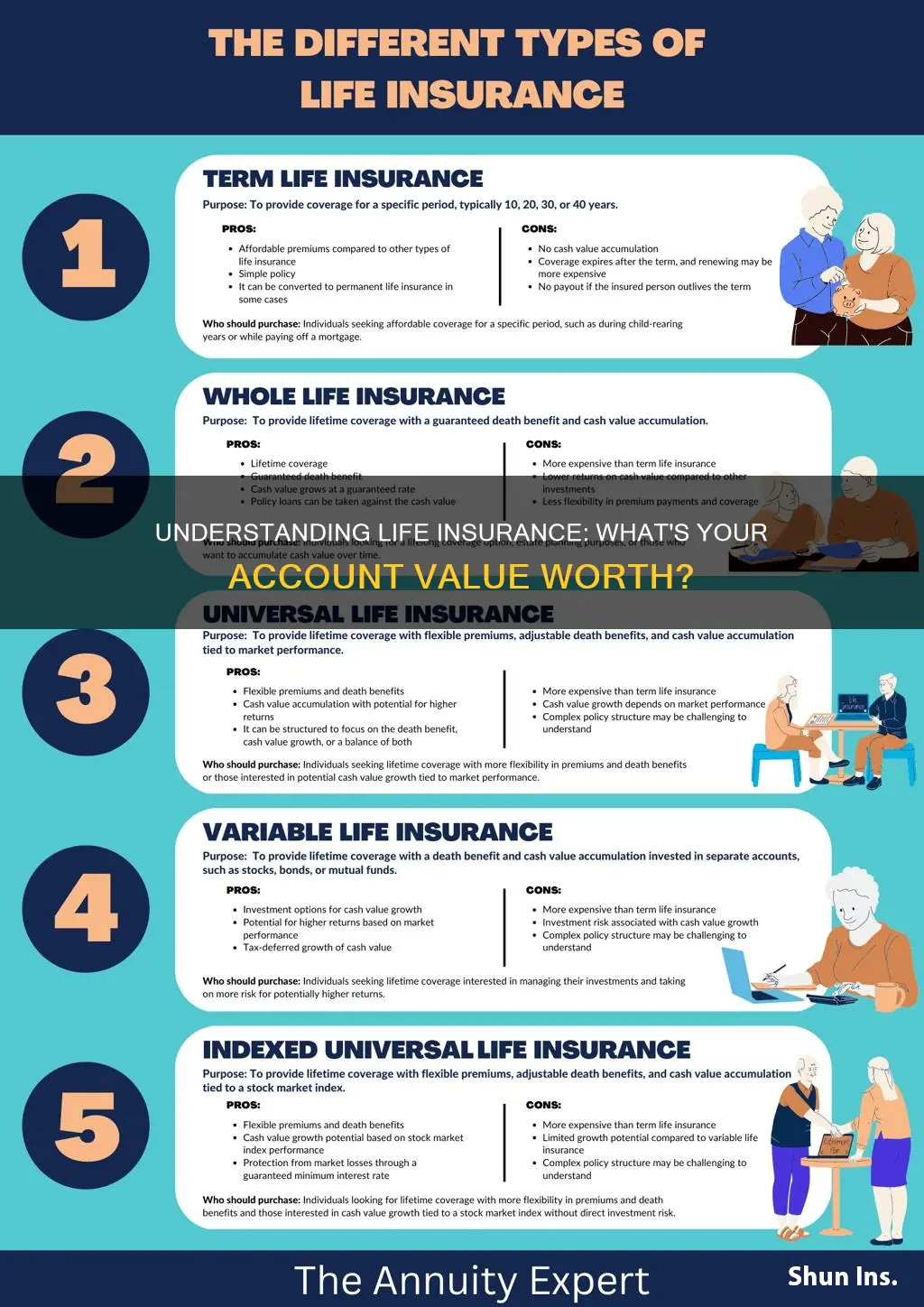

Life insurance is a financial product that provides a financial safety net for individuals and their loved ones. One of the key concepts in life insurance is the account value, which represents the cash value that accumulates over time within a life insurance policy. This value is built up through regular premium payments and investment returns, and it can be used for various purposes, such as taking out loans, paying for college, or even selling the policy for its cash value. Understanding the account value is crucial for policyholders as it allows them to make informed decisions about their insurance coverage and financial planning.

What You'll Learn

- Definition: Account value is the total amount in a life insurance policy's cash value account

- Calculation: It's based on policy earnings and investment performance

- Growth: Account value increases over time through policy fees and interest

- Withdrawal: Policyholders can withdraw funds from the account value

- Surrender: The account value can be surrendered for a lump sum payment

Definition: Account value is the total amount in a life insurance policy's cash value account

The concept of "account value" in the context of life insurance is a crucial aspect of understanding the financial benefits and value associated with your policy. When you purchase a life insurance policy, it often includes a component known as "cash value," which grows over time. This cash value is essentially an investment account linked to your insurance policy.

Account value refers to the total amount accumulated in this cash value account. It represents the monetary equivalent of the policy's growth and benefits. As you make regular premium payments, a portion of these payments goes towards building this cash value. Over time, with interest and investment earnings, this cash value account grows, and the account value increases.

This value is significant because it provides policyholders with several advantages. Firstly, it allows you to borrow against the account value through policy loans, providing access to funds without selling the policy. Secondly, the account value can be used to accelerate the death benefit payout, ensuring a faster financial support for your beneficiaries in the event of your passing. Additionally, the cash value can be utilized to pay for future premiums, ensuring the policy remains in force even if you encounter financial difficulties.

It's important to note that the account value is not just a theoretical concept but a tangible financial asset. It can be withdrawn or borrowed against, providing flexibility and financial security. However, it's crucial to understand the terms and conditions associated with accessing this value to ensure you are making informed decisions regarding your life insurance policy.

In summary, the account value in life insurance represents the accumulated cash value, offering policyholders financial flexibility, loan options, and the potential to enhance the policy's benefits. Understanding this concept is essential for anyone looking to maximize the value of their life insurance investment.

Medicare Life Insurance Scams: What You Need to Know

You may want to see also

Calculation: It's based on policy earnings and investment performance

The account value in a life insurance policy is a crucial metric that represents the total value of your insurance investment. It is a comprehensive measure that takes into account both the policy's earnings and the performance of the underlying investments. This value is dynamic and can fluctuate over time, reflecting the market's performance and the insurance company's investment strategies. Understanding how this value is calculated is essential for policyholders to assess the growth and potential of their insurance investment.

The calculation of the account value is primarily based on two key components: policy earnings and investment performance. Policy earnings refer to the profits or returns generated by the insurance company from the premiums collected. These earnings are typically invested in various financial instruments, such as stocks, bonds, and mutual funds, to grow the policy's value over time. The investment performance, on the other hand, is the result of the insurance company's investment decisions and market conditions. It includes the returns earned from the investments and any capital gains or losses incurred.

To calculate the account value, the insurance company considers the following steps. First, they determine the policy's earnings over a specific period, which could be annually or as per the policy terms. These earnings are then allocated to the policyholder's account, increasing the account value. Next, the investment performance is assessed, which involves analyzing the returns and growth of the invested assets. This performance is also reflected in the account value, showing how the policy's investment has grown or declined.

The account value is calculated by summing up the policy earnings and the net investment performance. Net investment performance takes into account any investment fees, expenses, and losses, providing a more accurate representation of the policy's growth. This calculation ensures that policyholders can understand the true value of their investment and make informed decisions regarding their insurance policy. It also allows them to track the progress of their investment and assess the insurance company's performance in managing their funds.

In summary, the account value on a life insurance policy is a comprehensive measure that reflects the policy's earnings and the investment performance. It is calculated by considering the policy's earnings and the net returns from the investments, providing policyholders with a clear understanding of their insurance investment's growth and potential. This calculation is essential for evaluating the performance of the insurance company and making informed choices regarding one's life insurance policy.

Life Insurance and Incapacitation: What's the Deal?

You may want to see also

Growth: Account value increases over time through policy fees and interest

The concept of account value in life insurance is an essential aspect of understanding the long-term growth and benefits of your policy. When you purchase a life insurance policy, especially those with a cash value component, your policy begins to accumulate value over time. This value is not just a theoretical number but a tangible asset that can be utilized in various ways.

One of the primary ways your account value grows is through policy fees. These fees are typically associated with the administration and management of your policy. Over time, a portion of these fees is reinvested back into the policy, contributing to its overall value. This reinvestment strategy ensures that your money works harder for you, allowing your account to grow exponentially. As the policy fees accumulate, they become a significant factor in the overall growth of your account value.

Interest also plays a crucial role in increasing your account value. Life insurance companies often invest a portion of the policy's cash value in various financial instruments, such as bonds or investment portfolios. These investments generate interest, which is then credited back to your policy. The interest earned can be substantial, especially over a more extended period, and it contributes to the overall growth of your account. The interest rate offered by the insurance company can vary, and it's essential to understand how it impacts your policy's performance.

As your account value grows, you gain several advantages. Firstly, it provides a financial safety net for your beneficiaries, ensuring they receive the death benefit when the time comes. Secondly, the growing account value can be borrowed against, providing access to funds without surrendering the policy. Additionally, some policies allow policyholders to make additional payments, further boosting the account value and potentially increasing the death benefit.

In summary, the account value in life insurance is a powerful feature that allows your policy to grow and provide long-term financial security. Through policy fees and interest, your account value increases, offering benefits like loan availability and a growing financial asset. Understanding how these factors contribute to your policy's growth is essential for making informed decisions about your life insurance investment.

Challenging Life Insurance Beneficiaries: Your Rights and Options

You may want to see also

Withdrawal: Policyholders can withdraw funds from the account value

When it comes to life insurance, the term "account value" refers to the cash value that accumulates over time within a permanent life insurance policy, such as a whole life or universal life policy. This value is essentially the investment component of the policy, allowing policyholders to build a savings component alongside the death benefit. Understanding how this account value works is crucial, especially when considering the option to withdraw funds from it.

Withdrawal from the account value is a feature that provides policyholders with access to their accumulated cash value. This can be particularly useful for various financial needs or goals. For instance, policyholders might use withdrawals to cover unexpected expenses, finance education, or invest in other opportunities. The process typically involves the policyholder submitting a request to the insurance company, who then processes the withdrawal and provides the funds. It's important to note that while withdrawals provide access to the cash value, they do not affect the death benefit or the policy's coverage.

The amount that can be withdrawn is generally limited to the policy's cash value, and there may be restrictions on how frequently withdrawals can be made. Some policies might allow for partial withdrawals, where the policyholder can take out a portion of the cash value, while others may require full withdrawals. Additionally, there could be surrender charges associated with withdrawals, especially if the policy is in its early years, which are fees imposed by the insurance company to cover the costs of selling the policy back to the company.

Policyholders should carefully consider the implications of withdrawals. While it provides financial flexibility, it can also impact the long-term growth of the policy's cash value. Withdrawals may reduce the overall value, and if not managed properly, could result in a decrease in the policy's death benefit. It is advisable to consult the policy's terms and conditions or seek professional financial advice to understand the specific withdrawal options and their potential effects on the policy.

In summary, the account value in life insurance represents the investment aspect of the policy, and withdrawals allow policyholders to access this value. This feature provides financial flexibility but should be approached with caution to ensure the policy's long-term viability and the intended death benefit are not compromised. Understanding the policy's terms and seeking appropriate guidance can help policyholders make informed decisions regarding withdrawals.

Life Insurance Coverage for Grandchildren: What You Need to Know

You may want to see also

Surrender: The account value can be surrendered for a lump sum payment

When it comes to life insurance, the term "account value" refers to the cash value that accumulates within a participating life insurance policy over time. This value is essentially the investment component of the policy, allowing policyholders to build a savings component alongside their insurance coverage. The account value grows through various means, such as interest credits, investment gains, and policyholder contributions.

One of the key features of life insurance with an account value is the flexibility it offers. Policyholders can choose to surrender the account value for a lump sum payment. Surrendering the policy means that the policyholder decides to terminate the contract and receive the accumulated cash value in a single payment. This option provides individuals with financial flexibility, allowing them to access their investment without canceling the insurance coverage entirely.

The process of surrendering the account value typically involves contacting the insurance company and requesting a surrender. Policyholders will need to provide necessary documentation and may be subject to certain surrender charges or penalties, especially if the policy is surrendered early. These charges are designed to cover the costs associated with the insurance company's operations and investments during the policy's initial years.

Upon surrender, the insurance company will calculate the account value based on the policy's terms and conditions. This value represents the total accumulation of the policyholder's contributions, interest earned, and any other applicable credits. The lump sum payment will then be issued to the policyholder, providing them with immediate access to their investment.

Surrendering the account value can be a strategic decision for those who need immediate financial resources or wish to explore other investment opportunities. It allows individuals to make informed choices about their insurance and financial plans, ensuring they have control over their assets. Understanding the surrender process and its implications is essential for policyholders to make the most of their life insurance policies and their associated account values.

Prudential Life Insurance: Cashing Out Your Benefits

You may want to see also

Frequently asked questions

Account value, often referred to as cash value, is a term used in permanent life insurance policies, such as whole life or universal life insurance. It represents the total amount of money that has accumulated in the policy over time, including any premiums paid, investment gains, and interest credited. This value grows tax-deferred and can be borrowed against or withdrawn, providing financial flexibility and a source of funds for the policyholder.

The account value in a life insurance policy grows through a combination of factors. Firstly, a portion of the premium payments is allocated to an investment account, where it can earn interest and investment returns. These returns are credited to the policy's account value. Secondly, some policies offer an additional bonus or dividend, which is also added to the account value. Over time, this accumulation of premiums, interest, and bonuses results in a growing account value, providing a financial reserve for the policyholder.

Yes, you can access the account value in your life insurance policy through various means. One common way is through policy loans, where you can borrow a portion of the account value as a tax-free loan. This can be useful for accessing funds for various purposes, such as education expenses or business ventures. Additionally, some policies allow for policy withdrawals, where you can take out a portion of the accumulated account value as cash. It's important to note that withdrawals may have tax implications, and policyholders should carefully consider their financial needs and the policy's terms before accessing the account value.