There is no set age at which a dependent must move off their parents' auto insurance and onto their own. Instead, this transition is determined by whether or not the dependent still lives with their parents. If the dependent has moved out—except in the case of college students, who often remain at their parents' address—they will need their own auto insurance. This is because auto insurance is tied to vehicles and not individuals, and every policy has a named policyholder.

| Characteristics | Values |

|---|---|

| How long can a dependent stay on parents' auto insurance? | Indefinitely, as long as they live at the same address |

| Does the dependent need their own insurance if they own a car? | Yes, the car needs its own insurance policy or needs to be listed on the parents' policy |

| Can a dependent be on their parents' insurance if they are married? | Yes, as long as they live in the same house |

| Can a dependent be on their parents' insurance if they are a full-time student? | Yes, even if they take their car to school |

| Can a dependent be on their parents' insurance if they move out? | No, unless they are a college student who only lives with their parents during the summer months |

What You'll Learn

Staying on parents' insurance while at college

Staying on your parents' insurance while at college

If you're a dependent who's away at college, you can remain on your parents' car insurance policy. This is because car insurance coverage is tied to vehicles and not individuals. As long as the college student's primary address is that of their parents' home, they can stay on their parents' insurance. This is true even if they take their car to school with them.

Some insurance companies offer a Student-Away-at-School Discount for parents with students away at school who only occasionally drive their car.

College students who live at home during the summer or go to school full-time usually remain on their parents' insurance policies.

However, if a student moves out of their parents' home and has a different permanent address, they will need to get their own car insurance policy.

Pros and cons of staying on your parents' car insurance

Pros

- Insurance will cover any accidents that may occur while the child is driving.

- It is usually cheaper to have a child covered under a parent's policy than it is to purchase an individual policy.

Cons

Premiums are higher when young drivers are named on policies.

How to reduce rates for students on their parents' car insurance

- Students with good grades may be eligible for discounts. Providers including Geico, Liberty Mutual, Progressive, and Travelers offer savings for students with a B average or higher.

- Your insurance company may offer a discount if your child is attending college at least 100 miles from home. This discount typically applies during the months your child lives away and doesn't have access to your car.

- You can get a discount for having no insurance claims or traffic violations within a certain time frame.

- Many providers offer programs that monitor your driving and reduce your rate for driving safely.

- If your student doesn’t drive often (e.g. just to school and back), they may be eligible for a low-mileage discount.

Understanding Auto Insurance Coverage: Navigating the Right Amount for Peace of Mind

You may want to see also

Getting married

Firstly, marriage is often associated with increased financial stability and lower-risk behaviour. As a result, insurance companies tend to view married couples as less risky drivers, which can lead to lower insurance rates. Combining policies can also result in a Multi-Policy Discount, helping you save money. Additionally, managing a single auto policy for both spouses is generally more convenient than maintaining separate policies.

However, it is important to consider both spouses' driving records when deciding whether to combine policies. If either spouse has a history of accidents or violations, it may be more cost-effective to keep the policies separate, at least until the violations are no longer recent. In some cases, excluding a spouse from the policy can result in lower insurance rates.

It is worth noting that, in most cases, being married can help you save money on car insurance premiums. After getting married, you should contact your insurance company to notify them of your change in marital status and request an adjustment to your policy to qualify for any applicable discounts.

Furthermore, if you and your spouse live with your parents, you may be able to stay on their car insurance policy as long as you share the same primary residence. However, once you move out, you will likely need to purchase your own insurance policy.

Elephant Auto Insurance: Understanding Their Employee Drug Testing Policies

You may want to see also

Moving out

If you're moving out of your parents' house, you'll typically need to get your own car insurance policy. This is because auto insurance is tied to the address where the car is kept. If you move out permanently, your parents' insurance company will usually require you to get your own policy, even if you don't have a car of your own.

There are a few exceptions to this rule. If you're headed to college, most insurers will allow you to stay on your parents' policy as a listed driver, especially if you're taking one of their vehicles with you. Some insurance companies even offer a "Student-Away-at-School" discount for parents with students who only drive their cars occasionally.

If you're married and living with your parents, you can typically stay on their policy, and your spouse can be added as a driver. However, if you and your spouse move out, you'll need to purchase your own auto insurance plan.

If you're moving out but keeping one of your parents' vehicles at your new home, you'll usually need to buy your own policy.

In summary, while there is no age limit for staying on your parents' car insurance, once you move out, you'll likely need to purchase your own policy.

Vehicle Insurance: Is It Mandatory in Massachusetts?

You may want to see also

Buying a car

As long as you live in the same house as your parents, you can stay on their car insurance policy indefinitely. This is also the case if you are away at college but still live at home during breaks. However, once you move out, you will need to purchase your own car insurance policy. If you own your car but keep it at your parents' house, you may be able to stay on their insurance, depending on their insurance company and the state you live in.

If you are thinking of buying a car as a dependent, there are a few things to keep in mind. Firstly, consider the ongoing costs of car ownership, such as insurance, maintenance, and fuel. Discuss this with your parents to ensure you are both aware of the financial responsibilities.

If you plan to finance the car, you will likely need to be a co-owner of the vehicle. Alternatively, you can buy the car with cash or have the dependent apply for a loan and cosign the application.

Each state has its own laws regarding vehicle titles, so be sure to understand the requirements for adding the dependent's name to the title. You may need to use specific wording, such as "or" or "and/or" instead of "and" to ensure only one party needs to sign when buying or selling.

Before completing the sale, you will typically need to provide proof of insurance. If the dependent is getting their own insurance policy, you may need to temporarily add the vehicle to your policy or obtain a verbal or written binder from your insurance agent.

Depending on your location and the value of the vehicle, you may be responsible for paying a gift tax. Check the requirements for the current year to ensure you comply with the law.

Finally, protect yourself by drafting a bill of sale that includes the make and model of the car, the purchase price, and any other relevant details. This will ensure that you are no longer responsible for the car after it has been gifted.

Insurance Coverage: Can They Change It?

You may want to see also

Pros and cons of staying on parents' insurance

Staying on your parents' insurance can have its benefits, but it may also come with some drawbacks. Here are some pros and cons to help you decide what works best for you:

Pros of Staying on Parents' Insurance:

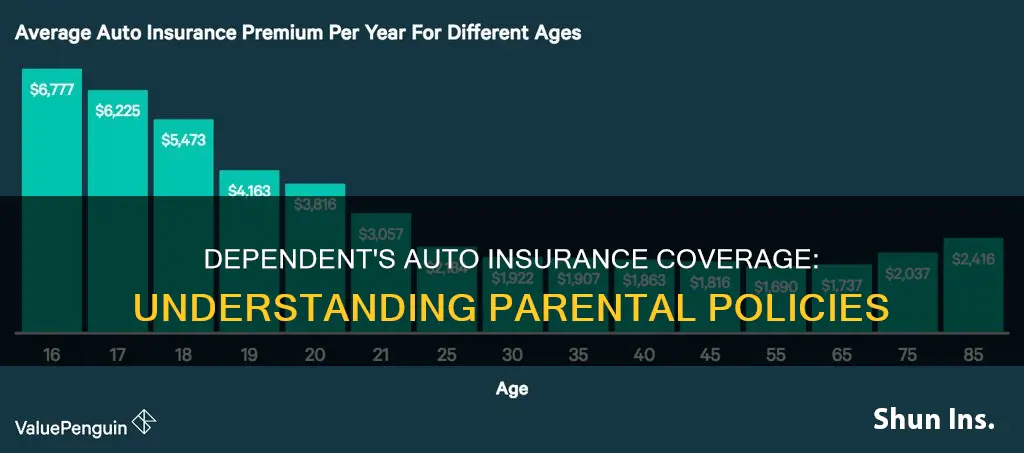

- Financial savings: Being on your parents' insurance plan can save you money, especially if you're a young or inexperienced driver. Teenage drivers typically have the highest average car insurance premiums, so being on a family plan can help mitigate the financial burden.

- Convenience: If you're still living with your parents or nearby, staying on their insurance plan can provide convenience in finding in-network medical professionals or hospitals nearby.

- Employment flexibility: Not having to worry about the responsibility of your own insurance policy gives you more freedom to take risks with your career choices in your 20s. You can jump between jobs without worrying about losing your insurance coverage.

Cons of Staying on Parents' Insurance:

- Restricted to dependents: You can generally only stay on your parents' insurance as long as you are considered a dependent, which usually means living in the same house. Once you move out, you will likely need to purchase your own insurance policy.

- Higher premiums: While adding a child to a parent's insurance policy can sometimes result in little to no additional cost, in other cases, having young drivers named on the policy can increase premiums.

- Limited family coverage: While you may be covered under your parents' insurance until the age of 26, any spouse or children you have will not be covered under the same policy. You will need to purchase a separate insurance plan for your own family.

- Missing out on better offers: If you have a great job that offers an attractive benefits package, staying on your parents' insurance might cause you to miss out on a better opportunity. Employment packages sometimes offer more comprehensive or affordable insurance options.

Remember, the decision to stay on your parents' insurance or get your own policy depends on your unique circumstances, including your age, living situation, and financial situation. It's important to carefully consider the pros and cons before making a decision.

Direct Auto's Customer Service Number: Quick Access

You may want to see also

Frequently asked questions

A dependent can stay on their parents' auto insurance indefinitely as long as they live at the same address.

If the dependent is away at college but still uses their parents' address as their primary residence, they can remain on their parents' auto insurance.

If the dependent has their own car, they may be able to stay on their parents' insurance as long as the car is kept at the same address as their parents.

A married dependent can stay on their parents' auto insurance as long as they live in the same house.

You should consider the pros and cons of staying on your parent's auto insurance. Staying on your parent's auto insurance can save you money, especially if you are a young driver, but premiums are usually higher when young drivers are named on policies.