repay the loan. Loan terms often include a repayment schedule, which may be monthly, quarterly, or annually. It's essential to note that interest is charged on the loan, and the interest rate can vary depending on the insurance company's policies.

Interest Rates: The interest rate on policy loans is a critical aspect to consider. Insurance companies often use a guaranteed interest rate, which is typically lower than market rates. This rate is applied to the loan amount, and the interest accrues until the loan is repaid. It's important to understand that the interest rate might be fixed or variable, and it can impact the overall cost of the loan. Some policies may offer a lower interest rate for loans taken out during the initial years of the policy, encouraging policyholders to borrow when the cash value is growing.

Withdrawal Rules: Withdrawals, also known as policy withdrawals or surrender options, allow policyholders to access the cash value of their policy before the death of the insured individual. This can be particularly useful if the policyholder needs immediate funds or wants to invest the money elsewhere. Withdrawal rules often include a surrender charge, which is a fee assessed by the insurance company for early policy termination. The charge is typically a percentage of the cash value and can vary depending on the policy's age. Additionally, there may be restrictions on the frequency and amount of withdrawals, ensuring the policy remains viable and providing sufficient death benefit.

Understanding the loan terms, interest rates, and withdrawal rules is essential for policyholders to make informed financial decisions. These provisions can provide access to funds when needed, but they also come with potential risks and costs. It's advisable to carefully review the policy documents and consult with a financial advisor to ensure a comprehensive understanding of the available options and their implications.

VA Life Insurance Benefits: Taxable or Not?

You may want to see also

Conversion Options: Describe rights to convert to permanent insurance and associated conditions

When it comes to life insurance, offering conversion options is a crucial aspect of providing policyholders with flexibility and long-term security. Conversion options allow policyholders to transform their temporary or term life insurance into a permanent policy, ensuring that they can secure coverage for the rest of their lives. This feature is especially valuable as it provides an opportunity for individuals to adapt their insurance needs as they age or their financial circumstances change.

The conversion option typically involves a provision in the policy that allows the insured individual to convert their existing term life insurance to a permanent life insurance policy, such as whole life or universal life, without the need for a new medical examination or providing updated health information. This process can be initiated by the policyholder, often within a specified period after the initial policy purchase. For instance, a term life insurance policy might offer a conversion privilege after the first year, allowing the insured to switch to a permanent policy without further medical underwriting.

The conditions associated with conversion options are designed to protect both the insurance company and the policyholder. Firstly, there is usually a time limit for conversion, which may vary depending on the insurance provider and the type of term policy. This time frame ensures that the insurance company can accurately assess the risk associated with the insured individual and set appropriate premiums for the permanent policy. Additionally, the insurance company may impose a maximum age limit for conversion, typically around 65 or 70 years, to maintain a balanced risk profile.

Another important condition is the requirement for the insured to be in good health at the time of conversion. Insurance companies often conduct a review of the policyholder's health during the conversion process to ensure that they are still eligible for the more comprehensive coverage of a permanent policy. This may involve a medical questionnaire or a simple health assessment to verify the policyholder's well-being. It is also common for insurance providers to offer a limited conversion period, during which the policyholder can exercise this right, usually within the first few years of the term policy.

Furthermore, the conversion option may come with a premium adjustment clause. When converting, the policyholder will typically pay a new premium based on their age and the selected permanent policy type. This adjustment ensures that the insurance company can accurately reflect the increased risk associated with the older age of the insured individual. The specific terms and conditions of conversion options can vary, so it is essential for policyholders to carefully review their insurance contracts and understand the rights and obligations they entail.

Life Insurance: ERS Cost and Coverage Explained

You may want to see also

Frequently asked questions

A life insurance contract provision package is a comprehensive set of documents that outlines the terms, conditions, and provisions of a life insurance policy. It serves as a legal agreement between the insurance company and the policyholder, ensuring both parties understand their rights and obligations. This package is crucial for providing clear guidance on policy coverage, benefits, and the claims process.

The provision package typically includes the following essential components:

- Policy Declaration Page: This page summarizes the basic details of the policy, including the insured person's information, policy type, coverage amount, and premium details.

- Policy Terms and Conditions: A detailed explanation of the policy's coverage, exclusions, and limitations. It defines the events that trigger a claim and the conditions under which benefits are paid.

- Premium Payment Options: Information on how and when premiums are due, including any available payment methods and late payment consequences.

- Claim Process: A step-by-step guide on how to file a claim, including required documentation and the timeline for claim settlement.

- Policyholder and Beneficiary Rights: Details about the policyholder's rights to review and change the policy, as well as the beneficiary's rights to receive the death benefit.

Yes, insurance companies must adhere to regulatory guidelines and laws when drafting life insurance contracts. The provision package should comply with the regulations set by the relevant insurance authority in the jurisdiction. This ensures that the policy is fair, transparent, and protects the interests of both the insurance company and the policyholder. It may include mandatory clauses, such as a cooling-off period, a right to return the policy, and a provision for policyholder education.