Dave Ramsey, a renowned personal finance expert, has been a strong advocate for life insurance as a crucial component of financial planning. In his extensive financial advice, he emphasizes the importance of having life insurance to protect your loved ones and ensure financial security in the event of your untimely death. Ramsey recommends term life insurance, which provides coverage for a specific period, typically 10, 20, or 30 years, and is generally more affordable than permanent life insurance. This type of policy offers a straightforward solution to cover essential expenses, such as mortgage payments, children's education, or daily living costs, during the specified term.

What You'll Learn

- Dave Ramsey's Insurance Philosophy: Emphasizes term life insurance for coverage

- Term Life Insurance: Affordable, pure protection, no cash value

- Whole Life Insurance: Permanent coverage with a cash value component

- Universal Life Insurance: Flexible, high-risk, long-term coverage

- Dave's Recommendations: Focus on term, avoid whole life

Dave Ramsey's Insurance Philosophy: Emphasizes term life insurance for coverage

Dave Ramsey, a renowned personal finance expert, has a strong stance on life insurance, advocating for a specific type that provides a safety net for one's family in the event of their untimely demise. His philosophy emphasizes the importance of term life insurance, which offers a straightforward and cost-effective solution for coverage.

Ramsey's approach to insurance is rooted in the belief that life insurance should primarily serve as a means to protect one's loved ones financially. He argues that the primary goal is to ensure that the family's basic needs and financial obligations are met if the primary breadwinner were to pass away. Term life insurance, according to Ramsey, is the ideal choice for this purpose. This type of policy provides a fixed amount of coverage for a specified term, typically 10, 20, or 30 years. During this period, the policyholder pays a set premium, and if an insured event occurs, the beneficiary receives the death benefit.

The beauty of term life insurance, as Ramsey sees it, lies in its simplicity and affordability. It is a pure form of insurance, focusing solely on the risk of death during the specified term. This allows for a lower cost compared to permanent life insurance policies, which include an investment component. By keeping costs down, Ramsey believes that more people can afford the coverage they need without unnecessary extras. He suggests that term life insurance is a more efficient way to provide for one's family, ensuring they have the financial support to maintain their standard of living and cover essential expenses.

In Ramsey's view, the key to successful insurance planning is understanding the specific needs of your family and choosing a policy that aligns with those needs. He encourages individuals to calculate their annual income and expenses, then determine how much coverage would be required to maintain their family's lifestyle if they were no longer there. This personalized approach ensures that the insurance policy is tailored to the individual's circumstances.

Dave Ramsey's insurance philosophy is a testament to his practical and straightforward financial advice. By emphasizing term life insurance, he empowers individuals to make informed decisions about their family's financial security, providing a solid foundation for their long-term financial well-being. This approach has resonated with many, as it offers a clear and cost-effective solution to a critical aspect of personal finance.

Life Insurance Payouts After Suicide: What You Need to Know

You may want to see also

Term Life Insurance: Affordable, pure protection, no cash value

Term life insurance is a popular and often recommended choice by financial experts like Dave Ramsey, who advocates for this type of coverage as a simple and effective way to protect your loved ones financially. This type of insurance is straightforward and offers pure protection without any additional features or investment components. Here's why it's a recommended option:

Affordability: One of the most significant advantages of term life insurance is its affordability. It provides a predetermined amount of coverage for a specified period, known as the 'term'. This term can range from 10 to 30 years, and during this period, the insurance company guarantees a death benefit if the insured individual passes away. The cost of this insurance is typically lower compared to permanent life insurance because it doesn't accumulate cash value over time. This affordability makes it accessible to a wide range of individuals, allowing them to secure their family's financial future without breaking the bank.

Pure Protection: Term life insurance is designed solely for protection. It doesn't build up any cash value or investment components, which means the primary focus is on providing a financial safety net for your beneficiaries. If you pass away during the term, the insurance company pays out the death benefit, which can be used to cover various expenses, such as mortgage payments, children's education, or daily living costs for your family. This pure protection aspect ensures that your loved ones receive the intended financial support without any complications or long-term commitments.

No Cash Value Accumulation: Unlike permanent life insurance policies, term life insurance does not have an investment component. This means there is no cash value that grows over time, which is a feature often associated with permanent life insurance. By avoiding the accumulation of cash value, term life insurance keeps costs lower and provides a more straightforward and cost-effective solution for temporary coverage needs.

When considering life insurance, Dave Ramsey often emphasizes the importance of understanding the different types of coverage available. Term life insurance is an excellent choice for those seeking affordable and focused protection. It ensures that your family receives the necessary financial support during a defined period without any unnecessary add-ons or long-term commitments. This type of insurance is a valuable tool in financial planning, especially for those with a limited budget who want to provide security for their loved ones.

Life Insurance for Retired Government Employees: What's Covered?

You may want to see also

Whole Life Insurance: Permanent coverage with a cash value component

Whole life insurance is a type of permanent life insurance that offers a range of benefits, making it an attractive option for those seeking long-term financial security. This insurance policy provides coverage for the entire lifetime of the insured individual, ensuring that beneficiaries receive a death benefit when the insured person passes away. One of the key advantages of whole life insurance is its dual nature: it combines a death benefit with a savings component, known as the cash value.

The cash value of a whole life policy grows over time, and it can be borrowed against or withdrawn, providing a valuable financial asset. This feature sets it apart from term life insurance, which does not accumulate cash value. As premiums are paid, a portion is allocated to build this cash reserve, which can be used for various purposes. For instance, policyholders can access the cash value through loans, providing a source of funds for major purchases or investments. Additionally, the cash value can be withdrawn as a lump sum, offering financial flexibility during retirement or other significant life events.

Whole life insurance is particularly appealing for long-term financial planning. It guarantees a death benefit, ensuring that your loved ones are financially protected regardless of future economic conditions. The cash value growth provides a means to build wealth over time, which can be used to secure your family's financial future. Moreover, the fixed premiums and predictable cash value growth make whole life insurance an excellent choice for those seeking stability and control over their insurance portfolio.

When considering whole life insurance, it's essential to evaluate your specific needs and financial goals. The policy's benefits can be tailored to suit various life stages and objectives. For example, younger individuals may opt for a higher death benefit to cover long-term financial obligations, while older policyholders might focus on maximizing cash value accumulation. Consulting with a financial advisor can help you navigate the options and choose the most suitable whole life insurance policy.

In summary, whole life insurance offers permanent coverage with a valuable cash value component, making it a recommended choice for long-term financial security. Its ability to provide both death benefits and a growing cash reserve makes it an attractive option for individuals seeking to protect their loved ones and build wealth over time. Understanding the features and benefits of whole life insurance can empower you to make informed decisions regarding your insurance needs.

How Canadians Can Get a US Life Insurance License

You may want to see also

Universal Life Insurance: Flexible, high-risk, long-term coverage

Universal life insurance is a type of permanent life insurance that offers a unique blend of flexibility and long-term coverage. It is a complex financial product that can be tailored to meet individual needs, making it a popular choice for those seeking a personalized insurance solution. This type of policy provides a death benefit and a cash value component, which can grow over time.

One of the key advantages of universal life insurance is its flexibility. Policyholders have the freedom to choose how much to pay in premiums, allowing them to adjust their contributions based on their financial situation. This flexibility is particularly beneficial for those who may experience fluctuations in income or prefer a more adaptable insurance strategy. During the early years of the policy, when the cash value is growing, higher premiums can be paid to maximize the death benefit and ensure comprehensive coverage. As financial circumstances change, premiums can be reduced, providing a more cost-effective solution.

The high-risk nature of universal life insurance is often associated with its investment component. The cash value in this policy is invested in various financial instruments, such as stocks, bonds, and mutual funds. This investment aspect can lead to potential gains, but it also comes with a higher level of risk. Policyholders should be prepared for the possibility of market volatility and the risk of losing some or all of the investment value. It is crucial to carefully review the investment options and understand the associated risks before making any decisions.

Over the long term, universal life insurance offers a stable and reliable death benefit. The policyholder can choose the death benefit amount, and as the cash value grows, it can provide a substantial financial safety net for beneficiaries. This long-term coverage ensures that the insured individual's loved ones are protected even after their passing. Additionally, the cash value can be borrowed against or withdrawn, providing access to funds for various financial needs or emergencies.

In summary, universal life insurance provides a flexible and high-risk investment strategy within a long-term insurance framework. It offers policyholders the ability to customize their coverage, manage their premiums, and benefit from potential investment growth. However, it is essential to carefully consider the risks and consult with financial advisors to ensure that this type of insurance aligns with one's financial goals and risk tolerance.

Uncover the Secrets: Essential Questions to Ask Your Life Insurance Agent

You may want to see also

Dave's Recommendations: Focus on term, avoid whole life

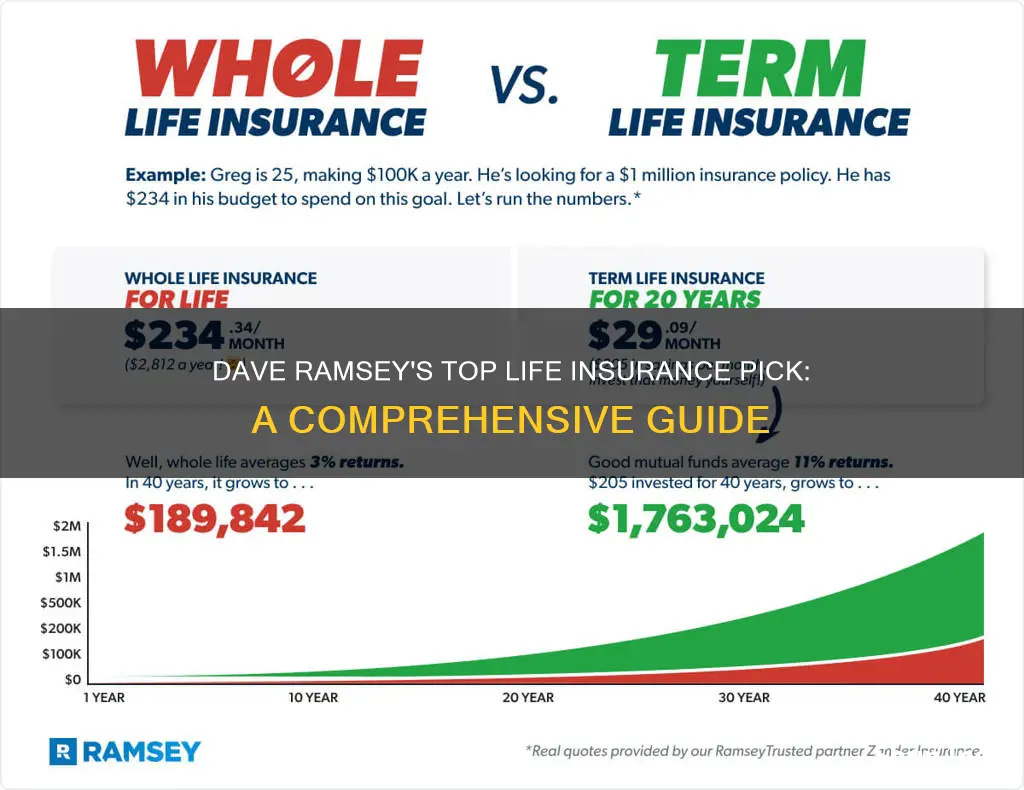

Dave Ramsey, a well-known financial guru, has been vocal about his preference for term life insurance over whole life insurance. His recommendations are based on the idea that term insurance is a more cost-effective and efficient way to protect your loved ones in the event of your untimely demise. Here's a breakdown of Dave's stance and why he advocates for term insurance:

Understanding Term Life Insurance:

Term life insurance is a straightforward and temporary policy. It provides a death benefit to your beneficiaries if you pass away during the specified term, which could be 10, 20, or 30 years. The beauty of term insurance lies in its simplicity and affordability. You pay a fixed premium for a defined period, and if the worst happens, your family receives the payout. This type of insurance is ideal for covering specific financial obligations, such as mortgage payments, children's education, or other short-term debts.

Dave's Argument Against Whole Life:

Dave Ramsey strongly advises against whole life insurance, which is a permanent policy with an investment component. He believes that the complexity and higher costs associated with whole life insurance make it less appealing. Whole life policies typically have higher premiums and can accumulate cash value over time, which may be tempting for long-term savings. However, Dave argues that this complexity often leads to unnecessary fees and higher overall costs. He suggests that the money spent on whole life insurance could be better utilized in other areas of your financial plan.

Term Insurance Benefits:

- Simplicity and Affordability: Term life insurance is easy to understand and manage. You pay a fixed rate for a set period, and the coverage is straightforward. This simplicity makes it an attractive choice for those who prefer a no-frills approach to insurance.

- Flexibility: With term insurance, you can choose the duration of coverage, ensuring that your loved ones are protected only when it's necessary. This flexibility allows you to adapt your insurance needs as your financial situation changes.

- Cost-Effectiveness: Dave emphasizes that term insurance is generally more affordable than whole life. The lower premiums make it accessible to a broader range of individuals, allowing more people to secure their family's financial future.

Dave's Recommendations:

Dave Ramsey suggests that individuals should focus on term life insurance as a primary protection tool. He recommends using the money saved on whole life insurance premiums to pay off debts, build an emergency fund, or invest in other assets. By doing so, you can ensure that your basic financial needs are met while still providing for your family's long-term security.

In summary, Dave Ramsey's life insurance recommendations emphasize the importance of term life insurance for its simplicity, affordability, and ability to provide targeted protection. By avoiding the complexities of whole life insurance, individuals can better manage their finances and ensure their family's financial well-being.

DUI's Impact on Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Dave Ramsey, a well-known financial guru, often promotes term life insurance as the best option for most people. He emphasizes the importance of covering a large amount of debt or financial obligations with a term policy, which provides coverage for a specific period, typically 10, 20, or 30 years.

Ramsey believes that term life insurance is cost-effective and provides excellent coverage during the years when you have significant financial responsibilities, such as a mortgage, children's education, or business debts. After the term ends, you can decide whether to renew or switch to a permanent policy if needed.

Yes, he highlights the simplicity and affordability of term life insurance. It offers a fixed death benefit and premium rate, making it easy to understand and budget for. Additionally, term policies are generally more affordable than permanent life insurance, allowing individuals to protect their loved ones without breaking the bank.

No, Dave Ramsey is known for his non-endorsement policy, meaning he does not promote specific brands or companies. He encourages his followers to research and compare different insurance providers to find the best fit for their needs and budget.

Ramsey advises his audience to calculate their financial needs, including debts, income, and expenses, to determine the appropriate death benefit. He suggests using online calculators or seeking professional advice to find the right coverage. Additionally, he emphasizes the importance of regularly reviewing and adjusting policies as life circumstances change.