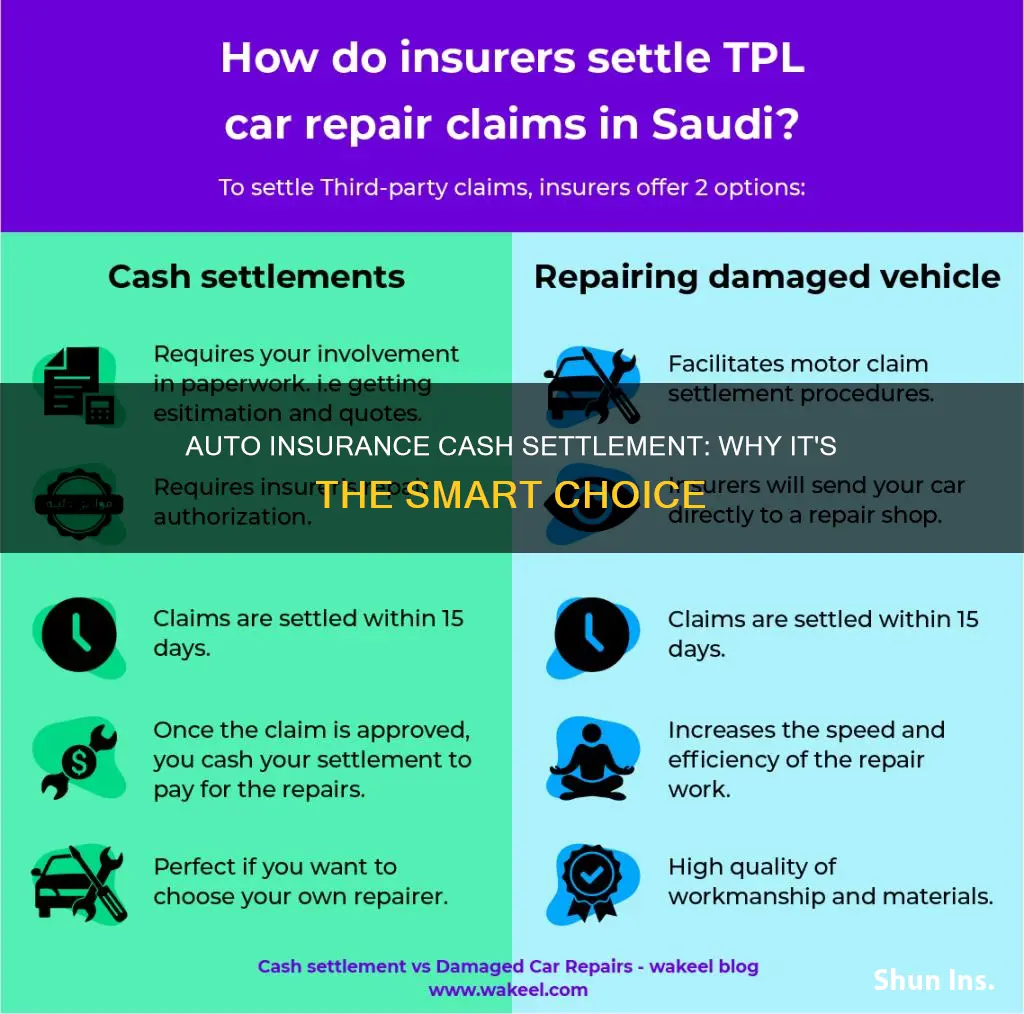

Cash settlement auto insurance claims are a lump sum payment from an insurance company to settle a claim. This can be appealing for those who want to use the money for other purposes, such as renovations or personal expenses. However, there are several factors to consider before choosing this option. Firstly, if you have a loan or lease on your vehicle, the insurance company may send the payment directly to the repair shop or require you to use the money for repairs, as failing to do so can violate your loan or lease agreement. Secondly, skipping repairs can lead to complications with future claims, as insurance companies may deny subsequent claims or reduce payouts if previous damages remain unfixed. Additionally, not repairing your vehicle can decrease its resale value and compromise its safety. Lastly, the cash settlement amount may not cover all costs, especially if there are delays in repairs or if additional damage is discovered later on. Therefore, it is important to carefully evaluate the pros and cons of a cash settlement auto insurance claim before making a decision.

| Characteristics | Values |

|---|---|

| Immediate financial relief | Keeping the claim money can provide instant access to funds that might be needed for other pressing financial obligations or emergencies. |

| Flexibility | You have the freedom to decide how to use the payout, whether it’s for future repairs, investments, or personal expenses. |

| Cost efficiency | If the damage is purely cosmetic and doesn’t affect the vehicle’s functionality, you might choose to save on repair costs altogether. |

| Future claim complications | Insurance companies may deny subsequent claims or reduce payouts if they discover that previous damages were not repaired. |

| Vehicle safety | Unrepaired damage can lead to hidden issues with critical components like brakes, wheels, or the engine, compromising your car’s safety. |

| Decreased resale value | A car with visible or known unrepaired damage can deter potential buyers and significantly reduce the vehicle’s resale value. |

| Loan/lease violations | If your car is financed or leased, keeping the claim money instead of making repairs might violate the terms of your agreement, leading to penalties or other complications. |

| Loss of insurance benefits | A cash settlement might cause you to lose certain insurance benefits. |

| Repair cost variation | In a cash settlement, quotes to repair property are fixed to the costs at the time of damage. If repairs are delayed or take a long time, rising labour and material costs might significantly increase the actual cost of fixing the property. |

| Temporary accommodation | A cash settlement will end the claim, so the settlement amount does not include accommodation cover. Therefore, claimants will need to find and pay for their own alternative accommodation arrangements. |

What You'll Learn

- If you own your car, you can choose to keep the insurance claim money and not repair it

- If you have a loan or lease, you cannot choose to spend the insurance payout on something else

- Pros and cons of pocketing auto insurance claim money instead of repairing your car

- If you don't use the insurance money for repairs, your insurer might not renew your coverage

- If you don't repair your car, you may face complications with future claims

If you own your car, you can choose to keep the insurance claim money and not repair it

Another factor to consider is whether you have a loan or lease on your vehicle. If you are still making payments, you do not own the vehicle outright, and you are typically obligated to repair it promptly to comply with the terms of your agreement. In this case, the insurance company may issue the payment directly to the repair shop or require you to use the claim money for repairs. Failing to do so could violate your loan or lease agreement and result in penalties.

If you own your car outright and choose to keep the insurance claim money, be aware that your insurer will only pay to fix the same claim once. If you file another claim for the same damage in the future, it may be considered fraud, and your insurer may refuse to cover the cost of repairs. Additionally, if you continue to drive an unrepaired vehicle, you could compromise your safety, as there may be hidden issues with critical components.

Ultimately, the decision to keep the insurance claim money and not repair your car depends on your specific circumstances and the extent of the damage. It is essential to carefully weigh the pros and cons before making a decision.

Autoimmune Disorders and Insurance Coverage: Unraveling the Blood Work Mystery

You may want to see also

If you have a loan or lease, you cannot choose to spend the insurance payout on something else

When you have a loan or lease on your vehicle, you are not the sole owner of the car. This means that you are not able to decide whether or not to fix it. In most cases, you are obligated to repair your vehicle, and you may even be required to use the auto insurer's preferred mechanic.

If you have a loan, the lender will likely receive the insurance check directly. In some cases, the check may be written out to both you and the lender, in which case you will need their permission to cash it. The lender will probably require you to fix the vehicle, and they may even ask you to sign the check over to them so that they can pay the auto body shop directly.

If you have a lease, the claim payout goes to both you and the leasing company. The leasing company will need to endorse the check before you can cash it, and they will likely require you to fix the vehicle.

In either case, if you choose to keep the insurance money and not repair the vehicle, you could be violating the terms of your loan or lease agreement. This could lead to penalties or other complications, such as repossession of your vehicle.

Additionally, if you don't repair the damage, you may face complications with future insurance claims. If your car is involved in another accident, the insurance company might refuse to cover the new damage or reduce the payout, citing pre-existing conditions. Not repairing your vehicle can also affect its safety and resale value.

Auto Insurance Rates After an Accident: What to Expect

You may want to see also

Pros and cons of pocketing auto insurance claim money instead of repairing your car

There are several reasons why you may want to keep the insurance claim money and not repair your car. You may not want to go through the hassle of car repairs, especially if it means being without a vehicle for an extended period. Or, if you have an older car, you might not mind driving around with a few dents and scratches, especially if you have a hefty check in your hand that could be used on other necessities.

However, there are also consequences to this decision. Here are some pros and cons to help you make a more informed decision:

Pros:

- Immediate financial relief: Keeping the claim money can provide instant access to funds that might be needed for other pressing financial obligations or emergencies.

- Flexibility: You have the freedom to decide how to use the payout, whether it's for future repairs, investments, or personal expenses.

- Cost efficiency: If the damage is purely cosmetic and doesn't affect the vehicle's functionality, you might choose to save on repair costs altogether.

Cons:

- Future claim complications: Insurance companies may deny subsequent claims or reduce payouts if they discover that previous damages were not repaired.

- Vehicle safety: Unrepaired damage can lead to hidden issues with critical components like brakes, wheels, or the engine, compromising your car's safety.

- Decreased resale value: A car with visible or known unrepaired damage can deter potential buyers and significantly reduce the vehicle's resale value.

- Loan/lease violations: If your car is financed or leased, keeping the claim money instead of making repairs might violate the terms of your agreement, leading to penalties or other complications.

Driving Uninsured in Michigan: Is It a Crime?

You may want to see also

If you don't use the insurance money for repairs, your insurer might not renew your coverage

Firstly, if your car has a lien holder or is leased, the insurance company might issue the payment directly to the repair shop or require you to use the money for repairs. Failing to do so can violate the terms of your loan or lease agreement.

Secondly, skipping repairs can lead to complications with future claims. If your car is involved in another accident and the previous damage was not repaired, the insurance company might refuse to cover the new damage or reduce the payout, citing pre-existing conditions.

Thirdly, not repairing your vehicle can affect its safety and resale value. Unfixed damage can worsen over time, potentially leading to more significant issues and higher repair costs in the future. Additionally, when you decide to sell your car, buyers may be deterred by visible damage or lower their offers, knowing they will need to cover the repairs themselves.

Finally, if you have a car loan or car lease, it is unlikely that your lienholder or leaseholder will permit you to perform fixes on your own.

Therefore, while your insurer might not renew your coverage if you don't use the insurance money for repairs, there are several other important factors to consider when making this decision.

Lowering Auto Insurance in Ontario: Tips and Tricks

You may want to see also

If you don't repair your car, you may face complications with future claims

If you have a lease or loan on your car, you are usually required to keep your car in good working order for the term of the agreement. This means that if you don't repair your car, you could be hit with a penalty or even have your car repossessed. Even if you own your car outright, choosing not to repair it could lead to safety issues and decrease its resale value.

Unfixed damage can worsen over time, leading to more significant issues and higher repair costs in the future. Additionally, when you decide to sell your car, buyers may be deterred by visible damage or lower their offers, knowing they will need to cover the repairs themselves.

It's also important to consider the safety implications of not repairing your car. While the damage from an accident may appear minor, there may be hidden issues with critical components like brakes, wheels, or the engine. Continuing to drive an unrepaired vehicle can exacerbate these problems, compromising your safety on the road.

In summary, while you may be able to keep the money from a car insurance claim and choose not to repair your car, there are several potential consequences to consider. These include complications with future claims, violations of lease or loan agreements, decreased resale value, higher repair costs, and safety risks.

Vehicle Insurance: What's Covered?

You may want to see also

Frequently asked questions

You have immediate access to funds that can be used for other financial obligations or emergencies. You also have the freedom to decide how to use the payout, whether it's for future repairs, investments, or personal expenses.

If you don't repair your vehicle, its safety and resale value can be affected. Unfixed damage can worsen over time, leading to higher repair costs in the future. Buyers may also be deterred or lower their offers, knowing they will need to cover the repairs themselves.

If you don't repair your car, your insurer will likely refuse to pay for any damage to the same area in the future. They may also not renew your coverage when the policy period ends.

If you have a loan or lease on your car, you are usually obligated to repair it and use the auto insurer's preferred mechanic. The insurance company might issue the payment directly to the repair shop or require you to use the money for repairs.

You can keep any leftover money from your claim. However, it is important to never intentionally overestimate the cost of repairs.