Medicare is a federal health insurance program for people aged 65 or older, certain younger people with disabilities, and people with end-stage renal disease. When an individual has Medicare and another health insurance policy, each type of coverage is called a payer. If you have auto insurance and Medicare, and you are injured in a car accident, Medicare will provide secondary coverage. This means that your auto insurance will be the primary payer, and Medicare will cover any remaining costs. In Michigan, for example, a driver cannot coordinate their No-Fault coverage with Medicare, as federal law prohibits drivers from making Medicare the primary payer for car accident-related medical expenses.

| Characteristics | Values |

|---|---|

| Medicare eligibility | People aged 65 or older, certain younger people with disabilities, people with End-Stage Renal Disease |

| Medicare parts | Part A (Hospital Insurance), Part B (Medical Insurance), Part D (prescription drug coverage) |

| Medicare coordination with auto insurance | Medicare is the secondary payer for car accident-related medical expenses |

| Medicare coordination with other insurance | COB (Coordination of Benefits) decides the health insurance plan that pays first when a person has dual health insurance plans |

What You'll Learn

Medicare and auto insurance coordination in Michigan

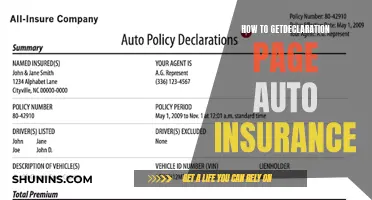

In Michigan, coordination of benefits refers to when a person coordinates their health insurance with their auto insurance. In return for a reduced auto insurance premium, the person's health insurance is the primary payer for car accident-related medical expenses. The No-Fault insurance acts as the secondary payer once the health insurance plan's coverage limit has been reached.

In Michigan, auto insurance generally pays first for accident-related medical expenses. Then, Medicare coverage pays any additional costs for Medicare-covered services not covered by auto insurance. This applies to both Original Medicare and Medicare Advantage members.

However, it is important to note that a driver cannot coordinate their No-Fault coverage with Medicare. The federal law known as the "Medicare Secondary Payer" rule prohibits drivers from making Medicare the "primary" payer for car accident-related medical expenses.

When it comes to choosing between coordinated and uncoordinated No-Fault benefits, auto accident attorneys generally recommend choosing uncoordinated No-Fault benefits. This is because No-Fault provides coverage for all "reasonably necessary" medical care and treatment for a car accident victim's care, recovery, or rehabilitation. In contrast, health insurance plans may contain auto exclusions, fail to cover necessary treatment, or limit treatment in ways that No-Fault does not. Additionally, health insurance plans may involve managed care or HMOs, which require pre-authorisation and prohibit victims from seeking care from their preferred doctor.

Auto Insurance Rates: Can You Negotiate?

You may want to see also

Medicare as a secondary payer

Medicare Secondary Payer (MSP) is the term used when Medicare does not have primary payment responsibility. In other words, when another entity is responsible for paying before Medicare.

When Medicare was introduced in 1966, it was the primary payer for all claims except those covered by Workers' Compensation, Federal Black Lung benefits, and Veteran's Administration (VA) benefits. However, in 1980, Congress passed legislation that made Medicare the secondary payer to certain primary plans. This shift aimed to transfer costs from Medicare to the appropriate private payment sources. The MSP provisions ensure that Medicare does not pay for items and services that certain health insurance or coverage is primarily responsible for.

The MSP provisions apply when Medicare is not the beneficiary's primary health insurance coverage. Medicare remains the primary payer for beneficiaries without other types of health insurance or coverage. It is also the primary payer in specific instances, provided certain conditions are met.

- Working Aged and Employer Group Health Plan (GHP): If an individual aged 65 or older is covered by a GHP through their or their spouse's current employment, and the employer has 20 or more employees, then the GHP pays primary, and Medicare pays secondary.

- Disability and Employer GHP: If an individual is disabled and covered by a GHP through their or a family member's current employment, and the employer has 100 or more employees, the GHP pays primary, and Medicare pays secondary.

- End-Stage Renal Disease (ESRD): During the first 30 months of eligibility for Medicare, if an individual with ESRD is covered by a GHP or a Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) plan, then the GHP or COBRA pays primary, and Medicare pays secondary.

- Retiree Health Plans: If an individual aged 65 or older has an employer retirement plan, Medicare pays primary, and the retiree coverage pays secondary.

- No-fault Insurance and Liability Insurance: If an individual with Medicare is in an accident or situation where no-fault or liability insurance is involved, the no-fault or liability insurance pays primary for accident-related health care services, and Medicare pays secondary.

- Workers' Compensation Insurance: If an individual with Medicare is covered under Workers' Compensation for a job-related illness or injury, Workers' Compensation pays primary for related health care items or services. Medicare generally won't pay for injuries or illnesses covered by workers' compensation. However, if a claim is denied by workers' compensation, a claim may be filed with Medicare.

Gap Insurance Claims: Report to NC Commissioner?

You may want to see also

Medicare and Medicaid coordination

In the US, Medicare is a federal health insurance program for people aged 65 and over, certain younger people with disabilities, and people with End-Stage Renal Disease. Medicaid, on the other hand, is a health insurance program for people with low incomes and assets. When an individual has both Medicare and other health insurance, including Medicaid, each type of coverage is called a "payer".

The "primary payer" pays up to the limits of its coverage and then sends the remaining balance to the "secondary payer". If the secondary payer does not cover the remaining balance, the individual may be responsible for the remaining costs. This order of payment is called "coordination of benefits".

The Federal Coordinated Health Care Office (Medicare-Medicaid Coordination Office) serves individuals who are dually enrolled in both Medicare and Medicaid. The office works with the Medicaid and Medicare programs, across federal agencies, states, and stakeholders to align and coordinate benefits between the two programs effectively and efficiently. The goal is to ensure that dually enrolled individuals have full access to seamless, high-quality healthcare and to make the system as cost-effective as possible.

In the state of Michigan, a driver cannot coordinate their No-Fault coverage with Medicare or Medicaid. The "Medicare Secondary Payer" rule prohibits drivers from making Medicare the "primary" payer for car accident-related medical expenses. Similarly, federal law prohibits a driver from making Medicaid the "primary" payer for car accident-related medical expenses.

Auto-Owners Insurance: Exploring Discounts for Non-Alcoholic Drinkers

You may want to see also

Medicare and individual health insurance

Medicare is the federal health insurance program for people aged 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease. It is divided into several parts, with Part A covering inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care; Part B covering certain doctors' services, outpatient care, medical supplies, and preventive services; and Part D covering prescription drugs.

If you have Medicare alongside other health insurance, such as a group health plan, retiree coverage, or Medicaid, each type of coverage is called a "payer". The "primary payer" pays up to the limits of its coverage, and the "secondary payer" covers the remaining balance. If the secondary payer does not cover the remaining balance, you may be responsible for the remaining costs. This order of payment is called "coordination of benefits" (COB).

In the case of individual or marketplace health insurance plans, Medicare typically pays first. However, it is illegal for someone to sell you a marketplace or individual market policy once you have Medicare. Marketplace plans generally do not coordinate with Medicare, so they cannot serve as secondary insurance either. Therefore, there is usually no coordination of benefits between Medicare and an individual policy.

Auto Insurance: AARP's Benefits and Coverage

You may want to see also

Medicare and military insurance

Medicare is a federal health insurance program for people aged 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant).

TRICARE, on the other hand, is a health insurance program provided by the federal government to active-duty and retired military personnel and their family members. There are many different TRICARE programs, including TRICARE for Life (TFL), which is for Medicare-eligible military retirees and their dependents.

If you are a military retiree with TRICARE, you must enroll in Medicare Part A and Part B to continue receiving TRICARE benefits after turning 65. TRICARE for Life acts as a supplement to Medicare, typically covering Medicare cost-sharing (deductibles, coinsurance, and copayments). TFL may also pay for services not covered by Medicare or when you have used up your Medicare benefits.

It is important to note that TRICARE for Life has no separate premium, but you must pay the Medicare Part B premium. TRICARE for Life also provides prescription drug coverage under the TRICARE pharmacy program, so you do not need a separate Part D prescription plan.

When you have both TRICARE for Life and Medicare, Medicare is the primary coverage that gets billed first. TRICARE for Life is secondary and pays the remainder of the bill directly to the provider. It covers most of Medicare's out-of-pocket costs, including deductibles and copayments.

Full Coverage Auto Insurance: State Farm Explained

You may want to see also

Frequently asked questions

Yes, you can have both Medicare and auto insurance. If you have multiple insurance plans, this is known as "coordination of benefits" (COB).

Each type of insurance coverage is called a "payer". The "primary payer" pays up to the limits of its coverage, then sends the rest of the balance to the "secondary payer". If the secondary payer doesn’t cover the remaining balance, you may be responsible for the rest of the costs.

Auto insurance is the primary payer for car accident-related medical expenses. Medicare is the secondary payer.