Annuities and life insurance are both financial products offered by insurance companies, but they serve very different purposes. Life insurance is designed to benefit your family after your death, while annuities are designed to provide a pension-like stream of income that you can use to fund your retirement. Life insurance is a good option for those who want to ensure their loved ones are financially secure if they are no longer around to provide support, while annuities are a way to guarantee a steady income during your retirement years and protect you from the risk of outliving your money.

| Characteristics | Values |

|---|---|

| Time of purchase | Annuities are typically purchased later in life, while life insurance is often purchased earlier. |

| Funding | Life insurance is funded by monthly or annual premiums paid over time, while annuities are usually funded by one or more lump-sum payments. |

| Taxation | Annuities offer tax advantages, while life insurance offers tax-free death benefits and withdrawals of premiums. |

| Purpose | Annuities provide a guaranteed stream of income during retirement, while life insurance provides financial protection for beneficiaries in the event of the policyholder's death. |

| Beneficiaries | The primary beneficiary of an annuity is typically the policyholder, while life insurance beneficiaries are usually the policyholder's spouse, children, or other designated heirs. |

| Underwriting | Life insurance requires health and financial underwriting, while annuities have guaranteed qualifications regardless of health status but may have age restrictions. |

| Access to funds | Life insurance allows early access to funds and has no age requirements for withdrawal, while annuities require funds to be kept in the contract for a minimum number of years. |

What You'll Learn

- Annuities are purchased later in life, while life insurance is often bought earlier

- Life insurance offers a death benefit to beneficiaries, while annuities are paid out during the annuitant's lifetime

- Annuities are paid in monthly instalments, while life insurance pays out a lump sum

- Annuities offer a guaranteed income for life, while life insurance offers early access to money

- Life insurance is recommended for those with financial dependents, while annuities are not

Annuities are purchased later in life, while life insurance is often bought earlier

Annuities and life insurance are both financial products offered by insurance companies, but they are designed for different purposes and are typically purchased at different stages of life. Annuities are generally purchased later in life to provide a guaranteed stream of income during retirement, whereas life insurance is often bought earlier to protect loved ones financially in the event of the policyholder's death.

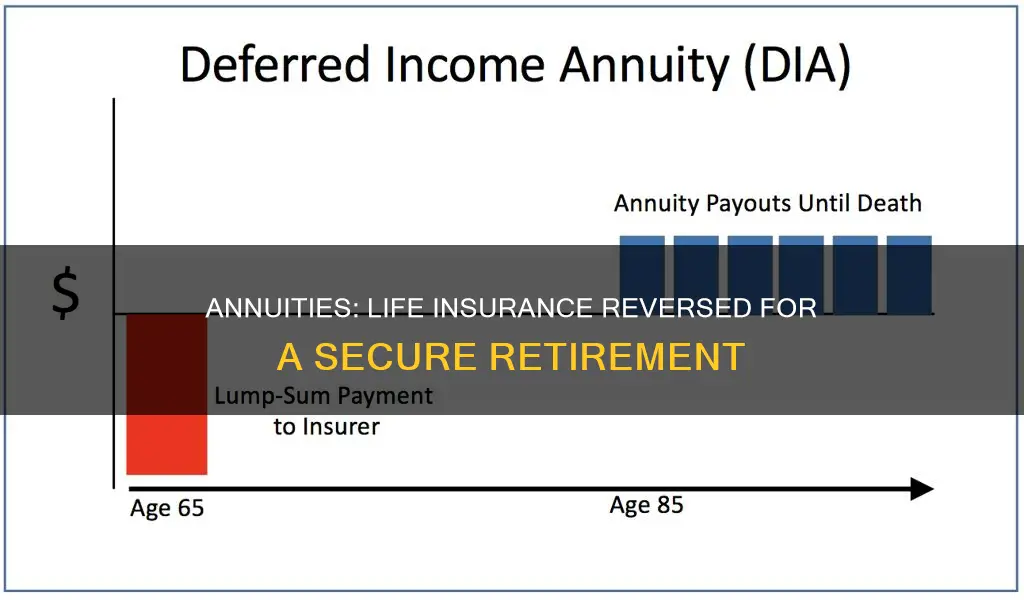

Annuities are a type of insurance contract that individuals purchase to receive a steady stream of income during their retirement years. Annuity contracts can be set up with a growth period, allowing individuals to build their savings over time. The primary benefit of an annuity is the pension-like income stream it provides during retirement. Annuities offer a way to supplement an individual's retirement income, ensuring they never outlive their financial resources. They can be structured in various ways, such as fixed or variable annuities, to meet an individual's risk tolerance and financial goals.

Life insurance, on the other hand, is typically purchased earlier in life, especially when individuals have financial dependents, such as a spouse or children. The primary purpose of life insurance is to provide financial protection to beneficiaries in the event of the policyholder's death. It ensures that loved ones will receive a death benefit, usually in the form of a lump-sum payment, which can help cover expenses, protect their financial well-being, and create an inheritance. Life insurance policies are usually funded through monthly or annual premiums paid over time.

The timing of purchasing annuities and life insurance reflects their distinct purposes. Annuities are bought later in life when individuals are closer to retirement and focus on securing a stable income during their golden years. In contrast, life insurance is often acquired earlier when individuals are more concerned with providing financial security for their dependents if they were to pass away prematurely.

While annuities and life insurance serve different needs, they can complement each other in financial planning. Annuities provide benefits during the policyholder's lifetime, while life insurance offers protection for loved ones after the policyholder's death. Therefore, it is not uncommon for individuals to consider both products as part of their comprehensive financial strategy, ensuring they are prepared for various life scenarios.

Life Insurance License Lapsed? Here's How to Reactivate It

You may want to see also

Life insurance offers a death benefit to beneficiaries, while annuities are paid out during the annuitant's lifetime

Life insurance and annuities are both financial products offered by insurance companies, but they are designed for different purposes and work in different ways. Life insurance is primarily designed to benefit your family or loved ones after your death, whereas annuities are designed to provide you with a regular income during your retirement.

Life insurance offers a death benefit to beneficiaries, which means that your designated heirs will receive a payout after you pass away. This death benefit can be a significant sum, and it is usually paid out as a tax-free lump sum. Term life insurance only provides a death benefit, while permanent life insurance policies can last your entire life and also build cash value, which you can withdraw while you're alive.

On the other hand, annuities are paid out during the annuitant's lifetime. Annuities are a type of insurance contract that allows you to turn your money into future income payments. You can buy an annuity with a lump sum payment or with multiple payments over time. The return on your investment depends on the type of annuity you choose. For example, a fixed annuity provides a guaranteed interest rate, while a variable annuity lets you invest your savings in mutual funds, potentially offering greater growth potential but also carrying more risk.

While the primary purpose of an annuity is to provide income during your retirement, some annuities also offer a death benefit provision, which means that a beneficiary you name will receive a payout after your death. This can be a lump sum or a continuation of the regular payments the annuitant was receiving. The death benefit in an annuity is typically smaller than the death benefit in a life insurance policy, and it may be subject to income tax, depending on the type of annuity and the age of the annuitant at the time of death.

Federal Life Insurance: Age 65 Decline Explained

You may want to see also

Annuities are paid in monthly instalments, while life insurance pays out a lump sum

Annuities and life insurance are both financial products offered by insurance companies, but they serve very different purposes. Annuities are typically purchased later in life as a way to provide a pension-like stream of income during retirement. On the other hand, life insurance is often bought earlier in life to protect your family's financial well-being in the event of your death.

Annuities are paid out during the annuitant's lifetime, while life insurance is paid out to beneficiaries once the policyholder has passed away. Life insurance beneficiaries can be your children, partner, or dependents, while you are the primary beneficiary of your annuity. Annuities are typically paid in monthly instalments, while life insurance pays out a lump sum.

Annuities can be purchased with either a lump-sum payment or many payments over time. They provide a guaranteed stream of income, which can be tailored to your needs. For example, you can choose a fixed annuity, which guarantees a minimum rate of return and pays out over a specified term, or a variable annuity, which lets you invest in mutual-fund-like investments with the potential for greater growth but also greater risk. Annuities also offer tax advantages, such as tax-free returns of your premiums. However, if you make a large lump-sum withdrawal or cancel your annuity before the agreed date, you may be charged a surrender fee.

Life insurance, on the other hand, typically involves paying a regular premium to the insurance company, usually on a monthly, quarterly, or annual basis. In exchange, your beneficiaries will receive a death benefit of a predetermined amount upon your death. This payout is usually tax-free and can be a valuable source of financial protection for your loved ones, helping them cover day-to-day living expenses and other financial responsibilities. Life insurance can also provide living benefits, such as the ability to withdraw or borrow against the cash value of the policy, which grows over time.

Borrowing Against Meritus Life Insurance: Is It Possible?

You may want to see also

Annuities offer a guaranteed income for life, while life insurance offers early access to money

Annuities and life insurance are both financial products offered by insurance companies, but they serve different purposes. Annuities are designed to provide a guaranteed income stream over a specified period, usually during retirement, but they can be utilised at any age. This means that annuities are a good option for those who want to ensure they never outlive their income. With an annuity, you can receive income for a fixed period, such as 20 years, or for the rest of your life. Annuities are typically purchased later in life and can be bought with either a lump-sum payment or multiple payments over time.

On the other hand, life insurance is primarily intended to provide a death benefit to beneficiaries in the event of the policyholder's passing. These income tax-free lump-sum payments can help beneficiaries handle day-to-day living expenses and other financial responsibilities in the absence of the policyholder's income. Life insurance is often purchased earlier in life, when the death benefit protection is more important to loved ones. It is funded by monthly or annual premiums that are paid over time.

While life insurance offers early access to money, annuities do not. With life insurance, you can withdraw or borrow money at your convenience, with no age requirements. In contrast, annuities require you to keep your money in the contract for a minimum number of years. If you make a large withdrawal or cancel the contract before the agreed date, you will be charged a surrender fee.

Annuities and life insurance have distinct benefits. Annuities offer a guaranteed income for life, while life insurance offers early access to money. Life insurance is a valuable tool for those with financial dependents who want to ensure their loved ones are financially protected if they can no longer provide support. Annuities, on the other hand, are ideal for those who want to supplement their pension or other income during retirement and want the security of a guaranteed income stream.

Life Insurance Tax Withholding: Indiana's Unique Case

You may want to see also

Life insurance is recommended for those with financial dependents, while annuities are not

Life insurance and annuities are two financial products offered by insurance companies, but they serve very different purposes. Life insurance is designed to benefit your family or financial dependents after your passing, while an annuity provides an income from the time you retire until you pass away.

Life insurance is almost always recommended for those with financial dependents, such as a spouse, children, or other loved ones who rely on your income. In the event of your death, your beneficiaries will receive a death benefit, usually a tax-free lump-sum payment, which can help cover a range of expenses, from food costs to college tuition. It can also be a valuable tool for business owners, who may use life insurance to protect their businesses and plan for succession.

On the other hand, annuities are typically purchased later in life as a way to provide additional income during retirement. Annuities can be seen as a pension-like stream of income that you can use to fund your retirement. You can buy an annuity with either a lump-sum payment or multiple payments over time. The return on your investment depends on the type of annuity you choose. For example, a fixed annuity pays a guaranteed interest rate, while a variable annuity allows you to invest your savings in stocks, bonds, and money market accounts, offering greater growth potential but also higher risk.

While annuities can have a death benefit provision, where a beneficiary receives the remaining payouts, this is not their primary purpose. Annuities are designed to provide a guaranteed income stream for the annuitant during their lifetime. Therefore, while life insurance is recommended for those with financial dependents, annuities are not, as they are intended to benefit the policyholder directly rather than their dependents.

In summary, life insurance and annuities serve distinct roles in financial planning. Life insurance is ideal for those seeking to provide financial protection for their dependents after their passing, while annuities are better suited for individuals looking to secure a steady income stream during their retirement years.

Life Insurance Conversion Options: Understanding Your Choices

You may want to see also

Frequently asked questions

The primary purpose of a life insurance policy is to provide financial protection to your beneficiaries in the event of your death. On the other hand, annuities are designed to provide a guaranteed stream of income for the policyholder, typically during their retirement years.

Life insurance pays the death benefit in one lump sum, whereas annuities typically pay benefits monthly over time.

With life insurance, your spouse, children, or other designated heirs are the primary beneficiaries. In contrast, with an annuity, you (and sometimes your spouse) are the primary beneficiary, receiving all income payments.