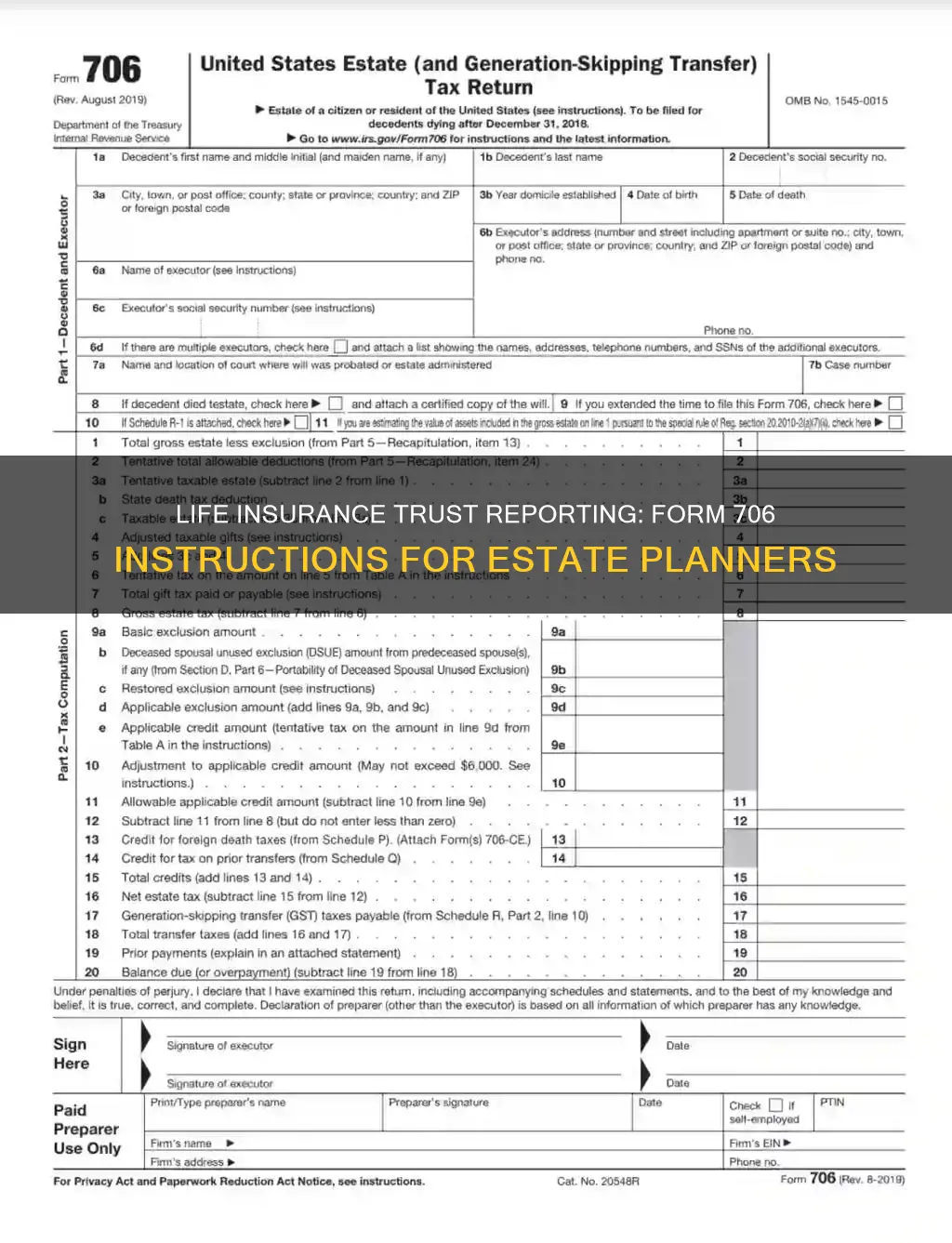

When dealing with irrevocable life insurance trusts, it's crucial to understand the reporting requirements. Form 706, also known as the United States Estate Tax Return, is a critical document for reporting the value of such trusts. This form is essential for individuals who have passed away and for those who are still alive but have an interest in an irrevocable life insurance trust. Understanding where and how to report these trusts is a key step in ensuring compliance with tax laws and avoiding potential penalties.

| Characteristics | Values |

|---|---|

| Form Type | IRS Form 706 |

| Purpose | Reporting the value of an irrevocable life insurance trust |

| Tax Year | The tax year for which the trust is being reported |

| Trustee's Responsibility | The trustee of the trust must file this form |

| Due Date | April 15th of the year following the tax year |

| Filing Status | The filer's individual tax return or estate tax return |

| Reporting Method | The value of the trust's assets is included in the gross estate |

| Exemption | May be exempt from estate tax under certain conditions |

| Instructions | Refer to the IRS instructions for Form 706 |

| Penalties | Late filing may result in penalties |

What You'll Learn

- Trust Reporting: Report irrevocable life insurance trust on Form 706, Schedule M, and attach Form 709

- Trust Income: Include trust income in the estate's gross income on Form 706

- Trust Assets: Value trust assets and report on Form 706, Schedule R

- Trust Distributions: Report trust distributions on Form 706, Schedule N, and Schedule M

- Trust Termination: Report trust termination on Form 706, Schedule M, and Form 709

Trust Reporting: Report irrevocable life insurance trust on Form 706, Schedule M, and attach Form 709

When dealing with irrevocable life insurance trusts, understanding the reporting requirements is crucial for both the trust beneficiaries and the estate tax implications. Form 706, also known as the United States Estate Tax Return, is a critical document for reporting the value of a deceased individual's estate. Schedule M of Form 706 is specifically designed to report interests in trusts, including irrevocable life insurance trusts (ILITs).

If you are a beneficiary of an ILIT, you must report the trust's assets and income on your tax return. This reporting ensures transparency and helps in determining the correct tax liability. The process involves filling out Schedule M, which requires detailed information about the trust, including its creation date, the type of trust, and the value of the trust assets. It is essential to provide accurate and up-to-date information to avoid any potential legal or financial issues.

In addition to Schedule M, you should also attach Form 709, the Grantor Trust Annual Information Return. This form is used to report the income and other activities of the trust for the tax year in question. By attaching Form 709, you provide a comprehensive overview of the trust's performance and ensure that all relevant tax information is disclosed. This step is crucial for maintaining compliance with the Internal Revenue Code and for accurately reflecting the trust's activities.

It is recommended to consult with a tax professional or estate planning attorney to ensure that you are meeting all the reporting requirements. They can guide you through the process, ensuring that you provide the necessary information and attach the correct forms. Proper reporting not only helps in avoiding penalties but also ensures that the trust's assets are properly valued and reported, which is essential for the smooth transfer of wealth to beneficiaries.

Remember, accurate and timely reporting of irrevocable life insurance trusts is a critical aspect of estate planning and tax management. By following the instructions provided on Form 706 and Schedule M, and by attaching Form 709, you can ensure that your trust's activities are properly disclosed and that you remain compliant with tax regulations.

Understanding Terminal Illness Coverage: A Guide to Life Insurance Benefits

You may want to see also

Trust Income: Include trust income in the estate's gross income on Form 706

When dealing with an irrevocable life insurance trust (ILIT), it's crucial to understand how to report the trust's income on Form 706, the United States Estate Tax Return. The key point to remember is that trust income must be included in the estate's gross income. This process ensures that the trust's assets are properly valued and reported for tax purposes.

The first step is to gather the necessary information. You'll need to know the trust's income for the year, including any interest, dividends, or other earnings. This income should be reported on the estate's tax return, even if the trust's beneficiaries have not yet received any distributions. It's important to note that the trust's income is considered taxable income for the estate, regardless of whether the income is paid out to beneficiaries or reinvested in the trust.

On Form 706, you will find a section dedicated to reporting trust income. This section typically requires you to provide details about the trust, including its name, identification number, and the type of trust. You must also calculate the trust's taxable income for the year, which includes all the income generated by the trust's assets. This taxable income is then added to the estate's total income, ensuring a comprehensive view of the estate's financial situation.

It is essential to accurately report trust income to avoid any potential penalties or legal issues. If the trust's income is not included in the estate's gross income, it may result in an underreporting of assets and potential tax liabilities. Therefore, it is advisable to consult with a tax professional or estate planning attorney who can guide you through the process and ensure compliance with the IRS regulations.

In summary, when reporting an irrevocable life insurance trust on Form 706, trust income must be included in the estate's gross income. This process involves calculating and reporting the trust's taxable income, ensuring that the estate's financial situation is accurately represented for tax purposes. Proper reporting is crucial to avoid any legal or financial complications.

Understanding Backup Withholding on Life Insurance: Your Responsibilities

You may want to see also

Trust Assets: Value trust assets and report on Form 706, Schedule R

When dealing with irrevocable life insurance trusts, it's crucial to accurately value the trust assets and report them on Form 706, Schedule R. This ensures compliance with IRS regulations and helps in proper estate planning. Here's a step-by-step guide to valuing trust assets and completing the necessary reporting:

Valuation of Trust Assets:

Start by identifying all the assets held within the irrevocable life insurance trust. These assets can include cash, investments, real estate, personal property, or any other valuable items. Each asset should be valued based on its current market value. For liquid assets like cash or stocks, the fair market value is typically used. Real estate and personal property may require professional appraisals to determine their accurate value. It's essential to obtain these valuations as of the date of the grant or the valuation date specified by the IRS.

Reporting on Form 706, Schedule R:

Schedule R of Form 706 is specifically designed to report the value of trust assets. Here's how you can approach this:

- List all the trust assets you've identified and valued in the previous step. Provide a brief description of each asset and its respective value.

- For each asset, select the appropriate category on Schedule R. The categories may include cash, securities, real estate, personal property, and others.

- Fill in the total value of each category, ensuring that the values are consistent with the valuations obtained in step one.

- Sum up the values of all the trust assets to arrive at the total value of the trust.

- Transfer the total value of the trust assets to the corresponding line on Form 706, indicating that the value has been reported on Schedule R.

Remember, accurate valuation is critical to ensure that the IRS receives the correct information regarding the trust's assets. It's advisable to consult with a financial advisor or estate planning professional who can provide guidance tailored to your specific trust and assets. They can help you navigate the valuation process and ensure compliance with all relevant tax laws.

By following these steps, you can effectively value the trust assets and complete the necessary reporting on Form 706, Schedule R, providing transparency and accuracy in your estate planning endeavors.

Best Manhattan Life Insurance: Understanding AM Ratings

You may want to see also

Trust Distributions: Report trust distributions on Form 706, Schedule N, and Schedule M

When it comes to reporting trust distributions, especially those related to an irrevocable life insurance trust (ILIT), it's crucial to understand the specific requirements and forms involved. The process can be complex, but with the right guidance, you can ensure compliance with the Internal Revenue Code. Here's a detailed breakdown of how to report trust distributions on Form 706, Schedule N, and Schedule M.

Understanding the Forms:

Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a critical document for reporting the value of a deceased individual's estate and any applicable taxes. Schedule N, "Trust Income and Distributions," is a part of Form 706 and is specifically designed to report trust-related information. Schedule M, "Generations-Skipping Transfer Tax Return," is used for certain types of trust distributions that may trigger generation-skipping transfer (GST) taxes.

Reporting Trust Distributions:

- Schedule N (Form 706): This schedule requires you to provide detailed information about the trust, including the trust's name, identification number, and the type of trust (e.g., ILIT). You must report the total income and distributions made from the trust during the tax year. For an ILIT, this often includes the income generated from the insurance policy's investment earnings and any death benefits received.

- Distributions to Beneficiaries: If the trust has beneficiaries who received distributions during the year, you must report this information on Schedule N. This includes the amount distributed, the date of distribution, and the beneficiary's tax identification number. It's essential to accurately report these distributions to ensure proper tax allocation.

- GST Taxes on Schedule M: In some cases, trust distributions may be subject to GST taxes. Schedule M is used to report these taxes. For an ILIT, this could apply if the trust's assets exceed certain threshold values and the distribution is made to a skip person (e.g., a grandchild). You'll need to calculate the GST tax liability and report it accordingly.

Important Considerations:

- Always refer to the latest IRS instructions and guidelines for Form 706 and its schedules, as the reporting requirements may change over time.

- If you are unsure about any aspect of the reporting process, consulting a tax professional or accountant is highly recommended to ensure accuracy and compliance.

- Keep detailed records of all trust-related transactions and distributions to facilitate the reporting process and provide necessary documentation if audited.

Ezlynx Life Insurance Support: What You Need to Know

You may want to see also

Trust Termination: Report trust termination on Form 706, Schedule M, and Form 709

When a trust is terminated, it's crucial to report this event to the IRS, especially if the trust was an irrevocable life insurance trust (ILIT). The process involves filing specific forms to ensure compliance with tax laws and to provide the necessary information to the IRS. Here's a detailed guide on how to report trust termination:

Form 706, Schedule M: This is the primary form used to report the termination of an ILIT. Schedule M, specifically, is designed for this purpose. It requires detailed information about the trust, including its identification number, the date of termination, and the reason for termination. You must also provide details about the trust's assets, including any remaining insurance proceeds or other assets that were part of the trust. This form is essential for the IRS to understand the distribution of assets and to ensure that any tax implications are considered.

Form 709: This form, also known as the "Grantor Trust Return," is used to report the income and other tax-related items of a trust for the tax year in which the trust was terminated. It is particularly important if the trust held assets that generated income or if there were any distributions made during the termination process. Form 709 ensures that the IRS is aware of the trust's final status and any potential tax consequences for the grantor or beneficiaries.

The reporting process for trust termination is a critical aspect of estate planning and tax compliance. It ensures that the IRS is informed about the distribution of assets and can help in avoiding any potential penalties or legal issues. When filing these forms, it is advisable to seek professional guidance from an accountant or tax attorney who specializes in estate planning to ensure accuracy and compliance with all relevant tax regulations.

Remember, the IRS provides detailed instructions and guidelines for these forms on its official website, which can be a valuable resource when preparing the necessary documentation. Proper reporting of trust termination is essential to maintain a transparent and compliant relationship with the tax authorities.

American Express: Life Insurance Benefits and Coverage Details

You may want to see also

Frequently asked questions

Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is used to report the value of an estate for tax purposes. If you have an irrevocable life insurance trust, you should report it on Schedule M, "Trusts and Estates," of Form 706. This schedule requires you to provide details about the trust, including its identification number, the type of trust, and the value of the trust's assets.

Yes, if you are the grantor or the trust itself, and the trust has assets valued at $100,000 or more at the time of the grantor's death, you are generally required to file Form 706. This ensures that the IRS is aware of the trust's existence and can properly assess any applicable taxes.

The value of the irrevocable life insurance trust should be determined as of the grantor's death. You will need to calculate the fair market value of the trust's assets, including any cash, investments, or property held within the trust. This value will then be reported on Schedule M of Form 706, along with any other relevant information about the trust.