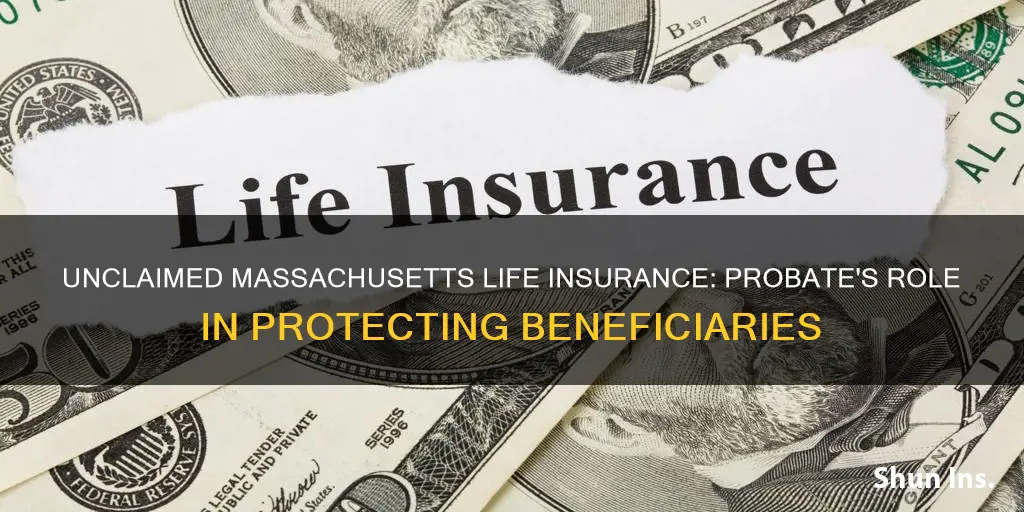

Unclaimed life insurance proceeds in Massachusetts, like in many other states, often require probate proceedings due to legal and administrative requirements. When an individual passes away, their life insurance policies become assets that need to be distributed according to the deceased's wishes, as outlined in their will or through legal inheritance processes. Probate is a court-supervised process that ensures the validity of the will and the proper distribution of the deceased's estate, including any unclaimed insurance benefits. This process is necessary to protect the interests of beneficiaries, creditors, and the state, ensuring that the distribution of assets is fair and transparent. Massachusetts law mandates that unclaimed proceeds be reported to the Probate Court, which then initiates the probate process to locate and notify potential beneficiaries and to establish the legal right to the funds.

| Characteristics | Values |

|---|---|

| Legal Requirement | Unclaimed life insurance proceeds in Massachusetts are subject to a legal process to ensure proper distribution and prevent fraud. |

| Probate Process | Probate is a court-supervised procedure to validate a will, appoint an executor, and distribute assets, including unclaimed insurance money. |

| Unclaimed Funds | These are funds that remain with the insurance company due to the lack of a valid beneficiary or the owner's death without a known heir. |

| Beneficiary Search | Probate helps locate and notify potential beneficiaries, ensuring they are aware of their rights and the existence of the insurance policy. |

| Fraud Prevention | The probate process adds a layer of security, making it harder for unauthorized individuals to access and misuse the funds. |

| Executor Appointment | Probate allows the court to appoint an executor to manage the distribution of the proceeds, ensuring proper handling and compliance with the law. |

| Will Validation | If a will exists, probate confirms its authenticity and ensures it aligns with the deceased's wishes regarding the insurance payout. |

| Asset Protection | Probate safeguards the unclaimed insurance proceeds, preventing them from being subject to potential legal challenges or claims by creditors. |

| Public Record | The probate process creates a public record, providing transparency and allowing beneficiaries and interested parties to access information. |

| Time Limit | Massachusetts has a statute of limitations for unclaimed insurance proceeds, and probate ensures these funds are not indefinitely held by the insurance company. |

What You'll Learn

- Legal Requirement: Massachusetts law mandates that unclaimed insurance proceeds must be probated to ensure proper distribution

- Estate Administration: Probate is essential for managing and distributing the deceased's assets, including insurance policies

- Beneficiary Identification: Probate helps locate and notify beneficiaries, ensuring they receive their rightful share

- Validity of Policy: Probate verifies the validity and authenticity of the insurance policy and its terms

- Tax Implications: Unclaimed proceeds may be subject to taxes, and probate ensures proper tax handling

Legal Requirement: Massachusetts law mandates that unclaimed insurance proceeds must be probated to ensure proper distribution

In Massachusetts, unclaimed life insurance proceeds are subject to a legal requirement that may seem unusual at first, but it is an essential process to ensure the fair and proper distribution of the deceased's assets. This requirement is rooted in the state's legal framework and is designed to protect the interests of all parties involved, including the insurance company, beneficiaries, and the public.

The primary reason for this legal mandate is to establish a clear chain of ownership and to prevent any potential disputes or challenges regarding the distribution of the insurance payout. When an individual passes away, their insurance policy becomes a part of their estate, and the proceeds are considered assets that need to be managed according to the legal procedures. Massachusetts law dictates that unclaimed insurance funds must be probated, which means the process of validating and authenticating the will and the distribution of assets through the court system.

Probate is a legal process that provides a structured and transparent method to identify and locate beneficiaries, especially in cases where the deceased had not explicitly named specific individuals in their will. By requiring probate, the state ensures that the insurance company can verify the rightful recipients of the payout, preventing any potential fraud or misuse of the funds. This step is crucial to maintain the integrity of the financial system and to protect the interests of all stakeholders.

The probate process also allows the court to oversee the distribution of assets, ensuring that the deceased's wishes are followed accurately. It provides an opportunity to address any legal challenges or disputes that may arise among beneficiaries or heirs. In the context of unclaimed insurance proceeds, probate helps to clarify the ownership of the policy, the validity of the beneficiaries' claims, and the proper allocation of the funds.

In summary, Massachusetts law mandates the probate of unclaimed life insurance proceeds as a legal requirement to ensure a fair and transparent distribution process. This procedure safeguards the rights of beneficiaries, protects the insurance company's interests, and maintains the integrity of the financial system. It is a critical step in managing the deceased's estate and ensuring that the insurance payout reaches the intended recipients.

Converting or Porting Life Insurance: Which Option Suits You Best?

You may want to see also

Estate Administration: Probate is essential for managing and distributing the deceased's assets, including insurance policies

Estate administration is a crucial process that ensures the smooth distribution of a deceased individual's assets, and in the case of unclaimed life insurance proceeds in Massachusetts, probate plays a vital role. When a person passes away, their estate, which includes various assets such as bank accounts, real estate, and personal belongings, needs to be managed and distributed according to their wishes or legal requirements. This is where the concept of probate comes into play.

Probate is a legal process that authenticates and executes the will of a deceased person, ensuring that their assets are distributed as intended. In the context of life insurance, when a policyholder passes away, the insurance company typically pays out the proceeds to the designated beneficiaries. However, if the proceeds remain unclaimed, the process of probate becomes essential to locate and distribute these funds appropriately. Massachusetts law requires that unclaimed life insurance proceeds go through probate to protect the interests of all parties involved.

The primary reason for this requirement is to provide a structured and transparent method for identifying and notifying the rightful beneficiaries. When an individual dies, their estate may have multiple beneficiaries, and it is the responsibility of the executor or administrator to locate and contact them. Probate court assists in this process by providing a legal framework to locate heirs, protect the estate from potential fraud, and ensure that all beneficiaries are aware of their rights. This is particularly important in the case of unclaimed insurance proceeds, as it prevents the funds from being left unattended or falling into the wrong hands.

During the probate process, the court appoints an executor or administrator who is responsible for managing the estate's assets, including the unclaimed insurance proceeds. This individual must provide detailed accounting and distribution plans to the court, ensuring that all legal requirements are met. The court's involvement adds a layer of security and fairness, allowing for the proper identification and notification of beneficiaries, even if they are not immediately apparent.

Moreover, probate helps in resolving any disputes or challenges regarding the distribution of assets. It provides a legal avenue for beneficiaries to voice their concerns or claim their rightful share. By going through the probate process, the distribution of unclaimed life insurance proceeds becomes a matter of public record, reducing the chances of fraud or misrepresentation. This ensures that the deceased's wishes are honored and that the beneficiaries receive their rightful inheritance.

In summary, the requirement for unclaimed life insurance proceeds to go through probate in Massachusetts is a crucial aspect of estate administration. It ensures the proper management and distribution of assets, including insurance policies, by providing a legal framework for identifying beneficiaries, preventing fraud, and resolving potential disputes. Probate court's involvement adds a layer of security and transparency, making it an essential step in the process of settling a deceased individual's affairs.

Life Insurance License Test: Challenging but Manageable

You may want to see also

Beneficiary Identification: Probate helps locate and notify beneficiaries, ensuring they receive their rightful share

The process of probate is essential in the context of unclaimed life insurance proceeds in Massachusetts, as it serves a critical function in beneficiary identification and distribution. When an individual passes away, their life insurance policy becomes a valuable asset, and it is the responsibility of the executor or administrator of the estate to locate and notify the rightful beneficiaries. This is where probate plays a crucial role.

Probate is a legal process that involves validating a will and administering the deceased's estate. In the case of life insurance, it helps identify the beneficiaries named in the policy. Many life insurance policies have designated beneficiaries, but over time, these beneficiaries may move, change their names, or pass away themselves, making it challenging to locate them. Probate provides a structured framework to locate and contact these beneficiaries, ensuring they are aware of their entitlement to the insurance proceeds.

During the probate process, the court-appointed executor or administrator must locate and notify all potential beneficiaries. This includes family members, heirs, and any individuals named in the will or life insurance policy. The executor must conduct a thorough search, which may involve searching public records, contacting known associates, and publishing notices in local newspapers. This comprehensive approach ensures that no beneficiary is overlooked, and their rights are protected.

Moreover, probate helps in the efficient distribution of the insurance proceeds. Once the beneficiaries are identified, the executor can facilitate the transfer of the funds to the rightful recipients. This process ensures that the beneficiaries receive their inheritance without unnecessary delays, providing them with the financial support they may need during a challenging time.

In summary, the requirement for probate in unclaimed life insurance proceeds in Massachusetts is vital for beneficiary identification and distribution. It ensures that the estate is administered fairly and efficiently, providing closure to the deceased's affairs and securing the beneficiaries' rights to their rightful share. This process, while often complex, is a necessary step to honor the intentions of the deceased and support the beneficiaries in their time of need.

Life Insurance Exam: Top Locations for a Smooth Process

You may want to see also

Validity of Policy: Probate verifies the validity and authenticity of the insurance policy and its terms

When a life insurance policy is involved in a claim, especially in cases of unclaimed proceeds, the process of probate is essential to ensure the validity and authenticity of the policy and its terms. This legal procedure is a critical step in Massachusetts to establish the legitimacy of the insurance contract and the rights of the beneficiaries. Probate serves as a safeguard to protect the interests of all parties involved, including the insurance company, the deceased's estate, and the intended recipients of the insurance payout.

The primary purpose of probate in this context is to verify the existence and validity of the insurance policy. It involves a thorough examination of the policy documents, including the terms, conditions, and any amendments or modifications. By doing so, the court can confirm that the policy is genuine and has not been altered or forged. This step is crucial because it prevents fraudulent claims and ensures that the insurance company pays out the proceeds to the rightful beneficiaries.

During the probate process, the court will scrutinize the policy to ensure it meets all legal requirements. This includes checking the policy's issuance date, the insured individual's details, the beneficiary designation, and the amount of coverage. Probate also involves identifying and locating the policyholders and beneficiaries, ensuring that all relevant parties are aware of the claim and have the opportunity to participate in the legal proceedings. This comprehensive approach helps to prevent disputes and ensures a fair and transparent process.

Moreover, probate provides an opportunity to clarify any ambiguities or discrepancies in the policy terms. If there are any conflicting clauses or unclear provisions, the court can interpret and resolve these issues. This is particularly important in cases where the policy has complex or unique provisions that require specific legal interpretation. By doing so, the court can ensure that the policy is executed according to the intentions of the policyholder and the law.

In summary, the probate process in Massachusetts for unclaimed life insurance proceeds is a vital step to validate the insurance policy and its terms. It safeguards the interests of all parties, ensures the authenticity of the policy, and provides a legal framework to resolve any disputes or ambiguities. This procedure is a necessary precaution to protect the rights of beneficiaries and maintain the integrity of the insurance system.

Life Insurance: Geico's Offerings and Your Options

You may want to see also

Tax Implications: Unclaimed proceeds may be subject to taxes, and probate ensures proper tax handling

Unclaimed life insurance proceeds in Massachusetts, like in many other states, often require probate for a specific reason: tax implications. When a life insurance policy is paid out, it is considered a taxable event, and the proceeds are subject to certain tax regulations. The process of probate ensures that these tax obligations are met and that the distribution of the proceeds is handled according to the legal requirements.

When an individual dies, their estate, including any unclaimed insurance benefits, becomes part of their taxable estate. The proceeds from the life insurance policy are considered income for the beneficiary, and they may be subject to income tax. In Massachusetts, the state's tax laws dictate that unclaimed insurance benefits are treated as part of the deceased's estate and are subject to inheritance or estate taxes. These taxes are levied on the value of the estate, and the proceeds from the policy are included in this calculation.

Probate, in this context, serves as a legal process to validate and distribute the estate's assets, including the unclaimed insurance money. It ensures that the state's tax authorities are notified and that the correct tax amount is paid. By going through probate, the executor of the estate can properly account for the insurance proceeds and fulfill the tax obligations associated with them. This process helps to prevent potential legal issues and ensures that the beneficiaries receive their rightful share while adhering to the tax laws.

The tax implications of unclaimed life insurance proceeds can be complex, especially when dealing with large sums of money. Probate provides a structured framework to handle these complexities. It allows the court to oversee the distribution of assets, ensuring that all legal and tax requirements are met. This process can help beneficiaries avoid potential penalties or legal consequences that may arise from failing to report and pay taxes on the unclaimed proceeds.

In summary, the requirement for probate when dealing with unclaimed life insurance proceeds in Massachusetts is primarily due to the tax implications. Probate ensures that the state's tax laws are followed, and the proceeds are properly accounted for and distributed. It provides a legal pathway to handle the tax obligations associated with the insurance benefits, offering protection and clarity for both the beneficiaries and the tax authorities.

Life Insurance: Job-Hopper's Guide to Coverage

You may want to see also

Frequently asked questions

In Massachusetts, unclaimed life insurance benefits are considered property of the deceased individual's estate. When a person dies, their assets, including insurance policies, become part of their estate. Probate is the legal process of validating a will, administering the estate, and ensuring the distribution of assets according to the deceased's wishes or state law. For unclaimed proceeds, the insurance company must locate the rightful beneficiary or the executor of the estate to initiate the claims process, which often involves probate court oversight.

If a life insurance policy lacks a named beneficiary or the beneficiary cannot be located, the proceeds typically become part of the estate. In such cases, the insurance company will usually file a claim with the probate court to initiate the distribution process. The court will appoint an executor or administrator to manage the estate and ensure the proper distribution of assets, including the unclaimed life insurance money.

While it is possible for a life insurance policy to have a provision for "no-probate" or "pay-on-death" benefits, not all policies offer this feature. If the policy does not have such a clause, or if the beneficiary is unknown or unavailable, the proceeds will still require probate. The insurance company will typically notify the probate court, and the court will oversee the process to ensure the funds are distributed correctly and legally.