Cancelling your car insurance policy is usually a simple process, and you can cancel your policy at any time. However, it's important to follow the correct procedure to avoid a lapse in coverage, which could result in fines and other penalties. The process for cancelling your car insurance will depend on your insurance company's requirements. Some companies may require a phone call, while others may ask you to send a letter or email. It's a good idea to check with your insurer to see if they require any fees, a cancellation letter, or a notice period before they will process your cancellation request.

| Characteristics | Values |

|---|---|

| Method of sending | Email, postal mail, fax, or phone call |

| Timing | Before the end of the policy, to avoid a lapse in coverage |

| Addressee | Previous insurer |

What You'll Learn

Cancelling auto insurance without notifying your insurer

Cancelling your auto insurance without notifying your insurer is not recommended, as it may result in extra fees or a failure to cancel your policy. If you stop paying your premiums without notifying your insurer of your intention to cancel, your policy will eventually be cancelled for non-payment, and you may be charged late fees.

In addition, if you have automatic bank transfers set up to pay your premiums, your insurer will continue to withdraw payments from your account until you request a cancellation. Therefore, it is always a good idea to notify your insurer of your plans to cancel your auto insurance.

To cancel your auto insurance, you can call your insurer, mail or fax a signed request for cancellation, or ask your new carrier for assistance if you are switching providers. Some insurers may also accept cancellation in person. Remember to ask for a cancellation confirmation, as this can be used as proof of your request if there are any issues with processing your cancellation.

Vehicle Insurance: MID Registration

You may want to see also

Cancelling car insurance by phone

Step 1: Finalise Your New Policy

Before you cancel your current car insurance, it is important to ensure that you have another policy in place. This is because a lapse in coverage can affect your future rates and result in a claim denial. It is advisable to start your new car insurance policy on the same day that your old policy ends, or sooner, to avoid being uninsured, even if for a short period.

Step 2: Gather Information

When you are ready to cancel your policy, you will need to provide certain information to your insurance company. This includes your personal details, such as your full name and address, as well as your contact information, such as your phone number and email address. You will also need to provide the policy numbers for both your current and new insurance policies, as well as the effective date of your new policy.

Step 3: Contact Your Insurer

Most major insurance companies allow policyholders to cancel their policies by phone. You can find the phone number on your insurance card, on the company's website, or in your policy documents. When you call, you will need to provide your policy number and other relevant information. Some insurers may require you to sign a cancellation form, either during the call or afterwards. Be sure to ask about any cancellation fees or other requirements, such as giving 30 days' notice.

Step 4: Request a Policy Cancellation Notice

Once you have cancelled your policy, be sure to request a policy cancellation notice from your insurer. This document will provide official confirmation that your policy has been cancelled and will specify the effective date of the cancellation. This can be important if there are any disputes or issues that arise later on.

Step 5: Confirm Cancellation in Writing

While cancelling by phone is convenient, it is always a good idea to follow up in writing. Send a letter or email to your insurance company, confirming the details of the cancellation, including the date of the cancellation and any refunds or fees involved. This will provide you with written documentation of the cancellation, which can be useful for your records and for resolving any potential issues or disputes.

Additional Considerations:

- Be Courteous: Remember to be polite and professional when cancelling your policy, as this can help ensure a smooth process.

- Ask for Confirmation: Request confirmation of the cancellation from your insurer and keep it for your records. This can be helpful if there are any issues or disputes later on.

- Keep a Copy of Your Records: Maintain your own records of the cancellation, including any relevant correspondence, in case you need to refer to them in the future.

- Consider the Timing: If you are cancelling your policy because you are selling your car, it is generally recommended to wait until the new owner takes possession and the title is transferred before discontinuing coverage.

Auto Insurance: Exempt Drivers Explained

You may want to see also

Cancelling car insurance by mail

Finalise your new policy

Before cancelling your current car insurance, it is important to have another policy in place to avoid a lapse in coverage, which could affect your future rates and cause a claim denial. So, finalise your new insurance policy and ensure it starts before your old policy ends.

Gather information about both policies

You will need to include the following information in your insurance cancellation notice or letter: your personal information (full name and address), contact information (phone number and email address), the policy numbers for both your current and new policies, and the effective dates of your new policy and the cancellation of your current policy.

Contact your current insurer

Ask your insurance company about their cancellation process, policy obligations, and procedures outlined in your insurance contract. You can usually do this by phone, email, or postal mail. Find out if there are any cancellation fees, if you are likely to receive a refund for unused premiums, and if there are any other requirements, such as giving 30 days' notice.

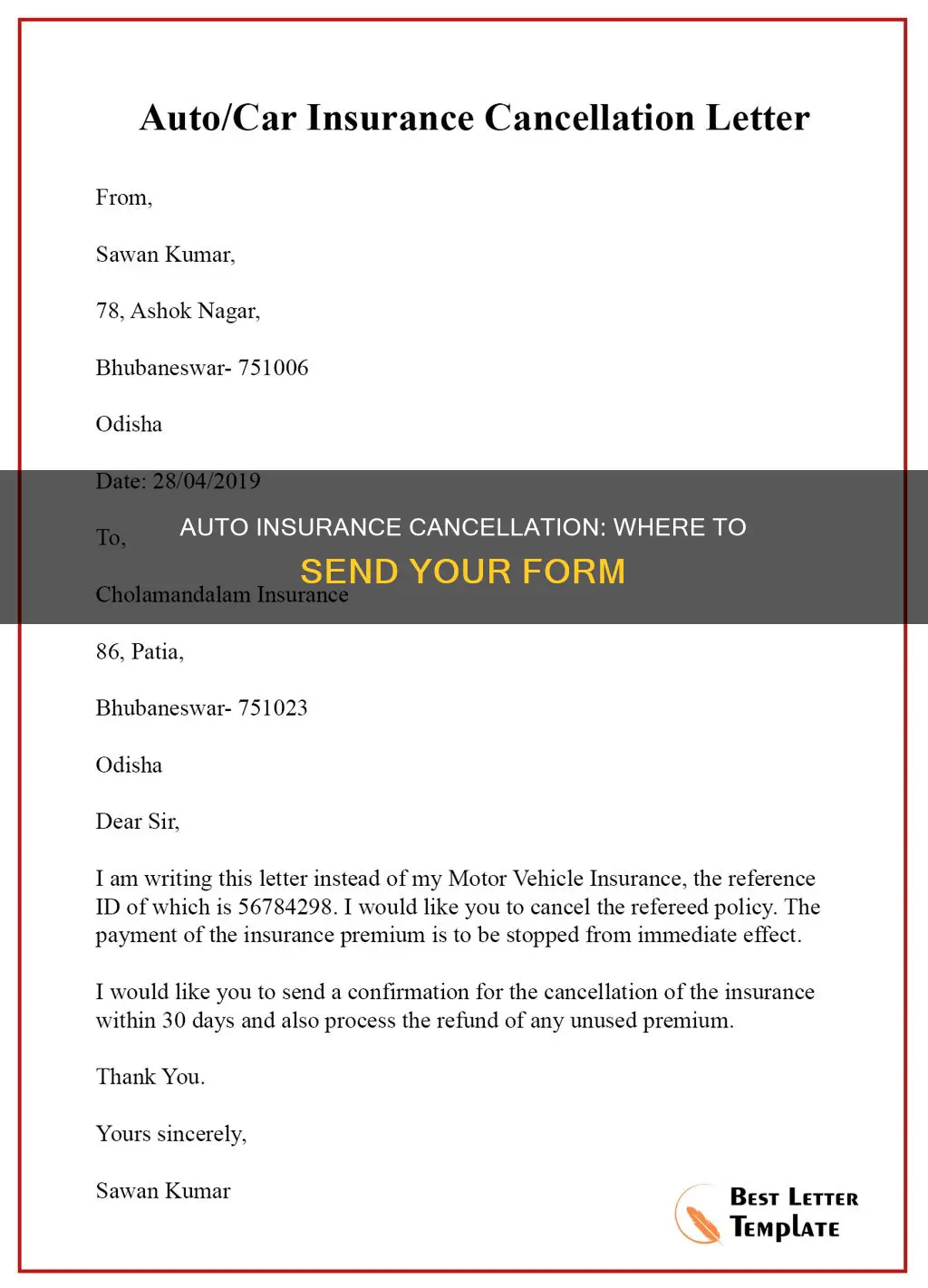

Write and mail your cancellation letter

Once you have the necessary information, write a cancellation letter to your insurance company. Include all the relevant details mentioned in step 2. You can send the letter by email or certified mail, which provides proof that your insurer received the paperwork. Ask your insurance company to confirm they have received your cancellation request and the effective date of the cancellation.

Switch insurers

When switching insurance companies, ensure that you complete each step to avoid an insurance lapse. Start your new coverage on the same day your old policy ends, or sooner.

Insurers: Aftermarket Parts Required

You may want to see also

Cancelling car insurance in person

Cancelling your car insurance in person is a straightforward process. Here's what you need to do:

Finalise your new policy

Before cancelling your current car insurance, make sure you have another policy in place to avoid a lapse in coverage, which could affect your future rates and cause a claim denial. Having a new policy in place will also ensure you meet your policy obligations and follow the procedures outlined in your insurance contract.

Gather information about both policies

You'll need to provide some key information about your current and new insurance policies, including:

- Your personal information, such as your full name and address

- Your contact information, such as your phone number and email address

- The policy numbers for both the current and new policies

- The effective date your new car insurance coverage starts

- The policy cancellation date for your current policy

Contact your insurer

Get in touch with your insurance company to inform them that you want to cancel your policy. You can do this by calling them, sending an email, or visiting their office in person. Ask about their specific cancellation process, including any cancellation fees, and whether they require a written cancellation letter or notice period.

Write and submit your cancellation letter

If your insurance company requires a written cancellation, draft a letter including all the relevant information about your policy and the cancellation date. You can send this letter via email or postal mail. Be sure to request a confirmation of cancellation from your insurer, and keep a copy of the letter for your records.

Receive written confirmation

Ask your insurance company to confirm that they have received your cancellation request and the effective cancellation date. This confirmation will be useful if you need to reference the cancellation at a later date, for example, if your next auto premium comes out of your bank account after you've cancelled.

Handle any necessary paperwork

Depending on your location, you may need to surrender your license plates or submit a Notice of Release of Liability to your state's Department of Motor Vehicles. Check the specific regulations in your state to ensure you're complying with all the necessary requirements.

Remember, it's important to follow the correct process when cancelling your car insurance in person to avoid any issues or penalties. By taking these steps, you can ensure a smooth and efficient cancellation process.

Full Coverage Auto Insurance: Washington's Definition and Requirements

You may want to see also

Cancelling car insurance: what to include in the letter

Cancelling car insurance is a simple process, but it's important to include all the necessary information in your letter. Here's a step-by-step guide on what to include when writing a car insurance cancellation letter:

- Finalize your new policy: Before cancelling your current policy, it's a good idea to have another policy in place to avoid any lapse in coverage, which could affect your future rates and cause issues with claims.

- Gather information: You'll need to include personal information such as your full name, address, contact details, policy numbers for both the current and new policies, and the effective dates of each policy. Ensure the cancellation date is the same day or after the new policy starts to avoid a coverage gap.

- Contact your current insurer: Different insurance companies have different cancellation processes. Some may accept a phone call or email, while others may require a written request. Contact your insurer to understand their specific requirements and meet your policy obligations.

- Write and send the cancellation letter: Address the letter to the insurance company, including the date, your name, address, and policy number. Clearly state your request for cancellation and the effective date. If you have automatic payments, be sure to mention that you want them stopped as well. You can also request written confirmation of the cancellation and a refund of any unused premiums.

- Receive written confirmation: Ask your insurance company to provide confirmation of the cancellation and the effective date. This will be helpful if there are any issues with future billing or if you need to prove the cancellation date.

- Follow up: After sending your cancellation letter, follow up with the insurance company to ensure they have received it and processed your request. This will help prevent any potential issues or delays in the cancellation process.

Remember to keep a copy of your cancellation letter for your records and be polite and professional in your communication. By following these steps, you can effectively cancel your car insurance policy and ensure a smooth transition to your new coverage.

Canceling Wawanesa Auto Insurance: Anytime?

You may want to see also

Frequently asked questions

You can send your cancellation form by post or email. If you are sending it by post, make sure to use certified mail so that you have proof of receipt.

You should include your full name, address, contact information, policy number, the effective date of cancellation, and your signature. You may also include the reason for cancellation and your new insurance details.

Although it is not mandatory, providing a reason for cancellation can be helpful.

You should request a written confirmation of the cancellation for your records.

This depends on your insurance policy and company. Some companies charge a flat fee, usually less than $100, or a "short rate" fee, which is a percentage of the remaining premium.