When considering where to get life insurance, it's important to research and compare different providers to find the best fit for your needs. Many insurance companies offer a range of policies, from term life to permanent life insurance, and it's beneficial to understand the coverage options and costs associated with each. Additionally, seeking advice from a financial advisor or insurance broker can provide valuable insights and help you navigate the process effectively.

What You'll Learn

- Cost Comparison: Research and compare rates from various insurers to find the best deal

- Coverage Needs: Assess your financial obligations and choose a policy that meets your needs

- Health Factors: Consider medical history and lifestyle when selecting a life insurance plan

- Agent Recommendations: Seek advice from insurance agents for personalized guidance

- Online Resources: Utilize online tools and calculators to estimate insurance needs and costs

Cost Comparison: Research and compare rates from various insurers to find the best deal

When it comes to finding the best life insurance policy, cost comparison is an essential step to ensure you get the most value for your money. The process involves researching and analyzing rates from different insurance providers to identify the most competitive offers. Here's a guide to help you navigate this aspect of your life insurance journey:

Understand Your Needs: Before diving into the comparison, it's crucial to understand your specific life insurance requirements. Consider factors such as the desired coverage amount, the type of policy (term life, whole life, or universal life), and any additional benefits or riders you may want. Knowing your needs will help you narrow down the options and focus on insurers that can provide tailored solutions.

Gather Information: Start by gathering quotes from multiple insurers. You can obtain these quotes through various channels, including online platforms, insurance brokers, or directly contacting insurance companies. Make sure to provide consistent and accurate information during the quote process, as this will ensure fair comparisons. Include details such as your age, health status, occupation, and any relevant medical history.

Compare Rates and Coverage: Once you have a list of quotes, carefully compare the rates offered by different insurers. Look beyond the premium cost and examine the coverage details. Evaluate the policy's term length, death benefit amount, and any additional benefits like accelerated death benefits or critical illness riders. A lower premium might be tempting, but ensure that the coverage meets your needs to avoid paying for unnecessary extras.

Consider Additional Factors: Cost comparison should not be limited to the premium alone. Take into account other factors that can impact your overall experience. For instance, check the insurer's financial strength and ratings to ensure they can honor their commitments. Read customer reviews and testimonials to gauge the insurer's reputation and customer service quality. Additionally, consider the flexibility of the policy, such as the option to convert term life to a permanent policy or the availability of policy loans and withdrawals.

Review and Negotiate: After narrowing down your options, review the shortlisted policies thoroughly. Pay attention to any hidden fees, exclusions, or conditions that might affect your coverage. If you have any concerns or questions, don't hesitate to contact the insurers for clarification. In some cases, you may be able to negotiate the terms or rates, especially if you're purchasing a larger coverage amount or have a favorable risk profile.

By following these steps, you can conduct a comprehensive cost comparison and make an informed decision when choosing a life insurance provider. Remember, the goal is to find a policy that offers the right balance between cost and coverage, ensuring financial security for your loved ones.

How Life Insurance for Grandparents Works?

You may want to see also

Coverage Needs: Assess your financial obligations and choose a policy that meets your needs

When considering life insurance, it's crucial to evaluate your financial obligations and future commitments to ensure you have adequate coverage. This assessment is a fundamental step in choosing the right policy that will provide financial security for your loved ones. Here's a guide to help you navigate this process:

Identify Your Financial Responsibilities: Start by making a comprehensive list of your financial obligations. This includes regular expenses such as mortgage or rent payments, car loans, student loans, credit card debts, and any other long-term financial commitments. Also, consider future expenses that may arise, such as your children's education costs or any planned large purchases. Understanding these financial responsibilities will give you a clear picture of the potential impact of your death on your loved ones.

Calculate the Required Coverage: The next step is to determine the amount of life insurance coverage you need. A common rule of thumb is to ensure that your policy pays out a sufficient sum to cover at least your final expenses, including funeral costs and any outstanding debts. Additionally, consider the income replacement needed for your family to maintain their standard of living. This might involve calculating the annual income required to support your family's lifestyle and multiplying it by the number of years you anticipate needing financial support. For example, if your family's annual expenses amount to $100,000 and you expect this need to last for 20 years, you might aim for a policy with a death benefit of $2 million.

Consider Long-Term Needs: Life insurance should not just cover immediate expenses but also provide long-term financial security. Think about the future goals and dreams you have for your family. For instance, if you want to ensure your children's education is funded, you'll need to factor in the cost of tuition, books, and living expenses for the duration of their studies. Also, consider any future plans, such as starting a business or purchasing a second home, and include these in your coverage assessment.

Review and Adjust Regularly: Life circumstances change over time, and so should your life insurance policy. Regularly review your financial obligations and adjust your coverage accordingly. Major life events like marriages, births, or significant career changes should prompt a re-evaluation of your policy. As you pay off debts or achieve financial milestones, you may find that your coverage needs decrease, allowing you to consider more affordable policy options. Conversely, if you take on new financial responsibilities, you might need to increase your coverage to ensure your loved ones are adequately protected.

By carefully assessing your financial obligations and future needs, you can select a life insurance policy that provides the necessary coverage. This ensures that your family can maintain their financial stability and achieve their goals, even in your absence. Remember, the key is to be proactive and regularly review your policy to make informed decisions about your life insurance coverage.

Nonprofits: Uncovering Death Benefits from Life Insurance

You may want to see also

Health Factors: Consider medical history and lifestyle when selecting a life insurance plan

When considering life insurance, it's crucial to understand the role of health factors in determining the best plan for you. Your medical history and lifestyle choices can significantly impact the cost and availability of coverage. Here's a detailed guide on how these factors come into play:

Medical History:

Your medical background is a critical piece of information for insurance providers. They will review your medical records, including any pre-existing conditions, chronic illnesses, surgeries, or hospital visits. Here's what you should consider:

- Pre-existing Conditions: If you have a history of heart disease, diabetes, cancer, or any other serious health issues, you may face higher premiums or even be deemed uninsurable by some companies. However, many insurers offer specialized plans for individuals with pre-existing conditions, so transparency is key.

- Recent Health Events: Recent health scares or major surgeries can also impact your insurance rates. For instance, a recent heart attack or a major surgery may require a more thorough medical assessment.

- Age and Gender: Age and gender are also considered. Generally, older individuals may pay higher premiums due to a higher risk of health issues.

Lifestyle Factors:

Your daily habits and lifestyle choices can also influence your life insurance options:

- Smoking: Smokers often face higher premiums as smoking significantly increases the risk of various health issues, including heart disease and lung cancer. Quitting smoking can lead to improved rates over time.

- Alcohol and Drug Use: Excessive alcohol consumption or drug abuse can also impact your insurance rates. These habits can lead to health complications and may be considered high-risk behaviors by insurers.

- Physical Activity and Diet: A healthy lifestyle, including regular exercise and a balanced diet, can positively influence your insurance rates. Insurers may offer lower premiums to individuals with a history of healthy habits.

- Occupation and Hobbies: Certain occupations or hobbies may also be considered. High-risk jobs or extreme sports enthusiasts might face higher premiums due to increased potential health risks.

Impact on Insurance Plans:

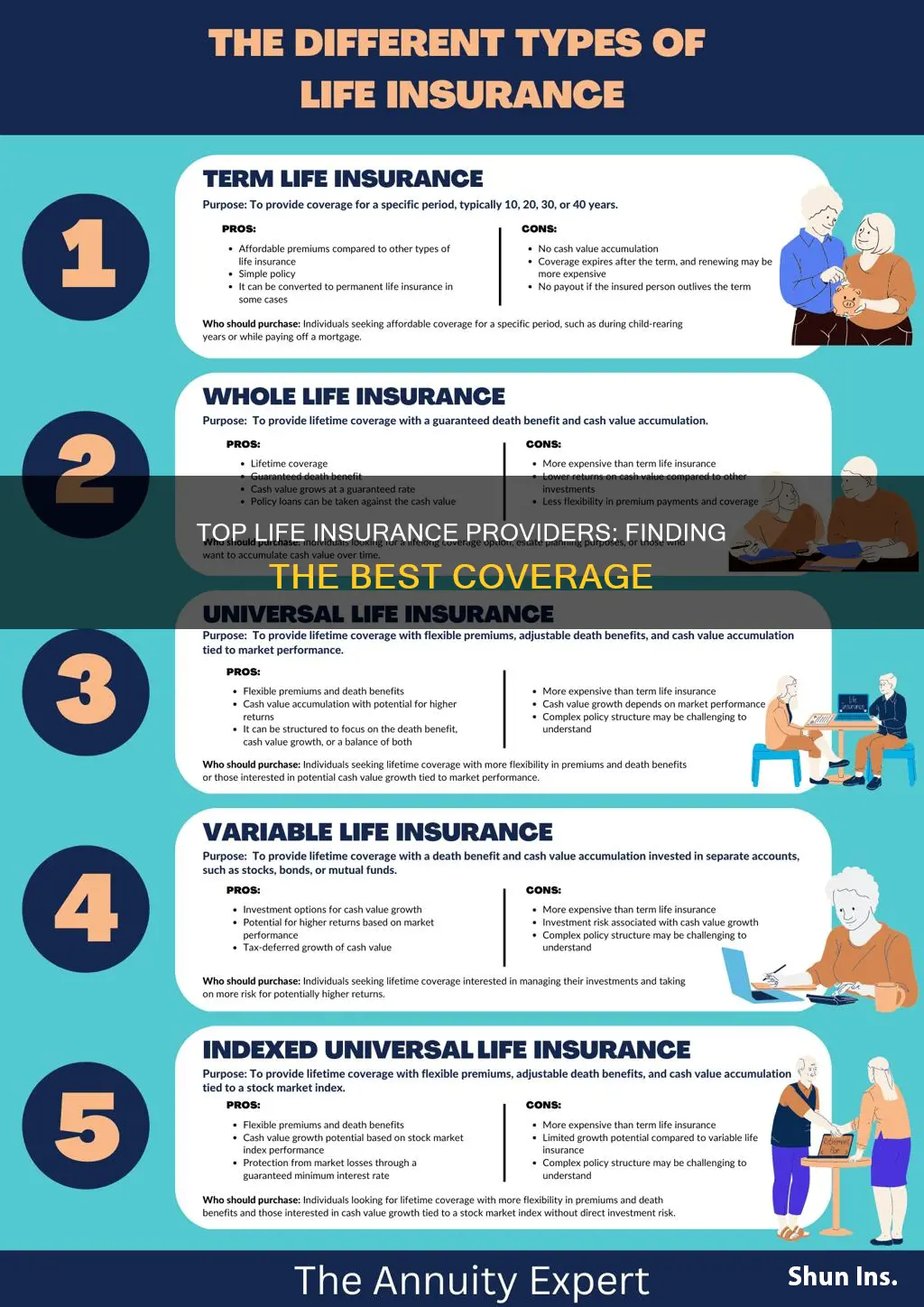

- Term Life Insurance: This type of coverage is often more affordable and may be suitable for individuals with no significant health issues. It provides coverage for a specified term, such as 10 or 20 years.

- Whole Life Insurance: This plan offers lifelong coverage and includes an investment component. It may be more expensive but can provide financial security for your beneficiaries.

- Universal Life Insurance: This plan offers flexibility in premium payments and death benefit amounts. It can be tailored to your changing needs and may be suitable for individuals with a desire for long-term financial planning.

When selecting a life insurance plan, it's essential to be transparent about your health and lifestyle. Providing accurate information will help you choose the right coverage and ensure you get the best rates. Additionally, consider consulting with a financial advisor or insurance specialist who can guide you through the process and help you make informed decisions based on your unique circumstances.

Transferring Your Life Insurance: Is It Possible?

You may want to see also

Agent Recommendations: Seek advice from insurance agents for personalized guidance

When it comes to finding the right life insurance policy, seeking professional advice from insurance agents can be an invaluable step. These agents are experts in the field and can provide personalized guidance tailored to your specific needs. Here's why consulting an insurance agent is a wise decision:

Personalized Assessment: Insurance agents will begin by assessing your unique circumstances. They will consider factors such as your age, health, lifestyle, and financial goals. This comprehensive evaluation allows them to recommend the most suitable type of life insurance policy, whether it's term life, whole life, or a combination of both. By understanding your individual profile, agents can ensure that the coverage meets your requirements and provides adequate financial protection for your loved ones.

Expert Advice: These professionals possess extensive knowledge about various insurance products and their features. They can explain the different types of policies, coverage options, and associated benefits in a clear and understandable manner. For instance, they can clarify the difference between term life insurance, which provides coverage for a specified period, and permanent life insurance, which offers lifelong coverage and potential investment components. Through their expertise, agents can help you make informed decisions and choose the policy that aligns best with your long-term objectives.

Tailored Recommendations: One of the key advantages of consulting an insurance agent is receiving personalized recommendations. They will consider your financial situation, risk tolerance, and future plans to suggest appropriate coverage amounts and policy terms. For example, if you have a large family and significant financial responsibilities, an agent might recommend a higher coverage amount to ensure your family's financial security. This tailored approach ensures that your life insurance policy is customized to fit your unique circumstances.

Comparison and Negotiation: Insurance agents often have access to a wide range of insurance providers and their products. They can compare policies from different companies, highlighting the advantages and disadvantages of each. This comparison helps you make an informed choice and potentially find the best value for your premium. Additionally, agents can negotiate on your behalf with insurance companies, aiming to secure favorable rates and terms for their clients.

Ongoing Support: The relationship with an insurance agent doesn't end after purchasing a policy. They provide ongoing support and assistance, ensuring that your coverage remains appropriate as your life circumstances change. Agents can help with policy reviews, adjustments, and even provide guidance on investment options if your policy includes them. This long-term support is crucial for maintaining an effective and relevant life insurance plan.

In summary, consulting insurance agents is a strategic approach to finding the right life insurance. Their expertise, personalized assessments, and tailored recommendations ensure that you receive the best advice and a policy that meets your specific needs. By seeking their guidance, you can make informed decisions and have the confidence that your loved ones are protected financially.

New York Life Insurance: AARP Payouts, Quick and Easy?

You may want to see also

Online Resources: Utilize online tools and calculators to estimate insurance needs and costs

In today's digital age, the internet offers a plethora of resources to help individuals navigate the complex world of life insurance. Online tools and calculators have become invaluable assets for anyone seeking to understand their insurance needs and estimate costs. These digital resources provide a convenient and efficient way to gather information and make informed decisions without leaving the comfort of your home.

When it comes to life insurance, online calculators are a powerful tool for self-assessment. These calculators typically require you to input specific details about your life, health, and financial situation. By providing information such as age, income, health status, and desired coverage amount, these tools can offer a personalized estimate of your insurance requirements. For instance, you can input your age and the desired policy term to calculate the potential premiums and coverage amounts for different insurance plans. This allows you to compare various options and make an informed choice.

Online resources also provide educational content and articles that can guide you through the process of choosing life insurance. Many insurance companies and financial advisors offer comprehensive websites with detailed explanations of different insurance types, coverage options, and benefits. These resources can help you understand the various factors that influence insurance premiums and how to select the right policy for your needs. For example, you can learn about term life insurance, whole life insurance, and universal life insurance, and how each type caters to different financial goals and risk profiles.

Additionally, online forums and communities can be a great source of information and support. These platforms allow you to connect with others who have gone through the life insurance process or are currently exploring their options. You can ask questions, share experiences, and gain valuable insights that might not be readily available in online articles or calculators. By engaging with these communities, you can make more informed decisions and potentially avoid common pitfalls when purchasing life insurance.

By utilizing online tools and calculators, you can take control of your life insurance journey. These resources empower you to make informed choices, compare different policies, and understand the financial implications of your decisions. Remember, while online resources provide valuable information, it is essential to consult with a licensed insurance professional for personalized advice and to ensure you select the best policy for your unique circumstances.

Borrowing Against Meritus Life Insurance: Is It Possible?

You may want to see also

Frequently asked questions

When it comes to finding the best life insurance, it's essential to explore various sources and providers. Start by researching reputable insurance companies that offer a wide range of policies. Compare their terms, coverage amounts, and premiums to find a plan that suits your needs and budget. Online platforms and financial advisors can also provide valuable insights and recommendations based on your specific requirements.

Yes, there are dedicated websites and online marketplaces that aggregate information from multiple insurance providers, making it easier to compare policies. These platforms often allow you to request quotes and even purchase policies online. Additionally, insurance brokers and agents in your local area might have partnerships with various companies, offering personalized advice and access to a range of products.

Getting a good deal on life insurance involves thorough research and understanding the market. Compare quotes from multiple insurers, as prices can vary significantly. Consider your personal circumstances, such as age, health, and lifestyle, as these factors influence premium costs. Additionally, look for any available discounts, such as those for non-smokers or individuals with healthy habits. Regularly reviewing your policy and making adjustments as needed can also help you optimize your coverage and costs over time.

Yes, there are options for life insurance without a medical exam, often referred to as "no-exam" or "instant issue" policies. These are typically term life insurance plans with simplified underwriting processes. They may have slightly higher premiums but offer convenience and faster approval. However, the coverage amount might be limited, and certain health conditions or lifestyle factors may still require a medical exam for more comprehensive coverage.

To find affordable life insurance in your area, consider the following tips:

- Compare quotes from multiple insurers to find the best rates.

- Consider term life insurance, which is generally more affordable than permanent life insurance.

- Maintain a healthy lifestyle, as non-smokers or individuals with good health may qualify for lower premiums.

- Look for group life insurance through your employer, as group rates can often be more competitive.

- Review your policy regularly and adjust coverage as your circumstances change to avoid overpaying.