Life insurance is a popular way for the wealthy to provide for their loved ones and ensure their wealth is transferred to their heirs after their death. Whole life insurance, a type of permanent life insurance, is particularly attractive to high-net-worth individuals as it offers a fixed return with steady, tax-free dividends and a death benefit that can be passed on to beneficiaries. This makes it an effective tool for transferring wealth to future generations and preserving the family's wealth. However, whole life insurance is generally more expensive than term life insurance and may not be a suitable investment for everyone. For the wealthy, it is important to carefully evaluate the complexities of whole life insurance policies and consult with qualified professionals to make informed decisions.

What You'll Learn

- Whole life insurance is a good investment for the rich as it offers a fixed return with steady tax-free dividends

- It is a useful financial tool for business owners or high-net-worth individuals

- It can be used as an investment tool with tax benefits while the insured is still alive

- It is a good option for those who have already maximised contributions to other tax-deferred savings accounts

- It can be a useful tool for transferring wealth to future generations

Whole life insurance is a good investment for the rich as it offers a fixed return with steady tax-free dividends

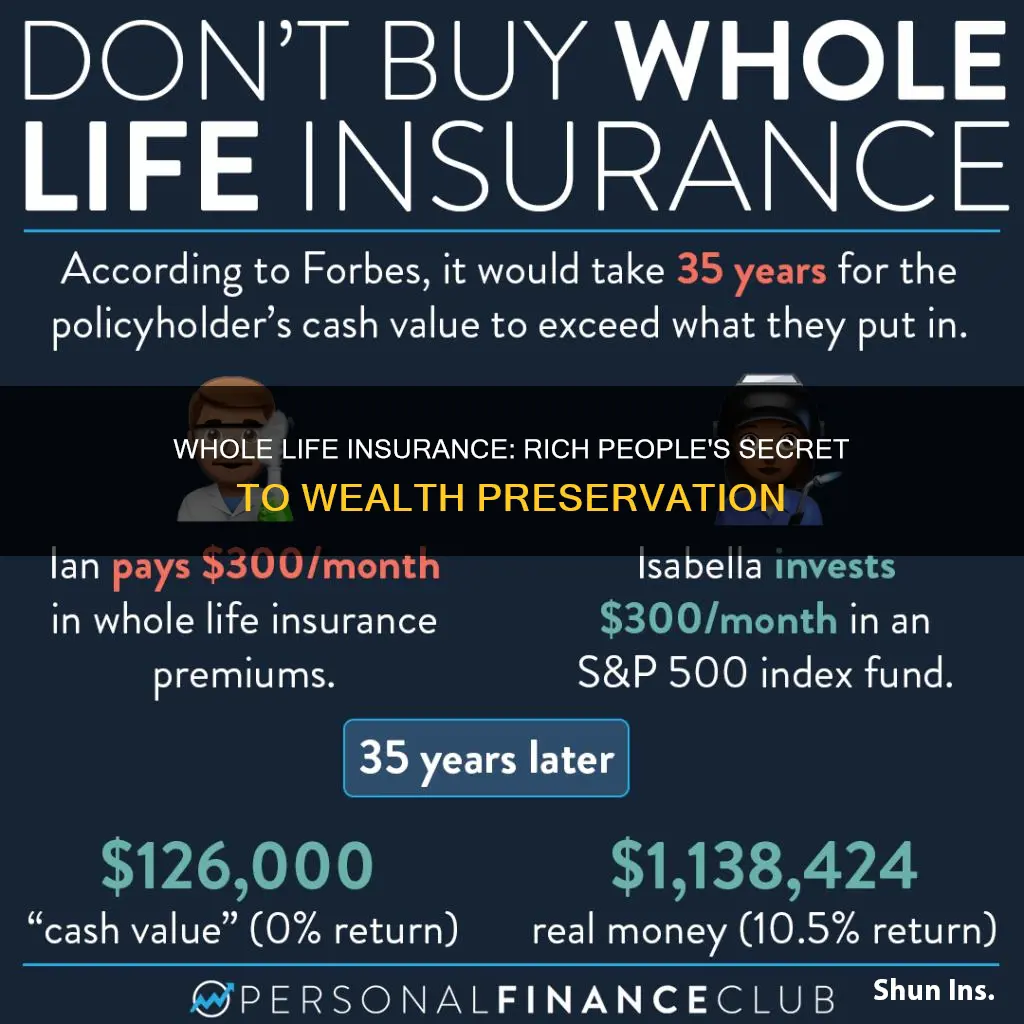

Whole life insurance is a form of permanent life insurance that covers the insured for their entire life, provided that the premiums are paid on time. It is distinct from term life insurance, which covers the insured for a set period, such as 10, 20, or 30 years. Whole life insurance is generally more expensive than term life insurance due to its savings component and fixed return structure. While it may not be a suitable investment for everyone, whole life insurance can be particularly advantageous for high-net-worth individuals seeking to maximise their after-tax estate and pass on wealth to their heirs.

Whole life insurance offers a fixed return with steady tax-free dividends, providing an additional stream of income. The cash value of the policy accumulates over time, earning a fixed rate of interest. This cash value component can be accessed during the lifetime of the insured, providing liquidity. The policy can also be borrowed against to pay for expenses such as college fees, with no income tax owed as long as the cash value remains within the policy. This feature makes whole life insurance a valuable financial tool for high-income earners, allowing them to leverage their wealth for multiple purposes.

The tax benefits of whole life insurance are particularly attractive to high-net-worth individuals. The death benefits from life insurance are income-tax-free for the beneficiaries, making them an ideal form of inheritance. This helps in preserving the family's wealth and ensuring financial security for future generations. Additionally, life insurance can assist in covering estate taxes, providing liquidity to pay these taxes without forcing the sale of assets such as real estate or businesses. By utilising whole life insurance, wealthy families can maintain control over their wealth and pass it on intact to their heirs.

While whole life insurance offers steady returns and tax advantages, it is important to consider the complexities involved. Wealthy individuals should carefully evaluate the features and funding requirements of the policy, seeking advice from financial advisors and insurance professionals. The accumulated cash value in whole life insurance may be subject to limitations on access, including surrender charges or interest on policy loans. Additionally, the purchasing power of the death benefit may erode over time due to inflation. Nevertheless, with proper management and structuring, whole life insurance can be a valuable tool for high-net-worth individuals to protect and transfer their wealth.

Life Insurance and ADD: Understanding the Connection

You may want to see also

It is a useful financial tool for business owners or high-net-worth individuals

Life insurance is a useful financial tool for business owners and high-net-worth individuals for several reasons. Firstly, it serves as a wealth transfer strategy, allowing them to pass on their wealth to future generations or beneficiaries upon their death. This is particularly important for business owners who want to keep their assets in the family and ensure a comfortable financial cushion for their surviving family members.

Secondly, life insurance offers tax benefits. The death benefits from life insurance are income-tax-free for the beneficiaries, which is especially advantageous for high-net-worth individuals who want to provide an inheritance that doesn't create an additional tax burden for their heirs. Life insurance can help cover estate taxes, preventing the need to sell off assets like real estate or a business to pay these taxes.

Thirdly, life insurance can act as an investment tool during one's lifetime. Whole life insurance, for example, offers a fixed return with steady, tax-free dividends, providing an additional stream of income. The cash value of a whole life policy accumulates over time and can be borrowed to pay for expenses or invested in mutual funds while retaining the tax benefits.

Additionally, life insurance can provide financial security for business owners and their families. In the event of an unexpected passing, life insurance can facilitate a buy/sell arrangement or a key-man policy, ensuring the continuity of the business.

Lastly, life insurance can be a valuable asset for high-net-worth individuals. They can sell their policy through a life settlement if they no longer need it, receiving an immediate cash payout.

While life insurance is a beneficial financial tool for business owners and high-net-worth individuals, it is important to note that the suitability of whole life insurance specifically depends on their financial situation, goals, and risk tolerance. It tends to be more expensive than term life insurance due to its savings component, and the growth potential may not align with the financial goals of all wealthy individuals. Consulting with qualified professionals is crucial to making informed decisions about life insurance choices.

QuickBooks Life Insurance: Easy Booking Steps

You may want to see also

It can be used as an investment tool with tax benefits while the insured is still alive

Whole life insurance is a type of permanent life insurance that covers the insured for their entire life as long as the premiums are paid on time. It is generally more expensive than term life insurance due to its built-in savings component. This savings component allows the insured to accumulate cash value over time, which can be used as an investment tool and a source of financial security while they are still alive.

The cash value of a whole life insurance policy grows at a fixed rate that is guaranteed by the insurer. It is also tax-deferred, meaning that any interest earned on the cash value is not taxed as long as the funds remain in the policy. This tax-free accumulation of cash value can provide high-net-worth individuals with an additional stream of income and a way to maximize their after-tax estate.

One way to access the cash value of a whole life insurance policy is through loans. The insured can borrow against the cash value of their policy, and the insurer will subtract any outstanding loans from the payout upon the insured's death. It is important to manage these loans carefully to avoid borrowing too much and running into issues later on.

Another option for accessing the cash value is to surrender the policy and collect the accumulated cash. However, this option may result in income tax liabilities on the value gained, and the beneficiaries will not receive a life insurance death benefit. Therefore, careful consideration is necessary before surrendering the policy.

While whole life insurance can provide investment opportunities and tax benefits, it may not be suitable for everyone. It is essential to consult with qualified financial advisors and insurance professionals to evaluate an individual's specific financial situation, goals, and risk tolerance before making any decisions regarding whole life insurance.

Life Insurance CE Courses: Where to Check and Learn

You may want to see also

It is a good option for those who have already maximised contributions to other tax-deferred savings accounts

Whole life insurance is a type of permanent life insurance, meaning the insured person is covered for their entire life as long as the premiums are paid on time. It is generally more expensive than term life insurance, but it offers a fixed return with steady tax-free dividends. This makes it a good option for those who have already maximised contributions to other tax-deferred savings accounts, such as a 401(k) or Roth IRA.

Whole life insurance policies are designed for long-term coverage and typically have inflexible premium payment schedules. The accumulated cash value can be used for various purposes, such as paying for college expenses or other costs during the policyholder's lifetime. This cash value grows on a conservative, tax-deferred basis and, if properly structured, can be accessed without income tax. This feature makes whole life insurance an effective tool for transferring wealth to future generations.

It is important to note that whole life insurance policies can be complex and require careful evaluation and ongoing management. Wealthy individuals considering this type of insurance should work closely with financial advisors and insurance professionals to fully understand the policy features, ensure proper funding, and make informed decisions about policy loans, withdrawals, or modifications.

While whole life insurance can provide numerous benefits, it may not be suitable for everyone. It is crucial for individuals to consult with qualified professionals to determine if this type of insurance aligns with their specific financial situation, goals, and risk tolerance.

Globe Life Insurance: Guaranteed Acceptance or Not?

You may want to see also

It can be a useful tool for transferring wealth to future generations

Life insurance is a popular way for the wealthy to have more money to pass on to their heirs. Whole life insurance is a type of permanent life insurance, meaning the insured person is covered for their entire life as long as the premiums are paid on time. Whole life insurance policies are designed for long-term coverage and typically have inflexible premium payment schedules. They can be an effective tool for transferring wealth to future generations.

Whole life insurance ensures that a substantial income tax-free death benefit is passed on to beneficiaries, providing financial security and preserving the family's wealth for future use. This is especially important for wealthy families, who often face significant estate tax liabilities. Whole life insurance can help offset these taxes by providing liquidity to pay estate taxes without forcing the sale of assets. This allows the family to maintain control over their wealth and pass it on intact to their heirs.

The cash value of a whole life insurance policy typically earns a fixed rate of interest and grows over time. This cash value can be accessed during the lifetime of the insured person, providing a source of funding for various purposes. However, accessing the cash value may come with limitations, such as surrender charges or policy loans with interest. While the growth potential of whole life insurance may not meet the financial goals of all wealthy families, it can be a useful tool for those seeking to transfer wealth to future generations while also having access to the policy's cash value during their lifetime.

It is important to note that whole life insurance is generally more expensive than term life insurance due to the savings component. Wealthy individuals with a high net worth can afford the upfront cost of whole life insurance and benefit from the tax advantages and wealth transfer capabilities it offers. When considering whole life insurance, it is crucial for wealthy individuals to consult with qualified professionals, including financial advisors and insurance professionals, to fully understand the policy features and ensure it aligns with their specific financial goals and risk tolerance.

Manhattan Life Supplemental Insurance: Silver Sneakers Access?

You may want to see also

Frequently asked questions

Whole life insurance is a financial tool that can help rich people leave a legacy to their loved ones and ensure their wealth is transferred to their heirs.

Whole life insurance offers a fixed return with steady tax-free dividends, providing an additional stream of income. It can also be used to invest in mutual funds while keeping the tax benefits.

The primary benefit of whole life insurance is the death benefit, which is passed on to the beneficiaries. This provides financial security and preserves the family's wealth.

Whole life insurance can help offset estate taxes by providing liquidity to pay these taxes without forcing the sale of assets. This allows rich families to maintain control over their wealth and pass it on intact to their heirs.

Whole life insurance can also be used as an investment tool and provide tax benefits during one's lifetime. The cash value of the policy can be borrowed to pay for expenses such as college fees.