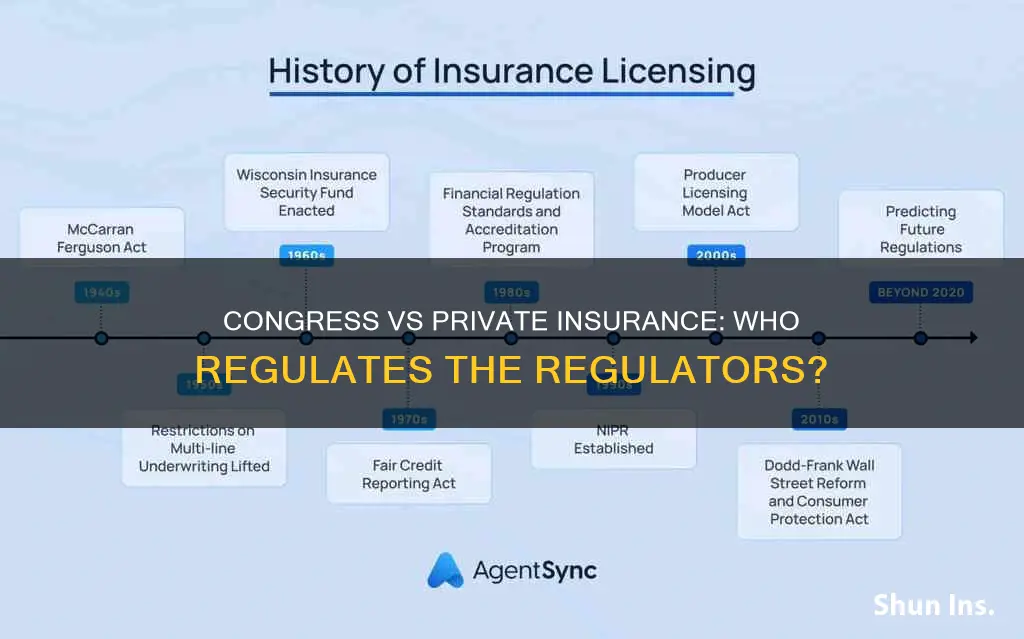

Congress has become increasingly involved in regulating private insurance, but the regulation of insurance has historically been a state responsibility. The McCarran-Ferguson Act of 1945 ceded regulatory authority to the states, and since then, several trends have emerged. Congress has intervened in insurance regulation when the private insurance market has failed or when its constituents have perceived it to be failing. For example, in 1965, Congress passed Medicare and Medicaid, and in 1974, it passed the Employee Retirement Income Security Act (ERISA), which has regulated the predominant form of health coverage for people under 65 for over 50 years.

In recent years, members of Congress have put forward ideas for a full-scale federal insurance regulator, an optional federal charter, and a federally mandated but state-controlled harmonization of state regulation. Proponents of federal involvement argue that the current system puts insurers at a disadvantage when competing with other financial institutions, while opponents argue that federal regulation is unnecessary and would weaken consumer protection.

While Congress has become more involved in insurance regulation, states remain the primary regulator of insurers, and the National Association of Insurance Commissioners (NAIC) has assumed a national role in establishing standards for states' regulation of insurers' financial solvency.

| Characteristics | Values |

|---|---|

| Private health coverage regulation | Has historically included steps to prevent insurers and plan sponsors from avoiding people in poor health, while also ensuring that risk pools include people in good health to guard against “adverse selection”. |

| Private health coverage | Is a mechanism for people to finance the health care services and medications they need, protecting them from the potentially extreme financial costs of this care. |

| Private health coverage | Is subject to significant requirements at the state and federal levels. |

| Private health coverage | Is considered “private” when those insuring the risk or paying health claims are private entities such as insurance companies or private employers. |

| Private health coverage | Is considered “public” when financing arrangements are paid primarily from public sources, e.g. Medicare and Medicaid. |

| Private health coverage | Can be obtained through an employer (“group” coverage) or by directly purchasing it from an insurer (“nongroup” coverage). |

| Private health coverage | Is regulated by the McCarran-Ferguson Act of 1945, which cedes authority to regulate insurance to the states. |

What You'll Learn

- Congress has no authority to regulate insurance

- State regulation of insurance is a historical artifact

- Congress has become increasingly involved in regulating insurance

- The National Association of Insurance Commissioners has assumed a national role

- Federal regulation of insurance is complex and fragmented

Congress has no authority to regulate insurance

The act declared that:

> [t]he continued regulation and taxation by the several States of the business of insurance is in the public interest, and that silence on the part of the Congress shall not be construed to impose any barrier to the regulation or taxation of such business by the several states.

The act also limited the application of the federal antitrust laws to the business of insurance by granting an immediate moratorium on their enforcement. This allowed states to decide, during the period of the moratorium, whether to allow insurers to set rates collectively.

Since 1945, several trends have emerged. Courts have circumscribed the antitrust exemption substantially, and congressional involvement in and oversight of insurance has increased. The National Association of Insurance Commissioners (NAIC) has also assumed a national role in establishing standards for states' regulation of insurers' financial solvency.

While the Affordable Care Act (ACA) of 2010 ushered in many new requirements for the federal regulation of private health coverage, another federal law, the Employer Retirement Income Security Act (ERISA), has for over 50 years regulated the predominant form of health coverage for people under the age of 65—employer-sponsored coverage.

States have traditionally been the primary regulators of health insurance, and state health insurance protections continue to play a major role alongside a growing list of federal protections.

Understanding Private Insurance Billing for Passe Services

You may want to see also

State regulation of insurance is a historical artifact

In 1945, the Supreme Court reversed its decision in South-Eastern Underwriters v. U.S., establishing that Congress did have the authority to regulate insurance and insurers. At the time, many worried that South-Eastern Underwriters vitiated state authority to tax and regulate insurers, so Congress enacted the McCarran-Ferguson Act. The act ceded to states the authority to regulate insurance and exempted insurers from most federal antitrust laws.

Since 1945, several trends have emerged. Courts have circumscribed the antitrust exemption substantially, congressional involvement in and oversight of insurance has increased, and the National Association of Insurance Commissioners (NAIC) has adopted a national role in establishing standards for states’ regulation of insurers’ financial solvency. The NAIC has also become involved in establishing international standards for insurance regulation.

Eliminating Private Insurance: A Step Towards Universal Healthcare

You may want to see also

Congress has become increasingly involved in regulating insurance

Congress has intervened most often when the private insurance market has failed or when its constituents have perceived it to be failing. For example, in 1965, the 89th Congress passed the comprehensive health insurance plans known as Medicare and Medicaid. In 1974, the 93rd Congress passed the Employee Retirement Income Security Act, which regulated employee benefit plans, including health plans.

The Affordable Care Act (ACA) of 2010, which was signed into law by President Obama, also significantly expanded the scope of federal regulations, especially in the nongroup market. The ACA established core market rules designed to expand coverage to most people in the U.S. and prevent insurers from avoiding people in poor health.

In addition, Congress has also been active in health insurance regulation through the passing of laws such as the Health Insurance Portability and Accountability Act of 1996, which established minimum federal standards of availability and renewability for health insurance.

Congress has also intervened in insurance regulation by conducting oversight and investigations into the effectiveness and efficiency of state regulation. For example, in 1958, the Senate Committee on the Judiciary investigated whether states had honoured the mandate of the McCarran-Ferguson Act by regulating the insurance industry in the public interest.

Furthermore, Congress has shown interest in examining the factors that affect insurance premiums, as they impact not only enrollees but also the federal budget.

Private Insurance in Massachusetts: What You Need to Know

You may want to see also

The National Association of Insurance Commissioners has assumed a national role

The National Association of Insurance Commissioners (NAIC) has been supporting state insurance regulators and protecting consumers and markets for over 150 years. It assists regulators in all 50 states, the District of Columbia, and five US territories. The NAIC sets standards and best practices, conducts peer reviews, and provides regulatory support and oversight coordination. It also provides business intelligence, analytics, and reports to help make the US insurance market one of the strongest and most resilient in the world.

The NAIC's role in insurance regulation is particularly important given the complex interplay between state and federal requirements. While states have traditionally been the primary regulators of health insurance, the federal government has played an increasingly significant role over the past 50 years. The federal government subsidizes most premiums directly or indirectly, at a cost of roughly $300 billion in fiscal year 2016.

The NAIC's work helps to stabilize markets and protect consumers. It provides support for regulators and consumers, helping to ensure fair, competitive, and healthy insurance markets. By setting standards and best practices, and coordinating regulatory oversight, the NAIC plays a crucial role in the US insurance landscape.

Regence Insurance: Private or Public? Understanding the Difference

You may want to see also

Federal regulation of insurance is complex and fragmented

The current insurance regulatory framework was established by the McCarran-Ferguson Act of 1945, which ceded regulatory authority to the states. This act also exempted insurers from most federal antitrust laws. However, over time, Congress has reclaimed parts of this authority and passed legislation to address failures in the private insurance market. For example, the Employee Retirement Income Security Act of 1974 placed employee benefit plans, including health plans, under federal jurisdiction.

The regulatory landscape is further complicated by the involvement of the National Association of Insurance Commissioners (NAIC), a private association of state insurance regulatory officials. The NAIC sets standards for insurance regulation and has assumed a national role, working to establish international standards.

The interplay between federal and state regulation can make insurance protections challenging for consumers to navigate. Federal regulation of private health coverage has evolved into a complex system of overlapping state and federal standards, with consumers' legal protections varying based on their coverage type and state of residence.

Public Option: Bettering Private Insurance?

You may want to see also

Frequently asked questions

Congress can and does regulate private insurance. The Affordable Care Act (ACA) of 2010, for example, brought in many new requirements for the federal regulation of private health coverage.

Private health coverage is subject to significant requirements at the state and federal levels. While the ACA has ushered in many new federal regulations, another federal law, the Employer Retirement Income Security Act (ERISA), has regulated employer-sponsored coverage for over 50 years.

Congress has become increasingly involved in regulating insurance and overseeing states' regulation of insurance. In 1945, the McCarran-Ferguson Act ceded insurance regulatory authority to the states, but also committed to assessing the effectiveness of this regulation. Since then, Congress has intervened most often when the private insurance market has failed or its constituencies have perceived it as failing.

Congress regulates private insurance through federal laws and subsidies, taxes, and fees. For example, the ACA's individual mandate requires most people to obtain health insurance or pay a penalty. Congress also regulates private insurance by overseeing state regulation.

The regulation of private insurance by Congress has had both positive and negative consequences. On the one hand, it has expanded health insurance coverage and improved the quality of care. On the other hand, it has also led to increased costs for enrollees and affected the federal budget.