Life insurance is a crucial consideration for accountants, and the American Institute of Certified Public Accountants (AICPA) offers a range of insurance plans to its members. With close to 500,000 members, the AICPA provides group life insurance products in partnership with Prudential and AON. The AICPA's life insurance plans offer financial protection and have features like level premiums and coverage extensions. However, with options ranging from individual policies to group plans, understanding the reasons behind any increase in AICPA life insurance rates is essential for accountants considering their options.

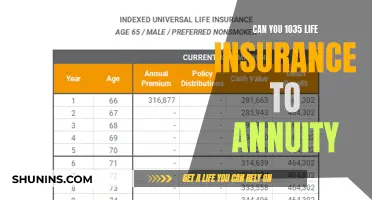

| Characteristics | Values |

|---|---|

| Membership | Only members and their spouses are eligible for AICPA life insurance |

| Age limit | Coverage up to age 80; 10- or 20-year terms available for ages 18-55; ages 56-65 are only eligible for a 10-year term |

| Medical exam | Brief medical exam required for ages 45+; convenient at-home or office options |

| Instant approval | Available for ages 40-44 without a medical exam |

| Coverage amount | Up to $2,500,000 (maximum depends on age) |

| Annual cash refund | Not guaranteed but has been issued every year; substantial decreases observed in 2023 |

| Financial protection | Provides financial protection against the unexpected |

What You'll Learn

AICPA life insurance rates

The AICPA life insurance plan offers financial protection against the unexpected. The most popular plan provides coverage up to age 80, even if you change jobs or retire, as long as you maintain your membership.

For those aged 40-44, no medical exam is needed to apply for Select rates, and instant approval is available. In certain circumstances, additional information may be required. Brief medical exams are required for those aged 45+ applying for Preferred rates.

The AICPA insurance plan offers instant online approval, with the opportunity to get a quote immediately.

While specific rate information is not publicly available, you can contact AICPA directly to discuss rates and obtain a quote.

Life Insurance Token: Where to Get Star Citizen Cover

You may want to see also

AICPA vs individual policies

When considering AICPA life insurance, it is essential to weigh its pros and cons against those of individual life insurance policies. AICPA, or the American Institute of CPAs, offers a range of insurance products to its members, including life insurance. AICPA life insurance is a group policy, which means that it is controlled by the group, and it provides coverage for members and their spouses. On the other hand, individual life insurance policies are controlled by the policy owner.

One advantage of AICPA life insurance is that it offers competitive group rates and policies that do not require a medical exam for most applicants, making the approval process relatively quick and easy. AICPA life insurance also provides income tax-free benefits, which can increase the amount of money that beneficiaries receive. Additionally, AICPA life insurance offers multiple coverage amounts, up to $2.5 million, and the ability to apply for additional coverage at any time. AICPA also provides other types of insurance, such as auto and homeowners insurance, as well as a long-term disability income plan.

However, AICPA life insurance may not always be the most cost-effective option. Group life insurance policies often come with substantial fees and may not offer the same level of benefits or policy control as individual policies. While AICPA life insurance can provide coverage up to age 80, it is contingent on maintaining membership with the organization, which requires ongoing payments. In contrast, individual term life insurance policies can offer more flexibility in terms of coverage amounts, premiums, and investment options.

When deciding between AICPA life insurance and an individual policy, it is crucial to compare quotes and features from both options while considering your specific needs, health, and budget. While AICPA life insurance may be a convenient choice for accountants due to its group benefits and simplified application process, individual policies can provide more personalized coverage and potentially lower costs. Ultimately, the decision should be based on a thorough evaluation of the available options to ensure that you are getting the most suitable coverage for your circumstances.

Ethos Life Insurance: Reliable or Risky Business?

You may want to see also

AICPA insurance plans and financial protection

The AICPA Member Insurance Programs, powered by Aon, offer a range of insurance solutions tailored to meet the unique needs of Certified Public Accountants (CPAs), their families, and firms. These plans provide comprehensive financial protection and peace of mind against unforeseen events.

One of the most popular offerings is the life insurance plan, which stands out for its flexibility and longevity. Members can retain their coverage up to age 80, even if they change jobs or retire, as long as they maintain their AICPA membership. This plan simplifies the application process by eliminating the need for a medical exam for most applicants up to age 44, making it convenient and accessible.

AICPA insurance plans are designed to safeguard not only your health but also your career and lifestyle. They offer custom-tailored solutions to manage risks and protect your professional endeavours. This comprehensive approach ensures that CPAs can focus on their work and personal lives with the assurance that they are backed by robust financial protection.

The AICPA Member Insurance Programs are endorsed by the AICPA to deliver best-in-class risk solutions. By partnering with Aon, a leading global professional services firm, they can provide CPAs with access to a wide range of insurance options and expert guidance to navigate the complex world of risk management and financial protection.

In summary, AICPA insurance plans go beyond traditional health coverage by addressing the specific needs of CPAs and offering financial protection for their careers, lifestyles, and families. With the support of industry leaders like Aon, the AICPA ensures that its members have access to top-tier insurance solutions, reinforcing their commitment to the accounting and finance profession.

Life Insurance and Death: How Do They Know?

You may want to see also

Annual cash refunds

The AICPA Life Insurance Plan offers an Annual Cash Refund to its participants. This refund is not guaranteed and may vary from year to year, but it has been issued every year of the plan so far. The amount of the refund is based on several factors, including the participant's age, payment basis, rate class, and type of product purchased. For instance, the refund rate for the CPA Life product has decreased substantially, while the term life product refund has increased.

The Annual Cash Refund provides an additional financial benefit to participants on top of the insurance coverage provided by the plan. It is similar to a universal life insurance policy, where the policyholder can withdraw the cash value annually. This feature adds flexibility to the plan, allowing participants to access their money and use it as needed.

The AICPA Life Insurance Plan's Annual Cash Refund sets it apart from individual life insurance policies. When comparing the AICPA Level Premium Term Life Insurance rates with individual term life insurance companies, the refund enhances the overall value of the AICPA plan. Participants should consider this refund as a significant factor when evaluating their life insurance options.

While the Annual Cash Refund is a valuable feature, it is important to note that it is not the only consideration when choosing a life insurance plan. Participants should also weigh other factors, such as coverage amounts, eligibility requirements, and long-term cost implications. By carefully reviewing the plan details and comparing it with alternative options, individuals can make informed decisions about their life insurance coverage.

Get Life Insurance Fast for an SBA Loan

You may want to see also

CPA Level Premium Term Life product

The CPA Level Premium Term Life product is one of the two term life products offered by AICPA. The rates for this product are level, meaning they stay the same for 10 or 20 years, but they are not guaranteed to remain level. This means that while Prudential Life, the insurance company used by AICPA, is not likely to raise rates, they do not guarantee that they will remain the same. The level rates make it easier to manage your budget.

The CPA Level Premium Term Life product offers coverage up to age 80, even if you change jobs or retire, as long as you maintain your membership. The product has Standard, Select, and Preferred underwriting rate classes, with instant approval available for Select rates for ages 40-44. A brief medical exam is required for those 45 and above who want Preferred rates. The eligibility criteria include questions about family health history, driving record, tobacco and nicotine use, flying experience, and participation in adventure sports.

The CPA Level Premium Term Life product also features an Annual Cash Refund, where money not used by the group life insurance plan for expenses, claims, and Prudential refunds is returned to the participants through the AICPA Insurance Trust. The refund amount is based on the participant's age, payment basis, rate class, and type of product purchased. While not guaranteed, a refund has been issued every year of the plan so far.

Compared to individual plans, the CPA Level Premium Term Life product may seem expensive. However, the CPA Life policy, which is part of the CPA Level Premium Term Life product, can be inexpensive, especially for younger ages. It is recommended to compare the AICPA life insurance products with other offerings in the market to make an informed decision.

Life Insurance for Parents: Where to Get Covered

You may want to see also

Frequently asked questions

AICPA life insurance rates have not increased since 2021. Rates stay the same for 10- or 20-year terms and may change only on a class-wide basis.

The AICPA life insurance rate depends on age, payment basis, rate class, and type of product purchased.

The maximum coverage available is $2,500,000, which depends on age.

AICPA life insurance provides financial protection against the unexpected. It offers fixed rates that can help manage your budget, and easy application with instant online approval.