Life insurance is a crucial financial tool that provides financial security and peace of mind for individuals and their loved ones. When considering life insurance, it's important to understand the different types and their unique features. One type that stands out is immediate or term life insurance, which offers coverage from the moment the policy is purchased, providing immediate protection for your loved ones. This type of insurance is designed to provide a safety net during the term of the policy, ensuring that your family is financially protected in the event of your passing. Whether you're a young professional starting a family or an experienced individual looking to update your coverage, understanding what life insurance starts immediately can be a key step in making informed decisions about your financial future.

What You'll Learn

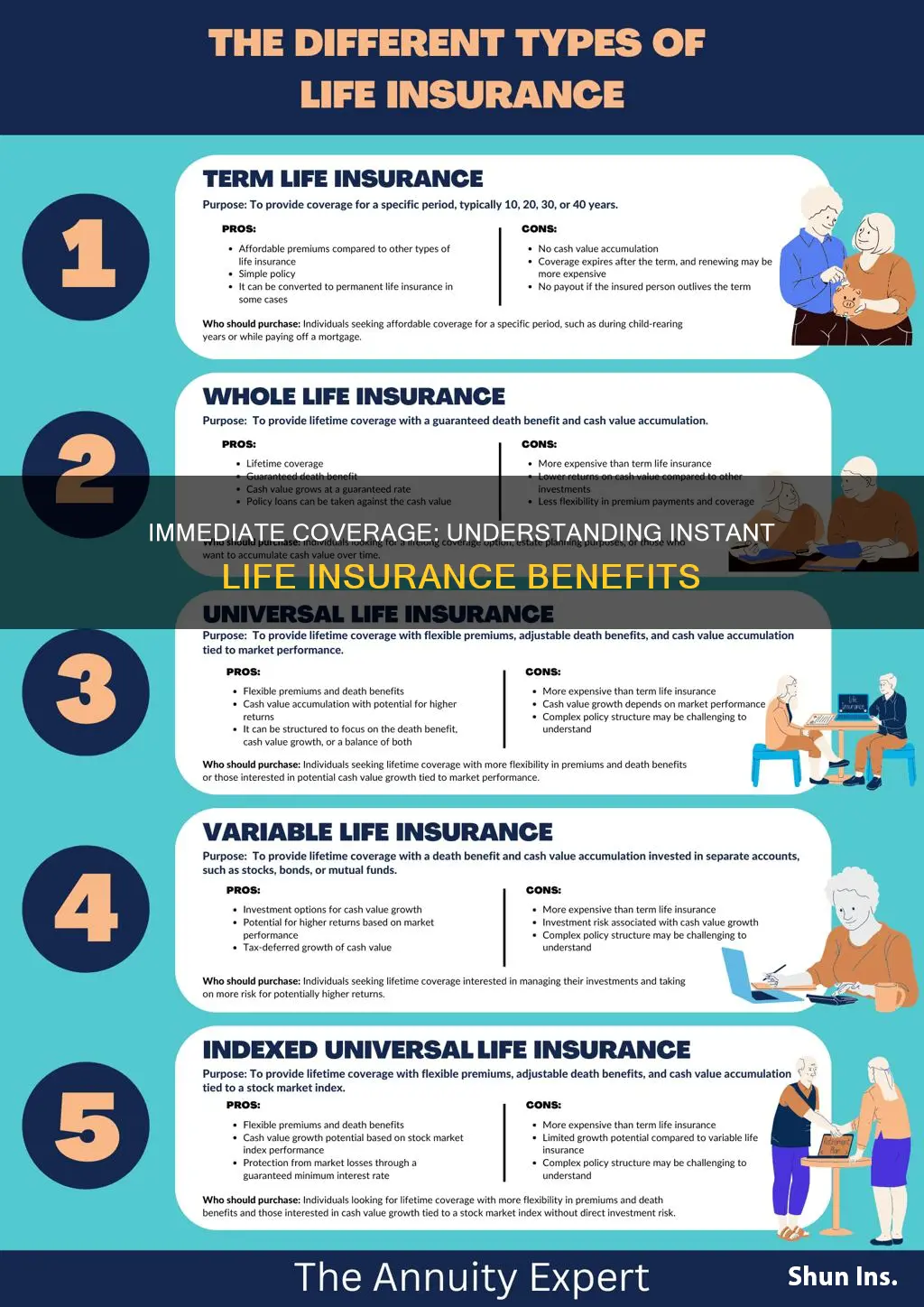

- Term Life Insurance: Provides coverage for a set period, offering immediate protection

- Whole Life Insurance: Offers lifelong coverage, with immediate benefits and a cash value component

- Universal Life Insurance: Provides flexible coverage, allowing for immediate adjustments and potential cash value growth

- Final Expense Insurance: Covers funeral and burial expenses, offering immediate financial support

- Riders and Endorsements: Allows for immediate enhancements to existing policies, providing additional coverage

Term Life Insurance: Provides coverage for a set period, offering immediate protection

Term life insurance is a type of coverage that offers immediate protection and is designed to provide financial security for a specific period. It is a straightforward and effective way to ensure your loved ones are financially protected during the years when they might need it the most. This type of insurance is ideal for those seeking a simple and direct approach to life insurance without the complexities of permanent policies.

When you purchase term life insurance, you agree to pay a premium for a set period, known as the 'term'. This term can vary, typically ranging from 10 to 30 years, and during this time, the policy provides a death benefit if the insured individual passes away. The beauty of this policy lies in its simplicity and the immediate coverage it offers. Unlike other types of life insurance, term plans do not accumulate cash value, and the primary focus is on providing a financial safety net during a defined period.

One of the key advantages is the cost-effectiveness. Since it provides coverage for a specific duration, the premiums are generally lower compared to permanent life insurance. This makes it an attractive option for individuals who want immediate protection without the long-term financial commitment. For example, if you have a 20-year mortgage or a child who will be financially dependent for that duration, term life insurance can provide the necessary coverage to ensure your family's financial stability in the event of your untimely demise.

The immediate protection aspect is crucial, especially for those with financial responsibilities that need to be covered right away. For instance, if you are the primary breadwinner in your family, a term life insurance policy can ensure that your loved ones have the financial resources to maintain their standard of living and cover essential expenses if something happens to you. This type of insurance is particularly beneficial for young families, recent homeowners, or anyone with significant financial obligations.

In summary, term life insurance is an excellent choice for individuals seeking immediate and straightforward protection. It provides a clear and defined period of coverage, making it an affordable and efficient way to secure your family's financial future. With various term lengths available, you can choose the option that best aligns with your specific needs and financial goals, ensuring that your loved ones are protected when it matters the most.

Sildenafil: Impact on Life Insurance Coverage and Costs

You may want to see also

Whole Life Insurance: Offers lifelong coverage, with immediate benefits and a cash value component

Whole life insurance is a comprehensive and long-term financial solution that provides immediate benefits and a unique feature: a cash value component. This type of insurance offers a sense of security and peace of mind, knowing that you and your loved ones will be protected throughout your entire life. Here's a detailed breakdown of its key attributes:

When you purchase whole life insurance, you're not just buying a policy; you're investing in a contract that guarantees coverage for your entire life. This is in contrast to term life insurance, which provides coverage for a specified period. With whole life, the benefits are immediate, ensuring that your family receives financial support when you need it the most. The policy pays out a death benefit to your beneficiaries upon your passing, providing a financial safety net for your loved ones.

One of the most appealing aspects of whole life insurance is the cash value it accumulates over time. Unlike other types of insurance, the premiums you pay are invested in a policyholder's account, growing tax-deferred. This means that a portion of each premium payment goes towards building a cash reserve, which can be borrowed against or withdrawn, providing financial flexibility. Over the years, this cash value can grow significantly, offering a valuable asset that can be used for various purposes, such as funding education, starting a business, or supplementing retirement income.

The immediate benefits of whole life insurance are substantial. Once the policy is in force, you and your family are protected. This is particularly important if you have dependents or financial obligations that require long-term support. The death benefit can cover essential expenses, such as mortgage payments, children's education, or daily living costs, ensuring that your loved ones can maintain their standard of living even if you're no longer around.

Furthermore, whole life insurance provides a level of financial stability that can be challenging to achieve with other investment vehicles. The guaranteed death benefit and the accumulation of cash value offer a sense of security and predictability. This type of insurance is an excellent tool for long-term financial planning, allowing you to build a substantial financial cushion over time.

In summary, whole life insurance is an immediate and lifelong financial safeguard. It offers the peace of mind that comes with knowing your family will be taken care of, while also providing a valuable investment opportunity through its cash value component. This insurance type is a powerful tool for anyone seeking to secure their family's financial future and build a substantial financial asset.

Understanding General Life Liability Insurance: A Comprehensive Guide

You may want to see also

Universal Life Insurance: Provides flexible coverage, allowing for immediate adjustments and potential cash value growth

Universal life insurance offers a unique and flexible approach to life coverage, providing immediate benefits and a range of features that can adapt to your changing needs. This type of policy is designed to offer both protection and the potential for long-term financial growth, making it an attractive option for those seeking a comprehensive insurance solution.

One of the key advantages of universal life insurance is its flexibility. Unlike traditional term life insurance, which provides coverage for a specified period, universal life insurance offers a permanent policy that can be tailored to your requirements. This means that as your life circumstances change, you have the option to adjust your coverage accordingly. For instance, if you start a new job or experience a significant life event, you can modify your policy to ensure you have the appropriate level of protection without any delays or additional paperwork. This immediate adjustability is a significant benefit, especially for those who want to ensure their loved ones are financially secure without the constraints of a fixed-term policy.

The policyholders have the freedom to choose how much to pay in premiums, allowing for customization based on their financial situation and goals. This flexibility is particularly useful for individuals who may have varying income levels or prefer to make larger contributions during periods of higher earnings. Additionally, universal life insurance policies often include an investment component, where a portion of the premium is allocated to an investment account. This feature enables the policy to accumulate cash value over time, providing a financial asset that can be borrowed against or withdrawn, offering a level of financial security and growth potential.

The immediate coverage aspect of universal life insurance is a significant advantage, ensuring that you and your loved ones are protected from the start. This is especially important in the event of unforeseen circumstances, as the policy can provide financial security without the need for a lengthy waiting period. With this type of insurance, you can rest assured that your family's financial needs will be met, even if your income or health status changes.

In summary, universal life insurance provides a flexible and comprehensive solution for those seeking immediate and adaptable life coverage. Its ability to adjust to changing circumstances, combined with the potential for cash value growth, makes it a powerful tool for managing financial risks and securing the future. By considering this type of insurance, individuals can ensure they have a reliable safety net in place, offering both protection and the opportunity for long-term financial benefits.

Life Insurance Blood Tests: Do STDs Show Up?

You may want to see also

Final Expense Insurance: Covers funeral and burial expenses, offering immediate financial support

When it comes to life insurance, the term "immediate coverage" often refers to the financial support that can be provided right away in the event of a policyholder's death. One type of life insurance that offers this immediate financial assistance is Final Expense Insurance, a specialized policy designed to cover the costs associated with end-of-life expenses. This insurance is particularly valuable as it ensures that your loved ones are financially supported during a difficult time, providing peace of mind and financial security.

Final Expense Insurance is tailored to cover the specific costs that arise when an individual passes away. These expenses typically include funeral and burial costs, which can vary widely depending on cultural traditions, geographic location, and personal preferences. The policy provides a lump sum payment, known as a death benefit, to the designated beneficiaries upon the insured individual's death. This immediate financial support can be a crucial source of comfort for families, allowing them to focus on honoring their loved one's memory without the added stress of financial burdens.

The beauty of Final Expense Insurance lies in its simplicity and directness. Unlike some other life insurance policies that may have lengthy waiting periods or complex claim processes, this type of insurance is designed to provide immediate relief. Once the policy is in effect, the death benefit is paid out promptly, ensuring that the covered expenses are met without delay. This is especially important as funeral and burial costs can be substantial and often need to be addressed promptly, providing a sense of closure and support to the grieving family.

Choosing the right Final Expense Insurance policy involves considering several factors. Firstly, evaluate your specific needs and preferences. Determine the coverage amount required to cover your desired funeral and burial expenses. It's essential to be realistic and thorough in this assessment to ensure that the policy adequately meets your requirements. Additionally, review the policy terms, including any exclusions, waiting periods, and benefits, to make an informed decision.

Another crucial aspect is understanding the different types of Final Expense Insurance available. Traditional whole life insurance with an immediate death benefit, for instance, can provide the desired coverage. Alternatively, pre-need funeral plans, which are separate contracts with funeral homes, can also offer immediate financial support for end-of-life expenses. Exploring these options and comparing their features will enable you to make a well-informed choice that aligns with your specific needs and financial goals.

Understanding CAP in Life Insurance Policies

You may want to see also

Riders and Endorsements: Allows for immediate enhancements to existing policies, providing additional coverage

When it comes to life insurance, the concept of "immediate coverage" is an attractive feature for many policyholders. This refers to the ability to enhance your existing life insurance policy without any delays, providing additional protection right away. One of the key mechanisms to achieve this is through riders and endorsements.

Riders and Endorsements are additional provisions or add-ons that can be attached to your life insurance policy. These allow you to customize and expand the coverage according to your changing needs and preferences. For instance, if you already have a basic life insurance policy, you can opt for a rider that provides critical illness coverage, accidental death insurance, or long-term disability benefits. These riders can be added immediately, ensuring that your policy adapts to your evolving circumstances without any gaps in protection.

The beauty of riders and endorsements lies in their flexibility and immediacy. Unlike making changes to the original policy, which might require a lengthy process and a new application, riders can often be added quickly and efficiently. This is particularly beneficial when you need to address specific concerns or when your lifestyle or health status changes, and you want to ensure your insurance keeps up with these changes. For example, if you start a new high-risk hobby, you can add an endorsement to your policy immediately to cover any potential risks associated with that activity.

Furthermore, riders and endorsements offer a cost-effective way to increase your coverage. Instead of purchasing a new, more comprehensive policy, you can simply enhance your existing one. This can be especially advantageous for those who want to maximize their insurance benefits without incurring significant additional costs. By strategically adding riders, you can tailor your life insurance to provide the exact level of protection you desire.

In summary, riders and endorsements are powerful tools for anyone looking to ensure immediate enhancements to their life insurance policies. They offer a straightforward way to add extra coverage, adapt to changing circumstances, and maintain comprehensive protection without the complexities and delays often associated with modifying standard policies. Understanding and utilizing these features can be a strategic move for individuals seeking to secure their financial well-being and the well-being of their loved ones.

Life Insurance: 30-Year Term Plans and Their Benefits

You may want to see also

Frequently asked questions

Immediate life insurance, also known as whole life insurance, provides coverage from the day it is purchased. It offers a guaranteed death benefit and a fixed premium, ensuring that the policyholder's loved ones receive financial support immediately upon their passing.

When you buy immediate life insurance, the insurance company promises to pay out a predetermined amount to your beneficiaries if you pass away during the policy term. The premiums are typically paid annually, semi-annually, or monthly, and the policy remains in force for the entire term, providing continuous coverage.

Immediate life insurance offers several advantages. Firstly, it provides financial security to your family, covering essential expenses like mortgage payments, children's education, or daily living costs. Secondly, it has a cash value component that grows over time, allowing policyholders to borrow against it or withdraw funds for various financial needs.

Yes, you can typically cancel or surrender your immediate life insurance policy at any time. However, it's essential to review the policy's terms and conditions, as there may be penalties or fees associated with early cancellation. The insurance company will usually provide surrender options and values, allowing you to make informed decisions regarding your policy.