Valuation plays a critical role in life insurance as it directly impacts the financial security and trustworthiness of the policy. It is the process of determining the monetary worth of an insurance policy, which is essential for assessing the policy's value, ensuring fair settlements, and providing accurate financial advice. By valuing life insurance policies, insurers can offer competitive rates, manage risk effectively, and ensure that policyholders receive the full benefit of their coverage when needed. This process also helps in maintaining the integrity of the insurance market and ensures that policyholders are protected with fair and transparent practices. Understanding the valuation process is key to making informed decisions about life insurance and maximizing its benefits.

What You'll Learn

- Risk Mitigation: Valuation helps assess financial risk and ensure adequate coverage

- Policy Customization: It enables tailored policies based on individual needs and risk profiles

- Regulatory Compliance: Valuation ensures adherence to insurance regulations and standards

- Investment Decisions: Accurate valuation aids in investment choices and policy growth

- Customer Satisfaction: Proper valuation enhances customer trust and satisfaction

Risk Mitigation: Valuation helps assess financial risk and ensure adequate coverage

Valuation plays a critical role in life insurance, particularly in the context of risk mitigation. It is a process that involves assessing the financial health and value of an insurance company, its policies, and the overall risk it is exposed to. This assessment is essential to ensure that the insurance provider can meet its financial obligations to policyholders and maintain a stable and secure operation. By evaluating the risks associated with life insurance policies, valuation helps to identify potential financial vulnerabilities and ensures that the company has sufficient resources to honor its commitments.

The primary purpose of risk mitigation through valuation is to protect both the insurance company and its customers. For the insurer, it means having a comprehensive understanding of the potential financial impact of various risks, such as mortality, longevity, and investment risks. This knowledge allows the company to set appropriate premiums and reserves, ensuring it can pay out claims and maintain a strong financial position. Adequate valuation also helps in identifying areas where the company might be over-exposed to certain risks, enabling it to take corrective actions.

In the context of policyholders, valuation ensures that their interests are protected. It guarantees that the insurance company has the financial capacity to fulfill its promises, providing peace of mind to policyholders. For instance, if a policyholder passes away, the insurance company with a strong financial position can promptly pay out the death benefit, ensuring the family's financial security. Similarly, for long-term care policies, valuation helps assess the likelihood of claims, allowing the company to set appropriate reserves and ensure policyholders receive the necessary benefits when needed.

Valuation also contributes to the overall stability of the insurance market. By regularly assessing risks and financial health, insurance companies can make informed decisions about their operations, investments, and risk management strategies. This proactive approach helps in maintaining a healthy and competitive insurance industry, which is beneficial for both consumers and the economy as a whole. Moreover, accurate valuation can prevent potential crises by identifying and addressing financial vulnerabilities before they become significant issues.

In summary, valuation is a vital process in life insurance that serves as a powerful tool for risk mitigation. It enables insurance companies to assess and manage financial risks effectively, ensuring they can provide the necessary coverage to policyholders while maintaining a robust financial position. Through valuation, the industry can operate with transparency, stability, and a commitment to protecting the interests of both its customers and the company itself. This process is a cornerstone of the insurance industry's ability to manage and mitigate risks effectively.

Understanding Whole Life Insurance: Key Elements Explained

You may want to see also

Policy Customization: It enables tailored policies based on individual needs and risk profiles

The concept of policy customization is a cornerstone of modern life insurance, allowing individuals to have a personalized approach to their coverage. This customization is a powerful tool that ensures the insurance policy meets the unique requirements of each policyholder, providing a level of protection that is both comprehensive and relevant. By tailoring the policy, insurers can offer a more precise and effective solution, which is crucial in a world where every individual's circumstances and risks are distinct.

When it comes to life insurance, valuation is the process of assessing the specific needs and risk factors of an individual. This involves a detailed analysis of various aspects of a person's life, including their health, lifestyle, financial situation, and family medical history. For instance, a non-smoker with a healthy diet and an active lifestyle may face different risks compared to a smoker with a sedentary job and a family history of heart disease. By understanding these nuances, insurers can create a policy that is specifically designed to address these unique circumstances.

The customization process begins with a comprehensive questionnaire or medical examination, which helps to identify the individual's risk profile. This information is then used to determine the appropriate level of coverage, the type of policy (term, whole life, etc.), and the premium amount. For example, a young, healthy individual may opt for a term life insurance policy with a higher death benefit, while an older person with pre-existing health conditions might require a more comprehensive policy with additional benefits. This tailored approach ensures that the policyholder receives the most suitable and cost-effective protection.

Moreover, policy customization allows for flexibility in policy terms. Insurers can offer various riders or add-ons to enhance the policy's coverage. For instance, a critical illness rider can provide a lump-sum payment if the insured person is diagnosed with a critical illness, offering financial support during a challenging time. Similarly, a disability rider can provide income replacement if the policyholder becomes unable to work due to an accident or illness. These customizable features ensure that the policy adapts to the changing needs and circumstances of the individual throughout their life.

In summary, policy customization is a vital aspect of life insurance, ensuring that the policy is a perfect fit for the policyholder. It empowers individuals to have control over their insurance coverage, providing a sense of security and peace of mind. With this level of personalization, life insurance becomes a dynamic and effective tool, offering protection that evolves with the individual's life journey. This approach not only ensures better coverage but also fosters a stronger relationship between the insurer and the policyholder, creating a more sustainable and beneficial insurance experience.

Life Insurance: Estate Planning and Inclusion Explained

You may want to see also

Regulatory Compliance: Valuation ensures adherence to insurance regulations and standards

Regulatory compliance is a critical aspect of the insurance industry, and valuation plays a pivotal role in ensuring that life insurance companies adhere to these standards. Insurance regulations are designed to protect consumers, maintain market stability, and promote fair practices within the industry. These regulations often require insurance companies to maintain specific financial standards, which are typically tied to the valuation of their assets and liabilities.

Life insurance companies are subject to a myriad of rules and guidelines set by insurance regulators and governing bodies. These regulations often mandate that insurance companies regularly assess and report on their financial health and stability. Valuation is an essential tool to meet these requirements, as it provides a comprehensive view of the company's financial position. By conducting regular valuations, insurance companies can ensure that their assets are accurately measured, liabilities are properly assessed, and their overall financial standing is in line with regulatory expectations.

One of the primary reasons for this compliance is to safeguard policyholders' interests. Insurance regulators require companies to maintain sufficient capital to meet their obligations to policyholders. This capital is often calculated based on the valuation of the company's assets and liabilities. Accurate valuations ensure that the company has enough financial resources to honor its commitments, such as paying out death benefits to policyholders' beneficiaries.

Moreover, regulatory compliance through valuation helps insurance companies maintain transparency and accountability. Insurance regulators often require companies to disclose their financial information, including valuations, to the public or regulatory bodies. This transparency ensures that stakeholders, including policyholders, investors, and regulators, have access to accurate and up-to-date financial data. It also enables regulators to monitor the industry's overall health and take appropriate actions if any company fails to meet the required standards.

In summary, valuation is a critical process that ensures life insurance companies comply with regulatory requirements. It enables companies to maintain the necessary financial standards, protect policyholders' interests, and provide transparency to all stakeholders. By adhering to these regulations, insurance companies contribute to a stable and trustworthy insurance market, fostering trust and confidence among consumers.

Activating Life Insurance Agents: Strategies for Success and Growth

You may want to see also

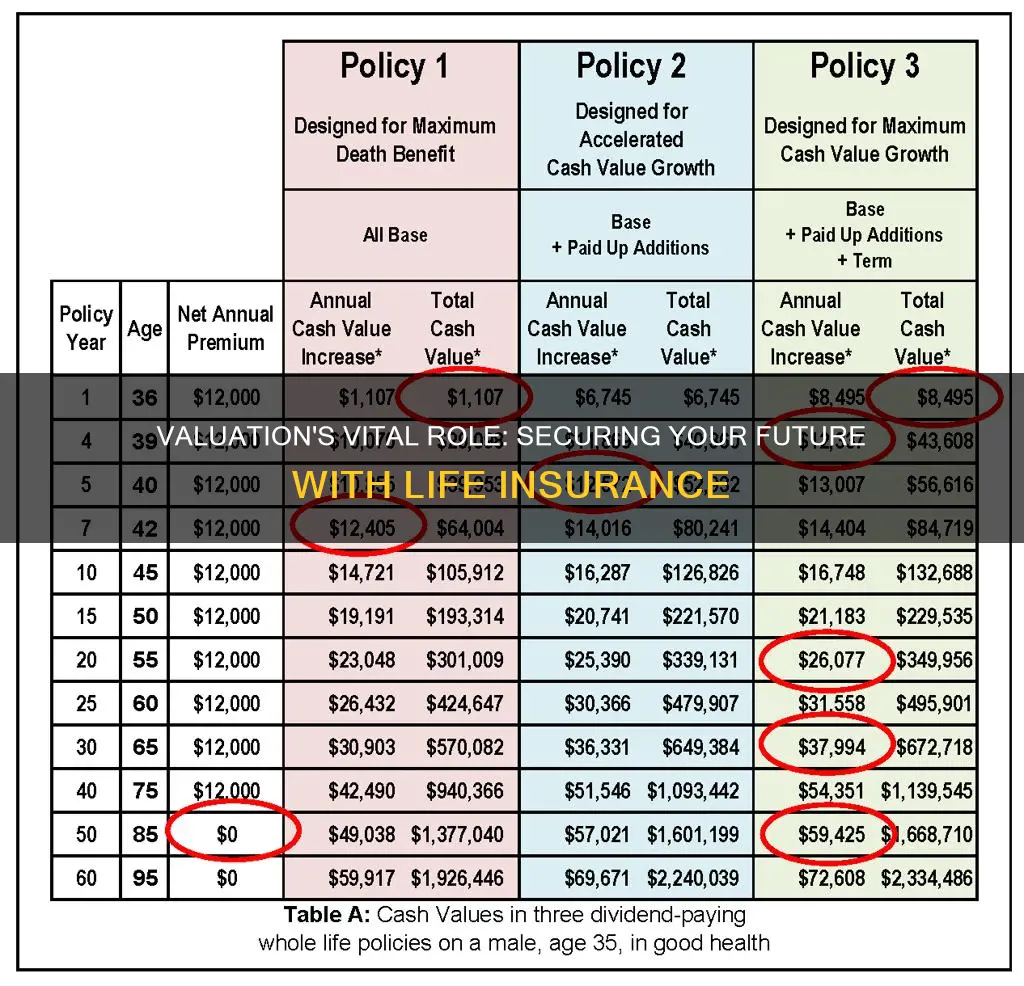

Investment Decisions: Accurate valuation aids in investment choices and policy growth

Accurate valuation is a critical aspect of life insurance, especially when it comes to investment decisions and policy growth. It provides a clear picture of the financial health and value of an insurance policy, which is essential for both the insurer and the policyholder. When making investment choices, insurers rely on valuations to assess the potential returns and risks associated with various investment options. This process involves analyzing the policy's assets, liabilities, and overall performance to determine its net worth and future prospects. By doing so, insurers can make informed decisions about where to allocate funds to maximize returns while ensuring the policy's long-term viability.

For instance, let's consider a life insurance policy with an investment component. The insurer might offer various investment options, such as stocks, bonds, or mutual funds, allowing policyholders to grow their policy's value over time. Accurate valuation helps determine the potential returns on these investments. If the policy's assets are valued at a higher amount, it indicates a more substantial potential return on investment. This information is crucial for policyholders when deciding how to allocate their investment funds within the policy to achieve their financial goals.

Moreover, valuation plays a vital role in policy growth and development. As life insurance policies mature, their value can change due to various factors, including investment performance, policyholder behavior, and market conditions. Regular and accurate valuations ensure that policyholders and insurers have a clear understanding of the policy's growth and any potential benefits or risks. This transparency enables policyholders to make informed decisions about policy adjustments, such as increasing or decreasing their investment allocation, to align with their changing financial objectives.

In the context of investment decisions, accurate valuation also helps insurers manage risk effectively. By assessing the value of the policy's investments, insurers can identify potential risks and opportunities. For example, if the policy's investments are heavily concentrated in a specific sector or market, a valuation analysis can highlight the potential impact of market fluctuations on the policy's value. This information allows insurers to diversify their investment portfolios, ensuring a more stable and secure investment environment for policyholders.

In summary, accurate valuation is a powerful tool in the life insurance industry, particularly for investment decisions and policy growth. It enables insurers to make strategic choices regarding investment options and risk management while providing policyholders with a clear understanding of their policy's value and potential. By valuing policies regularly and transparently, insurers can foster trust and confidence in their products, ultimately leading to stronger relationships with policyholders and more successful investment outcomes.

Life Insurance vs. Income Protection: Understanding the Key Differences

You may want to see also

Customer Satisfaction: Proper valuation enhances customer trust and satisfaction

Valuation plays a critical role in building and maintaining customer trust and satisfaction in the life insurance industry. When customers purchase life insurance, they are entrusting their financial security and the well-being of their loved ones to the insurer. Accurate and fair valuations are essential to ensure that customers receive the coverage they need and expect. Here's how proper valuation contributes to customer satisfaction:

Transparency and Trust: Insurance policies often involve complex financial instruments and calculations. By providing transparent valuations, insurers demonstrate their commitment to honesty and integrity. When customers understand the value of their policy and how it is determined, they are more likely to trust the insurer's expertise and recommendations. This transparency can lead to long-term customer loyalty and a positive reputation for the insurance company.

Customized Solutions: Proper valuation allows insurers to offer tailored policies to meet individual customer needs. Each person's life insurance requirements are unique, and accurate valuations enable insurers to design policies with appropriate coverage amounts, benefit options, and premium structures. When customers feel that their specific circumstances are considered and respected, they are more satisfied with the personalized nature of the insurance product.

Accurate Premiums: Valuation calculations directly impact the premium customers pay for their life insurance. A fair valuation ensures that the premiums are set at a competitive and reasonable rate. Customers appreciate when they receive value for their money, and they are more likely to be satisfied with the cost-effectiveness of the policy. Moreover, accurate valuations can prevent premium surprises, as customers will know that their premiums are based on a thorough understanding of their risk profile.

Claims Processing: In the unfortunate event of a claim, proper valuation ensures that the insurer can process the claim efficiently and accurately. When the policy's value is correctly assessed, the claims process becomes smoother, and customers can receive the benefits they are entitled to without unnecessary delays or disputes. Timely and fair claims settlements significantly contribute to customer satisfaction and a positive experience with the insurance provider.

In summary, valuation is a cornerstone of customer satisfaction in life insurance. By providing transparent and accurate valuations, insurers can build trust, offer customized solutions, and ensure fair pricing. This, in turn, leads to satisfied customers who feel confident in their insurance choices and receive the support they need when it matters most. Maintaining high standards in valuation practices is essential for the long-term success and reputation of any life insurance company.

Continental Life Insurance and Aetna: What's the Difference?

You may want to see also

Frequently asked questions

Valuation is a critical process in life insurance as it determines the financial worth and value of an insurance policy. It is essential for assessing the policy's cash value, which can be borrowed against or withdrawn, providing a financial safety net for the policyholder.

Valuation ensures that the policyholder receives the correct death benefit amount when the insured individual passes away. It also allows for policy adjustments, such as increasing or decreasing coverage, and helps in understanding the overall value of the policy over time.

Regular valuation reviews are necessary to reflect changes in the policyholder's circumstances, market conditions, and the insured's health. This ensures that the policy remains appropriate and beneficial, especially if the policyholder's needs or financial goals evolve. It also helps in identifying any potential issues or discrepancies in the policy's value.