Allstate, a well-known insurance company, has a strong incentive to encourage the sale of life insurance policies. The primary reason is to provide comprehensive financial protection for individuals and families. By offering life insurance, Allstate aims to ensure that policyholders' loved ones are financially secure in the event of the insured's passing. This product not only helps cover essential expenses like mortgage payments, funeral costs, and daily living expenses but also provides a financial safety net for beneficiaries, allowing them to maintain their standard of living and achieve their financial goals. Understanding the importance of life insurance is crucial for Allstate's mission to help people live life confidently.

What You'll Learn

- Customer Needs: Allstate aims to meet customers' life insurance needs through personalized sales strategies

- Profit Potential: Selling life insurance offers high profit potential for Allstate agents and the company

- Market Demand: Life insurance is a growing market, and Allstate wants to capitalize on this demand

- Brand Awareness: Promoting life insurance enhances Allstate's brand as a comprehensive insurance provider

- Customer Retention: Selling life insurance helps retain customers and build long-term relationships

Customer Needs: Allstate aims to meet customers' life insurance needs through personalized sales strategies

Allstate, a well-known insurance company, recognizes that selling life insurance is not merely about closing a sale but about understanding and addressing the unique needs of its customers. The company's primary goal is to ensure that individuals and families have the necessary financial protection in place to safeguard their loved ones' well-being. By offering personalized sales strategies, Allstate aims to cater to the diverse requirements of its customers, providing them with tailored life insurance solutions.

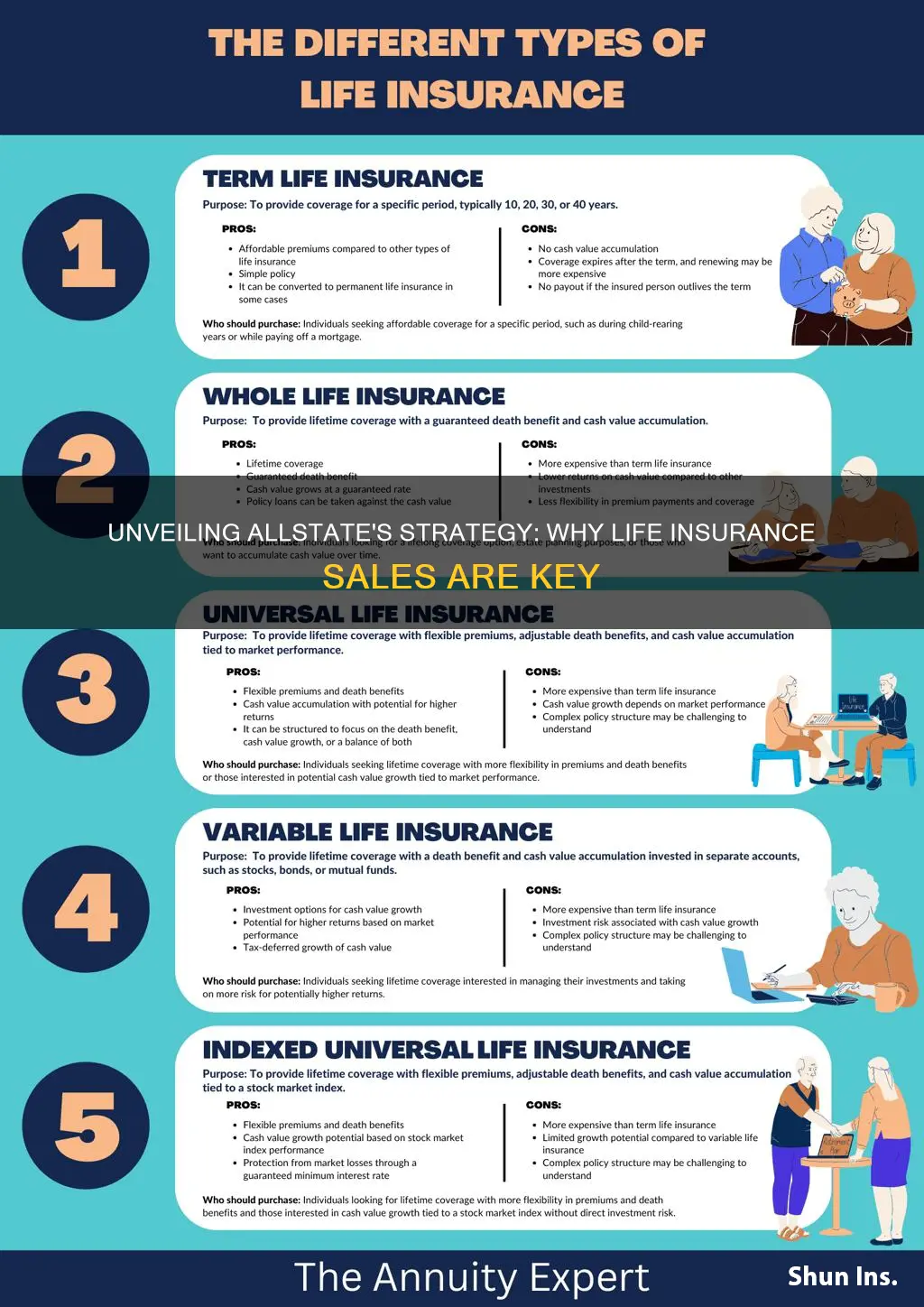

When it comes to life insurance, customers often have specific concerns and objectives. Some may seek coverage to secure their family's financial future in the event of their untimely demise, while others might focus on building a substantial cash value for future financial goals. Allstate's approach is to educate and guide customers through these considerations, ensuring they make informed decisions. By understanding their customers' priorities, Allstate can recommend appropriate coverage options, such as term life insurance for temporary needs or permanent life insurance for long-term financial security.

Personalization is key to Allstate's strategy. The company believes that each customer's situation is unique, and their life insurance needs should be addressed accordingly. For instance, a young professional starting a family might require different coverage compared to an elderly individual looking to supplement their retirement savings. Allstate's sales representatives are trained to assess these individual circumstances, offering tailored advice and products. This personalized approach not only ensures that customers receive the right coverage but also fosters a sense of trust and long-term relationship with the company.

Furthermore, Allstate understands that selling life insurance is about more than just the product itself. It involves providing valuable financial advice and educating customers on various aspects of life insurance. This includes explaining different types of policies, the importance of regular reviews, and the potential tax benefits. By empowering customers with knowledge, Allstate ensures that they can make confident decisions about their future and that of their dependents.

In summary, Allstate's focus on meeting customer needs through personalized sales strategies is a testament to its commitment to providing comprehensive financial protection. By understanding individual circumstances and offering tailored advice, Allstate aims to build long-lasting relationships with its customers, ensuring they have the right life insurance coverage to secure their financial future. This approach not only benefits the customers but also contributes to Allstate's reputation as a trusted insurance provider.

Life Insurance Course: How Long Does It Take?

You may want to see also

Profit Potential: Selling life insurance offers high profit potential for Allstate agents and the company

Allstate, a prominent insurance provider, recognizes the significant profit potential associated with selling life insurance. This financial product offers a lucrative opportunity for both Allstate agents and the company as a whole. The high profit margins on life insurance policies can be attributed to several factors. Firstly, life insurance is a long-term commitment, often requiring agents to maintain relationships with clients for years, ensuring a steady income stream. This long-term nature of the product allows agents to build a robust client base and generate recurring commissions.

Secondly, the complexity and variety of life insurance policies provide agents with a wide range of products to offer. From term life insurance to permanent policies, whole life, and universal life, each type has unique features and benefits. This diversity enables agents to cater to different client needs, increasing the likelihood of higher sales and commissions. Moreover, Allstate's extensive network of agents and their expertise in various insurance products can attract a broad customer base, further enhancing the profit potential.

The profit potential is further amplified by the fact that life insurance policies often have higher premiums compared to other insurance products. This is due to the long-term nature of the coverage and the potential for large payouts in the event of the insured's death. As a result, agents can earn substantial commissions on each policy sold, contributing significantly to their overall earnings. Additionally, Allstate's incentive programs and rewards for top-performing agents can further boost their motivation and productivity, ultimately driving more sales and higher profits.

For Allstate, the benefits of selling life insurance extend beyond individual agent success. The company can significantly increase its revenue and market share by encouraging its agents to sell life insurance. With a large customer base and a strong brand reputation, Allstate can leverage its existing relationships to promote life insurance policies effectively. This strategic approach allows the company to diversify its product offerings and cater to a wider range of customer needs, ultimately leading to increased profitability.

In summary, selling life insurance presents a compelling profit opportunity for Allstate agents and the company. The long-term nature of the product, diverse policy options, and higher premiums contribute to the high profit potential. By recognizing and capitalizing on this potential, Allstate can further strengthen its position in the insurance market and provide its agents with a rewarding career path. This strategic focus on life insurance sales is a key driver of success for Allstate in the highly competitive insurance industry.

Life Insurance Tax Rules in Washington State

You may want to see also

Market Demand: Life insurance is a growing market, and Allstate wants to capitalize on this demand

The life insurance market is experiencing significant growth, driven by an increasing awareness of the importance of financial security and the need to protect loved ones. This growing demand presents a lucrative opportunity for insurance providers like Allstate, which aims to expand its market share and diversify its product offerings. By encouraging its agents to sell life insurance, Allstate can tap into this expanding market and offer its customers comprehensive financial protection.

Allstate's strategy is to meet the rising demand for life insurance by providing a range of products tailored to different needs. This includes term life insurance, which offers coverage for a specified period, and permanent life insurance, providing long-term financial security. By offering these options, Allstate can cater to a wide range of customers, from those seeking affordable coverage to those requiring more comprehensive protection.

The company's focus on the life insurance market is also driven by the potential for cross-selling and upselling opportunities. Once a customer purchases life insurance, they may be more inclined to explore other financial products offered by Allstate, such as auto, home, and health insurance. This approach allows Allstate to build long-term relationships with its customers and increase its revenue streams.

Additionally, Allstate's desire to sell life insurance is likely influenced by the competitive landscape in the insurance industry. With many companies offering similar products, Allstate needs to differentiate itself and provide value to its customers. By emphasizing the importance of life insurance and offering competitive rates, Allstate can attract new customers and retain existing ones.

In summary, Allstate's push to sell life insurance is a strategic move to capitalize on the growing market demand. By providing comprehensive coverage options and building long-term customer relationships, Allstate aims to increase its market share and solidify its position as a leading insurance provider. This approach not only benefits the company but also ensures that customers have access to the financial protection they need.

MetLife Insurance Agencies: Are They Franchises or Not?

You may want to see also

Brand Awareness: Promoting life insurance enhances Allstate's brand as a comprehensive insurance provider

The promotion of life insurance is a strategic move by Allstate to enhance its brand image and establish itself as a comprehensive insurance provider. By offering life insurance, Allstate can showcase its ability to cater to a wide range of customer needs, providing a more holistic approach to insurance. This move is particularly important in the highly competitive insurance market, where consumers are increasingly seeking providers that can offer a diverse portfolio of products.

Brand awareness is a critical aspect of this strategy. When Allstate promotes life insurance, it highlights its commitment to meeting the diverse financial protection needs of its customers. This is a powerful message, as it reassures clients that Allstate is not just an auto or home insurance provider but a reliable partner for various insurance solutions. By doing so, Allstate can attract new customers and build trust with existing ones, as they recognize the company's expertise in multiple insurance domains.

The act of selling life insurance also allows Allstate to engage with its customers on a deeper level. It provides an opportunity to educate and inform clients about the importance of financial planning and the long-term benefits of life insurance. This personalized approach can significantly impact customer satisfaction and loyalty, as it demonstrates Allstate's dedication to understanding and addressing individual needs.

Furthermore, promoting life insurance can lead to increased customer retention and cross-selling opportunities. When Allstate agents or representatives offer life insurance to existing customers, they can tailor the product to the specific needs of the individual, ensuring a more personalized experience. This targeted approach can result in higher customer satisfaction and a stronger relationship with Allstate, potentially leading to long-term loyalty.

In summary, by promoting life insurance, Allstate can significantly enhance its brand awareness and reputation as a comprehensive insurance provider. This strategy not only showcases the company's ability to offer diverse products but also strengthens customer relationships and fosters trust. As a result, Allstate can position itself as a preferred choice for individuals seeking a wide range of insurance solutions, ultimately driving business growth and success.

AICPA Life Insurance: A Good Deal or Not?

You may want to see also

Customer Retention: Selling life insurance helps retain customers and build long-term relationships

Customer retention is a critical aspect of the insurance industry, and Allstate, a well-known insurance company, recognizes the importance of building long-term relationships with its customers. One effective strategy they employ to achieve this is by encouraging their agents to sell life insurance. Here's how this approach contributes to customer retention:

When an insurance agent sells life insurance to a customer, it opens up a dialogue and establishes a connection that goes beyond a single transaction. Life insurance is a complex product, and the process of understanding a customer's needs, explaining the various options, and providing personalized advice can be quite extensive. During this journey, agents have the opportunity to build trust and foster a sense of loyalty. Customers appreciate the personalized attention and the effort put into understanding their unique circumstances, which can lead to a stronger relationship with the insurance provider.

The act of selling life insurance also allows agents to gather valuable information about their customers. By assessing their financial situation, risk factors, and personal goals, agents can offer tailored solutions. This personalized approach makes customers feel valued and understood, increasing their satisfaction and loyalty. Over time, these customers become more inclined to continue their insurance relationship with Allstate, as they recognize the benefits and feel a sense of security.

Moreover, life insurance sales can lead to upselling and cross-selling opportunities. Once a customer has an understanding of their life insurance needs, agents can introduce other relevant products like term life insurance, whole life insurance, or critical illness coverage. This additional value proposition keeps the conversation going and provides customers with comprehensive solutions, further strengthening the agent-customer bond. As a result, customers are more likely to remain with Allstate, as they perceive the company as a one-stop solution for their insurance needs.

In the long run, the practice of selling life insurance not only helps in retaining customers but also contributes to their overall financial well-being. By providing customers with the right insurance coverage, agents can ensure that their clients' families are protected in the event of unforeseen circumstances. This sense of security and peace of mind is a powerful motivator for customers to stay with Allstate, as they recognize the value and reliability of the company's offerings.

In summary, Allstate's emphasis on selling life insurance is a strategic move to foster customer retention and long-term relationships. By providing personalized advice, building trust, and offering comprehensive solutions, agents can create a loyal customer base. This approach not only benefits the company's bottom line but also ensures that customers receive the necessary support and protection they need, leading to a mutually beneficial insurance partnership.

Colonial Penn Life Insurance: Can You Hold Two Policies?

You may want to see also

Frequently asked questions

Allstate, a prominent insurance company, recognizes the importance of comprehensive financial protection for its customers. Life insurance is a critical component of a well-rounded financial plan, offering peace of mind and financial security to individuals and their families. By promoting life insurance, Allstate aims to help its agents provide a valuable service to clients, ensuring that their loved ones are protected in the event of the insured's passing.

Selling life insurance allows Allstate agents to offer a product that can provide financial support to beneficiaries during challenging times. It helps customers plan for the future, ensuring that their dependents receive financial assistance for various expenses, such as mortgage payments, education costs, or daily living expenses. This can be a powerful tool for individuals to leave a lasting legacy and provide for their families.

Allstate's life insurance policies offer several benefits, including competitive rates, customizable coverage options, and flexible payment plans. These products can be tailored to meet the specific needs of each client, ensuring that they receive the appropriate level of protection. Additionally, Allstate's reputation and financial stability provide customers with the assurance that their policy will be honored when needed.

Encouraging life insurance sales can significantly impact an agent's career trajectory with Allstate. It demonstrates a commitment to providing comprehensive financial solutions, which can lead to increased customer satisfaction and loyalty. Successful life insurance sales may result in higher commissions, bonuses, and incentives for agents, fostering a more rewarding and prosperous career path within the company.