Many people often wonder why they need life insurance when they already have savings and a 401(k) plan. While it's true that these financial tools can provide a safety net for your loved ones and help secure your financial future, life insurance offers a unique and essential benefit. It provides a guaranteed payout to your beneficiaries, ensuring that your family receives financial support at a time when they need it most, especially if you were to pass away unexpectedly. This immediate financial assistance can cover essential expenses, such as funeral costs, outstanding debts, and ongoing living expenses, allowing your loved ones to grieve and focus on their well-being without the added stress of financial worries. Additionally, life insurance can be a valuable asset for estate planning, tax planning, and even as a source of liquidity to fund other financial goals. Understanding the role of life insurance in your overall financial strategy can help you make informed decisions about your future and the well-being of your loved ones.

What You'll Learn

- Long-Term Financial Security: Life insurance provides a safety net for dependents in case of premature death

- Debt Management: It helps cover debts, preventing financial strain on loved ones

- Healthcare Costs: Insurance covers medical expenses, especially for critical illnesses, ensuring financial stability

- Retirement Planning: It complements 401(k) by offering guaranteed death benefits, enhancing retirement savings

- Peace of Mind: Having life insurance offers reassurance and financial protection for the future

Long-Term Financial Security: Life insurance provides a safety net for dependents in case of premature death

Life insurance is a crucial financial tool that offers long-term security and peace of mind, especially for those with dependents. While having savings and a 401(k) plan is beneficial, they may not always be sufficient to cover the financial needs of your loved ones in the event of your untimely passing. This is where life insurance steps in as a reliable safety net, ensuring that your family's financial well-being is protected.

When you have dependents, such as a spouse, children, or other family members who rely on your income, life insurance becomes an essential part of your financial strategy. It provides a steady stream of financial support to your loved ones, helping them maintain their standard of living and covering essential expenses. For instance, life insurance proceeds can be used to pay for daily living costs, education fees, mortgage payments, or even cover the costs associated with funeral and burial arrangements. This financial cushion allows your dependents to grieve without the added stress of financial instability.

The beauty of life insurance lies in its ability to provide a lump sum payment or regular income to your beneficiaries, ensuring that your family's financial future remains secure. This is particularly important if you are the primary breadwinner, as your income contributes significantly to the family's overall financial health. By having life insurance, you can rest assured that your dependents will have the financial resources they need to navigate life's challenges and make important decisions, such as continuing their education or maintaining their home.

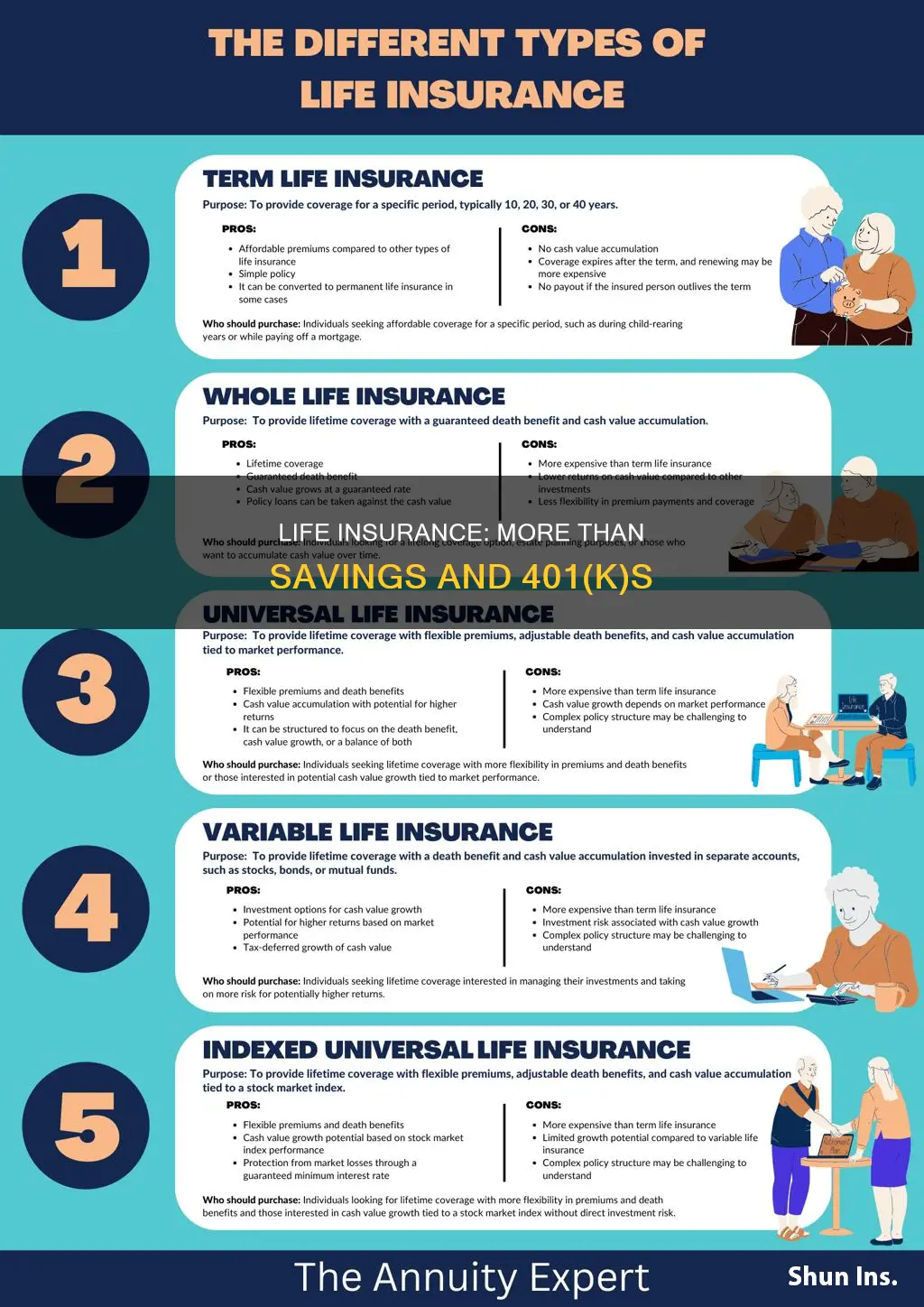

Furthermore, life insurance offers flexibility in terms of coverage and payment options. You can choose the amount of coverage that aligns with your family's needs and adjust it over time as your financial situation changes. Term life insurance, for example, provides coverage for a specific period, making it an affordable and flexible option. On the other hand, permanent life insurance offers lifelong coverage and a cash value component, which can be utilized for various financial goals.

In summary, while savings and a 401(k) plan are valuable assets, they may not fully address the financial security needs of your dependents. Life insurance complements these savings by providing a dedicated source of financial support in the event of your death. It ensures that your loved ones can maintain their lifestyle, cover essential expenses, and make important life decisions without the burden of financial worry. By incorporating life insurance into your financial plan, you are taking a proactive approach to safeguarding your family's long-term financial security.

Life Insurance Payouts: Taxable in Georgia?

You may want to see also

Debt Management: It helps cover debts, preventing financial strain on loved ones

Life insurance is a crucial financial tool that often gets overlooked, especially when individuals have savings and retirement plans like a 401(k). While having savings and a 401(k) is undoubtedly beneficial, life insurance plays a unique and essential role in financial planning, particularly in debt management. Here's how it can be a valuable asset:

Protecting Your Loved Ones: One of the primary reasons to consider life insurance is to safeguard your family's financial well-being. When you pass away, your loved ones might be left with significant debts, especially if you were the primary breadwinner. These debts could include mortgage payments, car loans, credit card balances, or even student loans. Without life insurance, your family may struggle to cover these expenses, leading to financial strain and potential loss of assets. For instance, if you have a substantial mortgage and your family relies on your income, life insurance can ensure that the mortgage is paid off, preventing the loss of your home.

Debt Management and Financial Security: Life insurance provides a safety net for your beneficiaries, allowing them to manage debts efficiently. The death benefit from a life insurance policy can be used to settle outstanding debts, ensuring that your loved ones are not burdened with financial obligations. This is particularly important if you have accumulated significant debt during your lifetime. By having a life insurance policy, you can leave a financial cushion for your family to cover these debts, preventing the need for them to take on additional financial risks or make difficult choices.

Long-Term Financial Planning: Incorporating life insurance into your financial strategy can be a part of a comprehensive plan. It complements your savings and 401(k) by addressing potential risks and uncertainties. While savings and retirement plans focus on long-term financial goals, life insurance provides immediate protection. For example, term life insurance offers coverage for a specific period, ensuring that your family is protected during the years when they might need financial support the most. This allows your savings and 401(k) to grow without the worry of unexpected financial burdens.

Peace of Mind: Perhaps the most valuable aspect of life insurance is the peace of mind it provides. Knowing that your loved ones will be financially secure in the event of your passing can significantly reduce stress and anxiety. It allows you to focus on your daily life, career, and relationships without constantly worrying about potential financial losses. This sense of security can be a powerful motivator to pursue your goals and dreams, knowing that your family's financial future is protected.

In summary, while savings and a 401(k) are essential components of financial planning, life insurance offers a unique and critical layer of protection. It ensures that your loved ones are not burdened with your debts and provides a safety net during challenging times. By incorporating life insurance into your financial strategy, you can achieve a more comprehensive approach to debt management and long-term financial security.

Life Insurance and NFCU: What You Need to Know

You may want to see also

Healthcare Costs: Insurance covers medical expenses, especially for critical illnesses, ensuring financial stability

When it comes to managing healthcare costs and ensuring financial stability, life insurance plays a crucial role, especially when you already have savings and a 401(k) plan. While having savings and a retirement account like a 401(k) is undoubtedly beneficial, they may not fully cover the unexpected and potentially devastating financial impact of critical illnesses or major medical expenses. This is where life insurance steps in as a comprehensive solution.

Medical expenses can quickly escalate, especially in the case of critical illnesses such as cancer, heart disease, or severe accidents. These conditions often require extensive treatment, including surgeries, medications, and specialized care, which can be incredibly costly. Without adequate insurance coverage, individuals and their families may face financial ruin, having to choose between accessing the best medical care or preserving their savings and retirement funds.

Life insurance provides a safety net by covering these medical expenses, ensuring that you or your loved ones are not burdened with overwhelming debt. It offers a financial cushion that can help cover hospital bills, doctor's fees, and other healthcare-related costs. With insurance, you can focus on your health and recovery without worrying about the financial implications, allowing you to access the necessary treatment and support.

Furthermore, life insurance policies often include critical illness coverage, which provides a lump sum payment upon diagnosis with a specified critical illness. This additional benefit can be a lifeline, enabling individuals to cover not only immediate medical expenses but also future treatment costs, rehabilitation, and even income replacement during the recovery period. By having this coverage, you can ensure that your financial situation remains stable, even in the face of a critical illness.

In summary, while savings and a 401(k) are essential components of financial planning, they may not be sufficient to manage the high costs associated with critical illnesses and major medical events. Life insurance complements these savings by providing coverage for healthcare expenses, offering peace of mind and financial security. It is a proactive approach to safeguarding your financial well-being and ensuring that you and your loved ones are protected against the unforeseen challenges that life may present.

Lumico Life Insurance: AmBest's Top-Rated Coverage Options

You may want to see also

Retirement Planning: It complements 401(k) by offering guaranteed death benefits, enhancing retirement savings

Life insurance is an essential component of a comprehensive retirement plan, especially when you already have a 401(k) and savings in place. While a 401(k) provides a solid foundation for retirement savings, life insurance offers unique benefits that can significantly enhance your financial security during this life stage. Here's how it complements your existing retirement strategy:

Guaranteed Death Benefits: One of the primary advantages of life insurance is the guaranteed death benefit it provides. When you purchase a life insurance policy, you agree to pay a premium in exchange for a financial payout to your beneficiaries upon your passing. This guaranteed benefit ensures that your loved ones receive a specified amount of money at a time when they may need it the most. In retirement, this financial support can be crucial for covering expenses, paying off any remaining debts, or even providing a financial cushion for your spouse or partner. It offers peace of mind, knowing that your family's financial well-being is protected, regardless of life's uncertainties.

Completing Retirement Savings: Life insurance can act as a complementary tool to your 401(k) and savings. While a 401(k) offers tax-deferred growth and a variety of investment options, it may not provide the same level of guaranteed death benefits. Life insurance fills this gap by offering a fixed benefit that is typically paid out regardless of market fluctuations or investment performance. This guaranteed aspect ensures that your retirement savings are further bolstered, providing an additional layer of financial security. By combining life insurance with your existing retirement accounts, you create a well-rounded strategy that addresses both short-term and long-term financial goals.

Long-Term Financial Strategy: Retirement planning involves a long-term perspective, and life insurance fits seamlessly into this strategy. As you age, your retirement savings may face various challenges, such as market volatility, inflation, or unexpected expenses. Life insurance provides a stable and predictable component to your financial plan. It ensures that your retirement savings remain intact and can continue to grow, even if other investment vehicles experience downturns. This stability is particularly important for retirees who want to maintain their standard of living and ensure their financial independence.

Flexibility and Customization: Modern life insurance policies offer a range of options to tailor the coverage to your specific needs. You can choose the amount of coverage, the duration of the policy, and even opt for term life insurance, which provides coverage for a specified period. This flexibility allows you to design a life insurance policy that complements your retirement plan perfectly. For example, you might opt for a term life policy to cover any remaining mortgage or provide for your children's education, while also having a permanent life insurance policy to ensure long-term financial security.

In summary, life insurance is a valuable addition to your retirement planning toolkit, especially when combined with a 401(k) and savings. It offers guaranteed death benefits, providing financial security for your loved ones and complementing the tax-deferred growth of a 401(k). By incorporating life insurance into your retirement strategy, you create a comprehensive plan that addresses various financial aspects, ensuring a more secure and comfortable retirement.

Did Your Dad Have Life Insurance? How to Find Out

You may want to see also

Peace of Mind: Having life insurance offers reassurance and financial protection for the future

Life insurance is a powerful tool that provides peace of mind and financial security for individuals and their loved ones. While having savings and a 401(k) plan can be beneficial, life insurance offers a unique and essential layer of protection that should not be overlooked. Here's why:

When you have a family or financial responsibilities, the loss of income due to your passing can be devastating. Life insurance steps in to fill that gap and ensure your loved ones' financial well-being. It provides a financial safety net, allowing your beneficiaries to maintain their standard of living and cover essential expenses even in your absence. This peace of mind is invaluable, knowing that your family's long-term financial goals and everyday needs are protected.

The primary purpose of life insurance is to provide financial security during challenging times. It ensures that your family can cover immediate costs like funeral expenses, outstanding debts, and any other final arrangements. Moreover, it enables them to continue making mortgage payments, pay for children's education, or support a business venture, providing stability and preventing financial strain on your loved ones. With life insurance, you can rest assured that your family's future is secure, and they won't have to make difficult choices due to a lack of financial resources.

In addition to the immediate benefits, life insurance also offers long-term financial protection. It can be used to pay for your children's education, ensuring they have the resources to pursue their dreams. For those with long-term financial goals, such as retirement planning, life insurance can provide the necessary funds to achieve these milestones. By having this coverage, you are actively contributing to your family's financial future and ensuring that your hard-earned savings and investments are utilized according to your wishes.

Furthermore, life insurance provides an opportunity to plan for the unexpected. Life is unpredictable, and having insurance ensures that your family is prepared for any unforeseen circumstances. It allows you to take control of your financial destiny and make decisions that align with your values and goals. With life insurance, you can leave a lasting legacy and provide for your loved ones, even in your absence.

In summary, while savings and a 401(k) are essential components of financial planning, life insurance offers a distinct advantage in terms of peace of mind and financial protection. It provides a safety net for your family, ensuring they can maintain their lifestyle and financial goals even when you're no longer there to support them. By considering life insurance, you are taking a proactive approach to safeguarding your loved ones' future and creating a more secure and stable environment for them.

Colonial Life Insurance: Group Benefits and Features Explored

You may want to see also

Frequently asked questions

While having savings and a 401(k) is beneficial for your financial future, life insurance serves a different purpose. It provides financial protection and peace of mind for your loved ones in the event of your untimely death. Savings and retirement accounts are designed to help you achieve long-term financial goals, but they don't cover immediate expenses or provide income replacement if you pass away. Life insurance ensures that your family can maintain their standard of living, cover funeral costs, and manage any outstanding debts during a difficult time.

Life insurance offers a guaranteed payout to your beneficiaries, which can be a crucial financial safety net for your family. If you were to pass away, the death benefit from your life insurance policy would provide a lump sum payment to your designated recipients. This money can be used to cover various expenses, such as mortgage payments, children's education fees, daily living costs, and any other financial obligations you may have left behind. It ensures that your family can maintain their lifestyle and have the resources to move forward without the added stress of financial burdens.

Absolutely! Having a 401(k) is an excellent way to save for retirement, but it's primarily designed for long-term financial goals. Life insurance can complement your 401(k) by providing immediate financial support to your loved ones. The proceeds from a life insurance policy can be used to cover short-term expenses, such as funeral costs, outstanding debts, or any other financial obligations, ensuring that your family is taken care of in the event of your death. It's a way to create a more comprehensive financial plan and provide security for your loved ones.

Yes, life insurance is valuable for individuals with stable incomes and good jobs, as well as those without. It provides financial security and peace of mind, ensuring that your loved ones are protected regardless of your employment status. Life insurance can be especially important if you have financial responsibilities, such as a mortgage, children's education costs, or other debts. It allows you to leave a legacy for your family and ensures they can maintain their standard of living even if you're no longer around. Additionally, life insurance can be a valuable tool for business owners, as it can provide funds to buy out partners or keep the business running smoothly in the event of their passing.