Life insurance is a financial tool that provides security and peace of mind for individuals and their families. One of the key features of life insurance is the ability to cash out or withdraw the accumulated value of the policy. This option allows policyholders to access the funds they have built up over time, providing financial flexibility and potential benefits. Understanding which life insurance policies offer this cash-out feature and how it works is essential for anyone considering this financial strategy.

What You'll Learn

- Lump Sum Payouts: Immediate cash value access for policyholders

- Surrender Options: Cashing out without penalties, allowing policyholders to withdraw funds

- Loan Features: Borrowing against the cash value without surrendering the policy

- Policy Loans: Tax-free loans with potential interest and principal repayment

- Cash Value Accumulation: Long-term investment growth and potential loan collateral

Lump Sum Payouts: Immediate cash value access for policyholders

Life insurance policies can provide a financial safety net for your loved ones, but they also offer an often-overlooked benefit: the ability to access cash value through lump sum payouts. This feature can be a valuable financial tool, allowing policyholders to utilize the money for various purposes, such as investing, paying for education, or starting a business. Understanding how this works and the options available can empower you to make the most of your life insurance policy.

Lump sum payouts are a way for policyholders to receive a portion of the cash value built up within their life insurance policy. This cash value is essentially the investment component of the policy, which grows over time through regular premium payments and investment gains. By opting for a lump sum payout, you can access this accumulated value, providing financial flexibility and control. This is particularly useful if you have built up a significant amount of cash value in your policy and want to utilize it for immediate financial needs or goals.

The process of accessing cash value through a lump sum payout typically involves a few key steps. Firstly, you, as the policyholder, need to review your policy documents to understand the specific terms and conditions related to cash value access. This includes knowing the policy's cash value accumulation rate, any fees or penalties associated with withdrawals, and the method of payout. Some policies may offer a loan feature, allowing you to borrow against the cash value, while others might provide a direct lump sum payment.

Once you have a clear understanding of your policy's terms, you can decide on the best course of action. If you choose to take a lump sum payout, the insurance company will typically provide a payment based on the policy's cash value. This payment can be a one-time sum or a series of payments, depending on the policy's structure. It's essential to consider the tax implications of these payouts, as they may be subject to income tax, and the timing of the payout can also impact the amount received due to potential interest or investment growth.

In summary, life insurance policies with cash value accumulation offer policyholders the opportunity to access their money through lump sum payouts. This feature provides financial flexibility and can be a valuable asset for various financial goals. By understanding the process and terms associated with cash value access, you can make informed decisions about utilizing this benefit effectively. Remember, when considering any financial decision, it's always advisable to consult with a financial advisor to ensure you are making the best choice for your specific circumstances.

Life Insurance Blood Tests: Do STDs Show Up?

You may want to see also

Surrender Options: Cashing out without penalties, allowing policyholders to withdraw funds

When it comes to life insurance, the concept of "cashing out" or "surrendering" a policy might seem counterintuitive, as it typically involves giving up the long-term benefits of the policy. However, many life insurance policies offer surrender options, providing policyholders with the flexibility to withdraw funds without incurring significant penalties. This feature can be particularly valuable for those who need immediate financial resources or wish to explore alternative investment opportunities.

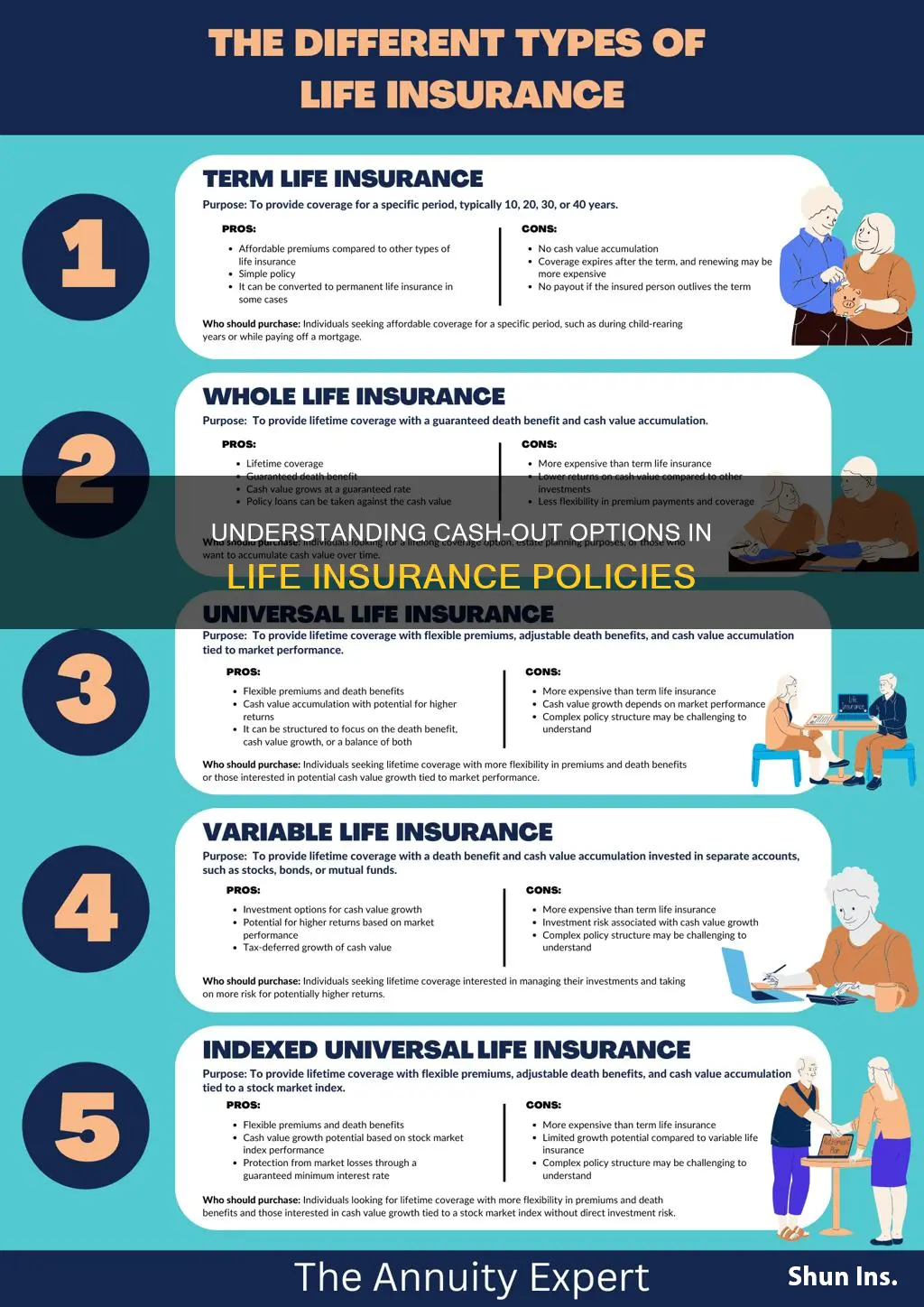

Surrender options are available in various life insurance products, including whole life, universal life, and variable life policies. These policies often accumulate cash value over time, which can be borrowed against or withdrawn. When a policyholder decides to surrender their policy, they essentially return it to the insurance company, and in return, they receive a lump sum payment, known as the surrender value. This value is typically calculated based on the policy's cash value and may be subject to certain fees or penalties, depending on the policy's terms.

One of the key advantages of surrender options is the ability to access funds without facing significant financial penalties. Traditional life insurance policies often have restrictions on withdrawals, especially during the early years of the policy. However, with surrender options, policyholders can take control of their finances and make decisions that align with their changing needs. For instance, if a policyholder encounters a financial emergency or wants to invest in a business opportunity, they can surrender the policy and receive a portion of the accumulated cash value.

The process of cashing out a life insurance policy typically involves several steps. First, the policyholder must notify their insurance company of their intention to surrender. The insurance provider will then evaluate the policy's cash value and determine the surrender value. This value is usually calculated based on the policy's investment performance and may be subject to a surrender charge, which is a fee assessed to cover administrative costs. Once the surrender charge period has passed, the policyholder can withdraw the funds without incurring additional penalties.

It's important to note that while surrender options provide flexibility, they should be considered carefully. Cashing out a life insurance policy may result in losing the long-term death benefit, which is a crucial aspect of life insurance. Therefore, policyholders should weigh the benefits of immediate access to funds against the potential loss of future financial security. Consulting with a financial advisor can help individuals make informed decisions regarding their life insurance policies and explore the best options for their unique circumstances.

Life Insurance Options While on Insulin: What You Need Know

You may want to see also

Loan Features: Borrowing against the cash value without surrendering the policy

When considering life insurance as a financial tool, one of the key features to explore is the ability to borrow against the cash value of the policy. This option provides policyholders with a way to access funds without surrendering the policy or disrupting their coverage. Here's an overview of this loan feature:

Borrowing against the cash value is a strategy that allows policyholders to utilize the accumulated cash value of their life insurance policy as collateral for a loan. This is particularly useful for those who want to access funds while retaining the long-term benefits of their insurance. The process typically involves the insurance company lending a portion of the cash value to the policyholder, often at a competitive interest rate. This loan can be a valuable financial resource for various purposes, such as funding education, starting a business, or covering unexpected expenses.

The loan feature is designed to be a flexible and convenient way to access funds. Policyholders can borrow a specific amount based on the cash value accumulated in their policy. This amount can be repaid over time, often with interest, ensuring that the policy remains intact and the insurance coverage continues. The interest rates for these loans are usually lower compared to traditional loans, making it an attractive option for those seeking financial flexibility.

One of the advantages of this approach is that it allows individuals to make use of their existing life insurance policy without the need to surrender it. Surrendering a policy can result in the loss of accumulated cash value and potential penalties. By borrowing against the cash value, policyholders can retain their insurance coverage and the associated benefits, ensuring financial security for their loved ones.

Furthermore, this loan feature provides a way to access funds without the lengthy and often complex process of selling the policy or taking out a separate loan. It offers a more straightforward and potentially cost-effective solution for those seeking immediate financial resources. Policyholders can decide on the loan amount and repayment terms that suit their needs, providing a level of control and customization.

In summary, borrowing against the cash value of a life insurance policy is a valuable loan feature that enables policyholders to access funds while maintaining their insurance coverage. It offers a flexible and potentially cost-efficient way to utilize the cash value, providing financial resources without disrupting long-term insurance benefits. This option is particularly useful for those seeking to make the most of their life insurance policy's financial potential.

Unlocking Affordable Life Insurance: Tailored Rates for Black Individuals

You may want to see also

Policy Loans: Tax-free loans with potential interest and principal repayment

Life insurance policies can be a valuable financial asset, offering both protection and potential financial benefits. One such benefit is the ability to access cash value through policy loans, which can be a tax-efficient way to borrow against your life insurance. This feature is particularly useful for those seeking to leverage their insurance coverage without disrupting their financial plans.

A policy loan is a loan taken against the cash value of your life insurance policy. It allows you to borrow a portion of the accumulated cash value, which can be used for various purposes. The key advantage is that these loans are typically tax-free, meaning you don't have to pay income tax on the borrowed amount. This makes it an attractive option compared to traditional loans, where interest payments may be taxable.

When you take out a policy loan, you can choose to repay the principal and interest over time, often with flexible repayment terms. This repayment strategy ensures that you maintain control over your policy's cash value while also accessing the funds you need. The interest on these loans is usually charged at a fixed rate, which is often lower than the interest rates on other types of loans. This makes it a cost-effective way to borrow, especially for those who may not qualify for traditional bank loans.

One of the critical aspects of policy loans is that they are secured by the policy itself. This means that if you default on the loan, the insurance company can use the policy's cash value to recover the debt. This feature provides a level of security for the lender and ensures that the loan is treated as a priority in the event of the policyholder's death. As a result, policy loans can be an excellent way to access funds while keeping your insurance coverage intact.

In summary, policy loans offer a unique opportunity to borrow against your life insurance policy's cash value, providing tax-free funds with potential interest and principal repayment options. This feature can be a valuable tool for individuals looking to access their insurance's financial benefits without compromising their overall financial strategy. It is essential to understand the terms and conditions of such loans to make an informed decision regarding your life insurance policy's utilization.

How Children Receive Money from Term Life Insurance

You may want to see also

Cash Value Accumulation: Long-term investment growth and potential loan collateral

Life insurance with a cash value component offers a unique financial tool that can be utilized in various ways, one of which is cash value accumulation. This feature allows policyholders to build up a significant amount of cash value over time, providing a long-term investment growth opportunity. Here's how it works and why it's beneficial:

Long-Term Investment Growth:

Life insurance with cash value is designed to grow over time. A portion of the premiums paid goes into an investment account, where it can earn interest and grow. This investment component is often separate from the death benefit, allowing it to accumulate value independently. As the policyholder makes regular payments, the cash value increases, providing a growing asset that can be used for various financial goals. The investment growth is typically tax-deferred, meaning it can compound over the years without incurring significant tax liabilities. This feature is particularly attractive for long-term financial planning, as it offers the potential for substantial growth over time.

Potential Loan Collateral:

One of the most valuable aspects of cash value accumulation is the ability to borrow against it. Policyholders can take out loans against the cash value, allowing them to access funds without selling the policy or disrupting their long-term financial strategy. These loans are typically interest-only, meaning the principal amount is not due until the loan is repaid. This feature provides a source of emergency funds or a way to finance other financial goals. For example, a policyholder could use the loan to start a business, invest in real estate, or cover unexpected expenses. The interest paid on the loan goes back into the policy, further growing the cash value. This loan feature is a powerful tool for those who want to maximize the benefits of their life insurance while maintaining control over their financial assets.

Additionally, the cash value can be withdrawn or surrendered if needed, providing flexibility. However, it's important to note that withdrawals may impact the policy's long-term growth and loan availability. Policyholders should carefully consider their financial needs and consult with a financial advisor to determine the best approach for utilizing the cash value accumulation feature of their life insurance policy.

In summary, cash value accumulation in life insurance provides a long-term investment strategy with the potential for significant growth. The ability to borrow against this accumulated value offers financial flexibility and can be a valuable tool for various financial objectives. Understanding this feature can empower individuals to make informed decisions about their life insurance and overall financial planning.

The Intricacies of Life Insurance Product Creation

You may want to see also

Frequently asked questions

The cash value is the amount of money that accumulates in a life insurance policy over time. It is essentially the investment component of the policy and can be borrowed against or withdrawn. This feature allows policyholders to access their money before their passing, providing financial flexibility.

Cashing out typically involves taking a loan against the cash value of your policy or making a withdrawal. You can usually do this by contacting your insurance provider and requesting a policy loan or withdrawal. The process may vary depending on the insurance company and the type of policy you have. It's important to understand the terms and conditions to avoid any penalties or fees.

Yes, there can be penalties associated with cashing out. Early withdrawals may incur surrender charges or fees, and taking a loan against the policy may result in interest charges. It's crucial to review the policy's terms and consider the potential impact on your coverage and financial goals before making any cash-out decisions.

While the cash value can be accessed, it's essential to use it wisely. The money can be used for various purposes, such as paying for college tuition, starting a business, or covering unexpected expenses. However, it's generally recommended to use the funds for long-term financial goals or emergencies rather than for short-term or impulsive spending.

If you cash out and later decide to continue with the policy, you may be able to reinstate it. However, there are usually specific conditions and fees associated with reinstatement. The insurance company will review your financial situation and may require you to pay back any withdrawals or loans, plus interest, to restore the policy's full value.