Life insurance is a crucial financial tool that provides protection and peace of mind for individuals and their families. Among the various types of life insurance policies, one specific category stands out for its unique feature: limited-time coverage. This type of insurance is designed to offer coverage for a specific period, typically ranging from a few years to a decade or more. The key advantage of this approach is that it provides a temporary safety net, ensuring financial security during a defined timeframe. Whether it's covering mortgage payments, providing for children's education, or ensuring financial stability in the event of an unforeseen accident, limited-time life insurance offers a tailored solution to meet specific needs.

What You'll Learn

- Term Life: Coverage for a set period, typically 10-30 years

- Temporary Disability: Short-term insurance for income replacement during illness or injury

- Critical Illness: Pays out if you're diagnosed with a serious illness within a defined period

- Long-Term Care: Covers care needs in later years, often with a time limit

- Accident Insurance: Provides benefits for injuries sustained within a specific timeframe

Term Life: Coverage for a set period, typically 10-30 years

Term life insurance is a type of coverage that provides financial protection for a specific, predetermined period. This form of insurance is designed to offer a straightforward and cost-effective solution for individuals seeking temporary protection. The term duration is typically between 10 and 30 years, making it an ideal choice for those who want coverage for a particular goal or milestone. For instance, a young professional might opt for a 20-year term policy to cover their mortgage or provide financial security for their children's education.

The beauty of term life insurance lies in its simplicity and affordability. During the specified term, the policyholder pays a fixed premium, and in return, the insurance company promises to pay a death benefit to the policy's beneficiaries if the insured individual passes away within that period. This type of insurance is particularly attractive because it offers a clear and defined risk, allowing insurers to provide competitive rates.

One of the key advantages is the peace of mind it provides. Knowing that your loved ones will be financially protected in the event of your untimely death can be a significant relief. Moreover, term life insurance is often more affordable than permanent life insurance, making it accessible to a broader range of individuals. This affordability factor is crucial, especially for those who may have limited budgets but still want to ensure their family's financial well-being.

When considering term life insurance, it's essential to evaluate your specific needs and circumstances. The duration of the policy should align with your financial goals and the time frame during which you require coverage. For example, a young family might choose a longer term, such as 25 years, to ensure their children's upbringing is financially secure. Conversely, a homeowner approaching retirement might opt for a shorter term to cover any remaining mortgage payments.

In summary, term life insurance is a practical and efficient way to secure financial protection for a defined period. Its flexibility, affordability, and clear-cut benefits make it an excellent choice for individuals seeking temporary coverage. By understanding the duration and its implications, you can make an informed decision to safeguard your loved ones' future.

Critical Illness Life Insurance: What Qualifies and What Doesn't

You may want to see also

Temporary Disability: Short-term insurance for income replacement during illness or injury

Temporary disability insurance is a crucial safety net for individuals who want to ensure their income is protected during short-term illnesses or injuries. This type of insurance is designed to provide financial support when you are unable to work due to a covered medical condition, offering a temporary solution to replace your lost wages. It is a valuable tool for anyone who wants to maintain their financial stability and peace of mind, knowing that they will have income security during a challenging period.

The primary purpose of temporary disability insurance is to replace a portion of your income when you are temporarily unable to perform your regular duties. This coverage can be particularly beneficial for those in careers where a sudden illness or injury could result in a significant loss of income. For example, a software developer who is unable to code due to a severe injury or a freelance writer who cannot meet deadlines because of an illness would find this insurance invaluable. The policy typically provides a percentage of your regular income, ensuring that you can cover essential expenses while you recover.

When considering temporary disability insurance, it's essential to understand the duration of coverage. As the name suggests, this type of insurance is designed for a limited period, often ranging from a few days to a few months, depending on the policy. This short-term coverage is ideal for addressing the immediate financial impact of an illness or injury, allowing you to focus on your recovery without the added stress of financial worries. The insurance company will have specific criteria and guidelines for determining the eligibility and duration of the claim, ensuring that the coverage is tailored to the individual's needs.

Obtaining temporary disability insurance is a straightforward process. It typically involves providing personal and medical information to an insurance provider, who will then assess your eligibility and offer suitable coverage options. The application process may include a medical examination or a review of your medical history to ensure that the insurance company can accurately assess the risk and provide appropriate protection. Once approved, the policy will outline the terms and conditions, including the income replacement rate, the duration of coverage, and any exclusions or limitations.

In summary, temporary disability insurance is a vital component of financial planning, offering a safety net during short-term medical absences. It provides income replacement when you need it most, allowing you to focus on your health and recovery. With this insurance, individuals can have the peace of mind that their financial obligations will be met, even when they are temporarily unable to work. Understanding the terms and conditions of such policies is essential to ensure that you are adequately protected and can make informed decisions about your insurance coverage.

Ethos Life Insurance: A Recent History and Overview

You may want to see also

Critical Illness: Pays out if you're diagnosed with a serious illness within a defined period

Critical illness insurance is a type of coverage that provides financial protection in the event of a serious medical diagnosis. This insurance policy is designed to offer a lump sum payment if the insured individual is diagnosed with a critical illness within a specified time frame, often referred to as the 'defined period'. The primary purpose of this insurance is to provide financial support during a critical time when the individual may be unable to work or face significant medical expenses.

When considering critical illness insurance, it's essential to understand the defined period, which is a crucial aspect of the policy. This period is typically a set number of years, and if the insured person is diagnosed with a critical illness during this time, the insurance company will pay out the agreed-upon amount. For example, a policy might offer a defined period of 10 years, meaning the payout will be triggered if the illness is diagnosed within the first 10 years of the policy's term.

The critical illnesses covered by this insurance can vary, but they often include severe conditions such as heart attacks, strokes, cancer, multiple sclerosis, and Parkinson's disease, among others. These illnesses are considered critical because they can significantly impact an individual's health and ability to work, often requiring extensive medical treatment and potentially long-term care. The insurance policy will compensate the insured individual for the financial burden associated with these illnesses, including medical expenses, loss of income, and the cost of adapting their home or lifestyle to accommodate their new circumstances.

One of the key advantages of critical illness insurance is the certainty it provides. If the insured person is diagnosed with a covered illness within the defined period, the payout is guaranteed, offering financial security during a challenging time. This type of insurance can be particularly valuable for individuals who have significant financial commitments or depend on a steady income to maintain their standard of living.

In summary, critical illness insurance with a defined period is a specialized form of life insurance that provides financial protection against severe medical conditions. It ensures that the insured individual receives a lump sum payment if they are diagnosed with a critical illness within the specified time frame, offering peace of mind and financial support when it is needed most. Understanding the defined period and the covered illnesses is crucial when choosing this type of insurance to ensure it aligns with one's specific needs and circumstances.

Adding a Beneficiary: A Simple Guide to Life Insurance

You may want to see also

Long-Term Care: Covers care needs in later years, often with a time limit

Long-term care insurance is a specialized type of coverage designed to address the financial challenges associated with extended periods of care and assistance in one's later years. This insurance is tailored to provide support when individuals require help with activities of daily living, such as bathing, dressing, eating, and using the bathroom, due to chronic illnesses, disabilities, or other medical conditions. One of the key features of long-term care insurance is that it often comes with a time limit or duration, which sets a specific period during which the policy will provide benefits.

The time limit on long-term care insurance is an essential aspect that distinguishes it from other insurance products. Typically, these policies offer coverage for a defined period, such as two years, five years, or even up to 10 years. This duration is carefully selected to ensure that the insurance company can manage the financial risk associated with long-term care needs while providing individuals with a safety net for a reasonable timeframe. When purchasing this insurance, it is crucial to understand the specific time limit to ensure that it aligns with one's anticipated care requirements.

The time limit on long-term care insurance is often based on the assumption that individuals will require care for a certain period, after which they may recover, return to independence, or pass away. For example, a policy with a two-year benefit period means that the insurance company will cover qualified long-term care expenses for the insured individual during that specific time frame. If the individual's condition improves or they become self-sufficient within this period, the coverage ends. This structured approach ensures that the insurance company can manage the financial risks and provide benefits within a defined scope.

It is important to note that long-term care insurance policies may also include a daily benefit amount, which specifies the financial amount provided each day the individual requires care. This daily benefit can vary, and it is a critical factor in determining the overall coverage and the time limit of the policy. Understanding these details is essential for individuals to make informed decisions about their long-term care insurance needs.

In summary, long-term care insurance is a specialized product designed to address the financial aspects of extended care needs in later years. The time limit on these policies is a defining feature, ensuring that coverage is provided for a specific duration, often aligned with the anticipated care requirements of the insured individual. By carefully considering the time limit and daily benefit amount, individuals can select a long-term care insurance policy that best suits their needs and provides the necessary financial protection during their later years.

Life Insurance Assignments: Conversion Complications and Solutions

You may want to see also

Accident Insurance: Provides benefits for injuries sustained within a specific timeframe

Accident insurance is a type of coverage that focuses on providing financial benefits in the event of accidental injuries sustained within a specific timeframe. This insurance is designed to offer immediate financial support when accidents occur, ensuring that policyholders receive the necessary assistance during critical moments. The key aspect of accident insurance is its time-limited nature, which sets it apart from other insurance types.

When an individual purchases accident insurance, they are essentially buying protection against accidental injuries. These injuries can range from minor cuts and bruises to more severe accidents like car crashes, falls, or sports-related incidents. The insurance policy will outline the specific time frame during which the coverage is active, often ranging from a few days to several years. This time limit is crucial as it defines the period during which the policyholder is protected against accidental injuries.

The benefits of accident insurance are straightforward. If an insured individual sustains an injury within the specified timeframe, they are entitled to receive financial compensation. This compensation can cover various expenses, including medical bills, hospitalization costs, rehabilitation, and even lost wages if the injury results in an inability to work. The amount of coverage provided depends on the policy terms, ensuring that policyholders receive adequate support during their recovery process.

One of the advantages of accident insurance is its ability to provide quick financial assistance. Unlike some other insurance types that may have lengthy claim processes, accident insurance often offers faster payouts. This is particularly beneficial when immediate medical attention is required, ensuring that policyholders can access the necessary treatment without delay. Additionally, accident insurance can be a valuable addition to an individual's overall insurance portfolio, offering comprehensive protection against accidental injuries.

In summary, accident insurance is a specialized form of coverage that provides financial benefits for accidental injuries within a defined time period. It offers a swift and efficient way to manage financial risks associated with accidents, ensuring that policyholders receive the support they need during challenging times. Understanding the time-limited nature of this insurance is essential for individuals seeking to protect themselves against accidental injuries and their potential financial consequences.

Term Life Insurance: Understanding the Policy and its Penalties

You may want to see also

Frequently asked questions

Limited-time life insurance, also known as term life insurance, is a type of coverage that provides protection for a specific period, typically ranging from one to 30 years. It is designed to offer a temporary safety net for your loved ones during a particular phase of your life, such as when you have a mortgage, children's education expenses, or other financial commitments.

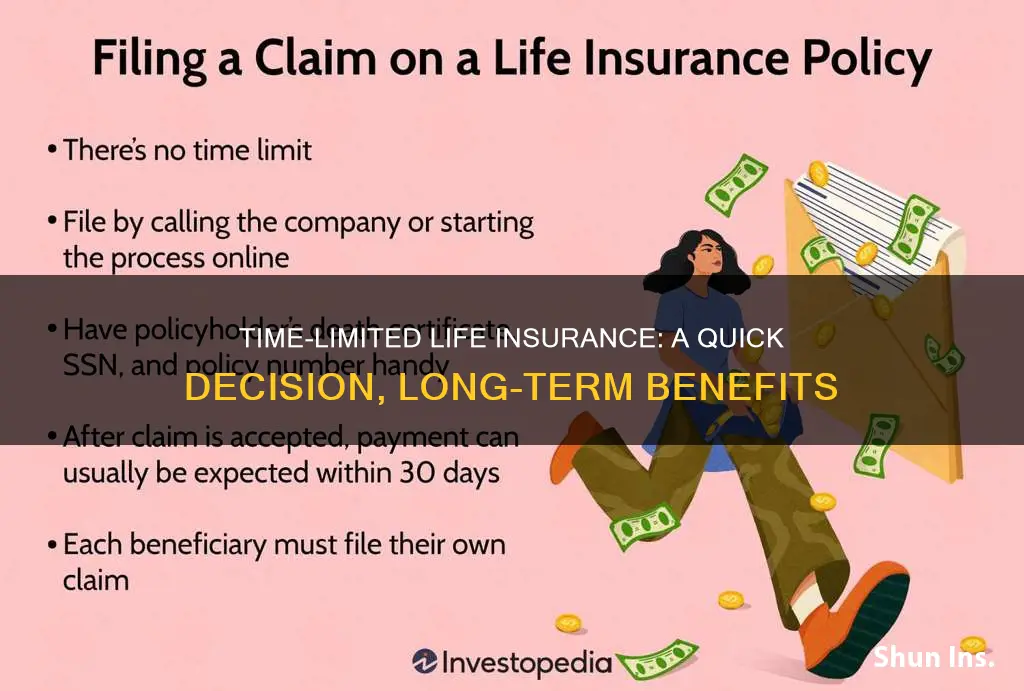

Term life insurance offers a straightforward approach to life coverage. You pay a fixed premium for a predetermined period, and in return, the insurance company promises to pay a death benefit to your beneficiaries if you pass away during that term. If you outlive the term, the policy expires, and coverage ends without any payout.

This type of insurance is advantageous for several reasons. Firstly, it is generally more affordable than permanent life insurance because it doesn't have a cash value accumulation feature. Secondly, it provides a clear and defined period of coverage, ensuring that your loved ones are protected only when it's necessary. Additionally, term life insurance can be an excellent way to build financial security for specific goals, like paying off a mortgage or covering children's education costs.

Yes, many term life insurance policies offer the option to convert to permanent life insurance, such as whole life or universal life, before the term ends. This conversion allows you to continue coverage indefinitely, providing long-term financial protection for your beneficiaries. However, converting may require a medical examination and could be more expensive than maintaining the original term policy.