Life insurance is a valuable tool for protecting your family's financial future in the event of your death. But what happens when you reach retirement age? Do you still need life insurance, and if so, what type of policy is suitable? This is a complex question that depends on various factors, including age, health, financial obligations, and lifestyle choices. Let's explore the options available to older individuals seeking life insurance coverage.

| Characteristics | Values |

|---|---|

| Minimum Age Requirement | 18 years old |

| Maximum Age Requirement | Typically 75 to 86+ years old (varies by insurer and policy) |

| Premium Increase | 8% to 10% for every year of age |

| Premium Increase for Over 50s | 9% to 12% for every year of age |

| Premium Increase for Over 40s | 5% for every year of age |

| Term Life Insurance Age Limit | 75 to 86 years old |

| Whole Life Insurance Age Limit | Typically no maximum age limit (varies by insurer) |

| Universal Life Insurance Age Limit | Typically no maximum age limit (varies by insurer) |

| Variable Life Insurance Age Limit | Typically no maximum age limit (varies by insurer) |

| Final Expense Insurance Age Limit | Typically 85 years old (varies by insurer) |

| Guaranteed Issue Insurance Age Limit | Typically 85 years old (varies by insurer) |

What You'll Learn

Life insurance for older people: when does it make sense?

Life insurance for older people can make sense in several scenarios. While the cost of premiums tends to increase with age, life insurance can provide financial security for older individuals and their loved ones. Here are some factors to consider when deciding if life insurance for older people makes sense:

Age Limits and Costs

The age limit for life insurance depends on the type of policy and the insurance company. Term life insurance typically has an age limit ranging from 75 to 86 years old, while whole life insurance, universal life insurance, and variable life insurance generally have no maximum age limit. Final expense insurance and guaranteed issue insurance usually have an age limit of around 85 years.

It's important to note that the cost of life insurance premiums generally increases with age due to higher mortality risks. The likelihood of health conditions or death increases with age, leading to higher premiums. Age-related health risks and mortality rates are considered when calculating premiums.

Dependents and Financial Obligations

One reason to consider life insurance for older people is to provide financial support for dependents. If you have children, a spouse, or other family members who rely on your income, life insurance can ensure their financial security in the event of your passing. This is especially important if you have dependents with special needs who require lifelong financial support.

Additionally, if you have significant debts, such as a mortgage, car loans, or other financial obligations, life insurance can help ensure that these debts are paid off without burdening your loved ones.

Estate Planning

Life insurance can also be a valuable tool for estate planning. It can provide liquidity to pay estate taxes, fund retirement plans, or leave an inheritance for heirs. If you have a substantial estate that may be subject to estate tax, financial advisors often recommend permanent life insurance. The death benefit can help your beneficiaries cover the tax burden.

Final Expenses and Burial Costs

Final expense insurance, also known as burial insurance, is specifically designed to cover end-of-life and funeral expenses. This type of insurance is suitable for older adults who want to ensure their beneficiaries don't bear the financial burden of their death-related costs. It provides a smaller coverage amount compared to traditional life insurance policies and is typically easier to qualify for, without the need for a medical exam.

Health Considerations

Age can also affect your ability to qualify for life insurance coverage. As you get older, the requirements for medical exams and health-related testing become more stringent. Insurance companies may also assess an individual's mental condition and perform cognitive evaluations as part of the underwriting process.

If you have existing health issues, guaranteed issue life insurance may be an option, although it tends to be more expensive. This type of policy provides coverage without the possibility of rejection, ensuring that older individuals with health problems can still obtain life insurance.

In conclusion, life insurance for older people can make sense in various circumstances. It provides financial security for dependents, helps with estate planning, covers final expenses, and ensures coverage for those with health issues. While costs tend to increase with age, life insurance can be a valuable tool for older individuals to protect their loved ones and manage their financial obligations.

Life Insurance: Death and Payouts Explained

You may want to see also

What types of life insurance are available to older people?

The types of life insurance available to older people include:

- Term life insurance: This is a temporary form of life insurance that offers coverage for a set period, typically 10 to 30 years. If you outlive the term or stop paying premiums, your coverage ends. Term life insurance is generally more affordable for older people, especially if they are in good health. However, the cost of premiums increases with age.

- Whole life insurance: This is a type of permanent life insurance with no expiration date as long as premiums are paid. It often includes a cash value component that can be accessed during the policyholder's lifetime. Whole life insurance is useful for lifelong needs and is commonly used for estate planning. While it tends to be more expensive than term life insurance, it may be a good option for older people who can afford the premiums and want the investment potential of the cash value accumulation feature.

- Universal life insurance: Another form of permanent life insurance, universal life insurance allows for flexible premium payments and the potential to build cash value over time. Policyholders can adjust their coverage and premiums as their needs change.

- Final expense insurance/Burial insurance: Also known as burial insurance, this type of insurance is designed to cover end-of-life and funeral expenses. It is a small whole life insurance policy, typically offering coverage between $5,000 and $35,000. Final expense insurance is generally easier to qualify for, often without a medical exam, making it a suitable option for older adults.

- Guaranteed issue insurance: This type of insurance guarantees acceptance, provided the applicant meets the age and death benefit requirements. It is often offered without a medical exam and can be a good option for seniors looking to cover final expenses or leave a small inheritance.

The availability and specifics of these insurance options may vary depending on the insurance company and the individual's circumstances. It is important to consult with insurance providers to determine the most suitable option based on age, health, and financial needs.

Large Life Insurance Check: Depositing and Managing Your Payout

You may want to see also

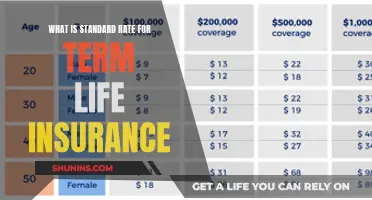

How much does life insurance cost for older people?

The cost of life insurance for older people depends on several factors, including age, health, gender, lifestyle, and the type and amount of coverage. Life insurance rates increase with age due to the higher mortality risks associated with older individuals. Here is a comprehensive overview of the factors influencing the cost of life insurance for older adults:

Age

Age is a pivotal factor in determining life insurance premiums. As individuals age, the likelihood of health complications and a shorter lifespan increases, resulting in higher premiums to compensate for the elevated risk of a payout. The difference in monthly premiums between younger and older adults can be significant. For example, the average life insurance quote increases by 6% between ages 25 and 30 but jumps by 86% between ages 60 and 65.

Health

Insurers assess the health of applicants through medical exams or health questionnaires and assign them to rating tiers accordingly. Individuals with pre-existing medical conditions or family histories of certain illnesses may be placed in higher-risk categories, resulting in higher premiums.

Gender

Actuarial data shows that women have a longer life expectancy than men, and as a result, men tend to pay more for life insurance. This disparity is reflected in the average rates, with men paying 23% more for term life insurance than women, on average.

Lifestyle

High-risk hobbies, such as skydiving or racing, can increase premiums due to the elevated mortality risk associated with these activities. Similarly, certain professions, such as construction work or firefighting, may be deemed more hazardous, leading to higher insurance rates.

Type of Policy

The type of life insurance policy also impacts the cost. Term life insurance, which offers coverage for a limited period, is typically the most affordable option. In contrast, permanent life insurance policies, such as whole life or universal life insurance, are generally more expensive since they provide coverage for the entire lifetime of the insured.

Amount of Coverage

The desired amount of coverage, also known as the death benefit, is another critical factor in determining the cost of life insurance. Higher coverage limits present a greater financial risk to the insurance company, resulting in higher premiums. For example, a policy with a $1 million death benefit will command a much higher premium than one with a $100,000 limit.

When to Purchase

It is generally recommended to purchase life insurance as early as possible since the cost increases with age. Acquiring a policy when young and healthy can result in significantly lower rates compared to waiting until later in life.

Senators' Health Insurance: A Lifetime of Coverage?

You may want to see also

What factors determine whether an older person needs life insurance?

Several factors determine whether an older person needs life insurance. Firstly, consider if you have any dependents, such as a spouse, partner, or children who rely on your income. If your loved ones depend on your income for their living expenses, education, or other needs, maintaining life insurance is essential to provide financial security for them.

Secondly, evaluate your debt obligations. If you have significant debts, such as a mortgage, car loans, or other financial commitments, life insurance can ensure these debts are settled without burdening your family.

Thirdly, consider your business obligations. If you own a business, life insurance can facilitate business succession planning, cover key persons, or repay business loans in the event of your death.

Fourthly, assess your financial situation. If you have substantial assets, life insurance can be a strategic tool for estate planning, helping to pay estate taxes or leave an inheritance for your heirs.

Fifthly, consider your health and age. As individuals age, the cost of life insurance premiums generally increases due to higher mortality risks. Age limits for life insurance policies vary, with term life insurance typically having an upper age limit of 75-86, while whole life insurance often has no maximum age limit.

Lastly, evaluate your end-of-life expenses. If you want to cover funeral costs and final medical bills or make charitable contributions, a small life insurance policy can be beneficial.

In summary, the need for life insurance in older age depends on factors such as dependents, debt obligations, business commitments, financial situation, health, age, and end-of-life expenses.

Foresters Life Insurance: Borrowing Against Your Policy?

You may want to see also

What are the alternatives to life insurance for older people?

While it is possible to get life insurance when you're older, there are also alternatives to life insurance for older people. Here are some options to consider:

Final Expense Insurance

Final expense insurance, also known as burial insurance, is a type of whole life insurance designed to cover end-of-life and funeral expenses. It provides a smaller coverage amount compared to traditional life insurance policies and is typically easier to qualify for, without a medical exam. This type of insurance is suitable for older adults who want to ensure their beneficiaries are not burdened with funeral and end-of-life expenses. The coverage amount for final expense insurance is usually between $5,000 and $25,000, and the premiums tend to be higher due to the increased risk of paying out a claim.

Guaranteed Issue Insurance

Guaranteed issue insurance is a type of life insurance that does not require a medical exam or health questions. It is designed for older individuals or those with pre-existing health conditions who may have difficulty obtaining traditional life insurance. The coverage amount for guaranteed issue insurance is typically between $5,000 and $25,000, and the premiums are higher due to the higher risk of a claim.

Term Life Insurance

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. While it is more affordable, especially for younger individuals, the premiums increase with age. Term life insurance may be an option for older individuals who are in good health and only require coverage for a limited time. However, a medical exam is usually required, and the cost can be high for older applicants.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire life, as long as premiums are paid. It also includes a cash value component that grows over time and can be accessed during the lifetime of the insured. Whole life insurance is more expensive than term life insurance, sometimes up to ten times the cost. However, it may be a good option for older individuals who want lifelong coverage and the potential for investment growth.

Universal Life Insurance

Universal life insurance is another type of permanent life insurance that offers flexible premium payments and the potential to build cash value over time. It combines a death benefit with a savings component, allowing the policyholder to adjust coverage and premiums as their needs change. Universal life insurance typically has no age limit, but insurers may set age limits and impose restrictions based on health and other criteria.

When considering alternatives to life insurance, it is important to assess your specific needs, financial situation, age, and health. Consulting with a financial advisor or licensed insurance professional can help you make an informed decision based on your unique circumstances.

Life Insurance and Debt: Can It Be Garnished in Texas?

You may want to see also

Frequently asked questions

Yes, the age limit depends on the type of insurance policy and the insurance company. Term life insurance typically has an age limit ranging from 75 to 86 years old, while whole life insurance, universal life insurance, and variable life insurance generally have no maximum age limit. Final expense insurance and guaranteed issue insurance usually have an age limit of around 85 years old.

Age is one of the primary factors influencing life insurance premium rates. The older you are when you purchase a policy, the more expensive the premiums will be, as the cost is based on actuarial life tables that assign a likelihood of dying while the policy is in force. The premium amount typically increases by about 8% to 10% for every year of age.

Life insurance quotes increase as you age, and any health problems can make it more difficult to find an affordable policy. If you're in good health, you may be able to sign up for a term life insurance policy, which is usually much cheaper than whole life coverage. If you're not in good health, consider guaranteed issue life insurance, which offers more expensive coverage but without the possibility of rejection.

This depends on various personal and financial factors. If you have dependents who rely on your income, significant debts, business obligations, or want to provide a financial legacy for your heirs, then you may still need life insurance. However, if your dependents are financially independent, you've paid off your debts, and have adequate retirement savings, you may not need continued coverage.

When deciding whether to continue life insurance into retirement, ask yourself if you still earn outside income, if your beneficiaries need protection, how you will pay for final expenses, and what your family situation looks like. If you retire with debt or still have income that your family relies on, keeping life insurance is a good idea.