Auto insurance companies use credit scores to determine insurance rates. While this practice is controversial and banned in California, Hawaii, Massachusetts, and Michigan, it is legal at the federal level. Credit-based insurance scores are calculated using factors such as payment history, outstanding debt, credit history length, pursuit of new credit, and credit mix. These scores are then used to predict the likelihood of filing insurance claims, with higher scores indicating lower risk and potentially resulting in better insurance rates. However, it's important to note that insurance companies also consider other factors, such as driving history and vehicle type, when determining rates.

| Characteristics | Values |

|---|---|

| Purpose | Protection against financial loss in the event of an accident or theft |

| What it covers | Property, liability, medical |

| Who it covers | You, other family members on the policy, someone not on the policy but driving with your consent |

| When it's mandatory | When a state requires it, or when a lender requires it |

| How it's priced | Individually, to allow customisation of coverage amounts |

| Policy timeframe | Six-month or one-year |

| Renewal | The insurance company sends a notice when it's time to renew |

| Primary costs | Premiums and deductibles |

| Factors affecting premium | Gender, age, years of driving experience, accident and moving violation history |

| Factors affecting type of policy | Commercial or personal use, commuting or pleasure use, mileage |

What You'll Learn

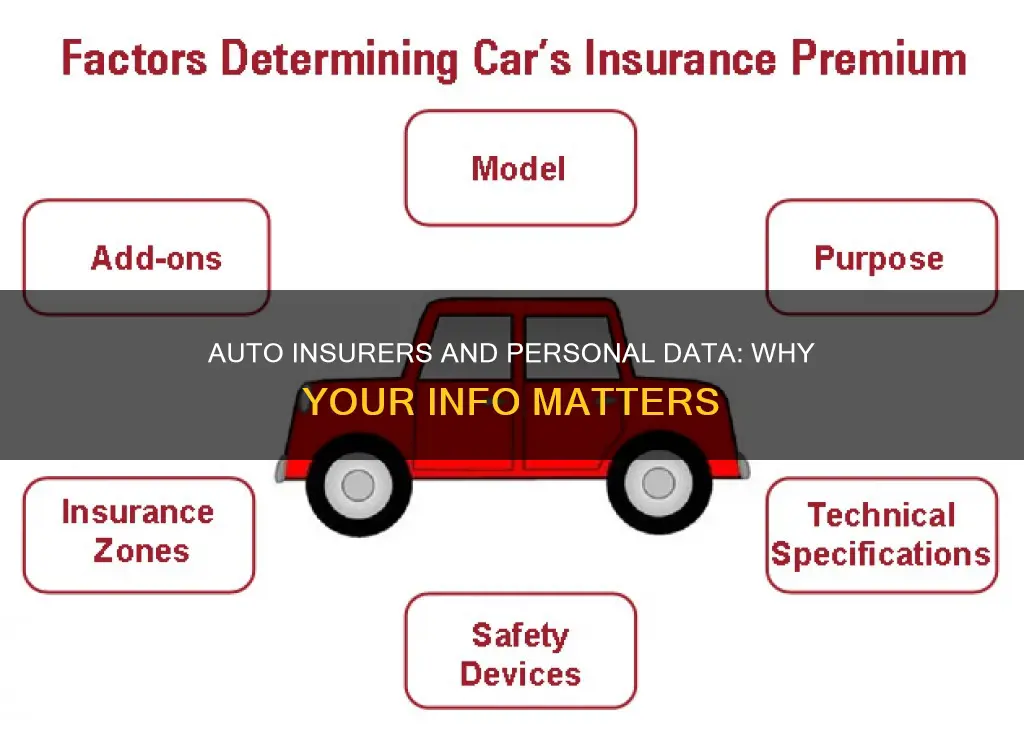

To calculate your level of risk and price your policy accordingly

Auto insurers use a variety of factors to calculate your level of risk and price your policy accordingly. These factors include your driving history, demographics, credit-based insurance score, occupation, location, age, gender, and marital status.

Your driving history is a key factor in determining your risk level. Insurers will look at any accidents you've been involved in, any moving violations, and whether your license has been suspended or revoked. If you have a history of accidents or violations, insurers will assume you are more likely to have future accidents and will price your policy accordingly.

Demographic characteristics such as age, gender, and marital status also play a role in calculating risk. For example, drivers under 25 and over 65 are statistically more likely to be involved in accidents and typically pay higher rates. Men are also statistically more likely to get into accidents than women and pay higher premiums on average. Married individuals are considered lower risk than single adults.

In some states, auto insurers are allowed to consider your credit-based insurance score when determining your premium. A low credit score is correlated with risky driving behaviors and a poor driving record, which can result in higher premiums.

Your occupation can also affect your insurance rates, as certain occupations are correlated with higher numbers of accidents. For example, business executives are considered high-risk, while teachers and first responders are low-risk occupations.

Location is another important factor, as individuals who drive more or live in areas with high traffic, high crime rates, or high population density are at higher risk for accidents.

By considering all these factors, auto insurers can calculate your level of risk and price your policy accordingly.

American Express Everyday Card: Exploring the Auto Rental Insurance Advantage

You may want to see also

To determine the type of policy you need

Auto insurance policies are legal contracts that bind the insurance company to perform specific actions under certain circumstances for an agreed-upon premium. Insurers want the contract to be as specific as possible, so policies are detailed and written in legal jargon.

The type of policy you need will depend on several factors, including your state of residence, your financial situation, and the type of vehicle you own.

State of Residence

Nearly every state requires car owners to carry bodily injury liability coverage and property damage liability coverage. Bodily injury liability covers costs associated with injuries and death caused by you or another driver while driving your car. Property damage liability reimburses others for damage that you or another driver operating your car causes to another vehicle or other property.

In addition, many states require you to carry medical payments or personal injury protection (PIP) coverage, as well as uninsured motorist coverage. Medical payments or PIP coverage reimburses medical expenses for injuries to you or your passengers and may also cover lost wages and other related expenses. Uninsured motorist coverage reimburses you when an accident is caused by a driver who does not have auto insurance, and underinsured motorist coverage protects you when you're involved in an accident with a driver who has some insurance but not enough to cover the full cost of a claim.

Financial Situation

If you are financing a car, your lender may stipulate that you carry certain types of car insurance, such as gap insurance, which can help pay off the difference between the vehicle's value and what you still owe on it if you're involved in an accident.

Additionally, consider whether you can afford a poor driving record. A history of accidents or moving violations will lead to higher premiums. You can reduce your premiums by agreeing to take on more risk, which means increasing your deductible. Your deductible is the amount you have to pay when filing a claim before the insurance company will pay out anything to you for damages.

Type of Vehicle

The age and value of your vehicle will also determine the type of policy you need. If you have a car of low dollar value, you may not want to purchase collision or comprehensive coverage unless your lender requires it. Collision coverage pays for damage to your car from a collision, regardless of fault, while comprehensive coverage protects against theft and damage caused by an incident other than a collision, such as fire, flood, or vandalism.

In summary, to determine the type of auto insurance policy you need, consider your state's requirements, your financial situation, and the type of vehicle you own. Review your policy regularly and choose the proper coverages and levels to ensure you have the protection you need.

Admiral Gap Insurance: What You Need to Know

You may want to see also

To check if you need commercial or personal auto insurance

Auto insurance is a necessity, but it can be confusing to determine whether you need commercial or personal auto insurance. Here are some key factors to consider:

Vehicle Ownership

One crucial distinction between commercial and personal auto insurance is vehicle ownership. If a business owns the vehicle, it typically needs to be insured under a commercial policy. This includes vehicles registered or titled to a business, partnership, LLC, or corporation. On the other hand, if you are a sole proprietor and own the vehicle yourself, personal auto insurance may suffice, especially if you only use it for commuting.

Vehicle Type and Weight

The type and weight of the vehicle play a significant role in determining the type of insurance needed. Commercial auto insurance is usually required for vehicles heavier than a typical pickup or SUV, such as dump trucks, semi-trucks, or commercial trailers. These vehicles can cause more damage in an accident, necessitating higher coverage limits.

Vehicle Usage

How you use your vehicle is another important consideration. Commercial auto insurance is often needed if you frequently travel to different job sites, transport goods or equipment, or drive clients or employees as part of your work. Personal auto insurance typically excludes business use, so you won't be covered if you have an accident while driving for work purposes. However, if you only occasionally use your vehicle for business purposes, you may be able to add limited business coverage to your personal policy or purchase hired and non-owned auto insurance (HNOA) to cover business use.

Liability Limits and Coverage

Commercial auto insurance typically offers higher liability limits and covers more complex claims than personal auto insurance. If your business vehicle requires higher liability limits or you need protection against auto-related lawsuits and settlements, commercial insurance is the better option. Commercial policies often include all employees as additional insureds, whereas personal policies usually only cover the vehicle owner and their immediate family members.

In summary, determining whether you need commercial or personal auto insurance depends on various factors, including vehicle ownership, type, usage, and the required liability limits and coverage. It's important to carefully consider your specific circumstances and consult with an insurance agent to ensure you have the appropriate level of coverage.

Auto Insurance: Illinois' Legal Requirements Explained

You may want to see also

To see if you qualify for any discounts

Auto insurance companies offer a wide range of discounts to their customers. These discounts are a great way to save money on your insurance premium. One of the reasons insurers check your details is to see if you qualify for any of these discounts.

Good Student Discount

If you are a high school or college student with good grades, you may be eligible for a discount on your car insurance. Most insurance companies require students to be full-time and maintain at least a B average to qualify. The discount percentage can range from 8% to 25% of the premium.

Resident Student Discount

If you are a student who lives away from home, more than 100 miles from your insured vehicle, you may be eligible for this discount. The student must not have regular access to the insured vehicle and is usually required to be under 25 years old. This discount can save you between 7% and 35% on your premium.

Good Driver Discount

If you have a clean driving record, with no accidents or violations, you can qualify for a good driver discount. The criteria for this discount vary, but generally, insurers look for drivers who have been incident-free for a certain period, typically between three and five years. The discount can range from 10% to 40% of the premium.

Driver Education Discount

Taking an approved defensive driving or safe driver course can also reduce your insurance rates. This discount is usually in the range of 2% to 10% of the premium.

Safety Features Discount

If your vehicle is equipped with additional safety technology, such as anti-lock brakes, stability control, or passive restraints like airbags, you may be eligible for a discount. The discount percentage can vary, but it is typically between 4% and 40% of the premium.

Anti-Theft System Discount

Insurers also offer discounts for vehicles with anti-theft devices, such as alarms, LoJack, or steering wheel locks. The discount can be up to 25% of your insurance rate.

New Vehicle Discount

If you are insuring a brand-new or almost-new vehicle, you may qualify for a discount. This discount is usually offered for cars that are less than three years old and can range from 5% to 20% of the premium.

Policy Discounts

Insurers also offer discounts to retain customers and as an incentive to switch to their company. These include customer loyalty discounts, new customer discounts, and continuously insured discounts. These discounts can range from 2% to 15% of the premium.

It is important to note that the availability and percentage of discounts may vary by insurance company and state. It is always a good idea to review the discounts offered by your insurer and ask if you qualify for any of them.

Amica Auto Insurance: What You Need to Know

You may want to see also

To ensure you get the most accurate rates

Vehicle Information

Auto insurers will ask for basic information about your vehicle, including the year, make, model, and trim level. This information helps insurers evaluate the vehicle's claims history, repair costs, and value. Luxury SUVs, for instance, may cost more to insure than economy cars due to their higher replacement value.

Vehicle Usage

Insurers will want to know how you use your vehicle, including whether it is for personal or business purposes, and if it is used for commuting to work or school. Commercial vehicles or those used for business purposes may require a different type of policy and pricing. Insurers also consider annual mileage, as higher mileage vehicles are generally subject to greater risk and more frequent claims.

Anti-Theft Devices

If your car is equipped with an anti-theft device, you may be eligible for a discount on your comprehensive coverage. Active devices, such as steering wheel locks, and passive devices, such as engine immobilizers, can provide different levels of discounts, so it's important to know the specifics of your vehicle's security features.

Loan or Lease Information

Insurers need to know if your vehicle is financed, leased, or owned outright. This information doesn't typically affect your rates but may determine the coverages and limits you need. For instance, leased vehicles often require higher liability limits, and financed vehicles usually require collision and comprehensive coverage.

Driving Record

Your driving record is a critical factor in determining your insurance rates. Insurers will ask about any violations, accidents, or claims on your record. A clean driving record can result in a good driver discount, while multiple violations or accidents may increase your rates, as they indicate a higher risk.

Personal Information

In addition to your driving record, insurers may ask about your marital status, occupation, education level, and homeownership status. Statistical data suggest that married individuals, certain occupations, and homeowners tend to file fewer claims, which can result in discounted rates.

By providing honest and detailed answers to these questions, you can help auto insurers calculate the most accurate rates for your specific circumstances.

Insuring Mom: Adding a Parent to Your Auto Policy

You may want to see also

Frequently asked questions

Auto insurers use your address to calculate your insurance premium. Your location is one of the factors that determine the cost of your insurance, as certain areas are associated with higher risks of theft, vandalism, and accidents.

Auto insurers use your credit score to calculate your insurance premium. A credit-based insurance score is used to determine how likely you are to file a claim, giving insurers an idea of the risk they are taking on by covering you.

Auto insurers use your driving history to calculate your insurance premium. A clean driving record can help you get lower auto insurance rates, whereas a history of accidents or violations can increase your rates.