Usable life insurance is a type of insurance policy that provides financial protection and benefits to the policyholder and their beneficiaries. It is designed to offer coverage for a specific period, typically the policyholder's working years, and can be used to secure various financial goals. This type of insurance is versatile and can be tailored to meet individual needs, allowing policyholders to choose the coverage amount, duration, and other features that align with their financial objectives. Whether it's providing income replacement, covering daily expenses, funding education, or building a retirement nest egg, usable life insurance offers a flexible and valuable tool for individuals and families to manage their financial well-being.

What You'll Learn

- Definition: Life insurance that provides financial protection during the policyholder's usable life

- Benefits: Covers expenses like mortgage, education, and living costs for beneficiaries

- Types: Term, whole life, and universal life offer varying coverage periods

- Tax Advantages: Premiums and death benefits may be tax-deductible or exempt

- Flexibility: Policies can be adjusted to meet changing financial needs

Definition: Life insurance that provides financial protection during the policyholder's usable life

Usable life insurance is a type of life insurance policy that offers financial security and protection to the policyholder throughout their entire life. Unlike traditional term life insurance, which provides coverage for a specified period, usable life insurance is designed to remain in effect as long as the policyholder is alive. This means that the policyholder can rely on the financial benefits of the insurance during their entire usable life, ensuring a consistent level of protection.

The key feature of usable life insurance is its flexibility and adaptability to the policyholder's changing needs. As individuals progress through different life stages, their financial requirements may vary. Usable life insurance allows policyholders to adjust their coverage accordingly, ensuring that they always have the appropriate level of protection. For example, a young professional might start with a basic policy and gradually increase the coverage as their income and responsibilities grow. This adaptability is particularly valuable, as it allows individuals to make the most of their insurance without overpaying for unnecessary coverage.

One of the advantages of usable life insurance is the potential for long-term savings. Since the policy remains in effect for the entire usable life, the insurance company can accumulate a substantial amount of premiums over time. This accumulation can lead to significant cash value within the policy, which can be borrowed against or withdrawn by the policyholder. The cash value can serve as a financial resource for various purposes, such as funding education, starting a business, or providing financial security during retirement.

Additionally, usable life insurance often includes various riders and optional benefits that can enhance the policy's value. These riders may provide additional coverage for specific risks, such as critical illness or accidental death, ensuring that the policyholder's financial protection is comprehensive. The flexibility of usable life insurance allows individuals to customize their policies to suit their unique circumstances and preferences.

In summary, usable life insurance is a comprehensive and adaptable form of life insurance that offers financial protection throughout the policyholder's entire life. Its flexibility enables individuals to adjust coverage as needed, ensuring they always have the appropriate level of security. With the potential for long-term savings and customizable benefits, usable life insurance provides a valuable financial tool for individuals seeking reliable protection and financial security.

Is Illinois' Insurance Exam Challenging?

You may want to see also

Benefits: Covers expenses like mortgage, education, and living costs for beneficiaries

Usable life insurance is a financial tool that provides a unique and valuable benefit to both the policyholder and their beneficiaries. One of its key advantages is the ability to cover essential expenses for the recipients, ensuring financial security and peace of mind. This type of insurance is designed to be flexible and adaptable, allowing policyholders to customize the coverage to meet their specific needs.

When it comes to beneficiaries, usable life insurance can be a powerful asset. It offers a safety net by providing financial support to cover various expenses that they might incur. For instance, the policy can be structured to pay out a lump sum or regular payments to cover mortgage payments, ensuring that the beneficiaries can maintain their home and avoid financial strain. This is particularly beneficial for those who have recently purchased a property or are planning to do so in the future.

Additionally, usable life insurance can be tailored to support educational expenses. Many policies allow for the allocation of funds to cover the costs of higher education, such as college or university fees, books, and living expenses. This is an excellent way to provide financial assistance to beneficiaries pursuing further education, ensuring they can achieve their academic goals without the added stress of financial burden.

The coverage also extends to everyday living costs, which can vary depending on the policyholder's preferences. It can include expenses like rent or utility bills, groceries, transportation, and other basic necessities. By providing this comprehensive support, usable life insurance ensures that the beneficiaries have the financial means to maintain their standard of living and focus on their well-being.

In summary, usable life insurance offers a practical solution for policyholders to provide for their loved ones. Its flexibility allows for customized coverage, ensuring that beneficiaries can cover essential expenses, including mortgage, education, and daily living costs. This type of insurance is a valuable tool for anyone seeking to secure their family's financial future and provide long-term peace of mind.

Key Man Life Insurance: Protecting Your Business's Future

You may want to see also

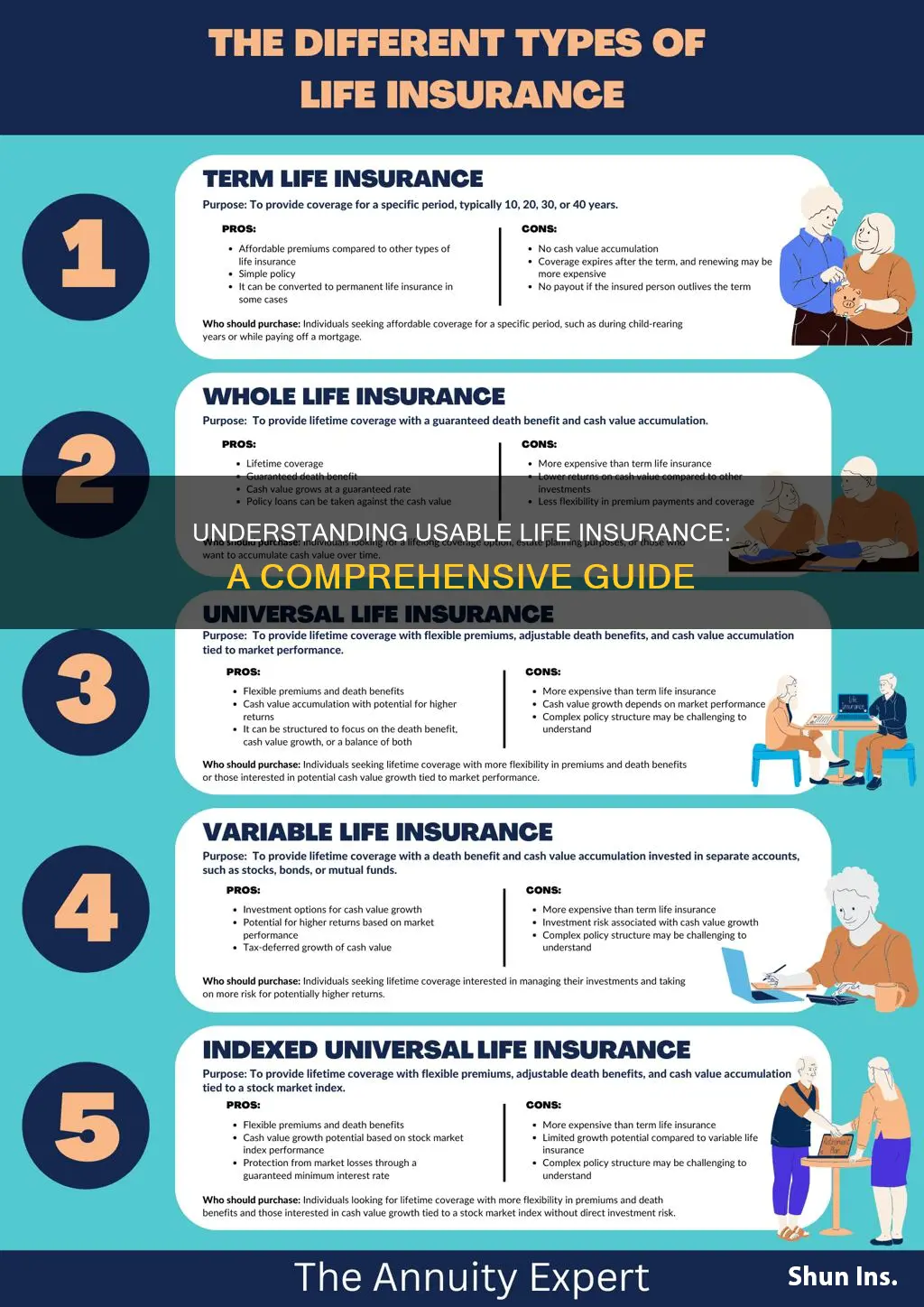

Types: Term, whole life, and universal life offer varying coverage periods

Life insurance is a financial tool that provides a safety net for individuals and their families, ensuring financial security in the event of the insured's death. It offers a range of options, each with its own unique features and benefits, catering to different needs and preferences. When considering life insurance, it's essential to understand the different types available, particularly term life, whole life, and universal life, as they offer varying coverage periods and benefits.

Term Life Insurance: This type of insurance provides coverage for a specified period, known as the 'term.' It is a straightforward and cost-effective option, offering a fixed amount of coverage for a predetermined duration. For example, you might choose a 10-year term policy, providing coverage for that specific period. Term life insurance is ideal for individuals who want temporary coverage, often used to secure financial obligations like mortgage payments or to provide for children's education. The advantage is its affordability, as premiums are typically lower compared to other types of life insurance. However, it does not accumulate cash value, and the coverage ends when the term expires.

Whole Life Insurance: In contrast, whole life insurance offers lifelong coverage, providing a sense of long-term security. This type of policy builds cash value over time, which can be borrowed against or withdrawn. The coverage amount remains constant throughout the insured's life, ensuring a fixed payout to beneficiaries. Whole life insurance is more expensive than term life due to the guaranteed payout and cash value accumulation. It is suitable for those seeking permanent coverage and the potential for tax-advantaged savings. With whole life, the premiums remain level, providing consistent coverage and financial benefits.

Universal Life Insurance: This is a flexible type of life insurance that offers both coverage and an investment component. Policyholders can adjust their premiums and death benefits over time, providing a level of customization. Universal life insurance also accumulates cash value, which can be used to pay premiums or taken out as loans. The coverage can increase or decrease based on the policyholder's decisions, offering flexibility. While it provides lifelong coverage, the cost can vary, and it may be more complex to understand compared to term or whole life policies. Universal life is attractive to those who want both insurance and investment opportunities, allowing for potential long-term financial growth.

In summary, the choice between term, whole life, and universal life insurance depends on an individual's specific needs and financial goals. Term life is ideal for temporary coverage, whole life provides permanent security with cash value, and universal life offers flexibility and investment potential. Understanding these variations is crucial in selecting the most suitable life insurance policy to ensure financial protection and peace of mind.

Gerber Life Insurance: Adult Options and Benefits Explored

You may want to see also

Tax Advantages: Premiums and death benefits may be tax-deductible or exempt

Life insurance is a financial tool that provides a safety net for individuals and their families. It offers a way to secure financial stability in the event of an untimely death. One of the key advantages of life insurance is the potential tax benefits it can offer. When it comes to life insurance, understanding the tax implications of premiums and death benefits is essential for maximizing the value of your policy.

In many countries, life insurance premiums can be a tax-deductible expense. This means that the amount you pay in premiums can be subtracted from your taxable income, reducing your overall tax liability. For example, if you have a high-income job and are required to pay a significant amount in premiums, you can claim this as a deduction, thus lowering your taxable income and, consequently, the tax you owe. This tax advantage is particularly beneficial for high-income earners or those with substantial insurance needs.

The tax treatment of death benefits is another crucial aspect. When a life insurance policyholder dies, the death benefit is typically paid out to the beneficiaries. In many jurisdictions, this death benefit is generally tax-free. This means that the beneficiaries receive the full amount without any tax implications. This is a significant advantage as it ensures that the intended recipients receive the financial support they need without any tax burdens.

Furthermore, the tax-free nature of death benefits can have a positive impact on the beneficiaries' financial planning. It allows them to use the proceeds for various purposes, such as covering funeral expenses, paying off debts, or investing for the future. The tax-free status of death benefits provides a sense of security, knowing that the financial support will not be diminished by tax obligations.

It is important to note that tax laws and regulations regarding life insurance can vary by country and region. Therefore, it is advisable to consult with a tax professional or financial advisor who can provide personalized guidance based on your specific circumstances. They can help you navigate the complexities of tax laws and ensure that you take full advantage of the tax benefits associated with your life insurance policy.

Life Insurance: Maximizing Your Policy for Peace of Mind

You may want to see also

Flexibility: Policies can be adjusted to meet changing financial needs

Life insurance is a financial tool that provides a safety net for individuals and their families, offering peace of mind and financial security. One of the key advantages of life insurance is its flexibility, which allows policyholders to adapt their coverage as their financial circumstances evolve. This adaptability is a significant feature that sets life insurance apart from other financial products.

When you purchase a life insurance policy, you typically choose a specific amount of coverage, known as the death benefit, which will be paid out to your beneficiaries upon your passing. However, life insurance is not a static product; it can be tailored to your changing needs over time. This flexibility is particularly valuable as your financial situation, family structure, and long-term goals may undergo various transformations throughout your life.

As your financial needs change, you might find yourself requiring more or less coverage. For instance, when you start a family, you may want to increase your life insurance to ensure your loved ones have the necessary financial support. Conversely, as your children grow older and become financially independent, you might consider reducing your coverage to avoid over-insuring. Life insurance policies often allow for adjustments to the death benefit, making it easy to accommodate these changes. You can opt for a policy that includes a review clause, enabling you to update your coverage periodically to reflect your current financial situation.

Additionally, some life insurance companies offer various policy options, such as term life and permanent life insurance, each with its own set of advantages. Term life insurance provides coverage for a specified period, which can be adjusted at the end of the term. This feature is useful if you want to ensure coverage for a particular period, such as when you have a mortgage or children in college. On the other hand, permanent life insurance, including whole life and universal life, offers lifelong coverage and can accumulate cash value over time, providing a flexible investment option.

The flexibility of life insurance policies allows you to make informed decisions about your financial future. You can work with your insurance provider to adjust the policy's terms, ensuring that your coverage remains relevant and appropriate. This adaptability is a powerful tool, allowing you to manage your finances effectively and provide long-term security for your loved ones, no matter how your life circumstances change. Understanding the flexibility of life insurance policies can help individuals make the most of this financial product, ensuring they have the right level of protection when they need it the most.

Sober but Denied: Life Insurance's Catch-22

You may want to see also

Frequently asked questions

Usable life insurance refers to the period during which an insurance policy is active and provides financial protection to the policyholder or beneficiaries. It is the duration from the date of policy issuance until the policy maturity or the point at which the death benefit is paid out. This concept is crucial for understanding the value and utility of a life insurance policy.

The usable life insurance period is a subset of the policy's term. The term of a life insurance policy is the duration for which the coverage is in effect, and it can vary depending on the policy type. For example, a 10-year term life insurance policy has a usable life insurance period of 10 years, during which the policy provides coverage. After the term ends, the policy may continue as a permanent life insurance policy if the policyholder chooses to convert it.

In some cases, the usable life insurance period can be extended or renewed, especially for term life insurance policies. If the policyholder desires continued coverage beyond the initial term, they can typically opt for policy conversion, which allows them to switch to a permanent life insurance policy with extended coverage. This option provides flexibility and ensures that the insurance remains usable for an extended period, offering long-term financial protection.