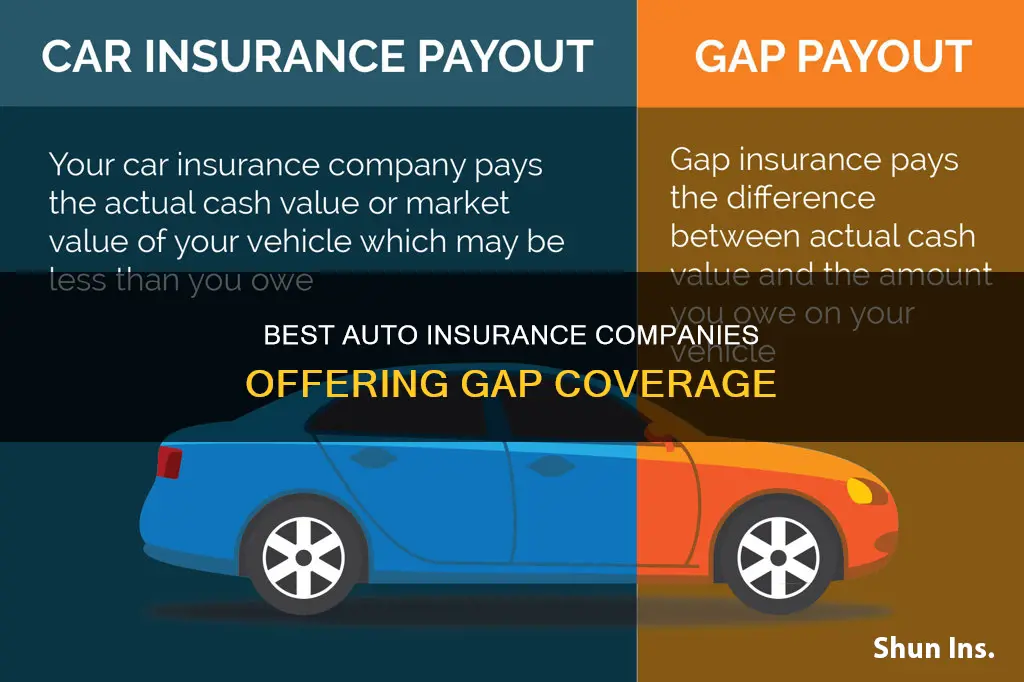

Gap insurance is an optional coverage that helps pay the difference between the actual cash value (ACV) of your vehicle and the remaining auto loan balance in the event of a total loss. It is usually added to full-coverage car insurance. If you're looking for gap insurance, you can get it from your insurance provider, a dealership, or a lender. Some of the best gap insurance companies in the US include Liberty Mutual, Nationwide, Allstate, and The Hartford.

| Characteristics | Values |

|---|---|

| Best Gap Insurance Companies | Travelers, Liberty Mutual, Nationwide, Allstate, The Hartford |

| How Gap Insurance Works | Covers the difference between the actual cash value of the vehicle and the remaining auto loan balance in the event of theft or a total loss |

| When to Get Gap Insurance | When buying a new car, especially if you made a down payment of less than 20%, financed for 60 months or longer, leased the vehicle, or purchased a vehicle that depreciates faster than average |

| Cost of Gap Insurance | Typically increases car insurance premium by $40 to $60 per year, but can be cheaper if bought through an insurance company instead of a car dealer or lender |

| What Gap Insurance Covers | Negative equity, theft (if the car is stolen and unrecovered), total loss from a covered accident |

| What Gap Insurance Doesn't Cover | Engine failure, deductible costs, medical costs, death, lost wages, bodily injuries |

What You'll Learn

- Gap insurance covers the difference between a car's value and the loan balance if it's stolen or a total loss

- It's an optional, add-on coverage for newer cars

- It doesn't cover deductible costs, engine failure, death, lost wages, or medical costs

- It's usually added to a full-coverage car insurance policy

- It's available from insurers, car dealerships, and lenders

Gap insurance covers the difference between a car's value and the loan balance if it's stolen or a total loss

Gap insurance is an optional, additional coverage that can be added to your collision insurance policy. It covers the difference between the balance of a lease or loan on a vehicle and the car's actual cash value (ACV) in the event of an accident or theft.

If your vehicle is stolen or totaled in an accident covered by your auto insurance, you will make a claim on either the collision or comprehensive insurance portion of your policy. Your insurer will pay your lender the ACV of your car. If you owe more on your loan than the ACV, gap insurance can cover the difference.

For example, if your car loan left to pay is $30,000, the ACV of your car is $25,000, and you have a deductible of $500, the car accident settlement is $24,500. Your gap insurance coverage may pay the remaining $5,500 on the loan instead of you having to pay it out of pocket.

When to Consider Gap Insurance

You might want to consider gap insurance for a new car or truck if you:

- Made a down payment of less than 20%

- Financed for 60 months or longer

- Leased the vehicle (carrying gap insurance is generally required for a lease)

- Purchased a vehicle that depreciates faster than average

- Rolled over negative equity from an old car loan into the new loan

When You Don't Need Gap Insurance

You may be able to skip gap insurance if:

- You made a down payment of at least 20% on the car when you bought it

- You're paying off the car loan in less than five years

- The vehicle is a make and model that historically holds its value better than average

Where to Get Gap Insurance

You can typically buy gap insurance from car insurance companies, banks, and credit unions. Your car dealer may also offer gap insurance, but it is usually more expensive than buying it through a traditional insurer. Many car insurance companies that offer gap insurance include Nationwide, NJM, and Plymouth Rock.

Auto Rental Insurance: Understanding the Nu Rentals Partnership

You may want to see also

It's an optional, add-on coverage for newer cars

Gap insurance is an optional, add-on coverage for newer cars that can be purchased at an additional cost to your standard insurance policy. It is designed to protect drivers from financial losses in the event of an accident or theft by covering the "gap" between the current value of the car and the amount still owed on a loan or lease. This type of insurance is particularly relevant for new cars, which can lose value quickly as soon as they are driven off the dealer's lot.

While basic auto insurance policies cover damages to other vehicles, they often do not cover damages to your own car. Therefore, gap insurance is a valuable option for those who have leased or financed their vehicle and could end up owing more than the car is worth. In the event of a covered accident, gap insurance can help protect you from having to continue making payments on a totaled car.

It is important to note that gap insurance does not cover deductibles, prior loan balances, missed payments, or late fees. Additionally, it does not cover mechanical repairs. Also, it is not available as a stand-alone policy but must be added to a comprehensive or standalone own-damage car insurance plan.

When considering gap insurance, it is essential to review your current coverage, understand your lender's requirements, and assess your financial situation to determine if this optional coverage is right for you.

Does Defensive Driving Reduce Your Liability?

You may want to see also

It doesn't cover deductible costs, engine failure, death, lost wages, or medical costs

Gap insurance is an optional, additional coverage that can be added to your auto insurance policy. It covers the difference between the balance of a lease or loan on a vehicle and the payout you receive from your insurance company if the car is considered a total loss.

While gap insurance can be a valuable safeguard, it does not cover every expense. Notably, it does not cover deductible costs, engine failure, death, lost wages, or medical costs.

Deductible Costs

Gap insurance does not cover your collision or comprehensive deductible amount. This means that if you have a gap of $3,000 after your collision insurance payout and a deductible of $500, you will only receive $2,500 from your gap insurance.

Engine Failure

Gap insurance is only applicable in the event of a total loss from a covered accident and does not cover mechanical repairs. Engine failure is not considered a total loss, so gap insurance will not cover this expense.

Death, Lost Wages, and Medical Costs

Gap insurance is strictly limited to vehicle losses and does not cover bodily injuries, death, funeral expenses, lost wages, or medical expenses resulting from an accident. If you require coverage for these types of expenses, you may want to consider additional insurance options, such as personal injury protection or medical payments coverage.

In summary, while gap insurance can provide valuable financial protection in the event of a total loss of your vehicle, it is important to understand its limitations. It does not cover deductible costs, engine failure, death, lost wages, or medical expenses.

Washington Auto Insurance: What You Need to Know

You may want to see also

It's usually added to a full-coverage car insurance policy

When it comes to auto insurance, "full coverage" typically refers to a combination of liability coverage, collision coverage, and comprehensive coverage. Liability coverage is mandatory in almost all states and covers damages or injuries you cause to another person or their property up to a certain limit. Collision coverage, on the other hand, protects your vehicle by covering the cost of repairs or replacements resulting from collisions with other objects, regardless of fault. Comprehensive coverage is also optional and covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

While there is no universally accepted definition of "full coverage", it generally includes liability, collision, and comprehensive insurance, along with other types of coverage that may be required by state law. For example, some states mandate medical payments (MedPay) or personal injury protection (PIP) as part of their full coverage requirements. Additionally, full coverage policies can vary in structure, with specifics differing between tort states and no-fault states.

When it comes to gap insurance, it is considered an optional, add-on coverage that can be included in a full-coverage car insurance policy. Gap insurance, or guaranteed asset protection insurance, covers the difference between the actual value of your car and the amount you still owe on a loan or lease in the event of a total loss. This type of coverage is particularly useful for newer cars, as they tend to depreciate quickly, leaving a significant gap between their market value and the outstanding loan or lease amount. While gap insurance is optional in most cases, lenders or leasing companies may require it as a condition of financing or leasing a vehicle.

Auto Insurance and Carrier Rack Coverage: What You Need to Know

You may want to see also

It's available from insurers, car dealerships, and lenders

Gap insurance is available from insurers, car dealerships, and lenders. It is an optional, additional coverage that can be added to your collision insurance policy. It covers the "gap" between the balance of a lease or loan on a vehicle and its actual cash value (ACV) in the event of an accident. This is because the ACV of a car is usually less than the price paid for it, due to depreciation.

Insurers such as Nationwide offer gap insurance as an optional add-on to their auto insurance policies. It is worth noting that gap insurance is only available for newer cars and is applicable to vehicles 6 years old or less. It is also important to check your coverage paperwork as some lenders may require loan gap insurance in addition to collision and comprehensive coverage.

Car dealerships also offer gap insurance, and it is generally required for leased vehicles. Dealerships may include lease gap insurance in the cost of the lease. It is important to note that gap insurance coverage from dealerships may be subject to sales tax.

Lenders may also require the purchase of gap insurance when financing or leasing a car. This is to ensure that the loan amount is covered in the event of an accident, protecting both the lender and the borrower from financial loss.

Overall, gap insurance is a valuable option for those who lease or finance a new car, especially if they made a small down payment, are financing for a long period, or purchased a vehicle that depreciates faster than average. It provides financial protection in the event of an accident, ensuring that individuals are not left with a large bill to pay.

Auto Insurance Claims: Occurrence or Claims-Made Policies?

You may want to see also

Frequently asked questions

Some of the best gap insurance companies include Travelers, Liberty Mutual, Nationwide, Allstate, and The Hartford.

Guaranteed Asset Protection (GAP) insurance is an optional coverage that helps pay the difference between the actual cash value (ACV) of your vehicle and the remaining auto loan balance in the event of a total loss.

Gap insurance covers the difference between the balance on a car loan or lease and the car's actual cash value (ACV) in the event of a total loss. For example, if you owe $24,000 on your loan and your car is worth only $20,000 when it's totaled, gap insurance would cover the $4,000 gap.

Gap insurance is typically not required, but it may be worth purchasing if you lease a car or have a small down payment on a financed vehicle.

Adding gap insurance to a full-coverage policy typically increases the premium by $40 to $60 per year, but costs can vary depending on the company.