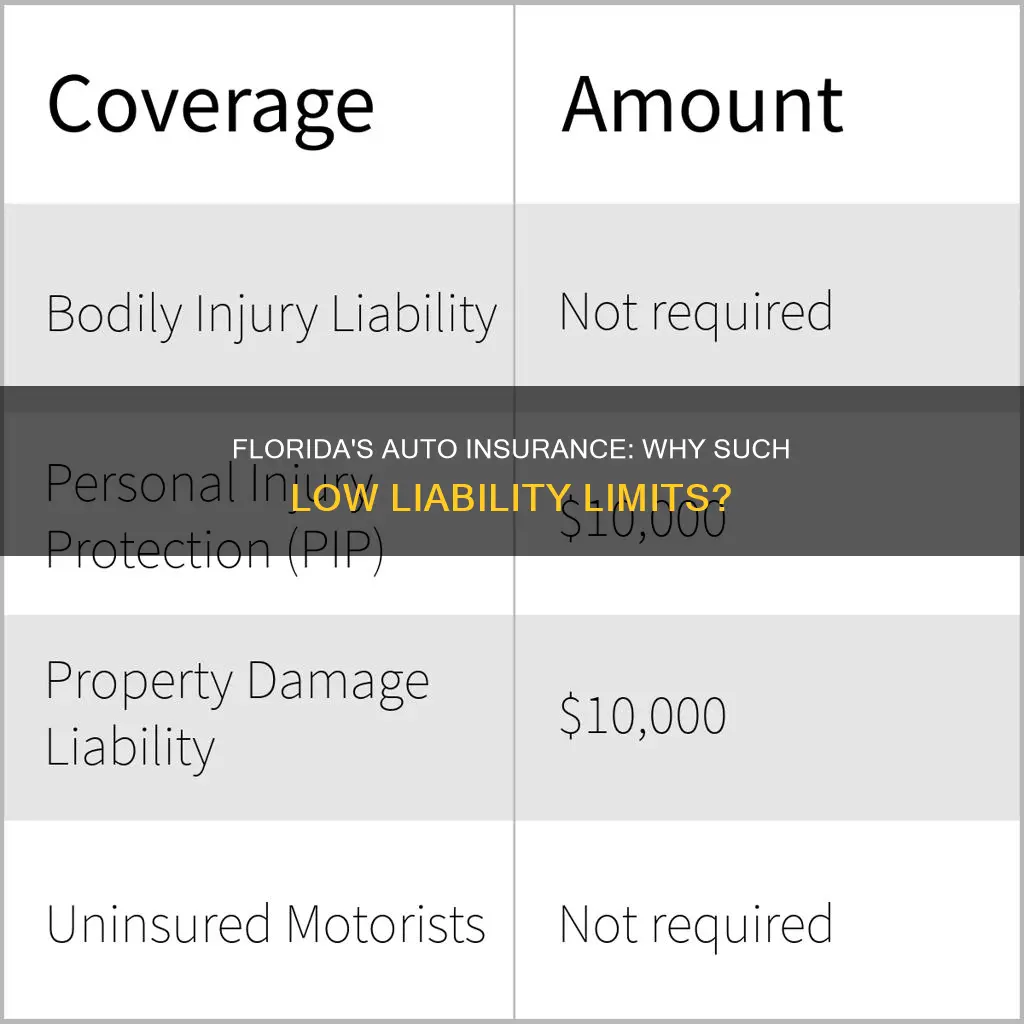

Florida's auto insurance liability limits are low compared to other states. The state only requires two types of coverage: personal injury protection and property damage. Florida is a no-fault state, meaning that each party pays for their own medical costs, childcare, and lost wages through personal injury protection in the event of an accident. The at-fault driver is still responsible for the other driver's property damage. The minimum coverage in Florida is $10,000 for personal injury protection and $10,000 for property damage liability.

| Characteristics | Values |

|---|---|

| Personal injury protection (PIP) | $10,000 per accident |

| Property damage liability (PDL) | $10,000 per accident |

| Florida's ranking in the U.S. for the cost of car insurance | Second |

| Average cost of car insurance in Florida | $1,414.17 per year |

| Average cost of minimum-liability car insurance in Florida | $1,605 per year |

| Average cost of full-coverage car insurance in Florida | $3,795 per year |

What You'll Learn

Florida's low liability limits for personal injury protection

Florida's auto insurance requirements are among the most minimal in the US. Florida residents are only required to have $10,000 in personal injury protection (PIP) and $10,000 in property damage liability (PDL) insurance to drive legally.

Florida is a no-fault state, which means that in the event of a car accident, each party pays for their own medical costs, childcare, and lost wages through personal injury protection. However, like liability states, no-fault states still require the at-fault driver to pay for the other driver's property damage.

Personal injury protection covers the policyholder directly and pays for medical bills, rehabilitation services, and wages lost due to injury. This coverage also protects anyone in the vehicle with you in the event of an accident.

Property damage liability insurance pays to repair or replace other people's property in a car accident you cause, whether that's another person's car, a guardrail, or someone's private property.

While Florida's minimum auto insurance requirements are low, it's important to note that they may not be sufficient to cover all costs in the event of an accident. For example, the average cost of a new car in the US topped $49,000 in January 2023, so $10,000 in property damage liability coverage may not be enough to cover the cost of a totalled vehicle. Additionally, the $10,000 PIP limit may not be enough to cover all medical costs, lost wages, and funeral expenses in the event of a serious accident.

As such, it is recommended that Florida drivers obtain additional coverage beyond the state-mandated minimums to ensure they are adequately protected. Optional add-on coverages in Florida include collision, comprehensive, uninsured motorist, medical payments, rental car reimbursement, and towing and labour.

AIAS Gap Insurance: Protection for Your Car Loan

You may want to see also

Property damage liability limits

Florida's property damage liability insurance pays for the repair or replacement of other people's property in a car accident caused by the policyholder. This includes damage to another person's car, a building, or any other physical property. The minimum property damage liability coverage in Florida is $10,000 per accident, which means that the insurance company will pay up to this amount for property damage caused by the policyholder in a single accident, regardless of the number of cars or properties involved. This low limit may not be sufficient to cover the cost of repairs or replacement for high-value vehicles, and policyholders may be responsible for any costs exceeding the $10,000 limit.

Florida is a no-fault state, which means that each driver's insurance covers their own injuries, medical expenses, and property damage, regardless of who caused the accident. As a result, Florida's property damage liability insurance only covers damage to third-party properties and not to the policyholder's vehicle. This is an important distinction, as policyholders may need to purchase additional coverage, such as collision or comprehensive insurance, to protect themselves financially in the event of an accident.

While Florida's minimum property damage liability limit is $10,000, it is recommended that drivers increase their coverage limit to protect themselves from potential out-of-pocket expenses. Most auto insurance companies allow drivers to increase their property damage liability coverage up to $100,000 or more. This higher coverage limit can provide valuable financial protection in the event of an accident, especially considering the high cost of car repairs and the prevalence of luxury and electric vehicles in the state.

It is important to note that Florida has strict requirements for maintaining continuous insurance coverage. Failure to maintain the required minimum insurance coverage can result in the suspension of the policyholder's driver's license and vehicle registration, as well as reinstatement fees of up to $500. Therefore, it is essential for Florida drivers to understand the state's insurance requirements and ensure they have adequate coverage to comply with the law and protect themselves financially.

Get Back on the Road: Navigating SR22 Auto Insurance

You may want to see also

The state's no-fault insurance system

Florida is a no-fault state, which means that in the event of a car accident, each party is responsible for covering their own medical costs, lost wages, and childcare expenses through personal injury protection. However, as with liability states, the driver at fault will still be responsible for covering the other driver's property damage.

Florida's no-fault insurance system is designed to reduce the number of lawsuits filed over car accidents, as drivers turn to their insurance carriers for claims. In a no-fault state like Florida, each driver's insurance covers injuries or medical expenses for them and their passengers, regardless of who caused the accident. This means that if someone injures you in a collision, their insurance will not cover your injuries. Instead, your own personal injury protection insurance will cover these costs.

Florida's no-fault system also means that drivers must carry a minimum of $10,000 in personal injury protection and property damage liability coverage to meet the state's minimum car insurance requirements. This coverage is necessary for legal driving in Florida. While Florida does not require bodily injury liability coverage, it is still recommended that drivers obtain coverage beyond the $10,000 legal requirement to ensure they are adequately protected.

Florida's auto insurance requirements are quite low, leaving many drivers with minimal financial protection. The average cost of a new car in the US topped $49,000 in January 2023, so $10,000 in property damage liability coverage will not be sufficient if you cause an accident that results in one or more cars being totalled. Additionally, if you or your passengers' medical costs exceed $10,000, you may have to pay the remaining amount out of pocket, as Florida does not allow for increasing the $10,000 personal injury protection limit.

Tennessee Vehicle Insurance Requirements

You may want to see also

Collision and comprehensive coverage not required

Collision and comprehensive coverage are optional in Florida, and not required by state law. However, they are important supplements to liability insurance. Collision coverage pays for damage to your vehicle if you hit an object or another car, while comprehensive insurance covers non-crash damage, such as weather and fire damage, and reimburses you for car theft and damage from collisions with animals.

Although collision and comprehensive coverage are not mandatory, they are highly recommended. If you have a car loan or lease, your lender or leasing company will likely require you to purchase both collision and comprehensive coverage. This ensures that you won't walk away from your loan or lease if your car is stolen or totaled. Even if you own your car outright, collision and comprehensive coverage can provide valuable protection. If your car is damaged or stolen, these coverages can help you pay for repairs or replace your vehicle.

In Florida, collision and comprehensive coverage are typically sold together as a package. The cost of collision and comprehensive coverage depends on various factors, including the insurer, your location, the value of your vehicle, and your chosen deductible. The deductible is the amount deducted from the insurance payout when you file a claim. Higher deductibles generally result in lower premiums.

It is worth noting that collision and comprehensive coverage have coverage limits. These limits are determined by the value of your vehicle and the deductible amount you select. If your vehicle is totaled, the maximum payout is typically the actual cash value of your vehicle minus the deductible. As your vehicle ages and decreases in value, the maximum possible insurance payout may also decrease. Therefore, it is essential to consider the cost of coverage against the potential benefits.

Vehicle or Person: Who's Insured?

You may want to see also

The high cost of insurance in Florida

Florida has the second-highest insurance costs in the US, with residents paying on average $1,414.17 per year, 24% more than the national average. So, why is the cost of insurance so high in the Sunshine State?

Florida's Insurance Requirements

Florida's insurance requirements are minimal compared to other states. Florida residents must have property damage liability and personal injury protection insurance to drive legally. The minimum coverage includes $10,000 for property damage liability per accident and $10,000 personal injury protection per person. Florida is also a no-fault state, which means that drivers must turn to their insurance company first to cover costs, regardless of who caused the accident.

The Cost of Minimum Coverage

The average cost of minimum coverage in Florida is $83 per month or $994 per year. This is significantly higher than the national average of $72 per month or $869 per year. Age is a significant factor in determining these rates, with drivers aged 22-29 typically facing the highest premiums due to inexperience and a higher risk of accidents.

The Cost of Full Coverage

For full coverage, Florida drivers pay $316 per month or $3,795 per year on average. Again, these rates are much higher than the national average of $223 per month or $2,681 per year.

The Cost of Uninsured Driving

Driving without insurance in Florida can result in severe penalties, including fines of up to $500, suspension of your driver's license and vehicle registration, and higher insurance premiums when you do eventually take out a policy.

Recommended Coverage

Given the high costs of repairing or replacing a car, it is recommended that Florida drivers opt for coverage beyond the state minimum. A limit of $10,000 for property damage liability may not be sufficient to cover the costs of repairing or replacing a vehicle, especially considering the average cost of a new car in the US topped $49,000 in January 2023. Additionally, Florida has a high concentration of luxury cars and electric vehicles, so a higher level of coverage can offer greater peace of mind.

Other recommended add-on coverages include collision insurance, comprehensive insurance, uninsured motorist coverage, medical payments coverage, rental car reimbursement, and towing and labor.

While the cost of insurance in Florida may be high, it is important to remember that these policies are in place to protect drivers and their property. By understanding the requirements and costs, residents can make informed decisions about their coverage and ensure they are adequately protected.

How Good Grades Can Lower Auto Insurance Premiums

You may want to see also

Frequently asked questions

Florida's auto insurance liability limits are low because it is a no-fault state. This means that, regardless of who is at fault, your own personal injury protection insurance will cover your damages after an accident up to your policy's limit.

The minimum liability limits in Florida are $10,000 for property damage and $10,000 for personal injury protection.

The property damage liability insurance pays to repair or replace other people's property in a car accident, including another person's car, a guardrail, or property.

The personal injury protection insurance covers medical expenses, lost wages, and funeral costs for you or your passengers, regardless of who is at fault.