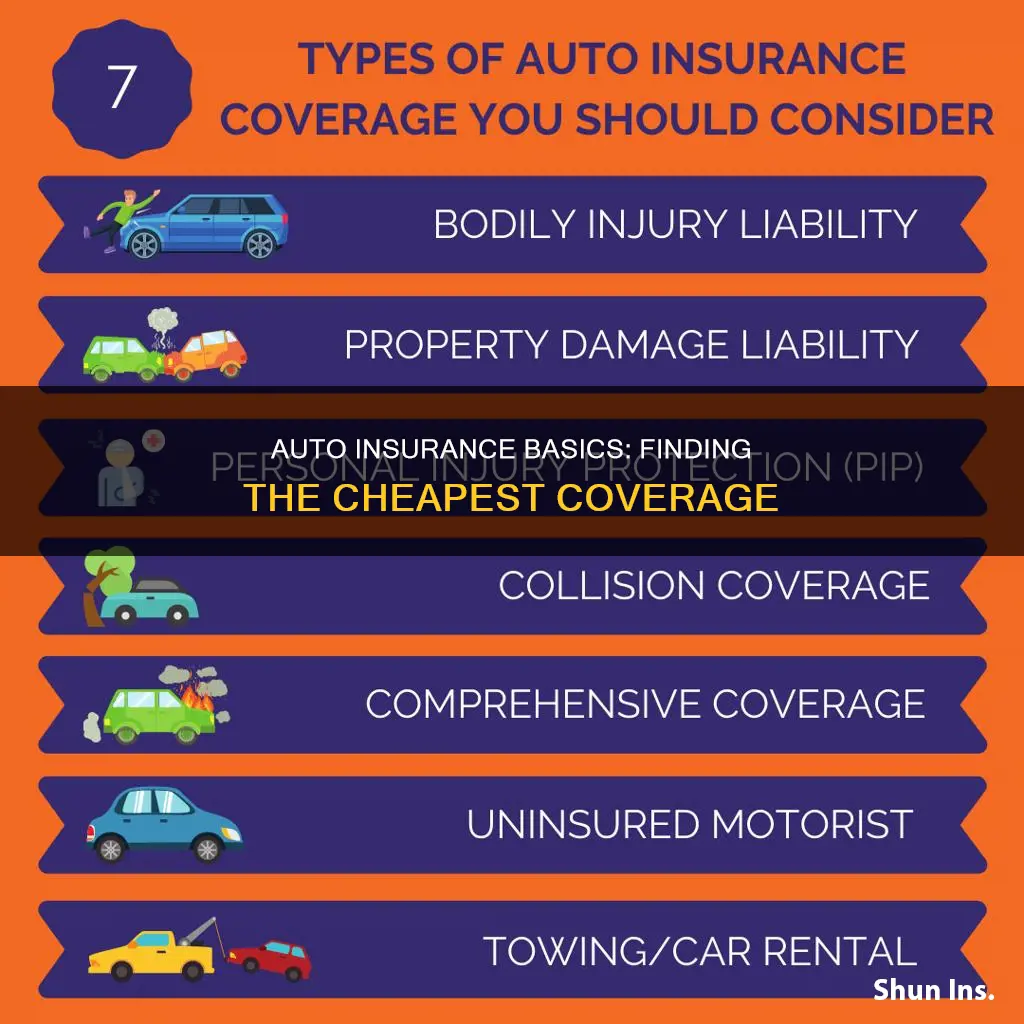

Finding the cheapest car insurance can be a challenge, but it's not impossible. The cheapest insurance can refer to both low cost and low quality, so it's important to find an option that balances affordability with good coverage. The cost of car insurance depends on various factors, such as age, driving record, location, and vehicle type. To get the cheapest car insurance, you can compare rates from different insurers, take advantage of discounts, maintain a clean driving record, and consider the coverage options and deductibles that best fit your needs. Some of the cheapest car insurance companies include Geico, Progressive, and Liberty Mutual, but the best option for you will depend on your specific circumstances.

What You'll Learn

How to find the cheapest car insurance

Finding the cheapest car insurance can be a tricky task, but there are a few ways to get a better deal. Firstly, it's important to shop around and compare quotes from multiple insurers. Car insurance companies regularly change their pricing models, so it's a good idea to request quotes from at least three companies to ensure you're getting the best rate. It's also worth asking insurers about any discounts that may be available to new customers, such as savings for bundling insurance policies or rewards for safe driving behaviour.

Another way to reduce your car insurance premium is to drop any optional coverage that you don't need. For example, if you have an older car that isn't worth much, you may be able to remove comprehensive and collision insurance, which covers the cost of repairs to your vehicle in certain situations. Similarly, you can also raise your deductible, which is the amount you pay out of pocket before your insurance kicks in. Just make sure that you have enough savings to cover the higher deductible amount if you need to make a claim.

Finally, building and maintaining a good credit score can help you get a better rate on your car insurance. In some states, insurers use a credit-based insurance score to price policies, so keeping your credit score high can lead to cheaper insurance.

While it's important to find affordable car insurance, it's also crucial to ensure that you have adequate coverage. Minimum coverage may not be sufficient to protect you financially in the event of a serious accident, so consider purchasing additional coverage if you can afford it. Collision and comprehensive insurance, for example, can provide extra protection if your car is stolen or damaged. Ultimately, it's important to find a balance between cost and the level of protection that you need.

Usaa: Commercial Auto Insurance Coverage

You may want to see also

Cheapest car insurance companies

The cost of car insurance is rising, but there are still some affordable options out there. The cheapest car insurance companies will vary depending on your driver profile, including your age, driving history, location, and other factors. Here are some of the cheapest car insurance companies in the United States, according to various sources:

Geico

Geico is often cited as one of the cheapest car insurance companies, especially for drivers with poor credit. They offer the cheapest minimum coverage, with an average rate of $349 per year, or about $29 per month. They also have cheap rates for young drivers, drivers with speeding tickets, and drivers who have been in an accident.

USAA

USAA offers insurance exclusively to military personnel, veterans, and their families. They have some of the lowest rates in the industry, especially for those with a clean driving record. Their average annual rate is $1,335.

Erie Insurance

Erie Insurance has the cheapest rates for teen drivers, both male and female. They also have the lowest rates for senior drivers and drivers with speeding tickets or accidents. Their average annual rate is $1,532.

Auto-Owners Insurance

Auto-Owners Insurance is a regional carrier that offers cheap rates in the 26 states where they operate. They have the cheapest average minimum coverage premium for drivers with clean driving records and good credit. Their average annual rate is $1,619.

Nationwide

Nationwide has the lowest sample costs for drivers with poor credit. They also have competitive rates for teen drivers and drivers with speeding tickets or accidents. Their average annual rate is $1,621.

Progressive

Progressive offers the cheapest rates for drivers with a DUI conviction. Their average annual rate is $2,296.

When looking for cheap car insurance, it's important to remember that the cost of insurance depends on many factors, and the cheapest company for one driver may not be the cheapest for another. It's always a good idea to shop around and compare quotes from multiple companies to find the best rate for your specific situation. Additionally, cheap insurance may come with higher deductibles and lower coverage limits, so be sure to consider your needs and choose a policy that offers adequate protection.

Car Insurance Checks: The Police and Your Policy

You may want to see also

Risks of cheap car insurance

While opting for a cheap car insurance plan may seem like a good idea, it is important to be aware of the potential risks involved. Here are some key considerations to keep in mind:

Lack of Coverage Options

Cheap car insurance plans may not provide sufficient coverage in the event of a serious accident. Basic insurance plans often only meet the minimum coverage requirements mandated by the state, which may not be enough to cover the full cost of damages and repairs. As a result, you could be left with unexpected out-of-pocket expenses.

High Deductible Payments

Cheap insurance plans often come with higher deductibles. This means that when filing a claim, you will need to pay a larger amount out of your own pocket before the insurance company covers the remaining costs. In some cases, the deductible may be so high that it negates the benefit of having insurance in the first place.

Poor Customer Service

Some insurance companies offering cheap plans may also have poor customer service. This can be a significant issue, especially when you need assistance the most, such as after an accident or when filing a claim. Response times may be slow, and you may find yourself dealing with unhelpful or unresponsive representatives.

Compromised Quality

When it comes to car insurance, the phrase "you get what you pay for" often rings true. Cheap insurance plans may indicate a compromise in the quality of service and coverage. This could lead to issues such as delays in repairs, subpar repair work, or even denial of coverage for certain types of accidents or damages.

Limited Additional Protection

In addition to the basic coverage, it is important to consider the additional protection options offered by the insurance company. Cheap insurance plans may not include add-ons such as rental car reimbursement, roadside assistance, or coverage for specific types of incidents like natural disasters or vandalism.

Effect on Credit History

Opting for a cheap insurance plan with a lesser-known or nonstandard insurance company can also impact your credit history. Some companies may not report your timely payments to credit bureaus, which could affect your overall credit score and, in turn, impact other areas of your financial life.

While finding affordable car insurance is important, it is crucial to carefully review the terms, coverage options, and reputation of the insurance company before making a decision. It is worth considering that cheap insurance may come at the cost of compromised quality and service, potentially leaving you vulnerable in the event of an accident or claim.

Allstate Auto Insurance: Is It Worth the Hype?

You may want to see also

How to save money on car insurance

There are several ways to save money on car insurance. Here are some tips to help you get started:

Shop Around for Insurance

Firstly, it's important to shop around for car insurance and get multiple quotes. Prices differ from company to company, so it's worth comparing rates from different insurers. Get at least three quotes from different insurance companies and types of insurance providers. Remember to also consider their reputation and the quality of their customer service.

Compare Insurance Costs Before Buying a Car

When buying a car, remember that auto insurance premiums are based on the car's price, repair costs, safety record, and the likelihood of theft. Many insurers offer discounts for safety features and cars that are known to be safe. So, be sure to research the insurance costs for the specific models you're considering.

Raise Your Deductible

Opting for a higher deductible on your car insurance can significantly lower your premium costs. Just make sure you have enough money set aside to pay the higher deductible in case you need to make a claim.

Reduce Optional Insurance on Older Cars

If your older car is worth less than ten times the insurance premium, it may not be cost-effective to have collision or comprehensive coverage. Check the value of your car to see if you can reduce these optional coverages.

Bundle Your Insurance

Consider bundling your insurance policies. Many insurers offer discounts if you purchase multiple types of insurance from them, such as homeowners and auto insurance, or if you insure more than one vehicle.

Maintain a Good Credit History

Establishing a solid credit history can lead to lower insurance costs. Many insurers use credit information to price auto insurance policies, as research shows that people who effectively manage their credit tend to make fewer claims.

Take Advantage of Low Mileage Discounts

If you drive less than the average number of miles per year, you may be eligible for low mileage discounts. Some companies offer these discounts to motorists who carpool or have a shorter commute.

Ask About Group Insurance

Inquire about group insurance options. Some companies provide reductions to drivers who get insurance through their employers or certain associations, such as professional, business, or alumni groups.

Seek Out Other Discounts

In addition to the above, there may be other discounts available. Ask your insurer about potential savings for safe driving records, taking a defensive driving course, or having a young driver on your policy who is a good student.

By following these tips and comparing options, you can find ways to reduce your car insurance costs without compromising on the coverage you need.

Retroactive Auto Insurance: Is It Possible?

You may want to see also

Best car insurance companies

When it comes to finding the best car insurance companies, there are several factors to consider. Here is a list of the top car insurance companies, along with a brief description of each:

- Progressive: Best for digital policy management. Progressive offers a strong digital platform that allows users to get quotes, buy policies, and manage their accounts entirely online or through its mobile app. They also offer numerous discounts to help lower premiums.

- Geico: Best for multiple discount opportunities. Geico is known for its low rates and offers a wide array of discounts, including highly-rated mobile apps and digital tools. However, they offer fewer coverage options and local agencies than some competitors.

- State Farm: Best for local agencies. State Farm is the largest auto insurer by market share and offers in-person agents to handle insurance needs. However, they do not write policies for drivers with a DUI record.

- Auto-Owners: Best for personalized coverage. Auto-Owners is a regional carrier offering a wide range of coverage options and discounts. However, they do not provide online quotes, and you will need to work with a local agent.

- USAA: Best for military-focused coverage. USAA offers low rates, excellent customer satisfaction, and coverage tailored to military needs. However, it is only available to active military, veterans, and their qualifying family members.

When choosing the best car insurance company, it is important to consider your individual needs, compare multiple carriers, and understand the minimum insurance requirements in your state. Additionally, consider the company's customer satisfaction ratings, financial strength, and the range of coverage options and discounts available.

Auto Insurance: Who's Tracking My License?

You may want to see also

Frequently asked questions

The cheapest car insurance company depends on your driver profile, location, and vehicle. However, USAA, Erie, Auto-Owners, Nationwide, Geico, and Progressive are some of the cheapest car insurance companies nationwide.

The cheapest type of car insurance is a state-minimum or liability-only policy, which only includes the minimum amount of coverage required by your state.

Those who are 55 years old tend to pay the lowest rates, regardless of their driver profile.

Geico tends to be cheaper for most drivers than Progressive. However, Progressive offers favorable rates for some drivers in certain areas, especially those in high-risk categories.

State Farm is the largest auto insurance company in the U.S., accounting for 18.31% of the total private auto insurance market.