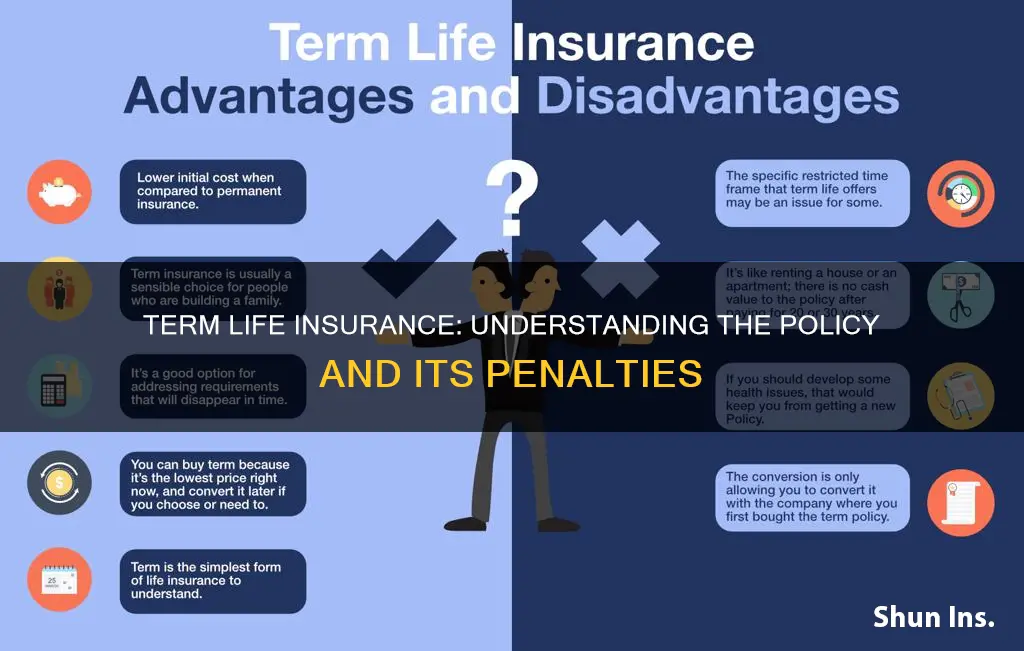

Term life insurance is a type of insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. Unlike permanent life insurance, which offers lifelong protection, term life insurance policies have a fixed duration, after which the policy expires and must be renewed or converted to a permanent policy. While term life insurance is generally more affordable, it does not build cash value, and there may be penalties for outliving the policy term. In this article, we will explore the penalties associated with outliving a term life insurance policy and discuss options for extending coverage.

| Characteristics | Values |

|---|---|

| Length of term | Typically 10, 15, 20, 25 or 30 years |

| Payout | Paid to beneficiaries if the insured dies during the term |

| Renewal | Possible, but at a higher rate |

| Conversion to permanent life insurance | Possible, but at a higher rate |

| Cash value | No cash value |

| Cost | Generally the cheapest type of life insurance |

What You'll Learn

Term life insurance policies have no cash value

The absence of cash value in term life insurance policies is a significant distinction from permanent life insurance policies, which offer a savings or investment component. Permanent life insurance allows policyholders to accumulate value over time, which can be used to pay premiums, borrow money, or withdraw funds for emergencies. This cash value component makes permanent life insurance policies significantly more expensive than term life insurance.

Term life insurance is intended to be a straightforward and affordable option for individuals who want substantial coverage at a low cost. It is ideal for those who want coverage for a specific period, such as until their children graduate from college or their mortgage is paid off. By not offering a cash value component, term life insurance premiums are more affordable, especially for young and healthy individuals.

While term life insurance policies do not provide a cash value benefit, they still offer valuable protection for individuals and their loved ones. In the unfortunate event of the insured person's death during the policy term, the beneficiaries will receive a financial payout known as the death benefit. This benefit can be used to cover funeral costs, living expenses, outstanding debts, and more.

Life Insurance Proceeds: US-Spain Tax Treaty Implications

You may want to see also

Premiums are based on age, health and life expectancy

Term life insurance premiums are calculated based on a person's age, health, and life expectancy. The older you are when purchasing a policy, the more expensive the premiums will be. This is due to the use of actuarial life tables, which assign a likelihood of dying while the policy is in force, with age increasing the likelihood of death. The premium amount typically increases by an average of 8-10% for every year of age, and this rate of increase can be as high as 12% annually for those over 50 years old.

In addition to age, health is a critical factor in determining life insurance rates. The presence of pre-existing conditions, such as heart disease, stroke, diabetes, or cancer, can significantly impact premiums. Insurers will also consider an applicant's overall health, including weight, family medical history, and participation in risky activities or hobbies.

Life insurance companies use these factors to assign applicants to different risk classes, which determine the premium rates. Those in the lowest risk class, typically referred to as "Preferred Plus" or "Elite," enjoy the lowest premiums, while those in higher risk classes due to health, smoking status, age, or other factors pay more.

When it comes to term life insurance, the premium is established when the policy is purchased and remains the same throughout the term. On the other hand, permanent life insurance policies may have premiums that rise annually.

It's important to note that life insurance rates can vary across different insurers, and it's recommended to compare quotes from multiple companies to find the best rates.

Huntington's Disease: Life Insurance Coverage and Exclusions

You may want to see also

Policyholders can renew or convert to permanent insurance

Policyholders can renew or convert term life insurance to permanent insurance, but it is important to note that not all term life insurance is convertible. It is essential to check the terms of your policy or consult a financial advisor to determine if your specific term life insurance policy can be converted.

When converting term life insurance to permanent insurance, policyholders typically have the option to choose between whole life insurance, universal life insurance, and variable universal life insurance. Here are some key considerations for each type:

Whole Life Insurance

Whole life insurance offers longer-lasting coverage, consistent premiums, and a cash value component that grows at a guaranteed rate. However, the premiums are typically higher than those of term life insurance and may cost more than five times as much. It is important to note that the premium payments may not have an end date, which can make it challenging to keep up with payments if your income changes or becomes unstable. The cash value component may also be subject to fees or taxes upon withdrawal and can reduce the value of the death benefit if too much is withdrawn. Additionally, the growth rate of the cash value may be lower compared to other investment options.

Universal Life Insurance

Universal life insurance provides longer-lasting coverage, a cash value component that earns interest, and flexible premium payment options. It is similar to whole life insurance but offers more flexibility in terms of premium payments. However, the premiums are typically higher than those of term life insurance, and the cash value component may be subject to fees or taxes upon withdrawal, similar to whole life insurance. The flexible payment options also have limitations, and reducing premium payments can affect the future cash value and death benefit of the policy. Additionally, adding a large lump sum to the policy may result in the IRS reclassifying it as a modified endowment contract, which has different tax implications.

Variable Universal Life Insurance

Variable universal life insurance offers longer-lasting coverage, a cash value component with investment options for potential higher returns or losses, and flexible premium payment options. It is similar to universal life insurance but provides more investment options for the cash value component. However, the premiums are typically higher, and the policy is more complex due to the investment options involved. Withdrawing from the cash value component may incur fees or taxes, and there is a risk of losing the initial investment and the death benefit if the investments perform poorly. Similar to universal life insurance, flexible payments have limitations, and reducing premium payments can affect the future cash value and death benefit. Additionally, adding a large lump sum may result in the policy being reclassified as a modified endowment contract with different tax implications.

When converting term life insurance to permanent insurance, policyholders can choose to convert only a portion of their existing coverage. This option can help keep costs lower compared to converting the entire policy, as the partial conversion results in having both term and permanent coverage simultaneously. It is important to carefully consider your financial goals and consult a financial advisor to determine the best course of action for your specific situation.

Life Insurance and NFCU: What You Need to Know

You may want to see also

Term life insurance is usually the cheapest option

Term life insurance is ideal for people who want substantial coverage at a low cost. It's a good option for people who cannot afford or do not want to pay the much higher monthly premiums associated with whole life insurance. It's also a good option for young people with children, as it offers substantial coverage for a low cost.

Term life insurance is also attractive to those who want to provide a lump sum to their dependents if something happens to them. It's a relatively inexpensive way to do this, especially if you are young and healthy and are supporting a family.

The cost of term life insurance is based on a person's age, health, and life expectancy. The premium is based on the policy's value (the payout amount) and factors such as age, gender, and health. The insurance company will also consider its business expenses, how much it earns from its investments, and mortality rates for each age.

While term life insurance is usually the cheapest option, it's important to note that premiums increase with age. It's also worth considering that term life insurance doesn't offer a savings component, so if you outlive your policy, you don't get anything back.

Divorce and Life Insurance: Virginia's Law and Your Policy

You may want to see also

There are no investment options

Term life insurance is a type of life insurance policy that has a specified end date, such as 20 years from the start date. Unlike permanent life insurance, term life insurance does not have a cash value component and does not offer any investment options. This means that if the policyholder outlives the policy, they do not receive any money back and there is no payout.

Term life insurance policies are typically more affordable than other types of life insurance, such as whole life or universal life insurance. This is because term life insurance is designed to provide coverage for a specific period, after which the policy ends. The policy has no cash value, and the premiums paid are not invested or saved.

While term life insurance does not offer investment options, it can be a good choice for individuals who want to ensure their loved ones are financially protected in the event of their death. The death benefit provided by term life insurance can be used by beneficiaries to cover funeral expenses, pay off debts, or maintain their financial lifestyle.

Additionally, some term life insurance policies offer the option to renew the policy or convert it into a permanent life insurance policy. This flexibility can be beneficial for individuals who may need coverage for a longer period or whose circumstances change over time. However, it's important to note that converting a term policy into a permanent policy will result in higher premiums.

Life Insurance Blood Tests: HIV Testing Included?

You may want to see also

Frequently asked questions

No, term life insurance does not have a cash value. It is designed to provide a death benefit for a specified period, and the premiums are based on factors such as age, health and life expectancy.

Yes, many term life insurance policies allow you to convert to a permanent life insurance policy without an additional medical exam. However, the deadline for conversion varies by policy, and not all policies offer this option.

If you outlive your term life insurance policy, it typically ends without any action needed from you. The insurance carrier sends a notice, and there is no longer a death benefit. Your premiums will not be refunded unless you have a "return-of-premium" feature included in your policy.

Yes, you can cancel your term life insurance policy at any time by formally cancelling it with your insurance company or simply stopping the premium payments. However, if you have a permanent life insurance policy, the cancellation process may be more complicated and may involve surrender fees.

Term life insurance is usually sufficient for most people as it is more affordable and provides coverage for a specific period. On the other hand, whole life insurance tends to be much more expensive but offers lifelong coverage and builds cash value over time. The best option for you depends on your financial goals, budget, and coverage needs.