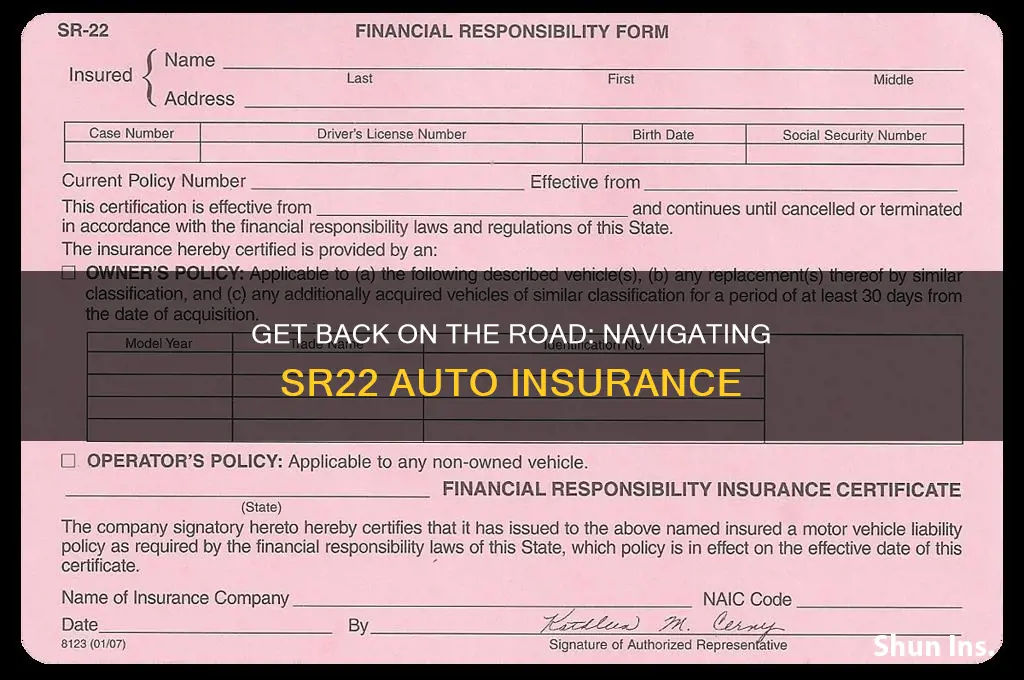

An SR-22 is a certificate of financial responsibility that proves you have the minimum amount of auto insurance required by your state. It is not a type of insurance but a form filed with your state's department of motor vehicles. SR-22 insurance is usually required for high-risk drivers who have committed serious driving violations like DUIs, DWIs, or driving without insurance. To obtain SR-22 insurance, you must contact your insurance company or find a new one that offers it. They will add an SR-22 endorsement to your existing policy and file the form with the necessary state department.

| Characteristics | Values |

|---|---|

| What is it? | A certificate of financial responsibility, also known as a "Certificate of Financial Responsibility" ("COFR"), "SR-22 Bond", or "SR-22 Form". |

| Who needs it? | High-risk drivers, typically ordered by a court or a state. |

| Why is it needed? | To prove that an individual has vehicle insurance that meets the coverage required by the state for reinstatement of driving privileges. |

| How long is it needed for? | Usually for three years, but can vary from two to five years depending on the state and the reason for the license suspension. |

| How to get it? | Contact your insurance company or find a new one that offers SR-22 insurance and request an SR-22 form. |

| Cost | A one-time filing fee of around $15-$50, which may vary by state and insurance company. |

| Effect on insurance rates | SR-22 drivers are considered high-risk, so insurance rates may increase. |

What You'll Learn

What is SR-22 auto insurance?

SR-22 auto insurance is a document that certifies that a driver has the minimum amount of auto insurance required by their state. It is not a type of insurance but a form filed with the state's Department of Motor Vehicles (DMV) to prove financial responsibility. SR-22s are typically required for high-risk drivers who have been convicted of serious driving violations, such as multiple traffic offences, DUIs, DWIs, or driving without insurance.

The SR-22 form is filed by the driver's insurance company directly with the state's DMV and serves as a guarantee that the driver will maintain the required insurance coverage for a specified period, usually around 2-3 years. The exact duration can vary depending on the nature of the driving offence and the decision of the court or the state DMV.

SR-22 requirements vary from state to state, and not everyone needs one. If you need an SR-22, you will typically be notified by the traffic court or the DMV. To obtain an SR-22, you need to contact your insurance company and request that they file the form on your behalf. Some insurance companies may charge a fee for providing an SR-22 certificate, which can range from $15 to $25, or even up to $200 in some cases.

It is important to note that not all insurance companies offer SR-22 forms, so you may need to switch to a new insurance provider if your current company does not provide them. Additionally, having an SR-22 will typically increase your insurance premiums due to the higher risk associated with your driving record.

Auto Insurance Survivor Benefits: Taxable?

You may want to see also

When is SR-22 auto insurance required?

SR-22 auto insurance is required in a few specific instances, usually involving driving violations or high-risk driving behaviours. SR-22 is not a type of insurance but a certificate of financial responsibility, proving that you have car insurance that meets the minimum coverage required by law. It is typically required in the following situations:

DUI or DWI Conviction

If you have been convicted of driving under the influence (DUI) or driving while impaired (DWI), you may be required to obtain an SR-22 certificate. This is because a DUI or DWI is considered a serious moving violation and can result in your driver's license being suspended or revoked.

Driving Without Insurance

In most states, if you are caught driving without valid insurance, you will need an SR-22 form. This is because driving without insurance is illegal in most places, and the SR-22 proves that you now meet the minimum insurance requirements.

Multiple Traffic Violations

Accumulating too many traffic violations or accidents within a short period can result in an SR-22 requirement. This includes things like speeding tickets, reckless driving, or any violation that leads to a revoked or suspended license.

Unpaid Child Support

In some states, failure to pay court-ordered child support can result in the requirement to obtain an SR-22 form. This is because the SR-22 proves financial responsibility and can be used as a way to ensure compliance with court orders.

Hardship or Probationary License

If your license has been suspended or revoked and you are seeking a hardship or probationary license, you may need an SR-22. This type of license is issued for temporary driving needs, usually to and from work, and the SR-22 proves that you have the necessary insurance to be on the road.

It's important to note that SR-22 requirements can vary from state to state, and not everyone needs an SR-22. If you are required to obtain one, you will typically be notified by a court order or a letter from your state's Department of Motor Vehicles.

Gap Insurance: Protecting Your Car Finance

You may want to see also

How to get SR-22 auto insurance

An SR-22 form is not an insurance policy but a certificate of financial responsibility that proves you have the minimum amount of auto insurance required by your state. It is typically required if you've been caught driving without insurance or a valid license, or if you've committed a serious driving violation, such as a DUI.

If you need an SR-22, you must request it from your insurance company as soon as possible, as there is usually a deadline for filing the form. If your current insurance company does not offer SR-22s, you will need to buy a new policy from a company that does. It's a good idea to let potential insurers know upfront that you require an SR-22.

Once you have purchased a policy from an insurance company that offers SR-22s, they will file the form with your state's Department of Motor Vehicles (DMV). This can often be done electronically and on the same day as your purchase. Your insurance company will charge a fee for filing the SR-22 form, which typically ranges from $15 to $50.

In most states, you will need to retain your SR-22 status for about three years. If your insurance policy lapses during this time, your insurer is required to notify the DMV, and your license will be suspended.

State Farm Auto Insurance: Unveiling Rodent Damage Coverage

You may want to see also

How much does SR-22 auto insurance cost?

The cost of SR-22 auto insurance can vary depending on several factors, including the state you live in, your insurance company, and your driving history. Let's take a closer look at the components that make up the cost of SR-22 auto insurance.

SR-22 Filing Fee

The SR-22 itself is a form or certificate that your insurance company files with the state, proving that you have the minimum required car insurance. The standard filing fee for an SR-22 is around $25, but it can range from $15 to $50, depending on your state and insurance provider. This is a one-time fee, and you won't have to pay it again unless your policy lapses or is cancelled.

Increased Insurance Rates

While the SR-22 form doesn't directly increase your insurance rates, the conviction or violation that led to the SR-22 requirement will. Insurance companies consider drivers with an SR-22 to be high-risk, which results in higher insurance premiums. The increase in rates will depend on the specific issue that triggered the SR-22 requirement, such as a DUI, reckless driving, or driving without insurance. For example, a driver with a DUI conviction can expect to pay an additional $1,400 per year, on average, due to the increased risk associated with that violation.

Average Cost of SR-22 Insurance

Combining the SR-22 filing fee and the increased insurance rates, the average cost of SR-22 auto insurance is approximately $3,270 per year for a driver with a DUI conviction, according to Forbes. However, this cost can vary significantly depending on the state. Idaho has the cheapest rate at $2,174 per year, while California has the most expensive rate at $5,593 per year. Additionally, some insurance companies offer more affordable SR-22 insurance rates than others. For example, Country Financial and USAA are known for having competitive rates for SR-22 insurance.

Additional Costs and Requirements

It's important to note that some states may require you to pay for your insurance policy in full for the entire coverage period instead of making monthly payments. This can be a significant financial burden for some individuals. Furthermore, if you need to reinstate your driver's license, there may be additional fees from the DMV, which can cost over $125.

Cheap Auto Insurance: 29 Dollar Monthly Plans

You may want to see also

How long do you need SR-22 auto insurance for?

The length of time you'll need to carry SR-22 auto insurance depends on your state and the reason for the SR-22 requirement. Most states require drivers to maintain SR-22 certification for a minimum of three years. However, the timeframe can range from two to five years. It's important to note that if you cancel your policy or it lapses during this period, your insurance provider is obligated to notify the state, and your license will be suspended. In such cases, the clock resets, and you'll need to start the SR-22 filing period anew, serving the full duration.

To find out the exact length of time you'll need SR-22 insurance, contact your state's department of motor vehicles. Once the required period has passed without any violations, your SR-22 form will no longer be necessary, and your insurance company can file an SR-26 form to lift the requirement.

Renters Insurance: Understanding Laptop Water Damage Coverage with State Auto

You may want to see also

Frequently asked questions

SR22 auto insurance is a certificate of financial responsibility that proves you have the minimum amount of auto insurance your state requires. It is not an actual type of insurance but a form filed with your state.

If your insurance company offers SR22 insurance, you can call them and they will take care of it. They will add the SR22 endorsement to your existing policy and then file the SR22 insurance document with the relevant state. If your insurance company does not offer SR22 insurance, you will need to buy a new policy from a company that does.

The cost of SR22 insurance varies depending on the company and state, but you can expect to pay a filing fee of around $15 to $50. Your insurance rates may also increase as SR22 insurance is typically for high-risk drivers.

The length of time you need to have SR22 insurance depends on your state and the reason for the requirement. Most drivers will need to have it for at least three years, but it can range from two to five years.