Many insurance agents strongly advocate for whole life insurance, a permanent policy that combines savings and coverage. They emphasize its long-term benefits, such as guaranteed death benefits, tax-deferred growth, and the potential for cash value accumulation. Agents often highlight whole life's ability to provide financial security for beneficiaries, especially in the face of unexpected events, and its role in building wealth over time. This approach is particularly appealing to those seeking a comprehensive financial plan that offers both protection and investment opportunities.

| Characteristics | Values |

|---|---|

| Long-Term Coverage | Whole life insurance provides permanent coverage, ensuring protection for the entire life of the insured individual. |

| Cash Value Accumulation | It builds cash value over time, which can be borrowed against or withdrawn, offering financial flexibility. |

| Guaranteed Death Benefit | The death benefit is guaranteed and will be paid out as a lump sum to the policyholder's beneficiaries upon the insured's death. |

| Investment Component | The policy includes an investment component, allowing the policyholder to potentially earn interest on the cash value. |

| Income Generation | Policyholders can take out loans against the cash value, providing a source of income during retirement. |

| Legacy Planning | It can be used as a tool for estate planning, helping to ensure a financial legacy for beneficiaries. |

| Predictable Premiums | Premiums are typically level or increasing, providing stability and predictability in insurance costs. |

| No Medical Exam in Some Cases | Certain whole life policies offer no medical exam options, making it accessible to individuals with health concerns. |

| Portability | The policy is portable, meaning it can be transferred or converted to a different type of policy if needed. |

| Tax Advantages | In some jurisdictions, the cash value growth in whole life insurance may be tax-deferred. |

What You'll Learn

- Long-Term Financial Security: Whole life insurance provides a steady income stream for beneficiaries over a person's lifetime

- Tax Advantages: It offers tax-deductible premiums and tax-deferred growth, benefiting those seeking tax benefits

- Guaranteed Death Benefit: This type of insurance guarantees a fixed payout upon the insured's death, offering financial security

- Investment Component: It includes an investment component, allowing agents to promote wealth accumulation and potential returns

- Legacy Planning: Agents often highlight how whole life can help build a legacy by providing financial support to heirs

Long-Term Financial Security: Whole life insurance provides a steady income stream for beneficiaries over a person's lifetime

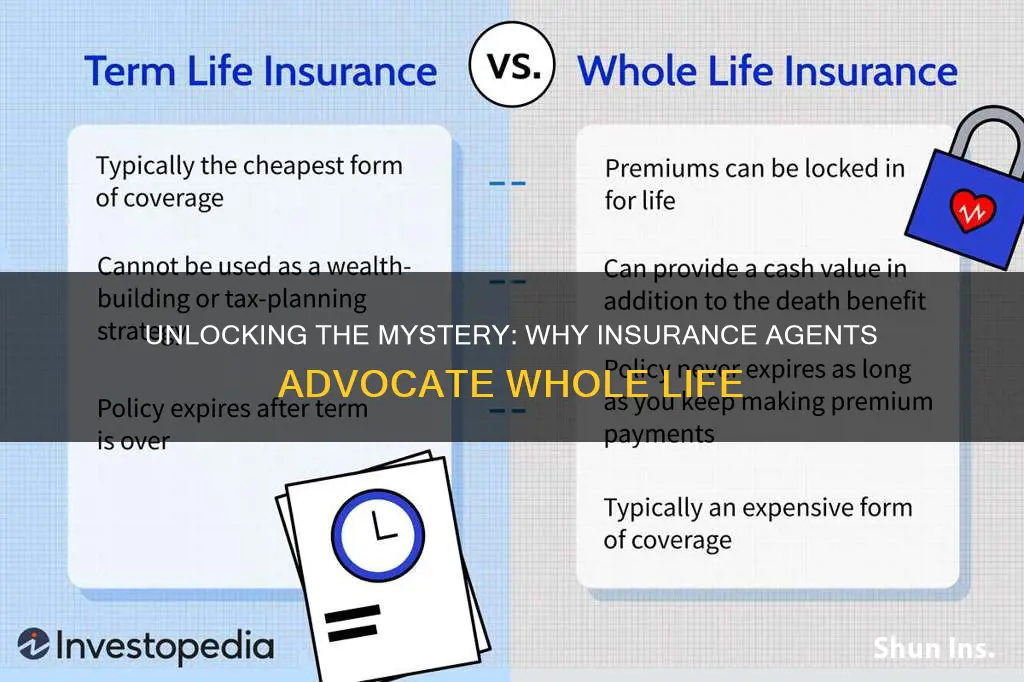

Whole life insurance is a powerful tool for long-term financial security, offering a consistent and reliable income stream for beneficiaries throughout an individual's lifetime. This type of insurance provides a sense of financial stability and peace of mind, knowing that your loved ones will be taken care of, even if you are no longer around. One of the key advantages of whole life insurance is its longevity. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers permanent coverage, ensuring that your beneficiaries receive financial support for as long as they need it. This long-term commitment is particularly valuable for those who want to provide for their families or dependents over an extended period, such as until their children finish college or become financially independent.

The steady income stream associated with whole life insurance is a significant benefit. As the policyholder, you pay a set premium over the years, and in return, you receive a guaranteed death benefit when you pass away. This death benefit is then paid out to your designated beneficiaries, providing them with a consistent financial source. The beauty of this arrangement is that the income stream is predictable and secure, allowing beneficiaries to rely on it for various financial needs, such as covering daily expenses, funding education, or even starting a new business. This financial support can be especially crucial during challenging life events, such as the loss of a primary income earner or unexpected medical expenses.

What sets whole life insurance apart is its ability to grow over time. As the policy accumulates cash value, it can be borrowed against or withdrawn, providing additional financial flexibility. This feature is particularly useful for those who want to access the policy's value without terminating the coverage. By utilizing the cash value, policyholders can make tax-free withdrawals, which can be used for various purposes, such as starting a business, investing in real estate, or simply building an emergency fund. Moreover, the cash value can be borrowed against, allowing policyholders to access funds without permanently altering the policy's coverage.

For insurance agents, promoting whole life insurance is often driven by the desire to provide clients with a comprehensive financial solution. Whole life insurance offers a unique combination of coverage, savings, and investment opportunities, all within a single policy. Agents understand that by presenting this product, they can help clients secure their family's financial future and build a legacy. The long-term nature of whole life insurance allows agents to offer a more stable and reliable financial plan, which can be particularly appealing to those seeking a secure investment option.

In summary, whole life insurance is a powerful tool for long-term financial security, providing a steady income stream for beneficiaries and offering a range of financial benefits. Its permanent coverage, predictable income, and potential for cash value growth make it an attractive option for those seeking to secure their family's future. By understanding the value of whole life insurance, insurance agents can effectively guide clients toward a more financially secure and stable path.

Group Life Insurance: Portability and Your Options

You may want to see also

Tax Advantages: It offers tax-deductible premiums and tax-deferred growth, benefiting those seeking tax benefits

Whole life insurance is a popular product that insurance agents often promote, and one of the key reasons for this push is the significant tax advantages it offers. For individuals and families seeking to optimize their financial strategies, understanding these tax benefits is crucial.

One of the primary tax advantages of whole life insurance is the ability to deduct the premiums paid. When you purchase a whole life policy, you can claim a portion of the premium as a tax deduction on your annual tax return. This is particularly beneficial for those in higher tax brackets, as it allows them to reduce their taxable income and, consequently, their overall tax liability. By deducting the premiums, individuals can effectively lower their tax burden, making whole life insurance an attractive option for those looking to maximize their financial efficiency.

Additionally, whole life insurance provides tax-deferred growth on the cash value of the policy. As the policyholder, you can accumulate cash value over time, and this growth is not subject to annual income tax. This means that the money grows tax-free, allowing your investments to potentially increase in value without the immediate impact of taxes. This tax-deferred growth is a powerful feature, especially for long-term financial planning, as it enables your money to grow and compound without the typical tax implications associated with other investment vehicles.

The tax advantages of whole life insurance are particularly appealing to those who want to maximize their tax benefits and, in turn, increase their overall financial savings. By offering both tax-deductible premiums and tax-deferred growth, this type of insurance provides a comprehensive solution for individuals seeking to optimize their financial strategies while also ensuring their loved ones are protected. It is a strategy that can benefit those looking to build a substantial financial cushion while also enjoying the tax advantages that come with it.

In summary, the tax advantages of whole life insurance are a significant factor in its promotion by insurance agents. The ability to deduct premiums and the tax-deferred growth on the cash value make it an attractive financial tool for those seeking to optimize their tax situation and build long-term wealth. Understanding these benefits can help individuals make informed decisions about their insurance and financial planning needs.

Haven Life: Insuring Innovation for the Reporter's Life

You may want to see also

Guaranteed Death Benefit: This type of insurance guarantees a fixed payout upon the insured's death, offering financial security

The concept of a guaranteed death benefit is a cornerstone of whole life insurance, and it's a feature that insurance agents often highlight when promoting this type of policy. This benefit ensures that, regardless of the insured's age or health at the time of death, the beneficiary will receive a predetermined sum of money. This financial security is a powerful incentive for individuals and families, as it provides a safety net and peace of mind.

When an insurance agent discusses whole life insurance, they often emphasize the guaranteed death benefit as a key advantage. This benefit is particularly attractive because it offers financial protection for the insured's loved ones, especially in the event of an untimely death. The fixed payout can be used to cover various expenses, such as funeral costs, outstanding debts, or even provide a financial cushion for the family to ensure their long-term financial stability.

The guaranteed aspect of this benefit is crucial, as it removes the uncertainty associated with other forms of life insurance. Term life insurance, for example, provides coverage for a specific period, and the payout is only guaranteed if the insured dies within that term. With whole life, the coverage is permanent, and the death benefit is assured, providing a sense of security that can be invaluable to policyholders.

Insurance agents often explain that the guaranteed death benefit is a long-term commitment, ensuring that the insured's family is protected even if their financial situation changes over time. This is especially relevant for those with dependent family members or significant financial obligations. The fixed payout can provide a reliable source of funds to meet these responsibilities, even if the insured's income is no longer available.

In summary, the guaranteed death benefit is a compelling reason for individuals to consider whole life insurance. It offers a level of financial security and peace of mind that is difficult to replicate with other insurance products. By understanding this feature, insurance agents can effectively communicate the value of whole life, helping clients make informed decisions about their long-term financial protection.

Borrowing on Veterans Group Life Insurance: Is It Possible?

You may want to see also

Investment Component: It includes an investment component, allowing agents to promote wealth accumulation and potential returns

The investment component of whole life insurance is a key feature that insurance agents often highlight when promoting this type of policy. This component is designed to provide a way for individuals to grow their money over time, offering a potential return on investment while also providing long-term financial security. Here's a detailed breakdown of how this works and why it's an attractive feature for many:

When an individual purchases a whole life insurance policy, a portion of their premium goes towards funding the insurance coverage, while the rest is allocated to an investment account. This investment account is typically managed by the insurance company and can be invested in various assets such as stocks, bonds, and mutual funds. The goal is to generate returns that can outpace inflation and potentially provide a higher return than traditional savings accounts or certificates of deposit (CDs). Over time, the value of the investment account grows, and this growth is directly linked to the performance of the investments made by the insurance company.

One of the advantages of this investment component is that it allows individuals to benefit from the power of compounding. Compounding occurs when the returns on an investment are reinvested, generating additional returns over time. This can lead to significant growth in the investment portion of the policy, especially over a long period. For example, if an individual invests $10,000 in a whole life policy with an annual return of 5%, after 20 years, the investment account could grow to over $26,000, assuming no additional contributions. This potential for wealth accumulation is a strong incentive for those seeking to build their financial portfolio.

Insurance agents often emphasize that the investment component of whole life insurance provides a level of security and predictability that is hard to find in other investment vehicles. Unlike the stock market, where returns can be volatile, the investment portion of a whole life policy offers a guaranteed rate of return, which is typically higher than what one might find in a traditional savings account. This predictability can be appealing to risk-averse investors who want a more stable approach to growing their wealth.

Additionally, the investment component of whole life insurance can be a valuable tool for long-term financial planning. The policyholder can access the funds in the investment account through withdrawals or loans, providing flexibility for various financial needs. This feature allows individuals to use their investment growth for education expenses, home purchases, or any other significant financial goals they may have. Furthermore, the death benefit of the insurance policy, which is typically tax-free, can be used to provide financial security for beneficiaries, ensuring that their financial goals are met even if the policyholder passes away.

In summary, the investment component of whole life insurance is a powerful tool for wealth accumulation and financial security. It offers individuals a way to grow their money over time, providing potential returns that can be significant and stable. By promoting this feature, insurance agents aim to help clients achieve their financial objectives while also ensuring that their loved ones are protected in the event of their passing. Understanding this aspect of whole life insurance can be crucial in making informed financial decisions.

Understanding Tax Implications on Life Insurance Payouts

You may want to see also

Legacy Planning: Agents often highlight how whole life can help build a legacy by providing financial support to heirs

Legacy planning is a crucial aspect of financial strategy, and insurance agents often emphasize the role of whole life insurance in this context. When individuals consider their long-term financial goals, they might envision leaving a substantial inheritance for their loved ones. Whole life insurance policies can be a powerful tool to achieve this objective. Here's how:

Whole life insurance is a permanent policy that offers lifelong coverage, ensuring that your beneficiaries receive a death benefit regardless of the policy's maturity. This feature is particularly attractive for legacy planning as it provides a guaranteed financial safety net for your heirs. Unlike term life insurance, which provides coverage for a specific period, whole life insurance builds cash value over time, which can be borrowed against or withdrawn, providing additional financial flexibility.

Agents often explain that the cash value accumulation in whole life policies can be a significant asset for future generations. As the policyholder, you can name beneficiaries who will receive the death benefit upon your passing. This financial support can be a substantial contribution to the heirs' financial well-being, allowing them to cover various expenses, such as education costs, mortgage payments, or even starting a business. By providing this financial legacy, you ensure that your loved ones have the means to maintain their current standard of living and potentially achieve their own financial goals.

Furthermore, whole life insurance can be structured to align with your specific legacy planning objectives. Agents can assist in tailoring the policy to meet your needs, ensuring that the death benefit is sufficient to make a meaningful impact on your heirs' lives. This level of customization allows for a more personalized approach to legacy planning, catering to individual family circumstances.

In summary, insurance agents promote whole life insurance as a means to secure a financial legacy for beneficiaries. The policy's permanent nature, cash value accumulation, and flexibility in naming beneficiaries make it an effective tool for providing financial support and peace of mind for future generations. By incorporating whole life insurance into legacy planning, individuals can take a proactive approach to ensuring their loved ones' financial security.

Lying About Weight on Life Insurance: Is It Worth It?

You may want to see also

Frequently asked questions

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, offering a sense of security and financial protection to the policyholder and their beneficiaries. Agents often promote it because it guarantees a death benefit, meaning the insurance company will pay out a specified amount upon the insured's death, regardless of when it occurs. This feature is particularly attractive to those seeking long-term financial security and a consistent financial plan.

One of the key benefits is the accumulation of cash value over time, which can be borrowed against or withdrawn, providing a source of funds for various financial needs. Additionally, whole life insurance offers a fixed premium, ensuring consistent payments and predictable costs. This predictability is appealing to those who want a stable financial strategy. The policy also builds equity, allowing the policyholder to build a substantial cash value that can be passed on as an inheritance or used for other financial goals.

Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifelong coverage. This means that once the policy is in force, the death benefit is guaranteed, providing a sense of long-term security. Agents may prefer it because it provides a comprehensive financial solution, allowing them to tailor the policy to meet the client's needs, including savings, investment, and protection components. The ability to build cash value and the potential for tax advantages make whole life insurance an attractive option for those seeking a more comprehensive insurance strategy.