Dividends in whole life insurance are sums of money paid to policyholders by life insurance companies. They are similar to traditional investment dividends, representing a share of the company's profits. Whole life insurance is a form of permanent life insurance that offers lifelong coverage and a death benefit. Certain types of whole life insurance policies, known as participating policies, offer the potential for dividends, while others, known as non-participating policies, do not. Dividends are not guaranteed and depend on the insurer's financial performance, including interest rates, investment returns, and new policies sold. Policyholders can use dividends in various ways, such as receiving them as cash, reducing premiums, purchasing additional insurance, or leaving them with the insurance company to earn interest. While dividends are generally not taxable, there may be tax implications if withdrawals exceed payments.

| Characteristics | Values |

|---|---|

| Dividend frequency | Annual |

| Taxable | No |

| Dividend amount basis | Company's financial performance |

| Dividend payment options | Cash, cheque, premium deductions, additional insurance, savings account |

| Dividend guarantee | No |

What You'll Learn

Dividends as a return on investment

Whole life insurance policies are a form of permanent life insurance that offers lifelong coverage and a death benefit. Some whole life insurance policies also pay dividends to their policyholders, which can be a great way to boost your investment returns. These dividends are not guaranteed and depend on the insurer's financial performance, such as investment returns, the number of claims paid out, and operational costs.

When an insurance company performs well financially, they may distribute a portion of their profits back to policyholders in the form of dividends. These dividends are typically based on the amount of insurance in force, with higher coverage resulting in potentially larger dividends. Dividends from participating policies are not subject to income tax, but taxes may apply if withdrawals exceed payments. It's important to note that dividends are different from interest or annuities and are only available with participating whole life insurance policies.

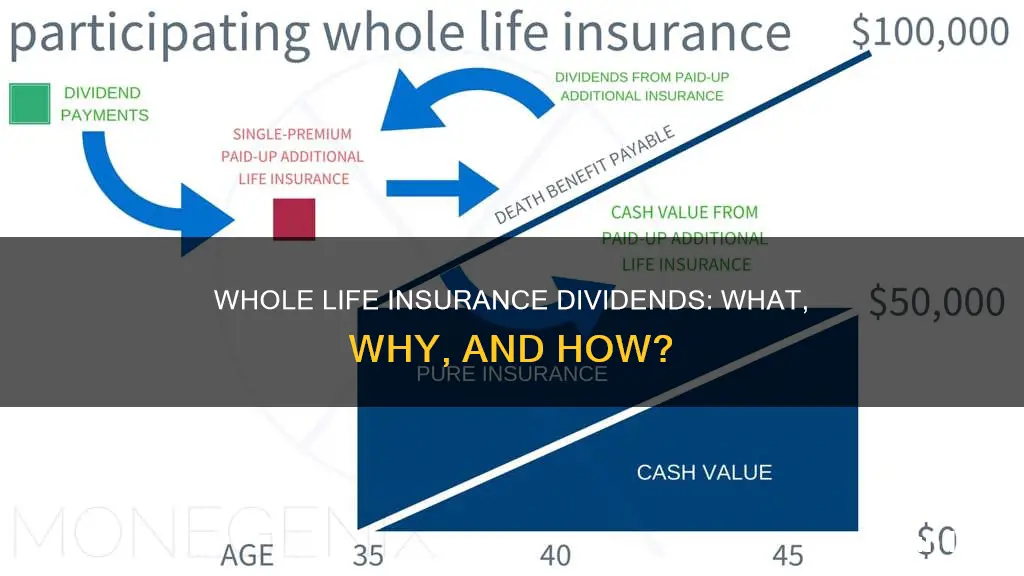

There are several options for using your dividends. You can choose to receive them as cash, which provides flexibility to use the funds as you wish. Alternatively, you can use dividends to reduce your future premiums, effectively lowering the cost of maintaining your coverage. You also have the option to purchase additional insurance with your dividends, increasing your total cash value and death benefits over time. This can lead to compound growth and a higher death benefit for your beneficiaries.

When evaluating insurance policies, it is important to consider how dividends are calculated and whether they are guaranteed. Additionally, policyholders should review the insurance company's credit rating to assess the sustainability of dividends in the future. While dividends provide a potential boost to your investment returns, they should be viewed as a bonus rather than a guaranteed feature of your whole life insurance policy.

By choosing to invest in a whole life insurance policy that offers dividends, you are not only securing lifelong coverage and a death benefit but also gaining the potential for additional financial benefits. These dividends can enhance your investment returns and provide you with more financial flexibility. However, it's important to carefully review the policy details and consider the trade-off between higher premiums and the potential for dividend payments.

Allstate Life Insurance: Is It Worth the Hype?

You may want to see also

Dividends as a distribution

Dividends are a distribution of the insurance company's profits to policyholders. They are typically paid out annually and are based on the company's financial performance, including investment returns, the number of claims paid out relative to premiums paid in, and operational costs. While dividends are not guaranteed, many mutual insurance companies have a long history of paying dividends to their policyholders.

Policyholders have several options for receiving and using their dividends. One option is to receive the dividend as a cash payment, either by check or direct deposit to a personal bank account. This option provides the most flexibility, as the funds can be used for anything the policyholder chooses. Another option is to use the dividend to pay for the policy, reducing the amount owed in future premiums. Policyholders may also choose to leave their dividends in a separate savings account with the insurer, where they can earn interest. This option offers liquidity and convenience, as the funds can be withdrawn at any time.

Additionally, dividends can be used to purchase additional insurance coverage, known as "paid-up coverage" or "paid-up additions." This option increases the death benefit without a corresponding increase in premiums. Policyholders can also use dividends to pay down policy loans, reducing their debt without impacting their regular income.

It is important to note that dividends from life insurance policies are generally not subject to income tax, as they are considered a refund of overpaid premiums. However, if the dividends are left in the policy to earn interest, the gains may be taxable. Therefore, it is often more financially advantageous to take the dividends as cash and reinvest them in other investment vehicles that offer higher returns.

When evaluating insurance policies, individuals should consider how dividends are calculated and whether they are guaranteed. Additionally, policyholders should review the plan in its entirety to ensure it aligns with their specific needs and circumstances.

Life Insurance: Sensible or Not?

You may want to see also

Dividends as a premium offset

When choosing this option, policyholders can request that the insurance company apply their dividend payout dollar-for-dollar to reduce the premium amount they are required to pay. This effectively lowers the out-of-pocket cost of the insurance policy for that year.

It is important to note that whole life insurance dividends are not guaranteed. They are based on the financial performance of the insurance company, including factors such as investment returns, claims paid out, and operational costs. Policyholders should carefully review the details of their insurance plan to understand how dividends are calculated and whether they are guaranteed.

Additionally, the amount of the dividend is typically tied to the price of the premiums paid by the policyholder. A higher dividend usually corresponds to a more expensive policy. As such, policyholders should consider their budget and financial goals when deciding between a participating (dividend-eligible) or non-participating policy.

Life Insurance: A Business's Safety Net

You may want to see also

Dividends as a cash option

The cash option is the most straightforward and flexible method of receiving dividends from a whole life insurance policy. The insurance company can send a check or make an ACH payment to the policyholder's bank account. The funds can be used for anything, including discretionary spending or keeping them in a savings account. This option provides liquidity and convenience, as the policyholder can withdraw the funds at any time without having to deposit a check or manage the money separately.

Policyholders can also use the cash dividend to pay for their insurance policy. They can request the insurer to put the dividend toward future premiums, reducing the amount they owe. This can be especially helpful in years when the insurer has strong financial performance, as it can lower the cost of maintaining coverage.

Another option is to use the cash dividend to purchase additional insurance coverage, known as "paid-up coverage." This allows the policyholder to add to their death benefit without a corresponding increase in premiums. This option can be beneficial if the policyholder's financial circumstances change or if they want to offset the impact of inflation.

It is important to note that while whole life insurance dividends are generally not taxable, there may be tax implications if the dividends are left in the policy to earn interest. In this case, the gains earned as interest may be subject to taxation. Therefore, it may be more financially advantageous to take the dividends as cash and reinvest them in other investment vehicles that offer higher returns.

When considering the cash option for dividends, it is also essential to evaluate the insurance company's credit rating and sustainability of dividend payments. Additionally, policyholders should carefully review the entire plan to ensure that it aligns with their specific needs and circumstances.

Understanding MEC: Life Insurance's Essential Clause

You may want to see also

Dividends as a death benefit

Whole life insurance policies offer a guaranteed death benefit, predictable premiums, and dividends that can provide cash or help offset the cost of life insurance. Dividends are based on the performance of the company's financials, including interest rates, investment returns, and new policies sold. The amount of a dividend is tied to the price of premiums paid by the policyholder.

Dividends can be distributed as cash or used to purchase additional paid-up insurance or reduce premiums due. The dividend amount often depends on the amount paid into the policy. For example, a policy worth $50,000 that offers a 3% dividend will pay a policyholder $1,500 for the year. If the policyholder contributes an additional $2,000 in value during the subsequent year, they will receive $60 more for a total of $1,560. Over time, these amounts can increase to sufficient levels to offset some costs associated with premium payments.

Whole life insurance dividends may be guaranteed or non-guaranteed. Policies that provide guaranteed dividends often have higher premiums to compensate for the added risk to the insurance company. Those that offer non-guaranteed dividends may have lower premiums, but there is a risk that no dividends will be paid in a given year. When evaluating insurance policies, it is essential to carefully review the plan's details, including how dividends are calculated and whether they are guaranteed.

Policyholders can choose to receive their dividends as a check or ACH payment, providing flexibility to use the funds for anything they choose. Alternatively, they can leave their dividends in a separate savings account with the insurer, earning interest at a specified rate. This option offers liquidity and convenience, as the funds can be withdrawn at any time without the need to manage them personally.

Another option is to use dividends to pay for the policy, reducing future premiums and the overall cost of coverage. Policyholders can also use their dividends to purchase additional insurance or prepay their policy, increasing their death benefit without a corresponding premium increase. This can be a good way to account for inflation or changing financial circumstances.

In summary, whole life insurance dividends can provide a valuable death benefit, either as a direct cash payment or by reducing the cost of coverage. Policyholders have several options for using their dividends, each offering distinct advantages. By understanding how dividends work and carefully reviewing the terms of their insurance plan, individuals can make informed decisions about how to utilize this benefit to meet their specific needs and circumstances.

Health Insurance and Air Ambulance: What's Covered?

You may want to see also

Frequently asked questions

Dividends in whole life insurance are annual payments made by insurance companies to their policyholders when the company performs well financially. These dividends are not guaranteed and depend on the insurer's financial performance.

Dividends are paid out from the profits generated by the insurance company through investing a portion of the premium money paid by policyholders. The amount of dividend is based on the insurer's financial performance, including investment returns, claims paid out, and operational costs.

There are several ways to use your dividends, including receiving them as cash, using them to reduce future premiums, purchasing additional insurance coverage, or leaving them with the insurer to earn interest.

Generally, dividends received from whole life insurance policies are not subject to income tax as they are considered a return of premium. However, taxes may apply if withdrawals exceed the total amount of premiums paid.

No, dividends are not guaranteed. They depend on the financial performance of the insurance company and are declared at the company's discretion.