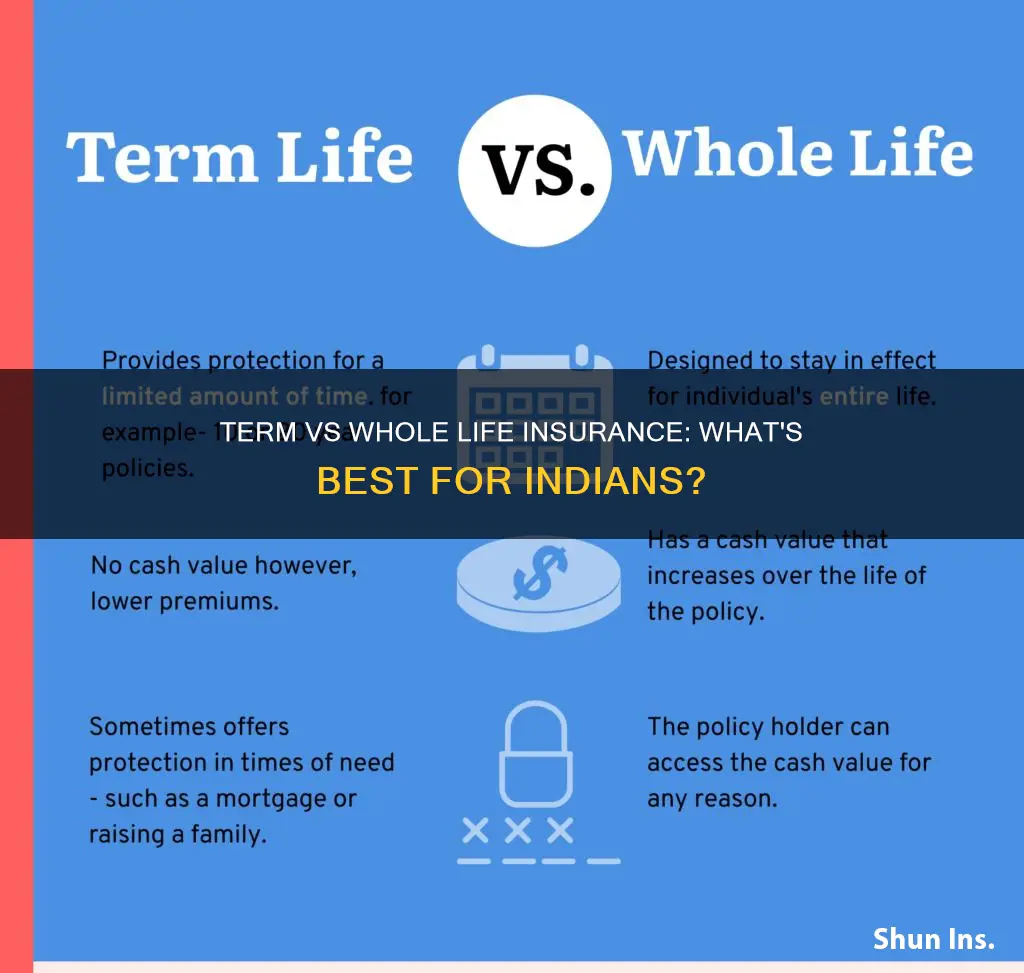

Term life insurance and whole life insurance are two common types of life insurance policies. The main difference between the two is that term life insurance covers a specific period, such as 10, 20, or 30 years, while whole life insurance covers the insured's entire lifetime, typically up to 99 or 100 years. Term life insurance is generally more affordable and suitable for those with limited funds, whereas whole life insurance is more expensive but offers lifelong coverage and the opportunity to build savings over time. The choice between term and whole life insurance depends on factors such as budget, financial goals, and the desired duration of coverage.

What You'll Learn

- Term insurance is cheaper but only covers a set period

- Whole life insurance is more expensive but lasts your entire life

- Whole life insurance can build cash value that can be borrowed against

- Term insurance is ideal if you only need coverage for a finite period

- Whole life insurance is better for those who want coverage for life and the ability to build retirement wealth

Term insurance is cheaper but only covers a set period

Term insurance is a cost-effective option for those who want to ensure their family is financially protected in their absence. It is a simple and straightforward type of insurance that covers the policyholder for a set number of years. For example, a 32-year-old man might opt for a 30-year term plan to financially secure his family.

The main advantage of term insurance is its low cost. Because it only covers a specific period, usually 10, 20, or 30 years, the premiums are much lower than those of whole life insurance. This makes it ideal for individuals with limited funds who want to ensure their family is provided for during that time, such as while raising children or paying off a mortgage.

Term insurance is also a good option for younger people who are in good health. The earlier in life a term insurance plan is purchased, the lower the premium is likely to be. This makes it an appealing choice for those who want to ensure financial protection for their loved ones at a low cost.

However, one of the drawbacks of term insurance is that it does not offer lifelong coverage. If the policyholder outlives the term, there is no payout, and the policy expires. This means that term insurance may not be suitable for those who want coverage for their entire lives or who are planning for retirement.

In conclusion, term insurance is a good option for those who want affordable coverage for a specific period. It is simple, easy to understand, and provides peace of mind that loved ones will be taken care of financially if the policyholder passes away during the term. However, it is important to consider the limited duration of term insurance and decide if long-term coverage is needed.

How Much Life Insurance Do You Need?

You may want to see also

Whole life insurance is more expensive but lasts your entire life

Whole life insurance is more expensive than term life insurance, but it lasts your entire life. Term insurance provides coverage for a specific term or period, such as 10, 20, or 30 years, and pays out if you die during that term. If you outlive the term, your beneficiaries won't receive any money. Whole life insurance, on the other hand, provides coverage for the entire lifetime of the policyholder, typically up to 99 or 100 years, and guarantees a death benefit payout to the beneficiaries, regardless of when the policyholder passes away.

The higher cost of whole life insurance is due to its lifetime coverage and the savings or income feature it offers. Whole life insurance accumulates a savings pool over time, which can be accessed during the policyholder's lifetime through loans or withdrawals, providing funds for emergencies, retirement, or other financial needs. This cash value component of whole life insurance can also supplement your retirement savings.

Whole life insurance is ideal for those who want coverage for life and the ability to build retirement wealth through the policy's cash value account. It is designed for individuals seeking long-term financial protection, estate planning, or those who want to leave a legacy to their beneficiaries. The permanent nature of whole life insurance also makes it a good choice for those who want the peace of mind that comes with knowing they will always have coverage, regardless of changing health conditions or other circumstances.

Term life insurance, on the other hand, is a more affordable option for those who need coverage but have limited funds. It is suitable for those who only need coverage for a specific period, such as while raising children, paying off a mortgage, or meeting other transitory financial obligations. Term life insurance is also simpler and easier to understand, without the complex investment components and monetary value accumulation of whole life insurance.

When deciding between term and whole life insurance, it is important to consider your budget, long-term financial goals, and the duration of coverage needed. Term life insurance may be the best choice if you are on a budget and just want to provide coverage for your family for a specific period. Whole life insurance, despite being more expensive, may be more appropriate if you want lifelong protection, the ability to build wealth, and the additional benefits of a savings component.

Global Life Insurance: What You Need to Know

You may want to see also

Whole life insurance can build cash value that can be borrowed against

Whole life insurance is a type of insurance that offers long-life protection. It has a cash value component that helps you borrow money from the plan when needed. This cash value is independent of the death benefit. Whole life insurance is more expensive than term life insurance, but it is more straightforward. It is also more complicated than term life insurance.

Whole life insurance policies have a cash savings component, known as the cash value, which the policy owner can draw on or borrow from. This cash value accumulates inside the policy, and you can borrow against it. Borrowing from your life insurance policy can be a quick and easy way to get cash, but it can also create financial problems. The insurance company cannot turn down your loan application, but borrowing against the policy will reduce the death benefit, and unpaid loans can affect the policy's performance.

The cash value of a whole life insurance policy grows quickly when the insured is young. However, as the insured ages, the cash value grows more slowly due to the higher risks associated with age. The cash value can be used to cover monthly premium payments or supplement income in retirement. It can also be used to make large purchases, such as a home. The cash value typically earns a fixed rate of interest, and the interest rate is specified in the policy.

When considering whether to borrow against your whole life insurance policy, it is important to keep in mind that there may be tax implications and that the loan will reduce the death benefit. It is also important to understand the specific rules and limitations of your insurance company. In general, you can borrow up to 90% of the policy's cash value, but it may take several years for this amount of cash value to accrue.

Life Insurance for Kids: Cancer and Coverage Options

You may want to see also

Term insurance is ideal if you only need coverage for a finite period

Term insurance is ideal if you only need coverage for a specific period or finite period. It is a type of life insurance that provides coverage for a set term or a specific amount of time, such as 10, 15, 20, or 30 years. It is often chosen by individuals who want to financially secure their families for a specific period, such as until their children become financially independent or their mortgage is paid off. Term insurance is also suitable for those with limited funds as it is more affordable compared to whole life insurance.

The key advantage of term insurance is its low cost. It has lower premiums than whole life insurance, making it an appealing option for those searching for cost-effective insurance. Term insurance is also simple and easy to understand. It does not have complex investment components, nor does it accumulate monetary value. It only provides financial protection in the event of the policyholder's premature death during the policy term. If the policyholder outlives the policy term, there is no payout.

Term insurance is a good option for those who want a simple and affordable way to protect their family during a specific period. It is also suitable for individuals with transitory financial obligations, such as a mortgage or children's schooling, or those who have individuals financially dependent on them. Young and healthy individuals often find term insurance more appealing due to its lower premiums and sufficient coverage during their critical years.

Additionally, term insurance offers flexibility in terms of policy customisation. It provides the option to add riders, such as critical illness cover, and income tax benefits. Some term life policies also offer a conversion option that allows you to switch to a whole life policy in the future if you decide that you want lifelong coverage.

Child Support and Life Insurance: What's Covered?

You may want to see also

Whole life insurance is better for those who want coverage for life and the ability to build retirement wealth

Whole life insurance is a type of insurance that offers lifelong protection. It guarantees a death benefit to be paid to the nominees/beneficiaries upon the policyholder's death. This type of insurance offers lifelong protection and a savings element, making it suitable for long-term financial planning. Whole life insurance is better for those who want coverage for life and the ability to build retirement wealth.

Whole life insurance is more expensive than term life insurance but provides coverage until the policyholder's death. It also has a cash value component that helps the policyholder to borrow money from the plan when needed. A portion of the premium paid goes towards building this savings/income component, which may grow at a guaranteed rate set by the insurance company. This cash value may be accessed during the policyholder's lifetime through loans or withdrawals, providing a potential source of funds for emergencies, retirement, or other financial needs.

Term life insurance, on the other hand, provides coverage for a specific term or period. It is much more affordable, making it a better choice for those who need coverage but have limited funds. Term life insurance is ideal if you only need coverage for a finite period, such as while raising children or paying off a mortgage.

Whole life insurance is better for those who want coverage for their entire lives and the ability to build retirement wealth through the policy's cash value account. It is important to consider your financial goals and obligations, the required coverage amount and duration, and your budget when choosing between term and whole life insurance.

In summary, whole life insurance offers lifelong coverage and the opportunity to accumulate savings, making it a suitable option for individuals seeking long-term financial protection and those who want to build retirement wealth. Term life insurance, on the other hand, provides coverage for a specific period and is more affordable, catering to individuals with limited budgets and transitory financial obligations.

Adjustable Variable Universal Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Term insurance provides coverage for a specific period, while whole life insurance covers the insured's entire lifetime.

Term insurance is much more affordable than whole life insurance, making it a better choice for those who are on a budget or have limited funds.

Term insurance is ideal if you only need coverage for a finite period, such as while raising children or paying off a mortgage. It is also a good option if you are looking for a simple, straightforward policy with lower premiums.

Whole life insurance is a good option for those who want coverage for life as well as the ability to build retirement wealth and income through the policy's cash value account. It also offers more flexibility in terms of policy customisation.

When deciding between term and whole life insurance, consider your budget, financial goals and obligations, the required coverage amount and duration, and your long-term investment and savings strategy. Consulting a trusted insurance advisor or financial planner can help guide you in making the right choice.