Life insurance is an important financial planning tool that provides financial protection to those who depend on your income. It is a valuable part of an overall financial portfolio, offering peace of mind and a legacy for your loved ones. While it is not mandatory to have life insurance in the USA, it is a good idea to have one, especially if you have a family or dependents, as it can help them sustain their lifestyle in your absence. Life insurance can also help pay off debts, cover living expenses, and provide funds for specific future expenses such as childcare, education, or medical costs.

| Characteristics | Values |

|---|---|

| Purpose | Financial security for yourself and your family |

| Peace of mind | |

| Protection for your business | |

| Income replacement | |

| Tax-free benefit for beneficiaries | |

| Cash value growth | |

| Dividend potential | |

| Debt management | |

| Paying off debts | |

| Funding childcare and activities | |

| Paying for college | |

| Covering funeral expenses | |

| Coverage for stay-at-home parents | |

| Special needs care | |

| Estate tax reduction | |

| Coverage for federal employees | |

| Coverage for military service members |

What You'll Learn

Peace of mind and financial security for your family

Life insurance is a financial tool that provides security and peace of mind for you and your loved ones. It is a contract between an individual (the policyholder) and an insurance company. In exchange for regular premium payments, the insurance company promises to pay a lump sum amount, known as the death benefit, to the designated beneficiaries upon the policyholder's death. This payment can be a crucial financial lifeline for your loved ones when you are no longer there to provide for them.

Life insurance is important if you have people who depend on you financially. It can help protect your spouse and children from the potentially devastating financial losses that could result from your death. The death benefit can be used to pay off debts, living expenses, and any medical or final expenses. It can also be used to create a future inheritance for your heirs, who will receive the benefit income-tax-free.

When considering life insurance, it is important to assess your current financial obligations and future needs. Factors such as outstanding debts, mortgages, children's education, and daily living expenses should be taken into account. Additionally, think about your long-term goals and how your family would cope financially in your absence. The amount of coverage you need depends on your income, debts, lifestyle, and the financial needs of your beneficiaries. A common approach is to have coverage equal to 5-10 times your annual income, although some recommend 10-15 times your annual income.

There are several types of life insurance policies available, including term life insurance, which provides coverage for a specific term (e.g., 10, 20, or 30 years), and whole life insurance, which offers guaranteed protection for those who depend on you financially. Whole life insurance also has savings or investment features, allowing policy owners to access the cash value of the policy while they are still alive. Other types of life insurance include universal life and variable life, which also have cash value components.

When applying for life insurance, it is recommended to get quotes from multiple insurance companies and consider their financial security and customer treatment. You can also add riders to your policy to customize your coverage, such as a waiver of premium rider or an accidental death benefit rider. By understanding the different options available and selecting the right partner, you can have peace of mind knowing that you have taken care of your family's financial future.

How to Evaluate Your Life Insurance Premium

You may want to see also

Protection for your spouse

Life insurance is an important decision for couples to make together, as it helps protect each other. It can be a way to set a financially secure foundation for your marriage and provide a "just-in-case" plan for your partner.

There are several types of life insurance policies available for spousal protection. The most common way for spouses to obtain life insurance protection is to purchase individually-underwritten policies. It is common for both spouses to be insured, although not required. Term life insurance covers a specific period, such as 10, 20, or 30 years, and offers a death benefit if the insured person dies within the term. This type of policy can be suitable for spousal protection during a specific period, such as when children are young or when there are outstanding debts, such as a mortgage. Whole life insurance provides lifelong coverage and accumulates cash value over time. Universal life insurance is a flexible policy that combines a death benefit with a savings component, allowing policyholders to adjust premium payments and death benefits over time.

By adding a spousal rider, the primary policyholder can provide life insurance protection to their spouse without needing a separate policy. In the event of the spouse's death, the rider provides a death benefit to the primary policyholder. Spousal riders are often available for various types of life insurance policies, such as term or whole life insurance, and they provide a convenient and cost-effective way to ensure spousal protection within a single policy.

Another option for couples is a joint life insurance policy, also known as a dual life insurance policy, which covers two people under one policy. Married couples who want to lower life insurance costs and protect their assets from taxes after death may consider getting a joint insurance policy. Joint life insurance comes in two options: first-to-die and second-to-die. In a first-to-die policy, the surviving spouse will receive the death benefit payout after the first spouse dies. In a second-to-die policy, also known as a survivorship policy, the beneficiaries will receive the death benefit after both spouses have passed away.

When deciding on life insurance, it is important to consider your family's financial situation and future goals. Life insurance can provide income replacement, especially if one spouse earns more than the other, and can help cover expenses such as childcare, education, and living expenses. It can also protect your spouse from the burden of significant debt, such as mortgage and auto loans, and provide financial stability during unexpected health changes.

Life Insurance Exam: Mastering the SC Test Questions

You may want to see also

Income replacement

Life insurance is an important part of long-term financial planning for you and your family. It provides financial security and peace of mind, helping to pay off debts, living expenses, and any medical or final expenses.

Life insurance provides a safety net by offering a lump-sum payment to your beneficiaries, who can use it to cover ongoing expenses in your absence. This includes everyday expenses such as the mortgage, car payments, utilities, groceries, and gas. It can also help with final expenses like funeral, burial, and outstanding medical bills.

To calculate the necessary coverage amount for income replacement, a common guideline is to multiply your annual salary by the number of years you want to cover. For instance, if you earn $60,000 annually and want to provide five years of coverage, you'll need a $300,000 policy. This calculation can be adjusted based on anticipated raises and additional expenses like college fees. It's worth noting that this method only considers your base salary, and you may require a higher coverage amount depending on your specific circumstances.

In addition to income replacement, life insurance can also provide other benefits, such as tax-free proceeds, guaranteed cash value growth, and dividend potential. These features can help meet various financial goals and provide additional financial security for your loved ones.

Life, AD&D Insurance: What You Need to Know

You may want to see also

Tax-free benefits

Life insurance is a financial safety net for your loved ones in case of your passing. It is a way to provide for your loved ones after you're gone, and one of its biggest advantages is the tax relief it offers.

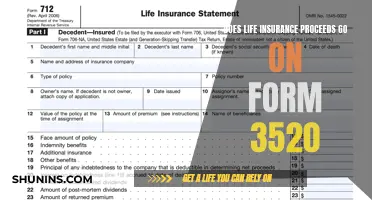

The death benefit your beneficiaries receive typically isn't taxed as income, meaning they get the full amount to use for expenses like paying off debts, covering funeral costs, or securing their future. This death benefit is generally not subject to federal income taxes, and beneficiaries will receive a guaranteed sum of money after you're gone.

Whole life insurance, in particular, offers tax benefits due to its cash value component. The cash value of a whole life insurance policy is not taxed while it's growing, which is known as "tax-deferred." This means your money grows faster because it's not reduced by taxes each year, and the interest you earn is applied to a higher amount.

Policyholders can generally borrow or withdraw money from the policy's cash value, and as long as they don't take out more than they've paid in, those withdrawals are usually tax-free. However, if there are unpaid loans against the policy, they will be deducted from the death benefit, resulting in a smaller payout for beneficiaries.

Additionally, when you're in a lower tax bracket later in life, withdrawing money from your policy can be taxed at a lower rate compared to when you were in a higher tax bracket during your prime working years.

Life After Retirement: Voluntary Life Insurance Cover

You may want to see also

Debt management

Life insurance is a crucial component of financial planning, offering protection and security for yourself and your loved ones. It is not just a policy but a plan for the future, helping to manage debts and secure your family's financial needs. While it is not mandatory, it becomes essential if others depend on your income or if you have financial obligations like mortgages or debts.

Life insurance can be a powerful tool for debt management, both during your lifetime and after. Here are some ways in which life insurance can help with debt management:

During Your Lifetime

Life insurance can be structured to help you manage and eliminate debt while you are alive. Certain life insurance policies, such as whole life or universal life insurance, accrue "'cash value'" over time. This cash value can be borrowed against to pay off high-interest credit card debt or other types of debt. This strategy, known as "becoming your own banker," allows you to borrow money from your policy to pay off existing debts while continuing to grow your wealth through compound interest. It is important to note that this approach requires discipline and long-term financial planning, as you will need to pay back the borrowed amount (with interest) to maintain the full death benefit for your beneficiaries.

After Your Lifetime

Life insurance can provide financial support for your dependents and help ensure they do not inherit your debts. Outstanding debts, such as mortgages, car loans, and credit card balances, can become a burden for your loved ones after your passing. A life insurance payout can be used by your beneficiaries to pay off these debts, ensuring your loved ones are financially secure during a difficult time. Additionally, life insurance can help secure funds for your children's future education, childcare, and extracurricular activities, providing opportunities you may have wanted for them.

In conclusion, life insurance is a valuable tool for debt management, offering financial security for yourself and your loved ones during your lifetime and beyond. It helps protect your family from financial burdens and ensures their stability and security in your absence. When considering life insurance for debt management, it is essential to consult a financial professional or licensed insurance agent to tailor a policy that fits your unique situation and needs.

Federal Life Insurance: A Good Deal or Not?

You may want to see also

Frequently asked questions

People get life insurance to provide financial security for their family and loved ones after they die. It can also help pay off debts, living expenses, and medical or final expenses.

Life insurance is not mandatory in the USA, but it is an important financial planning tool. It is a valuable part of an overall financial portfolio and can provide financial protection for you and your loved ones.

Life insurance can give you peace of mind that your loved ones will be taken care of financially if something happens to you. It can also help with debt management, income replacement, and tax-efficient wealth transfers.

When getting life insurance, it is important to consider your individual circumstances and financial goals. You should also shop around for the right coverage as there are many different types of life insurance policies available. Additionally, having a pre-existing health condition may influence rates and coverage amounts, but it does not automatically disqualify you from obtaining life insurance.