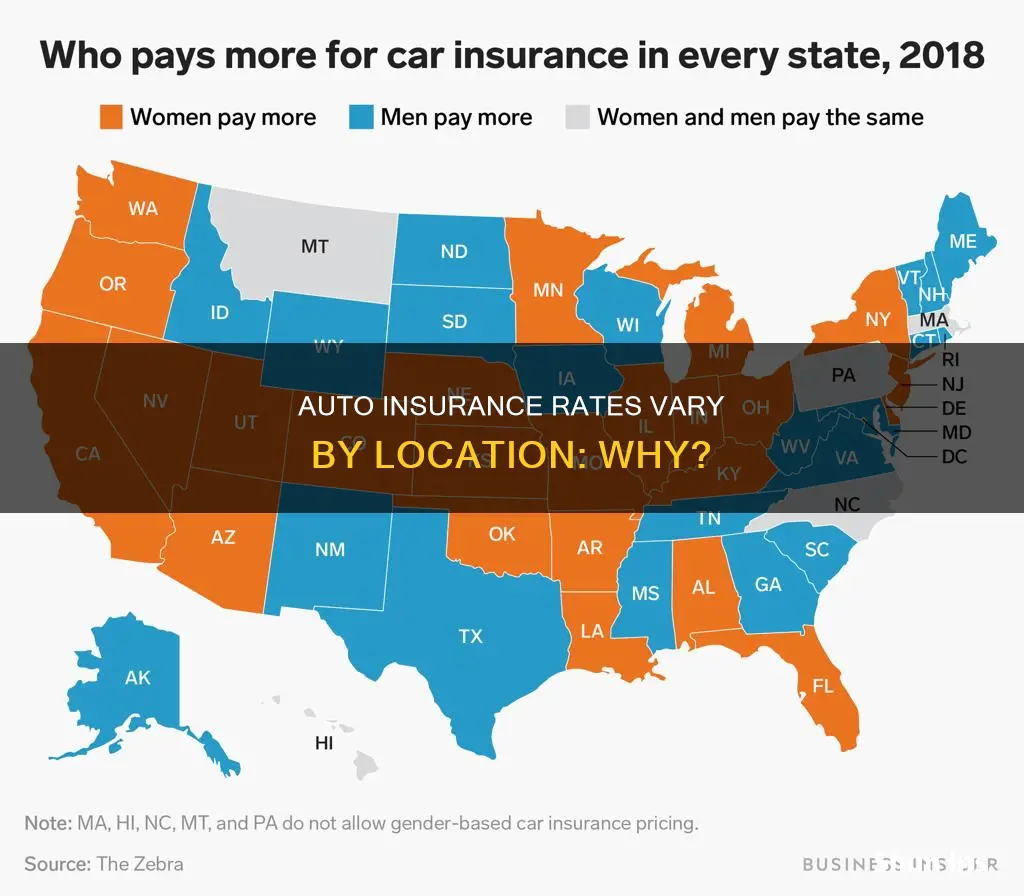

Auto insurance rates vary significantly by location, and there are several reasons why insurance premiums are higher in certain areas. One key factor is the frequency of claims in a particular area. If a ZIP code has a high number of auto insurance claims, insurers may designate it as high risk and quote higher premiums to offset their potential costs. Population density also plays a role, as urban areas with higher traffic volumes generally have a greater chance of car accidents, leading to increased insurance rates. Additionally, areas prone to harsh weather conditions, such as flooding or hail, often experience higher insurance rates due to the potential for multiple claims. Crime rates and road conditions can also impact insurance costs, with areas of high vandalism, theft, or poorly maintained roads resulting in higher premiums. Ultimately, insurance companies consider the likelihood of claims when setting rates, and areas with higher risk factors tend to have more expensive auto insurance.

| Characteristics | Values |

|---|---|

| Population density | High-population areas mean a higher chance of car accidents. |

| Frequency of claims | If a lot of auto insurance claims are filed in your ZIP code, insurers may designate your neighbourhood as high risk and quote higher premiums. |

| Weather | If you live in an area prone to harsh weather, there is a higher chance of an accident. |

| Crime rates | If you live in a city or neighbourhood with frequent incidents of vandalism or theft, your car insurance company will take that into account when they calculate your rate. |

| Unemployment rates | In areas with high unemployment, people may forgo car insurance due to budget constraints, and other policyholders in the same area wind up paying higher rates to compensate. |

| Road conditions | Roads in ill repair or with dangerous intersections increase the odds of an accident, resulting in higher car insurance costs. |

| Traffic density | Vehicles driven in an area with high traffic volume are exposed to a higher risk of accidents. |

| Accident reports | A high number of motor vehicle crashes signals to insurers that an area may carry higher insurance risks. |

| Property crime | If your area sees high property crime rates, you may pay more for full coverage. |

| Repair and healthcare costs | In high-cost areas, auto repair bills and medical bills may be higher, leading to more costly insurance claims and higher premiums for local vehicle owners. |

| Weather patterns | If your city is subject to severe weather that can lead to accidents and insurance claims, your insurance company may charge a higher rate. |

What You'll Learn

Crime rates and accident history in your area

If you live in an area with high crime rates, you are more likely to pay higher auto insurance premiums. This is because insurance companies view your location as a risk factor, and they will need to pay out more claims for theft, vandalism, and break-ins. Areas with higher populations and large cities tend to have higher crime rates and, consequently, higher insurance premiums.

Additionally, insurance companies take into account the rate of accidents in your area. If you live in a densely populated urban area, the chances of accidents occurring are higher, which leads to increased insurance claims. As a result, insurance companies will charge higher premiums to offset these costs.

To mitigate the effects of crime rates and accident history on your auto insurance rates, you can consider installing anti-theft devices in your vehicle and parking it in a secure location, such as a garage. Taking these precautions can help reduce the risk of theft or vandalism and potentially lower your insurance premiums.

Auto Insurance: Understanding the Standard Coverages You Need

You may want to see also

Population density and traffic volume

Living in a densely populated area, such as a large city, typically leads to higher car insurance premiums. This is because there are more vehicles on the roads, increasing the risk of accidents and subsequent claims. Insurers also consider the type and frequency of claims filed in these areas. If an area has a high frequency of claims and higher average expenses, insurance costs will likely be higher.

Traffic congestion is another consequence of high population density, and it further contributes to the increased risk of accidents. Poor road conditions, such as a lack of traffic lights or signage, can exacerbate the problem and lead to higher insurance rates.

Additionally, population density can impact the cost of repairs and healthcare, which are important factors in insurance claims. In areas with a high cost of living, auto repair bills and medical expenses tend to be higher, resulting in more costly insurance claims and, consequently, higher premiums for residents.

In summary, population density and traffic volume are crucial considerations for insurance providers when determining auto insurance rates. Higher population density and traffic volume increase the likelihood of accidents, claims, and repair costs, all of which contribute to higher insurance premiums in these areas.

Understanding Auto Insurance Scores with Credit Karma

You may want to see also

Repair and healthcare costs

The cost of living in a particular area is a significant factor in determining auto insurance rates. Repair and healthcare costs are influenced by the cost of living, and these, in turn, affect insurance premiums.

In areas with a high cost of living, auto repair bills and medical bills are typically higher. This means that insurance claims are more expensive, and local vehicle owners pay higher premiums. For example, the cost of repairing a vehicle after an accident can range from $100 to $2,000, depending on the type and severity of the damage. The cost of these repairs is influenced by factors such as the make and model of the vehicle, the complexity of the repair process, and local replacement part prices.

In addition, the cost of medical care in an area can impact insurance rates. Healthcare costs have been rising over time, and this is reflected in higher insurance premiums. This is particularly true in areas with a high cost of living, where medical services may be more expensive.

The cost of living also affects insurance rates through its impact on labour costs. In areas with higher wages, labour costs for auto repairs are typically higher, which can lead to increased insurance premiums.

Furthermore, insurance companies take into account the frequency of claims in a particular area when setting rates. If a neighbourhood is designated as high risk due to a high number of claims, insurance companies will quote higher premiums to offset their potential costs. This can be influenced by factors such as traffic density, accident reports, and property crime rates, which are all related to the cost of living in an area.

By taking into account repair and healthcare costs, as well as the frequency of claims, insurance companies can set premiums that reflect the risk of doing business in a particular area. This helps ensure that they can cover future claim payouts while also providing coverage for their customers.

The SF 95 Accident Insurance Claim: What You Need to Know

You may want to see also

Weather conditions

Seasonal weather conditions can also impact auto insurance rates. For instance, if you reside in a region with snowy winters and icy roads, you'll likely pay more for coverage. Similarly, areas susceptible to natural disasters like hurricanes, flooding, or wildfires may experience higher insurance rates due to the increased potential for vehicle damage.

It's worth noting that weather events primarily influence comprehensive auto insurance rates, which cover a range of perils, including natural disasters, fallen objects, theft, and accidents involving animals. In contrast, collision insurance pertains to accidents involving other vehicles or objects, regardless of weather conditions.

While weather conditions can directly impact the likelihood of accidents and vehicle damage, they can also affect driving conditions. For example, heavy rain, hail, or snow can increase the chances of an accident, leading to higher insurance rates in these areas.

To manage the increase in weather-related claims, it's advisable to consult experts who can help find cost-effective policies or explore discounts on your current plan. Taking precautions to protect your vehicle from weather damage, such as parking in a garage or avoiding areas with overhead hazards, can also help mitigate the impact of adverse weather.

Home and Auto Insurance: Mortgage Payment Coverage?

You may want to see also

Unemployment rates

Secondly, unemployment can indirectly impact insurance rates through its effect on credit scores. A decrease in income due to unemployment may lead to missed payments or increased debt, resulting in a lower credit score. In states where credit history is a factor in determining insurance rates, a lower credit score could lead to higher premiums.

It is important to note that unemployment itself does not directly affect insurance rates. Auto insurance providers do not use occupational status as a rating factor, and there is no obligation to inform your insurance company if you lose your job. However, certain professions may be eligible for discounts, so unemployment could result in the loss of such discounts.

To mitigate the impact of unemployment on auto insurance rates, individuals can compare quotes from different providers, as rates may vary. They can also consider pay-per-mile insurance, especially if their mileage has decreased due to unemployment. Maintaining a clean driving record, adjusting coverage levels, and raising deductibles can also help reduce premiums.

Boating DUI: Auto Insurance Impact

You may want to see also

Frequently asked questions

Auto insurance rates are influenced by the number of claims made in a particular area. If a neighbourhood has a high number of auto insurance claims, insurance providers may designate it as high-risk and increase premiums to offset potential costs. Areas with high population density and traffic volume also tend to have higher insurance rates since the chances of accidents are higher. Other factors that impact insurance rates include weather patterns, property crime rates, repair and healthcare costs, and road conditions.

Traffic density is a significant factor in determining auto insurance rates. Areas with high traffic volume, such as large cities, generally have higher insurance rates because there is an increased risk of accidents and collisions. The higher the traffic density, the greater the chances of vehicle damage, injuries, and subsequent insurance claims.

Weather patterns can significantly influence auto insurance rates, especially in areas prone to severe weather conditions. For instance, if you live in an area prone to flooding, your insurance premium may be higher due to the potential for multiple claims arising from flood damage. Similarly, areas with harsh weather conditions like heavy rain, hail, or snow have higher accident risks, leading to increased insurance rates.

Areas with high property crime rates, including vehicle theft and vandalism, tend to have higher auto insurance rates. Comprehensive coverage, which is part of full coverage policies, pays out for losses due to vehicle theft or damage caused by attempted theft. As a result, insurance providers may charge higher premiums in areas with frequent incidents of property crime to offset the potential costs of claims.

Yes, repair and healthcare costs can influence auto insurance rates, especially in high-cost areas. When repair bills and medical expenses are higher, insurance claims tend to be more costly. As a result, insurance companies may charge higher premiums in these areas to cover the potential increase in claim payouts.