Wawanesa auto insurance policyholders can cancel their policy at any time, but there is a $50 cancellation fee if they cancel within 60 days of the policy start date. To cancel your policy, you need to talk to your broker, and their contact information can be found on the cover page of your policy documents.

| Characteristics | Values |

|---|---|

| Is there a fee to cancel a Wawanesa auto insurance policy? | Yes, there is a $50 cancellation fee if you cancel within 60 days of the policy start date. |

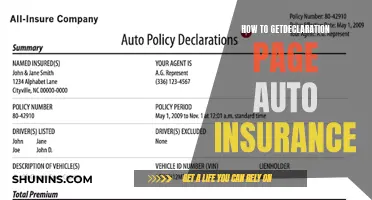

| How do I cancel my Wawanesa auto insurance policy? | Contact your broker to inquire about cancelling your policy. Your broker's contact information can be found on the cover page of your policy documents. |

What You'll Learn

- Wawanesa charges a $50 cancellation fee for policies cancelled within 60 days of their start date

- To cancel your policy, you need to talk to your broker

- You can make a payment for a cancelled policy online, but you should call to ensure coverage as soon as possible

- You can report a claim online or by calling 888-WAWA-CLAIM (929-2252)

- Wawanesa offers Roadside Assistance as an optional coverage

Wawanesa charges a $50 cancellation fee for policies cancelled within 60 days of their start date

Wawanesa does allow customers to cancel their auto insurance policy at any time. However, there is a fee for doing so. Specifically, Wawanesa charges a $50 cancellation fee for policies cancelled within 60 days of their start date. This fee is designed to cover administrative costs associated with policy cancellations.

If you cancel your policy after the 60-day period, you will not be charged a cancellation fee. However, it's important to note that Wawanesa may charge other fees if you cancel your policy, regardless of when you cancel. For example, if you have made any payments towards your policy, you may be entitled to a refund, but Wawanesa may deduct certain fees from that refund.

In addition, if you cancel your policy, you may lose certain benefits or coverage that you had under the policy. For example, if you had Roadside Assistance as part of your policy, you would no longer be covered for those services once your policy is cancelled.

It's always a good idea to carefully review the terms and conditions of your insurance policy before cancelling, to understand any potential fees, refunds, or loss of coverage that may apply. You can also contact Wawanesa directly to discuss the specifics of your policy and how cancellation may impact you.

Go Auto Insurance: Good or Not?

You may want to see also

To cancel your policy, you need to talk to your broker

To cancel your Wawanesa insurance policy, you need to talk to your broker. Your broker's contact information can be found on the cover page of your policy documents. If you don't have a broker, you can visit the Find a Broker page on the Wawanesa website to find a broker near you.

It's important to note that there is a $50 cancellation fee if you cancel your policy within 60 days of its start date. This fee is mentioned on the Wawanesa website and is applicable to all policies and payment plans.

In addition to contacting your broker, you can also manage your policy online or by calling customer service at 800-640-2920. Through these methods, you can make changes to your account, update your personal information, and access policy documents. However, for policy cancellation, speaking with your broker is the recommended course of action.

Remember to review your policy regularly and contact your broker if you need to make any significant changes, such as updating your address, adding a licensed driver, or changing how you use your vehicle. Your broker can provide expert advice and ensure that your insurance coverage meets your needs.

Canceling Auto Insurance Claims: Is It Possible?

You may want to see also

You can make a payment for a cancelled policy online, but you should call to ensure coverage as soon as possible

Wawanesa offers a range of insurance products, including auto and homeowners insurance. When it comes to cancelling your policy, there are a few things you should keep in mind. Firstly, if you have a Wawanesa policy in the US, there is a $50 cancellation fee for any new insurance policy that is cancelled within 60 days of the start date. This applies to both auto and homeowners insurance policies.

Now, let's focus on the scenario where your policy has been cancelled due to non-payment. In this case, Wawanesa allows you to make a payment online for your cancelled policy. However, it is important to understand that submitting a payment does not automatically reinstate your coverage. To ensure that your coverage is reinstated as soon as possible, you need to take an additional step. Wawanesa encourages you to call their customer service team at 800-640-2920 to confirm the reinstatement of your coverage. By doing so, you can be certain that you are covered without any lapse in your insurance policy.

It is worth noting that Wawanesa has specific requirements for reinstating a policy cancelled due to non-payment. For homeowners insurance, your coverage will be reinstated without a lapse if you pay the past-due amount in full within 25 days past the payment due date. Similarly, for auto insurance, you can avoid a lapse in coverage by paying in full within 30 days of the payment due date. If you make a payment after this timeframe, your insurance policy will be subject to new terms and conditions.

To make an online payment for a cancelled policy, you can log in to your Wawanesa online account and use either your bank account and routing number or a debit/credit card. Please be aware that there is a non-refundable processing fee of $4.99 for debit/credit card payments. Additionally, Wawanesa accepts payments by phone, mail, or through your financial institution's online banking service. Regardless of the payment method, remember to call Wawanesa to confirm the reinstatement of your coverage and avoid any gaps in your insurance protection.

NY Auto Insurance: No-Fault State

You may want to see also

You can report a claim online or by calling 888-WAWA-CLAIM (929-2252)

If you need to report a claim with Wawanesa, you can do so online or by calling 888-WAWA-CLAIM (929-2252). This line is open 24 hours a day, 7 days a week, and you can also report a claim at any time online. If you are a Wawanesa personal property or auto policyholder, you can use the Claims Central platform to share files, communicate with your adjuster, and track your claim in real time.

To report a claim by phone, call 1-844-WAWANESA (929-2637). This number is also available 24/7, 365 days a year. You can also use this number to get a quote. If you are an existing policyholder, you can call 800-640-2920 for assistance.

If you are looking to cancel your Wawanesa policy, you will need to speak to your broker. Their contact information can be found on the cover page of your policy documents. There is a $50 cancellation fee if you cancel within 60 days of your policy's start date.

U.S. Civilian Auto Insurance: Can You Join USAA?

You may want to see also

Wawanesa offers Roadside Assistance as an optional coverage

Roadside assistance from Wawanesa includes services such as emergency towing, flat tire change, battery jump-start, fuel delivery, winching service, and locksmith services. This coverage is particularly useful if you have a long commute, travel frequently, drive in unfamiliar areas, or have an older car.

The cost of adding roadside assistance to your Wawanesa auto insurance policy varies by state, and you can easily determine the cost by logging into your online account or contacting one of their helpful agents. It's important to note that roadside assistance coverage may not be effective on the same day it is added to your policy.

Wawanesa's roadside assistance services are provided by and/or through HONK, a leader in the roadside assistance industry. HONK has over 75,000 service vehicles across the U.S. and is known for its trusted and secure network of independent Service Provider Partners.

Elderly Parents and Auto Insurance

You may want to see also

Frequently asked questions

Yes, you can cancel your Wawanesa auto insurance policy at any time, but there is a $50 cancellation fee if you cancel within 60 days of the policy start date.

To cancel your Wawanesa auto insurance policy, talk to your broker. Your broker's contact information can be found on the cover page of your policy documents.

If you don't pay your Wawanesa auto insurance bill, your policy will be cancelled due to non-payment. You can make a payment online for your cancelled policy, but you should call Wawanesa to make sure you are covered as soon as possible.