Life insurance is a financial protection tool that provides a monetary benefit to the beneficiaries upon the insured individual's death. It is designed to offer financial security and peace of mind to individuals and their families by ensuring that their loved ones are taken care of in the event of the insured's passing. This type of insurance policy typically involves a contract between an insurance company and an individual, where the insurer promises to pay a specified sum of money to the designated beneficiaries when the policyholder dies. The amount paid out, known as the death benefit, can help cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or daily living expenses, ensuring that the family's financial obligations are met and their standard of living is maintained.

What You'll Learn

- Definition: Life insurance provides financial protection for beneficiaries in the event of the insured's death

- Types: Term, whole life, universal life, and variable life are common types

- Benefits: It offers financial security, covers final expenses, and provides for loved ones

- Cost: Premiums are based on age, health, lifestyle, and coverage amount

- Claims: The process involves submitting proof of death and receiving the death benefit

Definition: Life insurance provides financial protection for beneficiaries in the event of the insured's death

Life insurance is a financial tool designed to provide security and peace of mind for individuals and their loved ones. It is a contract between an individual (the insured) and an insurance company, where the insurer promises to pay a designated sum of money (the death benefit) to one or more beneficiaries upon the insured's death. This financial protection is a critical component of personal financial planning, especially for those with dependents or significant financial obligations.

The primary purpose of life insurance is to ensure that the financial needs of the insured's family or beneficiaries are met in the event of their untimely passing. This can include covering various expenses, such as funeral costs, outstanding debts, mortgage payments, or simply providing for the daily living expenses of the beneficiaries until they can financially recover. By doing so, life insurance helps alleviate the financial burden that often accompanies the emotional trauma of losing a loved one.

There are different types of life insurance policies, each with its own unique features and benefits. Term life insurance is a popular choice, offering coverage for a specified period, such as 10, 20, or 30 years. During this term, the policy provides a death benefit if the insured dies. Permanent life insurance, on the other hand, provides lifelong coverage and includes a cash value component that can be invested and grow over time. Universal life insurance offers flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their needs change.

When purchasing life insurance, individuals typically choose between different coverage options. These include the death benefit amount, which determines the financial payout, and the type of policy, such as term or permanent. The choice depends on various factors, including the insured's age, health, financial goals, and the level of coverage needed to support their dependents. It is essential to carefully consider these factors to ensure that the chosen policy aligns with one's specific requirements.

In summary, life insurance is a vital financial tool that offers protection and peace of mind. It provides a financial safety net for beneficiaries, ensuring they can maintain their standard of living and meet their financial obligations even after the insured's passing. With various policy types and coverage options available, individuals can tailor their life insurance plan to suit their unique circumstances and secure their family's future.

Short-Term Life Insurance: Is It Possible?

You may want to see also

Types: Term, whole life, universal life, and variable life are common types

Life insurance is a financial protection tool that provides a monetary benefit to the beneficiaries upon the insured individual's death. It is a way to ensure financial security for loved ones, covering various expenses such as mortgage payments, education costs, or daily living expenses. When considering life insurance, it's essential to understand the different types available to choose the one that best suits your needs.

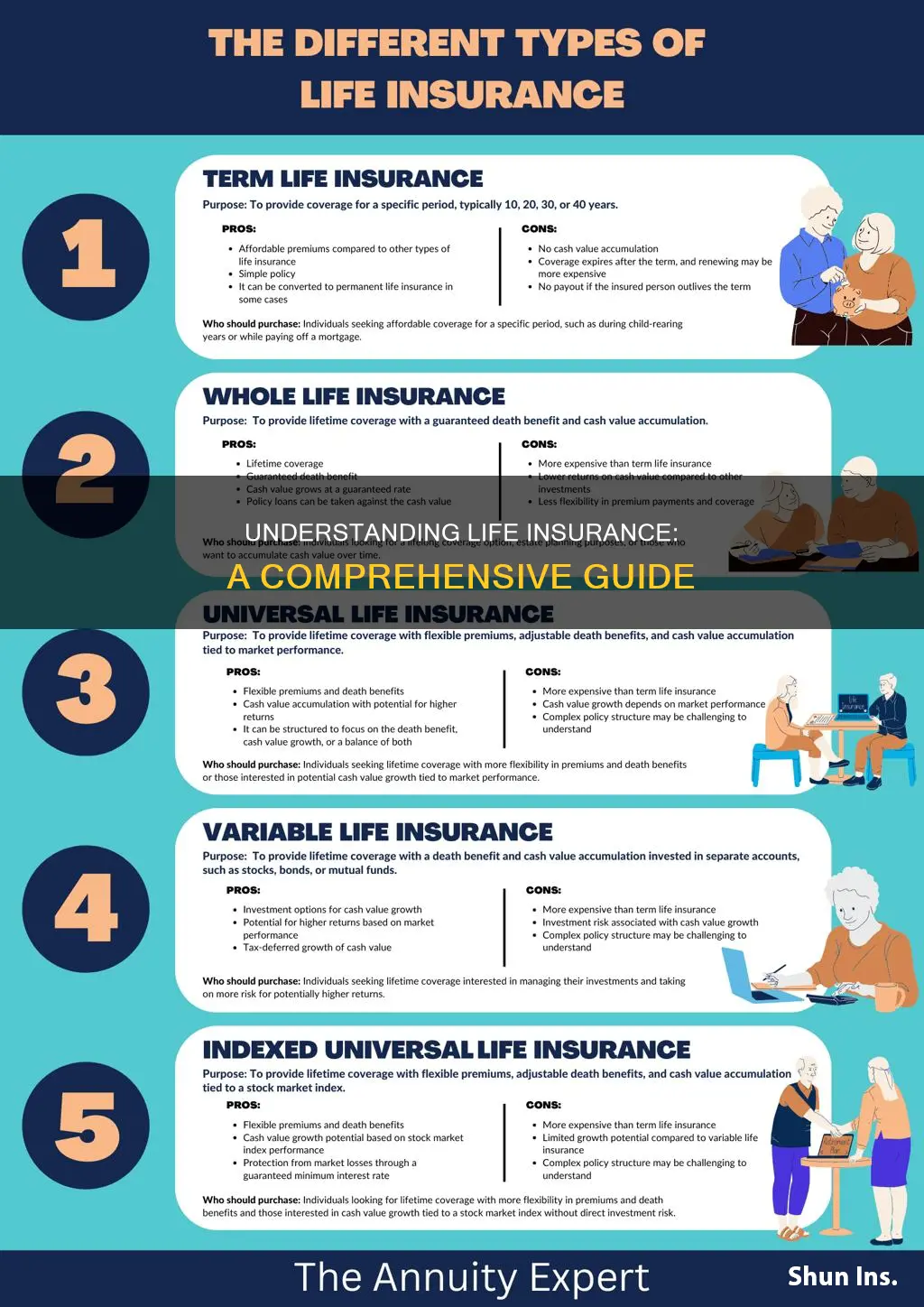

Term Life Insurance: This is a straightforward and affordable type of life insurance. It provides coverage for a specified term, typically 10, 20, or 30 years. During this period, the policyholder pays a fixed premium, and in return, the insurer promises to pay a death benefit to the beneficiaries if the insured person passes away within the term. Term life insurance is ideal for those who want coverage for a specific period, such as until a child's education is funded or a mortgage is paid off. It offers a simple and cost-effective solution without the complexity of permanent life insurance policies.

Whole Life Insurance: In contrast to term life, whole life insurance offers permanent coverage for the entire lifetime of the insured individual. It provides a guaranteed death benefit and accumulates cash value over time. Policyholders pay premiums that include both the cost of insurance and an investment component. The cash value can grow tax-deferred and can be borrowed against or withdrawn. Whole life insurance is suitable for those seeking long-term financial security and a consistent premium payment structure. It offers a sense of stability and the potential for tax-advantaged growth.

Universal Life Insurance: This type of policy provides permanent coverage and offers flexibility in premium payments and death benefit amounts. Policyholders can adjust their premiums and death benefits over time, allowing for customization based on changing financial circumstances. Universal life insurance also accumulates cash value, which can be used to borrow against or withdraw funds. It is an excellent option for those who want the security of permanent coverage but prefer the adaptability of adjusting their policy as their life changes.

Variable Life Insurance: Variable life insurance combines the permanent coverage of whole life with the investment options of an annuity. It allows policyholders to allocate a portion of their premium payments to various investment options, offering the potential for higher returns. The death benefit and cash value are linked to the performance of the investments. Variable life insurance is suitable for individuals who want both the security of a death benefit and the opportunity to grow their money through investments. It provides a level of customization and potential for higher returns compared to traditional life insurance.

Understanding the different types of life insurance is crucial in making an informed decision. Each type has its advantages and is suited to specific financial goals and life stages. Whether it's the simplicity of term life, the permanence of whole life, the flexibility of universal life, or the investment potential of variable life, choosing the right policy can provide valuable peace of mind and financial protection for your loved ones.

Life Insurance Bond: What You Need to Know

You may want to see also

Benefits: It offers financial security, covers final expenses, and provides for loved ones

Life insurance is a financial tool that provides a safety net for individuals and their families, offering a range of benefits that can be life-changing. One of the primary advantages is the financial security it provides. When you purchase life insurance, you are essentially creating a financial safety net for your loved ones. This is especially crucial if you have a family or dependents who rely on your income. In the event of your untimely demise, the insurance policy will pay out a lump sum or regular payments to your beneficiaries, ensuring that your family can maintain their standard of living and cover essential expenses. This financial security can help alleviate the stress and worry associated with providing for your loved ones, allowing them to focus on healing and moving forward during a difficult time.

Another significant benefit is the coverage of final expenses. Funerals and burial costs can be substantial, and having life insurance means these expenses are taken care of. The policyholder's beneficiaries receive the death benefit, which can cover the costs of the funeral, burial or cremation, and any outstanding debts or final wishes. This ensures that your family doesn't have to bear the financial burden of arranging your final affairs, allowing them to grieve without the added stress of financial worries.

Moreover, life insurance provides for your loved ones' future. The death benefit can be used to pay for various expenses, such as education costs for children, mortgage payments, or even the day-to-day living expenses of your family. By ensuring a steady income for your beneficiaries, life insurance helps maintain their financial stability and overall well-being. This is particularly important if you have young children or a spouse who relies on your income to cover daily living costs and long-term financial goals.

In summary, life insurance offers a comprehensive solution to financial security, covering final expenses, and providing for the future of your loved ones. It is a valuable tool that ensures your family can cope with the financial impact of your passing, allowing them to focus on honoring your memory and moving forward with their lives. Understanding the benefits of life insurance is the first step towards making informed decisions about your and your family's financial future.

Answering Life Insurance Alcohol Questionnaires: Be Honest, Stay Covered

You may want to see also

Cost: Premiums are based on age, health, lifestyle, and coverage amount

Life insurance is a financial product designed to provide financial security and protection to individuals and their families in the event of the insured's death. It is a contract between the policyholder and an insurance company, where the insurer promises to pay a designated beneficiary a sum of money upon the insured's passing. The cost of this coverage is determined by several factors, primarily the insured's age, health condition, lifestyle choices, and the amount of coverage desired.

Age is a critical factor in determining life insurance premiums. Younger individuals typically pay lower rates as they are considered less risky by insurers. This is because younger people have a longer life expectancy, and the likelihood of an early death is relatively low. As individuals age, the risk of death increases, and so do the insurance premiums. This is a standard practice in the insurance industry to reflect the changing mortality rates with age.

Health and lifestyle play a significant role in premium calculations. Insurers assess the overall health of the applicant, including any pre-existing medical conditions, to determine the risk of future claims. For instance, individuals with chronic illnesses, such as diabetes or heart disease, may be considered higher-risk and could face higher premiums. Similarly, lifestyle factors like smoking, excessive alcohol consumption, or participation in extreme sports can also impact the cost of life insurance. Insurers may offer discounts or higher coverage limits to non-smokers or individuals with healthier lifestyles, as these factors contribute to a reduced risk of death.

The coverage amount, or the death benefit, is another essential element in premium determination. This is the amount of money the insurance company agrees to pay out upon the insured's death. Higher coverage amounts result in higher premiums because the insurer takes on a more significant financial risk. For example, a policy with a $500,000 death benefit will likely cost more than a policy with a $100,000 benefit, assuming all other factors are equal. The coverage amount should be carefully considered to ensure it aligns with the insured's financial goals and the needs of their beneficiaries.

In summary, life insurance premiums are calculated based on a comprehensive assessment of the insured's age, health, and lifestyle, along with the desired coverage amount. These factors collectively determine the level of risk associated with insuring an individual. By understanding these cost determinants, policyholders can make informed decisions when selecting a life insurance policy, ensuring they receive appropriate coverage at a manageable cost.

Understanding Group Life and Disability Insurance: A Comprehensive Guide

You may want to see also

Claims: The process involves submitting proof of death and receiving the death benefit

When an individual purchases life insurance, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a financial benefit upon the insured person's death. This benefit is known as the death benefit, and it is a crucial aspect of life insurance. The process of claiming this benefit is a straightforward yet essential part of the policyholder's experience.

Upon the insured's passing, the beneficiary or beneficiaries named in the policy must initiate the claims process. This typically involves contacting the insurance company and providing them with the necessary documentation to prove the death. The proof of death usually includes official records such as a death certificate, which is issued by a medical examiner or a coroner. These documents serve as legal proof of the insured's demise and are essential to trigger the payment of the death benefit.

The insurance company will then review the submitted documentation to ensure its authenticity and accuracy. This step is crucial to prevent fraud and protect both the company and the beneficiaries. Once the claim is approved, the insurance provider will disburse the death benefit according to the terms of the policy. The amount received can vary depending on the policy's coverage and the insured's age, health, and other factors at the time of purchase.

It is important for policyholders to understand that the claims process can vary slightly depending on the insurance company and the specific policy. Some insurers may require additional documentation or have specific procedures for handling claims. However, the core requirement of providing proof of death remains consistent across most life insurance policies.

In summary, the claims process for life insurance is a critical phase that ensures the policyholder's beneficiaries receive the intended financial support upon their passing. By submitting the necessary proof of death, beneficiaries can initiate the claim, and the insurance company can fulfill its obligation under the policy, providing financial security to the insured's loved ones during a difficult time.

New York Life Insurance: Making Money, Explained

You may want to see also

Frequently asked questions

Life insurance is a financial protection tool that provides a monetary benefit to the beneficiaries of a policy when the insured individual passes away. It is a contract between the policyholder and an insurance company, where the insurer promises to pay a specified amount of money (the death benefit) to the designated recipients upon the insured's death.

When you purchase a life insurance policy, you agree to pay regular premiums (usually monthly or annually) to the insurance company. In return, the insurer promises to pay out a lump sum or regular payments to your chosen beneficiaries if you die during the term of the policy. The death benefit can be used to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or to provide financial security for your loved ones.

There are several types of life insurance policies, including:

- Term Life Insurance: Provides coverage for a specified period (term), such as 10, 20, or 30 years. It offers high coverage amounts at lower premiums but does not accumulate cash value.

- Permanent Life Insurance (Whole Life and Universal Life): Offers lifelong coverage and includes an investment component, allowing the policy to accumulate cash value over time. Premiums are typically higher, but the policy builds equity that can be borrowed against or withdrawn.

- Variable Life Insurance: Combines death benefit protection with investment options, allowing policyholders to adjust their investment strategy.

Life insurance is beneficial for individuals who have financial responsibilities or dependents who rely on their income. It can provide peace of mind, knowing that your loved ones will be financially protected in the event of your death. Common scenarios where life insurance is essential include having a family to support, a mortgage or rent to pay, student loans, or significant financial obligations. Additionally, individuals with high-risk careers, business owners, or those with substantial assets may also consider life insurance to ensure their family's financial security.