Life insurance is a crucial financial product that provides peace of mind and security for individuals and their loved ones. However, the process of obtaining life insurance can be challenging, especially for those who are overweight. While being overweight doesn't automatically disqualify an individual from obtaining life insurance, it can have a significant impact on the eligibility, cost, and availability of coverage. This is because life insurance companies use various factors, including height-to-weight ratios, health conditions, and lifestyle choices, to assess the risk of insuring an individual. This complex evaluation process, known as underwriting, determines the final rate offered to the applicant.

For those who are overweight, the challenge lies in navigating the varying standards and guidelines set by different insurance providers. Each company has its own height-to-weight table, also called a build chart, which is similar to a Body Mass Index (BMI) chart. These charts play a crucial role in classifying applicants into different risk categories, with higher rates for those deemed to be at greater risk. However, it's important to note that BMI has limitations and doesn't always accurately reflect an individual's health status.

While weight is a factor in the underwriting process, it is not the sole determinant. Other health factors, such as blood pressure, cholesterol levels, and smoking status, also come into play. Additionally, the presence of weight-related health complications, such as limited mobility due to morbid obesity, can further influence an individual's eligibility and rates. Nevertheless, it is relatively rare for life insurance providers to reject an application based solely on weight, especially if the applicant is otherwise healthy.

For those who are unable to obtain traditional life insurance due to weight-related issues, alternative options such as guaranteed issue policies, group life insurance, and accidental death and dismemberment insurance are available, albeit at higher costs and with lower coverage amounts. Overall, while weight can impact the availability and cost of life insurance, it is important to shop around and explore different providers, as each company has its own unique underwriting guidelines and rating systems.

| Characteristics | Values |

|---|---|

| Being overweight affects life insurance rates | Being overweight doesn't automatically disqualify you from getting life insurance, but it might affect your rate and the type of policy you qualify for. |

| Weight is one of many factors | Life insurance companies evaluate an applicant and offer a rate based on their risk, but each company calculates risk differently. |

| Weight limits | Depending on the insurer and policy, there may be a weight limit based on your height. |

| Insurers use height and weight to assess BMI | Insurers often use height and weight to assess your body mass index (BMI). Insurers then typically use their own "build chart" to determine how your BMI will affect your eligibility and rate. |

| Weight-related health complications | If you have weight-related or other health complications, you may pay more for coverage. |

| No denial solely based on weight | Your application typically won't be denied solely because of your weight. |

| Higher risk | A high BMI increases your risk of a serious medical issue. |

| Weight loss affects rates | Losing weight may help you qualify for better rates, but insurers will only give you partial credit for major weight loss in the previous 12 months. |

What You'll Learn

- Weight is one of many factors used to determine eligibility and risk

- Insurers use their own height/weight matrix to determine eligibility and rates

- Being overweight may not significantly affect your rate if you are otherwise healthy

- You can still get life insurance if you are overweight, but it may be more expensive

- You can improve your health rating by preparing for the life insurance medical exam

Weight is one of many factors used to determine eligibility and risk

Weight: One of Many Factors Used to Determine Eligibility and Risk

When it comes to life insurance, weight is indeed a factor that insurance providers consider when determining an individual's eligibility and risk. However, it is important to understand that weight is just one of the many factors that come into play. The overall health and lifestyle of the applicant are also taken into account, and these factors often play a more significant role in the evaluation process.

Height-to-Weight Ratio and BMI

Insurance companies typically assess an applicant's height-to-weight ratio to determine if they qualify as overweight or obese from a medical perspective. Body Mass Index (BMI) is a commonly used tool for this purpose, and insurers often have their own BMI "build charts" to evaluate applicants. However, it is worth noting that BMI has its limitations and does not consider body composition.

Health Conditions and Complications

Weight-related health complications, such as diabetes, heart disease, or sleep apnea, can significantly impact life insurance rates. Insurers may offer higher rates to overweight individuals, especially if they have other health issues. The presence of these conditions indicates a higher risk of early or unexpected death, which increases the insurer's risk and, consequently, the cost of coverage.

Lifestyle Factors

In addition to health conditions, lifestyle habits such as smoking and drinking can also affect life insurance premiums. These unhealthy habits can significantly impact an individual's health and increase their risk, which insurers take into consideration when setting rates.

Family Medical History

An applicant's family medical history is another factor that insurers consider. Information about any conditions or diseases that have caused death in the family is usually taken into account, along with the applicant's own health status.

Underwriting Process

The underwriting process involves assessing an applicant's risk profile based on health and lifestyle details. Underwriters use mortality statistics and health data to determine an applicant's risk and calculate the appropriate policy. They consider weight as one factor but also take into account other health factors and family history.

Impact of Weight Loss

Weight loss can influence life insurance rates. Insurers may request information about weight changes in the past year, as sudden or significant weight loss can be a concern. They may also offer lower rates if an applicant has maintained a lower weight for a more extended period, indicating a sustained improvement in health.

In summary, while weight is a factor in determining eligibility and risk for life insurance, it is just one of many factors considered by insurers. The overall health, lifestyle, and family medical history of the applicant play a significant role in the evaluation process as well.

Child Support and Life Insurance: Can It Be Garnished?

You may want to see also

Insurers use their own height/weight matrix to determine eligibility and rates

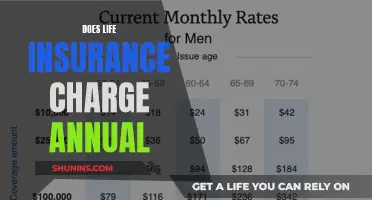

Insurers use their own height-to-weight ratio matrix, or "build chart", to determine eligibility and rates for life insurance. This matrix is used to assess an applicant's Body Mass Index (BMI), which is calculated from their height and weight. The higher an applicant's BMI, the more their insurance is likely to cost.

Each insurer's matrix is slightly different, but they all work on the same principle: correlating body metrics with risk categories. These categories typically range from "preferred best" to "standard" and below. The lower the risk category, the less costly the insurance.

For example, a 6-foot-tall man weighing 195 pounds would be considered overweight according to a standard BMI calculation. However, he would qualify for a "Preferred Plus" life insurance rating with MetLife. If he weighed 225 pounds, his BMI would be considered obese, but he would still qualify for better-than-standard rates.

While weight is a factor in determining eligibility and rates, it is not the only factor. Insurers also take into account an applicant's medical history, family history, and lifestyle choices. They also look at how weight is distributed across the body, as abdominal weight can indicate a higher health risk.

It's important to note that being overweight does not automatically disqualify someone from getting life insurance. In many cases, if an individual is overweight but otherwise healthy, they will qualify for a policy with a relatively low rate.

Insuring Baby Daddy: Life Insurance Options for Co-Parents

You may want to see also

Being overweight may not significantly affect your rate if you are otherwise healthy

Being overweight does not automatically disqualify you from getting life insurance. Weight is just one of the many factors that life insurance companies consider when determining your eligibility and risk. If you are overweight but otherwise healthy, you will likely qualify for a policy with a relatively low rate.

Life insurance companies evaluate applicants and offer rates based on their risk profile. Each company calculates risk differently, but they often use height and weight to assess an applicant's body mass index (BMI). Insurers then use their own "build chart" to determine how an applicant's BMI will affect their eligibility and rate. While there is no industry standard for how insurers use BMI to make decisions, life insurance build charts can be more generous than other BMI classifications. For example, an individual who is 5'10" could weigh up to 229 pounds and still qualify for the best rate class through eFinancial's RAPIDecision® Life feature.

Your BMI and weight will not be the only factors that go into assessing your health. Any questions you answer about your health and the results of your medical exam will also be considered. If you are in overall good health, being overweight may not significantly affect your rate.

If you are young and have recently lost a significant amount of weight, you may want to wait six months or longer to apply for life insurance. Insurers can look at your full health history, and if you recently lost weight, they might use your heavier weight to determine your risk. However, if you want coverage now, don't let your weight history stop you from quoting and comparing life insurance rates.

Life Insurance Denial: Overweight and Uninsured?

You may want to see also

You can still get life insurance if you are overweight, but it may be more expensive

Being overweight does not automatically disqualify you from getting life insurance, but it might affect your rate and the type of policy you qualify for. Life insurance companies evaluate an applicant and offer a rate based on their risk, but each company calculates risk differently. Some companies may consider overweight individuals to be more likely to suffer from diseases that can shorten life expectancy, such as diabetes, heart disease, and certain types of cancer. They may offer you a higher rate, especially if your life insurance medical exam shows that you have other health issues.

Insurers compare your body mass index (BMI) against their own "build chart" to determine how your BMI will affect your eligibility and rate. While any actual weight limits will vary by insurer and policy, here's a breakdown of common BMI categories according to the National Heart, Lung, and Blood Institute:

- Underweight: Below 18.5

- Healthy weight: 18.4–24.9

- Overweight: 25.0–29.9

Your BMI and weight won't be the only factor that goes into assessing your health — any questions you answer about your health and the results of your medical exam will also be factored in. If you're in overall good health, being overweight may not significantly affect your rate.

If you're young and you recently lost a significant amount of weight, you might decide to wait six months or longer to apply for life insurance. Insurers can look at your full health history, and if you recently lost weight, they might use your heavier weight to determine your risk. If you want coverage now, though, don't let your weight history stop you from quoting and comparing life insurance rates.

If you have weight-related or other health complications, you may pay more for coverage. However, unless you have severe weight-related health issues, such as limited mobility due to morbid obesity, you're unlikely to be rejected for coverage. If you're an athlete or have a high BMI but low body fat percentage, you'll likely be able to receive credits from an insurance company to qualify for the best life insurance ratings.

If your weight or health issues are preventing you from qualifying for a traditional life insurance policy, you might want to consider a guaranteed issue policy, also known as guaranteed acceptance life insurance. These policies guarantee acceptance, no matter your weight, but they tend to be more expensive and offer lower death benefit amounts. They also provide very limited coverage — usually no more than $25,000.

Life insurance is extremely personalized, and it is recommended that you thoroughly explore your options to see which life insurance provider offers the best coverage and pricing for your medical condition.

Life Insurance Payouts: Can You File for Bankruptcy?

You may want to see also

You can improve your health rating by preparing for the life insurance medical exam

Being overweight does not automatically disqualify you from getting life insurance, but it might affect your rate and the type of policy you qualify for. Insurers will compare your body mass index (BMI) against their own "build chart" to determine how your BMI will affect your eligibility and rate.

If you are overweight but otherwise healthy, you will likely qualify for a policy with a relatively low rate. However, if you have weight-related or other health complications, you may pay more for coverage.

- In the weeks leading up to the exam: Drink plenty of water, limit your salt intake, eat a healthy diet, and limit your alcohol consumption.

- The day before the exam: Avoid alcohol and nicotine, red meat, over-the-counter medications such as antihistamines and nasal decongestants, and be sure to get a good night's sleep.

- On the day of the exam: Avoid caffeinated drinks, strenuous exercise, and drink plenty of water. Have a photo ID, your medical information, and wear short sleeves or sleeves that can be rolled up.

- During the blood pressure reading: Do not have a full bladder and keep your feet flat on the floor.

Remember, you won't be able to make major changes to your health in a short period. However, making a few minor tweaks in the weeks and days leading up to your exam can pay off in the long run.

Life Insurance Salesmen: Scammers or Misunderstood Professionals?

You may want to see also

Frequently asked questions

Being overweight doesn't automatically disqualify you from getting life insurance, but it might affect your rate and the type of policy you qualify for. If you're overweight but otherwise healthy, you'll likely qualify for a policy with a relatively low rate. If you have weight-related or other health complications, you may pay more for coverage.

Life insurance companies evaluate an applicant and offer a rate based on their risk. They often use height and weight to assess your body mass index (BMI). Insurers then typically use their own "build chart" to determine how your BMI will affect your eligibility and rate.

If you can't get a standard term or permanent life insurance policy due to issues linked to your BMI, you could try losing weight and then reapplying for coverage. If you need coverage immediately, you may want to consider a guaranteed acceptance life insurance policy. These policies guarantee acceptance, no matter your weight, but they are more expensive and provide very limited coverage.