When it comes to reporting non-taxable life insurance proceeds on Form 1120S, it's important to understand the specific rules and guidelines. This paragraph will provide an overview of where and how to report these proceeds, ensuring that your tax return is accurate and compliant with IRS regulations. By the end of this paragraph, you'll have a clear understanding of the process and the necessary steps to take.

What You'll Learn

- Proceeds from Non-Taxable Insurance: Report on Schedule D of Form 1120S

- Exempt Income: Non-taxable insurance gains are exempt from corporate income tax

- Life Insurance Proceeds: Only taxable amounts need to be reported

- Form 1120S Instructions: Refer to the instructions for guidance on reporting

- Taxable vs. Non-Taxable: Distinguish between taxable and non-taxable insurance proceeds

Proceeds from Non-Taxable Insurance: Report on Schedule D of Form 1120S

When it comes to reporting non-taxable life insurance proceeds on your 1120S tax return, it's important to understand the specific guidelines and requirements. While the proceeds from a life insurance policy may not be taxable, there are still important considerations for your business tax return. Here's a detailed guide on how to handle this situation:

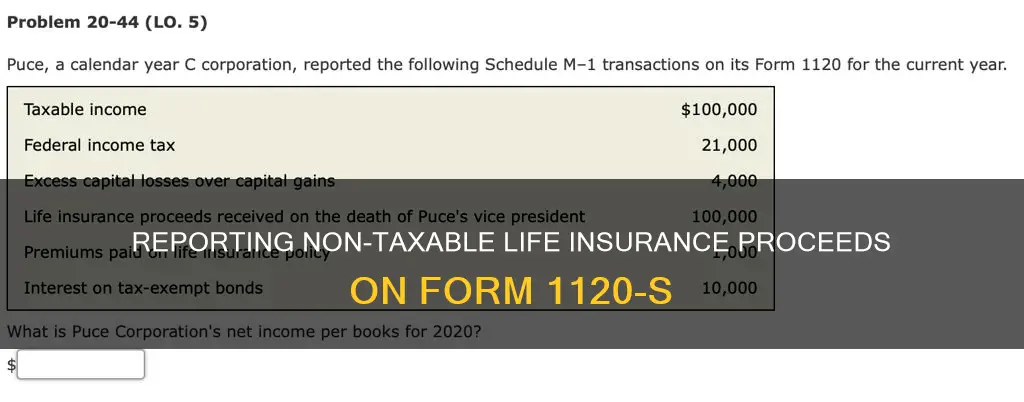

Non-taxable life insurance proceeds can arise in various scenarios, such as the death of a key employee or a business owner. These proceeds are typically paid out to the policyholder or beneficiaries and are not subject to income tax. However, for tax purposes, these amounts must be reported on your business tax return, specifically on Schedule D of Form 1120S. This schedule is designed to report income and expenses related to your business, and it includes a section for "Other Income."

To report non-taxable life insurance proceeds, you need to provide specific details on Schedule D. You should include the total amount received from the insurance policy and any relevant information about the policy, such as the policy number and the date of the death of the insured individual. It's crucial to accurately document the source and nature of these proceeds to ensure compliance with tax regulations.

One important aspect to consider is that non-taxable insurance proceeds are generally not deductible as business expenses. However, there might be exceptions or specific circumstances where these proceeds can be used for tax purposes. For instance, if the insurance policy was owned by the business, the proceeds could be considered a distribution or a return of capital, which may have tax implications. Consulting with a tax professional is advisable to navigate these complexities.

Additionally, when reporting these proceeds, you should also consider any state-specific tax requirements. Some states may have different rules regarding the reporting of non-taxable insurance benefits, so it's essential to check the regulations in your jurisdiction. Staying informed and ensuring accurate reporting will help you maintain compliance with both federal and state tax laws.

Life Insurance Proceeds: Are They Taxable in the UK?

You may want to see also

Exempt Income: Non-taxable insurance gains are exempt from corporate income tax

Non-taxable insurance proceeds, such as those from life insurance, can be a significant source of income for businesses, and understanding how to report these gains is crucial for accurate tax compliance. When it comes to corporate income tax, non-taxable insurance gains fall under the category of exempt income, which means they are not subject to corporate income tax. This is an important distinction for businesses to recognize, as it can impact their overall tax strategy and financial planning.

For businesses filing Form 1120S, the tax return for S corporations, the reporting of non-taxable insurance proceeds is an essential aspect of tax preparation. These proceeds are typically not included in the corporation's taxable income, and therefore, do not need to be reported as regular income. Instead, they should be treated as exempt income, which is a specific category on the tax return. This exemption ensures that businesses can accurately reflect their financial position without incurring unnecessary tax liabilities.

To report non-taxable insurance gains on Form 1120S, businesses should carefully review the instructions provided by the IRS. The process may vary depending on the specific circumstances of the insurance proceeds. In some cases, businesses might need to provide additional documentation or schedules to support the exemption claim. It is essential to maintain detailed records of the insurance policies, payout amounts, and any relevant tax forms received from the insurance company to ensure proper reporting.

When filling out Form 1120S, businesses should identify the non-taxable insurance proceeds as exempt income. This may involve completing specific sections or schedules dedicated to reporting exempt items. By accurately reporting these gains, businesses can ensure compliance with tax regulations and avoid potential penalties or audits. It is advisable to consult with tax professionals or accountants who can provide guidance tailored to the business's unique situation, ensuring that all tax obligations are met.

In summary, non-taxable insurance proceeds, including life insurance gains, are exempt from corporate income tax. Businesses filing Form 1120S should report these gains as exempt income, following the IRS instructions and providing necessary documentation. Proper reporting ensures compliance and allows businesses to manage their tax obligations effectively while taking advantage of the tax benefits associated with exempt income.

Whole Life Insurance: Cash Surrender Value After Modifications?

You may want to see also

Life Insurance Proceeds: Only taxable amounts need to be reported

When it comes to reporting life insurance proceeds on Form 1120S, it's important to understand that not all proceeds are taxable. The Internal Revenue Code (IRC) provides specific guidelines on how to handle taxable and non-taxable amounts. Here's a detailed guide on how to report only the taxable life insurance proceeds:

Understanding Taxable and Non-Taxable Proceeds:

First, let's clarify the difference. Taxable life insurance proceeds are those that exceed the insurance company's investment in the policy. In simpler terms, if the insurance company's investment in the policy is $50,000, and the death benefit is $100,000, only the $50,000 excess is considered taxable income. Non-taxable proceeds are typically the amount up to the investment limit.

Reporting on Form 1120S:

Form 1120S, also known as the "U.S. Income Tax Return for Associations," is used by tax-exempt organizations, including S corporations and partnerships. When reporting life insurance proceeds, you should only include the taxable amount. Here's how:

- Schedule K-1 (Form 1120S): This schedule is used to report income, deductions, credits, and other items to partners or shareholders. You need to report the taxable life insurance proceeds on the appropriate line, usually designated for "Rents, royalties, interest, and dividends."

- Box 14: This box is specifically for reporting "Other Income." If the life insurance proceeds exceed the investment limit, you should report the excess amount here.

Example:

Let's say a partnership received a life insurance death benefit of $150,000. The insurance company's investment in the policy is $100,000. In this case, the taxable proceeds are $50,000 ($150,000 - $100,000). You would report this amount on Schedule K-1, Line 14, as other income.

Important Considerations:

- Always refer to the IRC and the specific instructions for Form 1120S to ensure accurate reporting.

- If you are unsure about the taxable amount, consult a tax professional or accountant who can provide guidance based on your organization's unique circumstances.

- Keep in mind that reporting non-taxable proceeds may not be necessary, as they do not generate taxable income.

By following these guidelines, you can ensure that your organization correctly reports life insurance proceeds on Form 1120S, adhering to the tax laws and regulations.

Life Insurance After Cancer: What's the Wait Time?

You may want to see also

Form 1120S Instructions: Refer to the instructions for guidance on reporting

When it comes to reporting non-taxable life insurance proceeds on Form 1120S, it's crucial to follow the instructions provided in the form's guidelines. These instructions are designed to ensure that you accurately report the proceeds and comply with the relevant tax laws. Here's a detailed breakdown of how to approach this:

The Form 1120S Instructions will guide you through the process of identifying and reporting non-taxable life insurance payments. Non-taxable proceeds typically arise when a life insurance policy is paid out to beneficiaries or the insured individual, and the payment is not considered taxable income. These proceeds are often exempt from income tax, but they still need to be reported on the appropriate tax forms.

According to the instructions, you should report non-taxable life insurance proceeds on Schedule K-1 (Form 1120S) of the 1120S tax return. Schedule K-1 is specifically designed to report various types of income, including non-taxable life insurance payments. When completing this schedule, ensure that you provide the necessary details, such as the recipient's name, the amount of the proceeds, and the nature of the payment.

It's important to note that the instructions will also provide guidance on how to handle different scenarios. For instance, if the non-taxable proceeds are received by a corporation, you may need to allocate the payment to the appropriate shareholders or beneficiaries. The instructions will clarify the reporting requirements for each situation, ensuring that you remain compliant with tax regulations.

Additionally, the Form 1120S Instructions may offer specific advice on when and how to report these proceeds. This includes information on the timing of reporting, any applicable deadlines, and the necessary documentation to support the reported amounts. By carefully following these instructions, you can ensure that your reporting of non-taxable life insurance proceeds is accurate and in compliance with the IRS's requirements.

Life Insurance Guaranty: Protecting Your Policyholder's Interests

You may want to see also

Taxable vs. Non-Taxable: Distinguish between taxable and non-taxable insurance proceeds

When it comes to insurance proceeds, understanding the difference between taxable and non-taxable amounts is crucial for accurate tax reporting. This distinction is particularly important for businesses, especially those filing Form 1120S, which is the U.S. income tax return for an S corporation. Here's a breakdown of taxable and non-taxable insurance proceeds and how to handle them:

Taxable Insurance Proceeds:

Taxable insurance proceeds typically include any payments received from insurance companies for losses or damages that are considered taxable income. For instance, if a business owner's property is damaged in a fire, the insurance payout for the property's value may be taxable. This is because the insurance payment often represents the replacement value of the damaged asset, which can be considered a gain or profit. When filing Form 1120S, these taxable proceeds should be reported on the appropriate lines, ensuring that the business's income is accurately reflected.

Non-Taxable Insurance Proceeds:

Non-taxable insurance proceeds are those payments that are exempt from taxation. A common example is life insurance benefits paid out upon the death of the insured individual. These proceeds are generally not considered taxable income for the recipient. However, there are some exceptions and considerations. For instance, if the insurance policy was a modified endowment contract (MEC), the proceeds might be taxable. Additionally, if the insurance payments are used to pay for certain qualified expenses, such as medical bills or funeral costs, they may be non-taxable.

Reporting on Form 1120S:

When reporting insurance proceeds on Form 1120S, it's essential to categorize the payments correctly. Taxable proceeds should be included in the business's income, while non-taxable amounts should be excluded. This ensures compliance with tax regulations and provides an accurate financial picture of the business. It's worth noting that the IRS provides specific instructions and guidelines for reporting insurance-related items on this form, so referring to these resources is essential for proper reporting.

Understanding the nature of insurance payments is key to proper tax treatment. Taxable proceeds should be reported as income, while non-taxable amounts may require special handling. By accurately distinguishing between the two, businesses can ensure they meet their tax obligations and maintain compliance with the IRS. This knowledge is particularly valuable for S corporations, as it directly impacts their financial reporting and overall tax strategy.

How to Get Life Insurance for Your Dad

You may want to see also

Frequently asked questions

Non-taxable life insurance proceeds are typically not reported on Form 1120S, as this form is used for reporting income, deductions, credits, and other financial activities of a corporation. However, if the insurance proceeds are received by a corporation, they should be included in the corporation's income on the appropriate tax return, such as Schedule K-1 (Form 1120S) if the corporation is an S corporation, or Form 1120 if it is a C corporation.

Yes, non-taxable life insurance proceeds are generally exempt from federal income tax. However, they may be subject to state income tax, depending on the jurisdiction. It's important to check the tax laws of the state where the corporation is located to ensure compliance with state tax regulations.

For S corporations, non-taxable life insurance proceeds should be reported on the Schedule K-1 (Form 1120S) that is provided to the corporation's shareholders. The proceeds will be included in the shareholders' income on their personal tax returns, and the corporation itself does not need to report them on its 1120S return.

No, non-taxable life insurance proceeds and premiums are not deductible expenses for the corporation. However, if the corporation pays for life insurance that provides benefits to the business, such as key person insurance, the premiums may be deductible as a business expense. It's essential to differentiate between personal and business-related insurance when reporting and claiming deductions.