Life insurance policies play a crucial role in financial planning, and understanding their tax implications is essential for investors and financial advisors. When it comes to K-1 forms, which are used to report income and expenses for partnerships, life insurance policies can be considered non-taxable expenses. This is because life insurance premiums paid by a partnership can be deducted as an expense, reducing the partnership's taxable income. This non-taxable status is particularly beneficial for partnerships, as it allows them to allocate a portion of the premium to each partner, potentially reducing their individual tax liabilities. By recognizing the non-taxable nature of life insurance premiums on K-1 forms, investors can optimize their tax strategies and make informed decisions regarding their insurance coverage and financial planning.

| Characteristics | Values |

|---|---|

| Tax Treatment | Life insurance premiums are generally considered non-taxable expenses for individuals. |

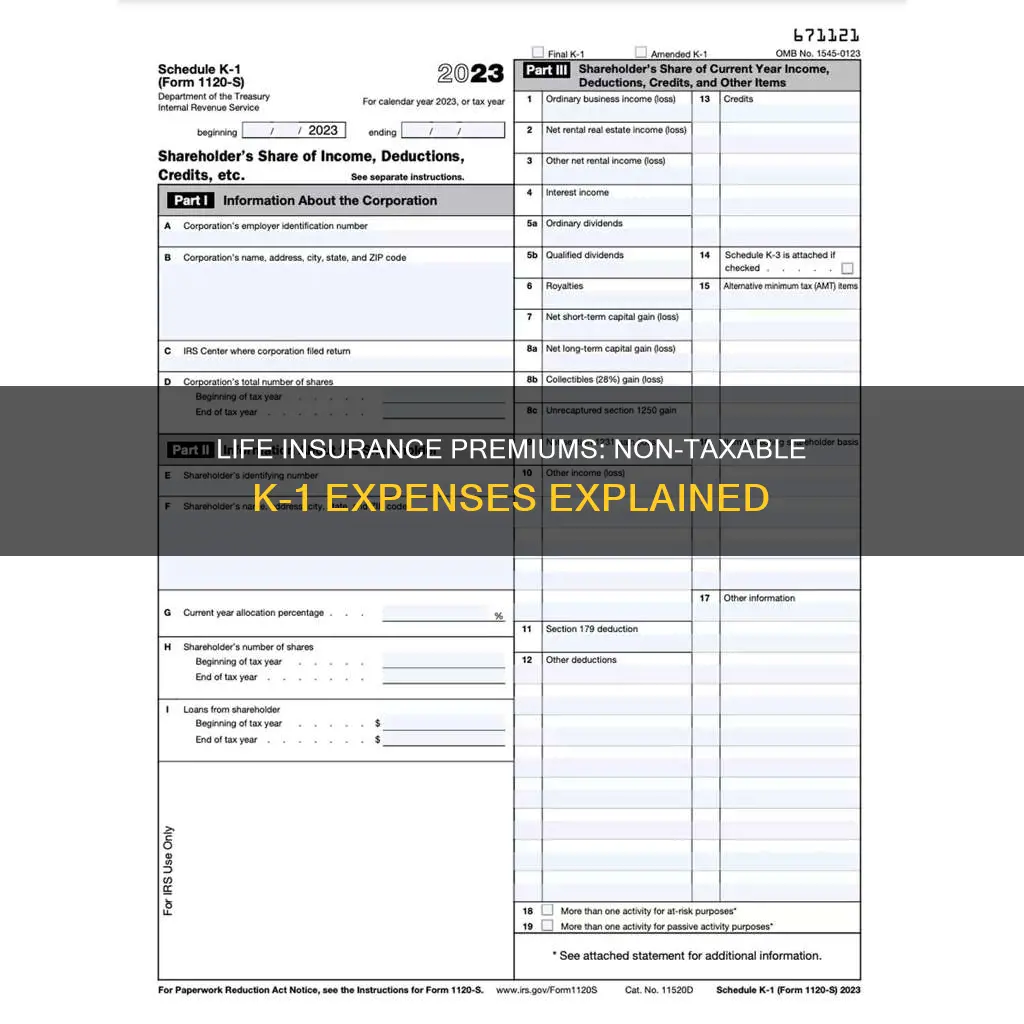

| K-1 Form | The K-1 form is used to report income, deductions, credits, and other items for tax purposes, especially in partnership and S corporation tax returns. |

| Business Expenses | For businesses, life insurance premiums can be a deductible expense, but there are specific rules and limitations. |

| Non-Taxable Income | Proceeds from a life insurance policy are typically non-taxable if the beneficiary is the insured individual or their estate. |

| Exclusions | Certain types of life insurance policies, like those with significant cash value, may have different tax implications. |

| Policy Types | Term life insurance, whole life insurance, and universal life insurance have varying tax treatments. |

| Deductions | Business owners can deduct life insurance premiums as a business expense, but they must meet specific criteria. |

| Regulations | IRS regulations provide guidelines for tax treatment, ensuring compliance with tax laws. |

| Beneficiary Designations | Properly designated beneficiaries can impact the tax treatment of life insurance benefits. |

| Policy Ownership | The owner of the policy may affect tax considerations, especially in estate planning. |

What You'll Learn

- Exempt Income: Life insurance proceeds are tax-free, exempt from income tax, as they are considered death benefits

- Non-Taxable Basis: K-1 form reports non-taxable income, including life insurance payments, to the IRS

- Death Benefits: Proceeds from life insurance policies are non-taxable as they are intended for beneficiaries

- IRS Regulations: The IRS allows non-taxable treatment for life insurance death benefits on K-1 forms

- Exemption Rules: Life insurance policies meet the criteria for non-taxable treatment under IRS regulations

Exempt Income: Life insurance proceeds are tax-free, exempt from income tax, as they are considered death benefits

Life insurance proceeds are indeed a unique aspect of financial planning and taxation, and understanding why they are considered non-taxable can be quite insightful. When an individual purchases a life insurance policy, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a death benefit payout to the policyholder's beneficiaries upon their passing. This arrangement has significant tax implications, particularly in the context of the K-1 form, which is a document used for reporting income and expenses related to certain business activities.

The key to understanding the tax-free nature of life insurance proceeds lies in their classification as 'death benefits'. When an insured individual dies, the life insurance company is obligated to pay out the death benefit as per the policy terms. This payout is not considered income for the deceased individual because it is a predetermined amount intended to provide financial security to the beneficiaries. As such, it is not subject to income tax, which is levied on earned or taxable income.

The tax-exemption of life insurance proceeds is a significant advantage for policyholders and their beneficiaries. It ensures that the financial support provided by the insurance policy is not diminished by tax liabilities, allowing the beneficiaries to receive the full intended amount. This aspect is particularly crucial in estate planning, where life insurance can play a vital role in ensuring a smooth transfer of wealth without incurring unnecessary tax burdens.

Furthermore, the non-taxable nature of life insurance proceeds is consistent with the broader principle of tax-exemption for death benefits. Similar exemptions apply to other forms of death benefits, such as retirement plan distributions and certain inheritance amounts. These exemptions recognize the unique purpose of such benefits, which are designed to provide financial support and security to individuals and their families during challenging times.

In summary, life insurance proceeds are non-taxable because they are classified as death benefits, which are intended to provide financial security to beneficiaries upon the insured individual's passing. This tax-free status is a valuable aspect of life insurance planning, ensuring that the intended financial support reaches the beneficiaries without being eroded by tax obligations. Understanding this principle is essential for individuals and their financial advisors when considering the role of life insurance in their overall financial strategy.

Imputed Income: Calculating Life Insurance with Precision

You may want to see also

Non-Taxable Basis: K-1 form reports non-taxable income, including life insurance payments, to the IRS

The K-1 form is an essential document for reporting non-taxable income, and it plays a crucial role in understanding the tax implications of life insurance policies. When an individual or entity receives life insurance payments, these amounts are typically reported on the K-1 form, which is a Schedule K-1, Form 1040-NR (for non-residents) or Form 1040-NR-EZ. This form is used to report various types of non-taxable income, and it is particularly relevant when it comes to life insurance benefits.

Life insurance policies are often structured in a way that provides tax-free benefits to the policyholder or their beneficiaries. The K-1 form ensures that the IRS is aware of these non-taxable payments, which can include death proceeds, annuity payments, and other forms of life insurance compensation. By reporting this information, the K-1 form helps individuals and entities comply with tax regulations and accurately reflect their financial activities.

The non-taxable nature of life insurance payments is based on the principle that these benefits are intended to provide financial security and support to the insured individual or their dependents. When a life insurance policy is in force, the premiums paid by the policyholder are typically not deductible as a tax expense. Instead, the benefits received upon the insured's death or as regular annuity payments are generally exempt from taxation. This tax treatment encourages individuals to purchase life insurance as a means of financial protection.

When the insured individual passes away, the life insurance company pays out the death benefit, which is then reported on the K-1 form. This report ensures that the IRS is informed about the non-taxable income received by the beneficiaries. Similarly, if the policyholder receives regular annuity payments, these amounts are also reported on the K-1 form, indicating that they are non-taxable. It is important for policyholders and beneficiaries to understand this reporting process to ensure compliance with tax laws.

In summary, the K-1 form is a critical tool for reporting non-taxable income, including life insurance payments. By accurately reflecting these payments, the K-1 form helps individuals and entities meet their tax obligations and ensures that the IRS is aware of the non-taxable benefits provided by life insurance policies. Understanding this process is essential for anyone involved in managing life insurance policies and their tax implications.

Sun Life Insurance: Applying for Coverage Simplified

You may want to see also

Death Benefits: Proceeds from life insurance policies are non-taxable as they are intended for beneficiaries

The proceeds from life insurance policies are generally non-taxable when it comes to death benefits, and this is a crucial aspect of tax law and estate planning. When an individual purchases a life insurance policy, the primary purpose is to provide financial security and support to beneficiaries in the event of the insured's death. These death benefits are designed to offer a tax-free payout, ensuring that the intended recipients can access the funds without incurring additional tax liabilities.

The non-taxable nature of death benefits from life insurance policies is a significant advantage for both the insured and their beneficiaries. When a person dies, the insurance company pays out the death benefit to the designated recipients, and this amount is typically exempt from federal income tax. This means that the proceeds are not subject to taxation, providing a direct and efficient way to transfer wealth and provide financial support to loved ones.

The tax treatment of life insurance death benefits is based on the principle that these funds are intended for the support and maintenance of the beneficiaries. By allowing tax-free proceeds, the government recognizes the importance of providing financial security to those who depend on the insured individual. This approach ensures that the insurance payout can be used for various purposes, such as covering funeral expenses, paying off debts, or providing long-term financial support to family members.

Furthermore, the non-taxable status of life insurance death benefits encourages individuals to utilize insurance as a valuable estate planning tool. By including life insurance in an estate plan, individuals can strategically allocate assets to minimize tax obligations and ensure that their beneficiaries receive the intended financial support. This aspect of tax law highlights the importance of understanding how different financial instruments, such as life insurance, can be utilized to achieve specific estate planning goals.

In summary, the proceeds from life insurance policies are non-taxable as death benefits because they are intended to provide financial support to beneficiaries. This tax treatment allows for a seamless transfer of wealth and ensures that the intended recipients can access the funds without additional tax burdens. Understanding this aspect of tax law is essential for individuals to make informed decisions regarding their estate planning and insurance coverage.

Life Insurance and Food Stamps: Compatible Benefits?

You may want to see also

IRS Regulations: The IRS allows non-taxable treatment for life insurance death benefits on K-1 forms

The Internal Revenue Service (IRS) has specific regulations regarding the taxation of life insurance policies, particularly in the context of K-1 forms, which are used to report income and expenses for partnerships and other entities. When it comes to life insurance death benefits, the IRS allows for non-taxable treatment, providing certain conditions are met. This is an important consideration for individuals and businesses who own life insurance policies and want to understand the tax implications.

According to IRS regulations, life insurance death benefits are generally exempt from taxation if the policy is owned by an individual or a trust for the benefit of that individual. This means that if a person owns a life insurance policy, and the policy's death benefit is paid out upon their passing, this amount is typically non-taxable. The key factor here is the ownership and beneficiary status of the policy. If the policy is owned by an entity, such as a partnership or corporation, the rules become more complex.

For entities, the IRS allows for non-taxable treatment of life insurance death benefits if the policy is owned by the entity and the death benefit is paid to the entity itself. In this case, the entity can claim the death benefit as an expense on its K-1 form, which reports income and expenses to partners or shareholders. This is a significant advantage for businesses, as it allows them to offset potential losses or reduce taxable income, thus improving their overall financial health.

However, there are specific requirements that must be met to qualify for this non-taxable treatment. The policy must be owned by the entity, and the death benefit must be paid to the entity or its beneficiaries. Additionally, the entity must have a valid business reason for owning the policy, such as providing financial security for its employees or partners. It is essential to consult IRS guidelines and seek professional advice to ensure compliance with these regulations.

Understanding these IRS regulations is crucial for individuals and businesses to make informed decisions regarding their life insurance policies. By recognizing the non-taxable nature of death benefits on K-1 forms, taxpayers can effectively manage their finances and potentially reduce their tax liabilities. Proper planning and adherence to IRS guidelines can lead to significant savings and a better understanding of one's financial obligations.

When to Review and Potentially Drop Your Life Insurance

You may want to see also

Exemption Rules: Life insurance policies meet the criteria for non-taxable treatment under IRS regulations

Life insurance policies are often considered non-taxable expenses on K-1 forms due to specific IRS regulations and exemption rules. These rules are designed to provide tax benefits to individuals and businesses, ensuring that certain insurance-related expenses are not subject to taxation. Here's an overview of the exemption criteria:

The IRS allows for the exclusion of certain life insurance premiums from taxable income under specific conditions. These premiums are typically associated with qualified life insurance policies, which offer coverage for the insured's life and provide financial benefits upon their death. The key factor here is the nature of the insurance policy and its intended purpose. For life insurance to qualify for this exemption, it must meet the following criteria: it should be a regular or term life insurance policy, providing coverage for the insured's life, and it should not be a modified endowment contract (MEC). MECs are a type of life insurance policy that offers additional investment features, which can lead to taxation. By adhering to these rules, individuals can exclude the premiums paid for these policies from their taxable income, thus reducing their overall tax liability.

One of the critical aspects of this exemption is the concept of 'qualified status.' The IRS defines a qualified life insurance policy as one that meets specific requirements. These policies are designed to provide pure insurance protection, ensuring that the death benefit is paid out upon the insured's death. The premiums for such policies are typically non-taxable, and the death benefit is generally tax-free. This qualification is essential to ensure that the insurance policy is not being used for investment purposes, which could lead to taxation.

Additionally, the IRS has set guidelines for the amount of life insurance coverage that qualifies for this non-taxable treatment. Generally, the death benefit should not exceed a certain threshold, which is periodically adjusted by the IRS. This limit is set to prevent individuals from using life insurance as a means of tax-efficient savings. By keeping the coverage within these limits, individuals can ensure that their life insurance premiums remain non-taxable.

It is important to note that these exemption rules may vary depending on the type of life insurance policy and the individual's circumstances. For instance, certain types of whole life insurance policies may offer additional features, such as an investment component, which could affect their tax treatment. Therefore, it is crucial to consult IRS guidelines or seek professional advice to ensure compliance with the latest regulations.

In summary, life insurance policies can be non-taxable expenses on K-1 forms due to IRS exemption rules. These rules apply to qualified life insurance policies, ensuring that the premiums paid are excluded from taxable income. Understanding the criteria for qualification, including the nature of the policy and coverage limits, is essential for individuals to take full advantage of this tax benefit.

Life Insurance Coverage for Grandchildren: What You Need to Know

You may want to see also

Frequently asked questions

Life insurance policy payments are often non-taxable on K-1 forms because they are considered a form of tax-advantaged savings. These payments are typically made into an insurance policy that provides coverage for the insured's life. The premiums paid are not subject to income tax because they are used to build a cash value account, which can grow tax-deferred.

In a life insurance policy with a cash value component, a portion of the premium payments is invested and grows tax-deferred. This means that any earnings or interest accrued within the policy are not taxed as income in the year they are earned. Instead, the growth is reinvested and can compound over time, allowing the policyholder to build a substantial amount of cash value.

Yes, there are certain conditions that must be met for life insurance policy payments to be considered non-taxable. The policy should be a permanent life insurance policy, meaning it provides coverage for the insured's life and has a cash value component. Additionally, the policy must be owned by the insured and not by a third party, and the payments should be made directly to the insurance company.

Yes, in many jurisdictions, individuals can claim a deduction for life insurance premiums paid during the tax year. This deduction can help reduce taxable income, but it's important to note that the deduction is typically limited to the amount of premium paid that is not contributed to an employer-sponsored plan or a qualified retirement plan.

Withdrawing funds from the cash value of a life insurance policy may result in income tax consequences. When you take out money from the policy's cash value, it is generally considered a taxable distribution. The amount withdrawn is taxed as ordinary income, and any earnings or interest accrued within the policy are also subject to tax. It's advisable to consult with a tax professional to understand the potential tax implications.