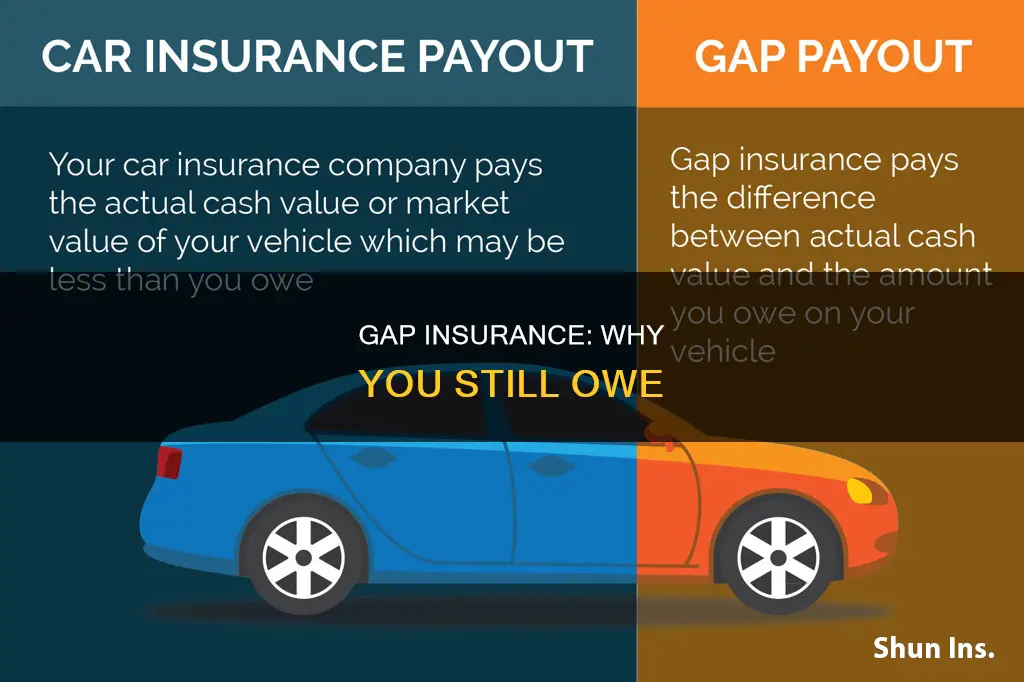

Gap insurance is a type of coverage that can help you pay the difference between the actual cash value (ACV) of your car and the remaining loan balance. However, it is important to note that gap insurance does not cover every situation. For example, it will not cover the cost of a rental car after an accident or damage to other people's property. Additionally, if you still owe more on your loan than your car is worth, even with gap insurance, you may be upside down on your loan, meaning you will have to pay out of pocket to make up the difference.

| Characteristics | Values |

|---|---|

| When is gap insurance needed? | When the compensation received for a total loss of your vehicle is less than the amount still owed on a car loan. |

| What does gap insurance cover? | The difference between the insurance payout and what's left on your auto loan. |

| When is gap insurance not needed? | When you've paid a large down payment, paid off enough of your loan, or your lease agreement doesn't require it. |

| When does gap insurance not pay? | When the car is not a total loss, the policy has lapsed due to non-payment, or the claim is over the limit. |

What You'll Learn

- Gap insurance doesn't cover the cost of a rental car after an accident

- Gap insurance doesn't cover damage to other people's property

- Gap insurance doesn't cover repairs after an accident

- Gap insurance doesn't cover the value of a stolen car

- Gap insurance doesn't cover loan balances rolled over into a new loan

Gap insurance doesn't cover the cost of a rental car after an accident

Gap insurance is a type of optional auto insurance that covers the cost difference between the remaining loan balance and the depreciated value of a car that has been stolen or deemed a total loss. In other words, gap insurance ensures that you don't owe money on a car loan after your car has been stolen or destroyed.

However, gap insurance does not cover the cost of a rental car after an accident. If your car is damaged but still drivable, you will need to pay for a rental car out of your own pocket, unless you have rental car reimbursement insurance.

Gap insurance also does not cover:

- Car payments in the case of financial hardship, job loss, disability, or death.

- Repairs to your vehicle.

- The value of your car or the balance of a loan if your car is repossessed.

- The diminished value of your car after an accident.

- A down payment for a new car.

- Carry-over balances on any loans you rolled over into your new car loan.

- Extended warranties you add to your car loan.

In short, gap insurance is not a "super coverage" policy that protects you from all financial responsibilities related to your car. It is designed to cover the gap between the remaining loan amount and the depreciated value of your car in the event of theft or total loss.

Vehicle Insurance: Rising Costs Explained

You may want to see also

Gap insurance doesn't cover damage to other people's property

Gap insurance, or guaranteed asset protection, is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the actual cash value (ACV) of the vehicle and the current outstanding balance on your loan or lease. However, it is important to note that gap insurance does not cover damage to other people's property. This type of coverage is meant to protect you from owing money on a car that you can no longer drive due to it being stolen or totaled.

Gap insurance is particularly useful if you have a car loan that is higher than your car's value, which can happen if you have a long loan term, a low down payment, or extra fees and charges added to your loan. It can also be beneficial if your vehicle depreciates quickly, as some cars do. By purchasing gap insurance, you can ensure that you won't be left paying for a car that you can no longer use.

While gap insurance can provide valuable financial protection, it is important to understand its limitations. In addition to not covering damage to other people's property, gap insurance also does not cover rental car fees, the value of a car that has been stolen or repossessed, loan balances rolled over into a new loan, down payments on a new car, extended warranty costs, or your car's reduced value if it is still drivable after an accident.

To determine if gap insurance is right for your situation, consider factors such as the amount of your down payment, the length of your loan term, the depreciation rate of your vehicle, and whether you have sufficient savings to cover the gap in the event of a total loss or theft.

Gap Insurance: Requesting from Dealers

You may want to see also

Gap insurance doesn't cover repairs after an accident

Gap insurance is a type of auto insurance coverage that covers the difference between what you owe on your car and its actual cash value if it is damaged or totaled. It is important to note that gap insurance is optional and not required by any state as part of your car insurance policy. It is meant to protect you from owing money on a car that is no longer driveable.

While gap insurance can help cover the cost of a total loss, it does not cover repairs after an accident. Gap insurance is designed to bridge the gap between the actual cash value of your vehicle and the amount you still owe on your lease or loan when your vehicle is stolen or totaled. In other words, it helps pay off your loan if your car is stolen or totaled and you owe more than it is worth.

For example, if you owe $25,000 on your loan and your car is only worth $20,000, gap insurance can cover the $5,000 difference, minus your deductible. However, if your car is damaged but still drivable, gap insurance will not cover the cost of repairs. In this case, you would need to rely on your comprehensive or collision coverage to pay for the repairs.

It is important to understand the limitations of gap insurance before purchasing it. While it can provide valuable protection in certain situations, it does not cover every type of expense related to your vehicle. Repairs after an accident are typically covered by collision or comprehensive insurance, not gap insurance.

Insurance Surveillance: What to Do

You may want to see also

Gap insurance doesn't cover the value of a stolen car

Gap insurance, or guaranteed asset protection, is an optional form of coverage that pays the difference between what your vehicle is worth and how much you owe on your car loan at the time it is stolen or totaled. This type of insurance is useful if you have a car loan that is higher than your car's value. This can occur if you have a long-term loan, a low down payment, or extra fees and charges added to your loan. Some cars also lose value faster than others.

Gap insurance does not cover the value of a stolen car. It is designed to cover the difference between the insurance payout and what is left on your auto loan. In other words, it covers the "gap" between your car's value and the amount you still owe. This means that if your car is stolen, you will still need to pay off the remaining balance on your loan.

For example, let's say your new car is stolen, and at the time it is worth $25,000. Unfortunately, you still owe $30,000 on the car. You have comprehensive insurance, which will pay for the value of your car at the time of theft. You are responsible for your $500 insurance deductible, and then the insurance company pays $24,500 to your lender. There is still a gap of $500 that you are responsible for paying. Gap insurance is designed to pay this final $500 so that you don't owe money on a stolen or totaled car.

In summary, gap insurance does not cover the value of a stolen car. Instead, it covers the difference between the insurance payout and the remaining balance on your loan, ensuring that you don't owe money on a car that you can no longer drive.

Rented Vehicle Insurance: What You Need to Know

You may want to see also

Gap insurance doesn't cover loan balances rolled over into a new loan

Gap insurance, or guaranteed asset protection, is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the insurance payout and what's left on your auto loan. However, it is important to note that gap insurance does not cover loan balances rolled over into a new loan. This means that if you have an existing auto loan balance that you roll over into a new loan when purchasing a new car, gap insurance will not cover that rolled-over balance.

When you buy a car with a loan, you agree to pay back the lender over a certain period. However, if your car is in an accident and deemed a total loss before you finish paying off the loan, you may end up owing more money than your car is worth. This situation is called being "upside down" or "underwater" on your loan. Gap insurance is designed to protect you from this scenario by covering the difference between your car's value and your remaining loan balance.

While gap insurance can provide valuable protection, it is essential to understand its limitations. In addition to not covering loan balances rolled over into a new loan, gap insurance also does not cover the following:

- Your car payments if you suffer financial hardship.

- Repairing your vehicle if it is damaged but still drivable.

- The value of a car that has been stolen or repossessed.

- Down payments on a new car.

- Extended warranty costs on your existing or new vehicle.

- Rental car fees while you are without a car.

- Your car's reduced value if it is in an accident but still drivable.

Before purchasing gap insurance, it is important to carefully review the policy documents and understand the specific coverage details, limitations, and exclusions. Additionally, it is worth noting that gap insurance is typically only necessary when you owe more on your car loan than the car is worth. If your loan balance is less than or close to the car's value, you may not need gap insurance.

Gap Insurance: The General's Coverage

You may want to see also

Frequently asked questions

Guaranteed auto protection (GAP) insurance covers the difference between the compensation received after a total loss of a vehicle and the amount still owed on a car loan.

GAP insurance only covers the difference between the insured current value of a vehicle and the loan amount. It does not cover other costs such as repairs, regular loan payments, or a rental car after an accident.

GAP insurance does not cover any damage that is not a total loss. It also does not cover claims that are over the limit or if policy premiums have not been paid.

GAP insurance can help protect against financial losses due to depreciation. It is especially useful for those who put no money down on a car and choose a long payoff period, as they may owe more than the car's current value.

You can purchase GAP insurance from your lender or insurance company, or it may be included in your existing car insurance policy. It is an optional product but may be required by the terms of your lease or loan agreement.