Being involved in a car accident is already stressful, but it can be even more overwhelming when you start to think about how it will impact your insurance rates. The short answer is that, yes, your insurance rates will likely go up after an accident, especially if it was your fault. However, the extent of the increase depends on a variety of factors, including the type of accident, your insurer, your location, and your driving record.

What You'll Learn

At-fault accidents

Being at fault in a car accident will almost always cause your insurance rates to increase. The exact amount that your premium will increase depends on a variety of factors, including your auto insurance provider, driving record, claims history, geographic location, age, and gender. Young drivers may experience the highest increases after an accident, as insurers typically view them as a particularly risky group to insure.

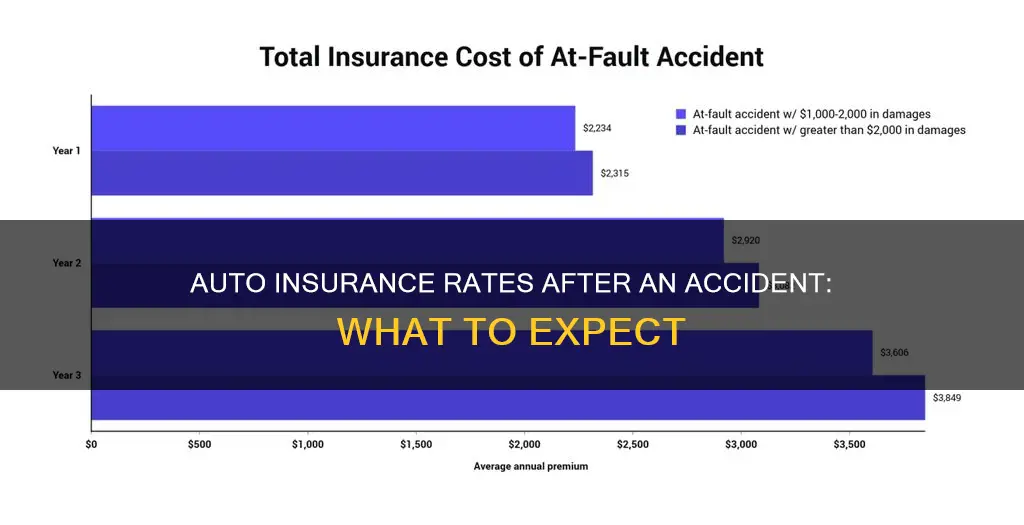

On average, car insurance rates go up by around $80 per month for full coverage following an at-fault accident, which equates to a 49% increase. However, this varies by state, with accidents in California doubling insurance rates, while accidents in Alaska increase rates by only 26%.

In addition to the financial cost, an at-fault accident can remain on your driving record for up to six years, and you may be labelled as a high-risk driver, particularly if you have multiple accidents within a short period. This can result in higher insurance rates for an extended period.

To offset the risk, insurance companies charge higher rates for drivers with at-fault accidents on their records. On average, a full-coverage premium will increase by about 42% after an at-fault accident. If the accident caused serious injury, extensive property damage, or was due to intoxication, your insurance rates could increase substantially more, and your insurer may even deny your policy renewal.

It is worth noting that some insurance companies offer accident forgiveness programs, which may waive the surcharge for the first at-fault accident. Additionally, certain states have thresholds for damage amounts, below which insurance companies will not raise your premium.

Penske Truck Rentals: Are You Covered by Your Auto Insurance?

You may want to see also

No-fault accidents

However, there are situations where a no-fault accident can still lead to an increase in your insurance rates. For instance, if you had a claim-free discount prior to the accident, your rates could go up. Additionally, if you have to make an uninsured or underinsured motorist claim, or a collision claim after a hit-and-run, your rates are likely to increase. This is because your insurance company may consider you a riskier driver.

According to the Consumer Federation of America, drivers who have been involved in no-fault accidents experience an average premium increase of 10%. However, this can vary depending on the insurer, with some companies raising premiums by 10% and others by only 2%.

It's also important to note that a no-fault accident will show up on your driving record and can remain there for up to three years. This can impact how insurance companies view you as a driver and may affect your rates.

To avoid a rate increase after a no-fault accident, you can consider switching to another insurance carrier. Some companies specialize in offering competitive rates that don't penalize drivers for not-at-fault claims. It's always a good idea to shop around and compare quotes from different insurers to find the best deal for your situation.

Auto Insurance Mileage Verification: Fact or Fiction?

You may want to see also

Comprehensive claims

Whether or not an accident will affect your auto insurance rates depends on a number of factors, including whether you were at fault, the severity of the accident, your auto insurance provider, driving record, claims history, and location. Young drivers may experience the highest increases after an accident, as insurers typically view them as a risky group to insure.

Comprehensive insurance coverage is an optional addition to most car insurance policies that protect against damage caused by non-collision events outside of your control. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature. Lenders may require you to carry comprehensive insurance if you finance or lease a vehicle.

After a comprehensive claim, your insurance rates may be impacted by the value of your car, your current savings, and your location. If your car has a low cash value and you have sufficient savings to cover potential repair or replacement costs, you may want to drop comprehensive coverage. Additionally, if you live in an area with a high risk of damage due to factors like fallen branches or animal crossings, purchasing comprehensive insurance may be advisable.

To save on insurance after a comprehensive claim, you can consider the following strategies:

- Don't pay for extra coverage: Assess the value of your car to determine if you need comprehensive or collision coverage. If your car is worth less than $4,000, it is generally recommended to drop these coverages.

- Raise your deductible: Increasing your deductible can lower your monthly insurance payments. However, keep in mind that a higher deductible means higher out-of-pocket expenses if you need to file a claim.

- Look for discounts: Insurance companies offer various discounts, such as good student discounts, multi-policy discounts, and usage-based telematics programs that reward safe driving practices.

- Shop around: Compare quotes from different insurance companies to find the best rates and discounts for your circumstances.

Understanding Your Auto Insurance Policy: A Step-by-Step Guide to Checking Your Coverage

You may want to see also

Accident forgiveness

There are different types of accident forgiveness offered by insurance companies. Some companies offer small accident forgiveness, which applies to claims below a certain dollar amount, typically $500. Others offer large accident forgiveness, which applies to claims exceeding $500. Some companies may also offer accident forgiveness as a reward for good driving, providing a discount on your policy or waiving a rate increase for your first accident.

It is worth noting that accident forgiveness only applies to your first accident, and subsequent occurrences do not qualify. Additionally, if you had a safe driver or claim-free discount prior to the accident, your rates could still increase slightly.

To summarize, accident forgiveness can provide peace of mind and help you retain good driver discounts by preventing insurance rate increases after your first at-fault accident. However, it may not be available in all states, and eligibility criteria can vary across insurance providers.

Smart Ways to Save 10% on Auto Insurance

You may want to see also

Insurance rates by state

The cost of car insurance varies significantly from state to state. The national average for full-coverage car insurance is $2,118 per year, with New York being the most expensive state at $4,769 per year and Idaho the cheapest at $1,021 per year.

Several factors influence the cost of car insurance in each state, including:

- Population density: Urban areas tend to have higher insurance rates due to higher accident rates and more congested traffic.

- Number of uninsured drivers: States with a high percentage of uninsured drivers often have higher insurance rates.

- Weather conditions: States prone to severe weather events, such as hurricanes or floods, may have higher insurance rates due to an increased number of claims.

- Crime rates: States with higher crime rates, including car theft and vandalism, can impact insurance rates.

- State laws and regulations: Minimum coverage requirements, no-fault laws, and fraud rates can all influence insurance costs.

- Cost of repairs and medical care: States with higher repair and medical costs tend to have higher insurance rates.

- California: $2,585

- Florida: $4,326

- New York: $4,112

- Texas: $2,121

- Illinois: $2,179

- Ohio: $1,660

- Idaho: $1,588

- Maine: $1,460

It's important to note that insurance rates within a state can also vary based on individual factors such as age, gender, driving record, and credit score.

Switching Vehicles: Geico Insurance Guide

You may want to see also

Frequently asked questions

Your insurance rates may still increase after an accident that wasn't your fault, especially if you've made multiple claims over a short period. This is because insurance companies may consider you a risky driver, and because any accident can indicate a higher likelihood of future accidents.

An accident will usually affect your insurance rates for three to five years, depending on your state and insurance provider. However, some insurance companies may surcharge rates for up to five years following a driving incident.

Car insurance rates go up by an average of 49% if you cause an accident. This amounts to an average increase of $80 per month for full coverage. However, the exact rate increase will depend on factors such as your location, age, gender, driving record, and insurance provider.