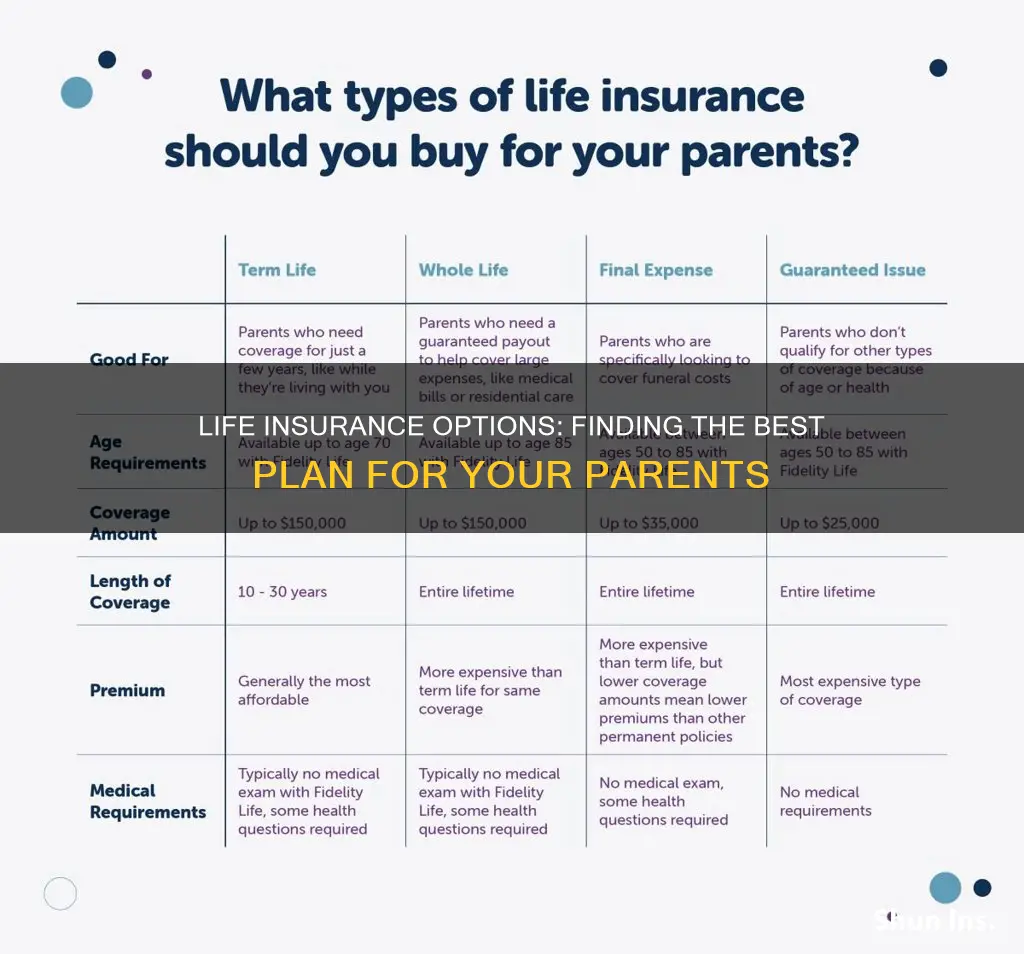

Navigating the world of life insurance can be a daunting task, especially when it comes to finding the right coverage for your parents. Whether you're looking to secure their financial future or provide peace of mind, understanding the options available is crucial. This guide will explore the various places where you can find life insurance policies tailored to your parents' needs, from traditional insurance companies to online platforms and financial advisors. By considering factors such as age, health, and lifestyle, you can make an informed decision that ensures your parents receive the support they deserve.

What You'll Learn

- Online Platforms: Compare policies from various insurers on dedicated websites

- Independent Brokers: Seek personalized advice from licensed professionals

- Financial Advisors: Consult experts for tailored recommendations based on needs

- Senior Discounts: Explore options offering reduced rates for older individuals

- Government Programs: Research state-sponsored plans for affordable coverage

Online Platforms: Compare policies from various insurers on dedicated websites

When it comes to finding life insurance for your parents, online platforms can be a convenient and efficient way to compare policies from multiple insurers. These dedicated websites provide a comprehensive overview of the various options available, allowing you to make an informed decision. Here's a guide on how to utilize online platforms to secure life insurance for your loved ones:

Research and Compare: Start by visiting reputable online platforms that specialize in comparing life insurance policies. These platforms often have a wide range of insurers listed, each offering different plans and coverage options. You can input your parents' personal details, such as age, health status, and desired coverage amount, to receive tailored recommendations. This approach ensures that you compare similar policies side by side, making it easier to identify the best fit for your parents' needs.

Explore Insurer Options: Online platforms typically display a list of insurers along with their respective policies. Take time to review the offerings from each company. Consider factors such as the insurer's reputation, financial stability, customer reviews, and the specific features of each policy. For instance, some insurers might offer term life insurance, while others provide permanent life insurance options. Understanding these differences will help you choose a policy that aligns with your parents' long-term financial goals.

Request Quotes and Quotes Comparison: Many online platforms allow you to request quotes directly from the insurers. This process is straightforward and often involves filling out a simple form with your parents' information. Once you have quotes from multiple insurers, you can easily compare the premiums, coverage amounts, and policy terms. This comparison will highlight any significant differences in pricing and benefits, enabling you to make a well-informed decision.

Read Policy Details: When comparing policies, ensure that you thoroughly read the fine print. Pay attention to the coverage terms, exclusions, and any additional benefits or riders offered. Online platforms often provide policy summaries or explanations to help you understand the key features. This step is crucial to ensure that the chosen policy meets your parents' expectations and provides adequate financial protection.

Consider Customer Support and Reviews: Online platforms may also provide customer reviews and ratings for each insurer. These reviews can offer valuable insights into the insurer's service quality, claims processing, and overall customer satisfaction. Additionally, checking the platform's ratings and testimonials can help you gauge the reliability and trustworthiness of the insurers listed.

By utilizing online platforms, you can streamline the process of finding life insurance for your parents, ensuring that you compare a variety of options and make a decision that suits their individual needs. Remember, it's essential to choose a policy that provides long-term financial security and peace of mind for your parents and your family.

Life Insurance Options for Seniors with Stents

You may want to see also

Independent Brokers: Seek personalized advice from licensed professionals

When it comes to finding the right life insurance for your parents, engaging the services of independent brokers can be a strategic move. These professionals offer a unique advantage by providing personalized advice tailored to your parents' specific needs. Here's why considering independent brokers is a wise decision:

Expertise and Independence: Independent brokers are licensed professionals who have a deep understanding of the insurance market. They are not tied to a single insurance company, which means they can offer a wide range of options from various providers. This independence allows them to provide unbiased advice, ensuring your parents receive the best coverage without any hidden biases.

Personalized Approach: Each individual has unique circumstances, and independent brokers excel at offering customized solutions. They will take the time to assess your parents' health, age, financial situation, and other relevant factors. By understanding their specific needs, these brokers can recommend appropriate life insurance policies, whether it's term life, whole life, or a combination of both. This personalized approach ensures that the chosen insurance aligns perfectly with your parents' goals and budget.

Comprehensive Options: The market offers a vast array of life insurance products, and independent brokers have access to this entire spectrum. They can present you with a variety of options, including traditional insurance plans, variable life insurance, and even niche products tailored to specific needs. This comprehensive overview empowers you to make an informed decision, ensuring your parents get the coverage they require.

Negotiation Power: Working with independent brokers gives you an advantage in negotiations. These professionals often have strong relationships with insurance companies, allowing them to advocate for your parents' best interests. They can negotiate terms, premiums, and coverage amounts, potentially saving your parents money and ensuring they receive a fair deal.

Ongoing Support: The relationship with an independent broker doesn't end after the policy is purchased. These professionals provide ongoing support and guidance, ensuring your parents' insurance needs are met as they change over time. They can assist with policy reviews, adjustments, and even provide financial advice related to life insurance, offering long-term peace of mind.

By seeking the expertise of independent brokers, you gain a dedicated advocate who will work diligently to secure the perfect life insurance policy for your parents. This personalized approach, combined with their industry knowledge, ensures a tailored solution that meets your parents' unique requirements.

Whole Life Insurance: Canceling Policy Penalties Explained

You may want to see also

Financial Advisors: Consult experts for tailored recommendations based on needs

When it comes to securing life insurance for your parents, consulting a financial advisor is an invaluable step. These professionals offer tailored recommendations based on individual needs, ensuring a comprehensive and personalized approach to financial planning. Here's why engaging a financial advisor is beneficial:

Personalized Guidance: Financial advisors take the time to understand your parents' unique circumstances, including their age, health, lifestyle, and financial goals. By gathering this information, they can provide tailored advice on the types of life insurance policies that would be most suitable. This personalized approach ensures that the chosen insurance plan aligns perfectly with your parents' needs, offering adequate coverage and peace of mind.

Expert Knowledge: These advisors possess extensive knowledge of the insurance market and various policy options. They can explain the different types of life insurance, such as term life, whole life, and universal life, and their respective benefits and drawbacks. With their expertise, they can help your parents make informed decisions, ensuring they understand the coverage, premiums, and long-term implications of each policy.

Risk Assessment and Management: Financial advisors can conduct a thorough risk assessment to identify potential challenges your parents may face when obtaining life insurance. This includes evaluating their health, medical history, and any existing conditions. By understanding these factors, advisors can recommend appropriate coverage and suggest ways to mitigate risks, making it easier for your parents to secure affordable and comprehensive insurance.

Long-Term Financial Planning: Beyond just life insurance, financial advisors can provide a holistic view of your parents' financial situation. They can offer strategies to optimize their overall financial health, including retirement planning, investment advice, and tax-efficient strategies. By integrating life insurance into a broader financial plan, advisors ensure that the decision to purchase insurance is part of a well-rounded and sustainable financial strategy.

Negotiation and Advocacy: When working with insurance providers, financial advisors can negotiate on your parents' behalf, securing better rates, coverage options, and policy terms. They advocate for their clients' interests, ensuring that the final policy meets the agreed-upon needs and expectations. This advocacy can save your parents time, effort, and potentially significant amounts of money.

Engaging a financial advisor is a strategic move when considering life insurance for your parents. Their expertise, personalized approach, and ability to provide tailored recommendations based on individual needs make them an essential partner in securing the right insurance coverage. By consulting these professionals, you can ensure that your parents receive the financial protection they deserve and make informed decisions about their long-term financial well-being.

Understanding Life Insurance and Annuity with a 1035 Exchange

You may want to see also

Senior Discounts: Explore options offering reduced rates for older individuals

When considering life insurance for your parents, it's important to explore options that cater to their age and life stage. One aspect to look into is whether insurance providers offer senior discounts, which can significantly reduce the cost of coverage for older individuals. These discounts are often available through various insurance companies and can be a valuable way to secure financial protection for your parents without breaking the bank.

Senior discounts for life insurance are designed to recognize the financial responsibility and experience of older adults. As individuals age, they often develop a more stable financial situation, and their risk profile may change, making them eligible for more favorable rates. These discounts can be particularly beneficial for older parents who want to ensure their family's financial security without incurring excessive expenses.

To find suitable options, start by researching insurance companies that specialize in senior-friendly policies. Many traditional life insurance providers offer senior discounts, often referred to as "senior life insurance" or "mature-age insurance." These policies are tailored to meet the needs of older adults and can provide a sense of peace of mind for both your parents and your family. Look for companies that have a good reputation for customer service and a history of catering to the senior market.

When comparing policies, pay close attention to the terms and conditions of the senior discount. Some insurers may offer reduced rates for a specific age range, while others might provide discounts based on overall health and lifestyle factors. It's essential to understand the criteria for eligibility to ensure your parents qualify for the best possible rates. Additionally, consider the coverage options and any additional benefits that might be included in the policy.

Exploring senior discount options can be a strategic approach to securing life insurance for your parents. By taking advantage of these discounts, you can provide them with the necessary financial protection while also ensuring that the insurance remains affordable. Remember to compare multiple quotes and policies to find the best fit for your parents' needs, allowing them to enjoy the peace of mind that comes with knowing they are protected.

Contingent Life Insurance: Am I the Primary Beneficiary?

You may want to see also

Government Programs: Research state-sponsored plans for affordable coverage

When considering life insurance for your parents, it's important to explore all available options, including government-sponsored programs. Many states in the United States offer state-sponsored life insurance plans that can provide affordable coverage for individuals who may not qualify for private insurance. These programs are designed to ensure that residents have access to basic life insurance protection, often at reduced rates.

Researching state-sponsored plans can be a valuable step in securing life insurance for your parents. Each state has its own insurance department or agency that oversees and administers these programs. Start by visiting your state's official government website and look for the section dedicated to insurance or consumer protection. Here, you can find information about the state-offered life insurance options available to residents. These programs often have specific eligibility criteria, such as age, residency, and income requirements, so it's crucial to understand these before proceeding.

The application process for state-sponsored life insurance typically involves completing an application form, providing personal and financial information, and paying the applicable premiums. The coverage amounts and terms may vary, but they generally offer a basic level of protection. For instance, some states provide term life insurance, which covers a specific period, while others might offer permanent life insurance with a cash value component. It's essential to review the policy details to ensure it meets your parents' needs.

One of the significant advantages of these government programs is the affordability. Since these plans are state-sponsored, they often have lower overhead costs compared to private insurance companies, allowing for more competitive pricing. This can be particularly beneficial for individuals or families who may not have access to employer-sponsored group life insurance or prefer a more personalized approach.

Additionally, state-sponsored life insurance plans can be a valuable resource for those who might not qualify for private insurance due to health issues or other factors. These programs often have more flexible underwriting criteria, making it easier for individuals with pre-existing conditions to obtain coverage. However, it's still advisable to compare the terms and conditions of government-offered plans with private insurance options to ensure you're making the best choice for your parents' specific circumstances.

Life Insurance and Experimental Vaccines: What's Covered?

You may want to see also

Frequently asked questions

Finding the best life insurance for your parents involves considering their specific needs and circumstances. Start by assessing their age, health, and any existing medical conditions. Term life insurance is often a popular choice for parents as it provides coverage for a set period, ensuring financial security for your family during that time. You can explore options from various insurance companies, compare policies, and choose one that aligns with your budget and the desired level of coverage.

Yes, it is possible to obtain life insurance for parents with pre-existing health issues, but it may be more challenging and expensive. Insurance companies often consider health factors when determining premiums. It's recommended to disclose all relevant health information to the insurance provider. Some companies offer specialized policies for individuals with medical conditions, so thorough research and comparing quotes from multiple insurers can help find suitable options.

The process typically involves several steps. First, you'll need to gather information about your parents' personal details, medical history, and any relevant financial information. Then, you can compare quotes from different insurance companies and choose a policy. The application process usually requires filling out forms, providing necessary documentation, and possibly undergoing a medical examination. Once approved, you can make the necessary payments to keep the policy active.

Yes, life insurance can offer some tax advantages. In many countries, life insurance death benefits are generally tax-free and can be a valuable financial tool. Additionally, certain types of policies, like permanent life insurance, can accumulate cash value over time, providing tax-deferred growth. It's best to consult a financial advisor or insurance professional to understand the specific tax implications in your region.

The amount of life insurance coverage you should consider depends on various factors, including your family's financial goals, income, and expenses. A common rule of thumb is to ensure the policy covers at least six to twelve months' worth of living expenses for your family. It's also essential to consider any outstanding debts, future education costs, and other financial obligations your parents may have. Consulting a financial advisor can help you determine the appropriate coverage amount.