Connecticut's auto insurance rates are high due to a combination of factors, including its dense population, high cost of living, and frequent insurance claims. The state's affluent population tends to purchase more expensive vehicles and comprehensive coverage options. The cost of car insurance is also influenced by the increasing number of accidents, claims, and payouts, as well as rising healthcare and auto repair costs. Additionally, the state's proximity to New York City and severe weather events contribute to higher premiums. Connecticut's insurance requirements and dense population in cities like Hartford and Bridgeport further drive up the cost of auto insurance.

What You'll Learn

Connecticut's dense population and high cost of living

Connecticut has one of the densest populations in the country, and its residents have the highest personal income in the US. The state's cost of living is 27.7% above the national average, with housing costs 44.7% higher than the national average. This is reflected in the price of car insurance, which is higher than in some neighbouring states.

The cost of living in Connecticut is influenced by the amenities the state provides to its residents, such as good schools, parks, paved streets, and social services. The state also has top-performing schools, healthier lifestyles, and safer towns and cities than the US average. Connecticut ranks 4th in the nation for healthcare access for adults and children and is ranked the 7th healthiest state in the country.

The high cost of living in Connecticut is also due to the high taxes its residents pay. Taxes are needed to fund the state's services, and property taxes are particularly high in areas with good school systems. Connecticut's housing costs are also impacted by building restrictions on more affordable housing.

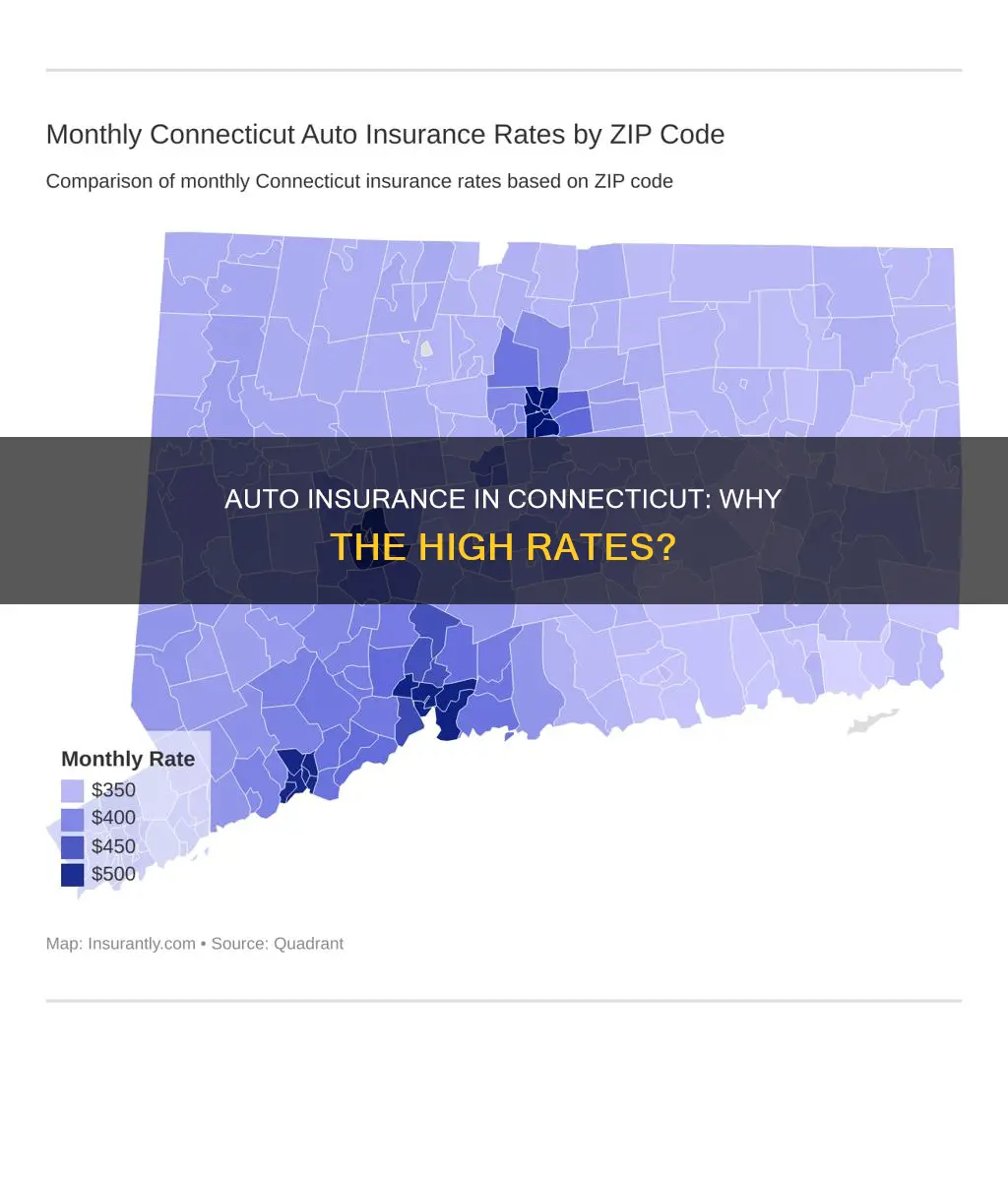

The state's dense population contributes to higher car insurance rates. More people on the roads mean more accidents, claims, and payouts. In 2020, there were 279 fatal crashes in Connecticut, compared to 2018 in 2011. The state's population density also means that there are more accidents, more property crime, and more frequent insurance claims. The cities of Hartford, Bridgeport, and New Haven are the most expensive locations for insurance in Connecticut.

Credit Card Auto Insurance: Understanding Dual Coverage for Vehicles

You may want to see also

The state's affluent population buying more coverage

Connecticut is a developed and affluent state with a high per capita income. It is the wealthiest state in the US in terms of per capita income, which was $44,496 in 2019. The state's wealth is concentrated in lower Fairfield County, with several zip codes in this area among the wealthiest in the country. Other wealthy areas include the suburbs surrounding Hartford and New Haven, towns along the coast, and parts of Litchfield County.

The state's affluent population tends to purchase more expensive vehicles and more coverage options. This is one of the reasons why car insurance in Connecticut is expensive. In the state, you can expect to pay approximately $5,450 per year for full coverage car insurance or $2,326 per year for minimum coverage. These rates are higher than the national average, which is around $2,000 annually for full coverage and about $700 per year for minimum coverage.

The cost of car insurance in Connecticut is steadily increasing, and as the cost of providing insurance goes up, the premiums insurers charge also rise. This means that insured drivers share the increasing cost of insurance.

The richest towns in Connecticut include Darien, Riverside, Westport, Old Greenwich, Wilton, Weston, Greenwich, Southport, New Canaan, Avon, Ridgefield, Stamford, Woodbridge, Essex, and others. These towns are characterised by high median household incomes and expensive home prices.

Texas Auto Insurance: Understanding Non-Owned Vehicle Coverage

You may want to see also

Auto repair costs are rising

Firstly, newer vehicles are heavier and more complex, with advanced technology and features. This means that when repairs are needed, they are often more expensive. The increased use of lightweight materials such as aluminum, which are brittle and require replacement, is a contributing factor. Additionally, cars now have more sensors and computer components that can be damaged in accidents, leading to higher repair costs.

Secondly, there is a talent shortage in the auto repair industry, with a lack of skilled technicians. This is partly due to the Covid-19 pandemic, which caused many technicians to leave the industry. As a result, labor rates for repairs have increased.

Thirdly, supply shortages and shipping disruptions during the pandemic drove up the cost of parts. This, coupled with the increased demand for repairs due to a higher average age of vehicles on the road, has resulted in higher repair costs.

Finally, regional factors also play a role. Connecticut has the highest average car repair cost in the nation, with an average total repair cost of $418.37. This is due to a combination of high labor and parts costs.

Lemonade: Auto Insurance Available?

You may want to see also

Severe weather is becoming more common

Severe weather events are becoming more common in Connecticut, and this is a significant factor in the high cost of auto insurance in the state. The state is experiencing more frequent severe storms, serious winter weather, and tropical cyclones. These weather events result in insurers paying out a higher number of claims, which tend to be more expensive and less predictable. As a result, insurance providers are forced to increase their rates to keep up with the rising number of claims.

In recent years, there have been several instances of severe weather in Connecticut. For example, in July 2023, there were reports of heavy rain, flooding, and the risk of severe thunderstorms, heavy rainfall, and tornadoes. In September 2024, there were coastal flood warnings, with expectations of one to two feet of inundation above ground level in vulnerable areas near the waterfront and shoreline.

The impact of severe weather on auto insurance rates is twofold. Firstly, the increased frequency and intensity of severe weather events lead to more claims being filed by policyholders for weather-related damage to their vehicles. This includes damage caused by flooding, hail, strong winds, and fallen trees or branches. Secondly, severe weather can also cause indirect damage to vehicles, such as when flooding or strong winds result in road closures, parking lot closures, or damage to parking structures, leaving vehicles vulnerable to further weather damage or increasing the risk of vandalism or theft.

To mitigate the impact of severe weather on their auto insurance rates, Connecticut residents can take several proactive measures. These include:

- Choosing parking locations wisely: Whenever possible, avoid parking in areas prone to flooding or close to trees that could potentially fall and damage your vehicle during a storm.

- Investing in vehicle protection: Consider purchasing a waterproof car cover or using a garage or covered parking structure to protect your vehicle from hail, falling objects, and heavy rain or snow.

- Maintaining comprehensive insurance coverage: Ensure that your auto insurance policy includes comprehensive coverage, which will help cover the cost of repairs or replacement if your vehicle is damaged or destroyed by a covered weather event.

- Taking advantage of weather alerts: Stay informed about severe weather alerts and warnings in your area, and take necessary precautions to protect your vehicle, such as moving it to higher ground during flood warnings or covering it when hail is expected.

Self-Insuring Vehicles in New York

You may want to see also

Healthcare costs are increasing

The cost of medical care is rising due to a number of factors, including:

- The high cost of medical technology and treatments

- An aging population, with more people requiring medical care

- The high cost of prescription drugs

- The increasing cost of hospital stays and procedures

These factors are contributing to the rising cost of healthcare in Connecticut, and this is having a direct impact on the cost of car insurance in the state.

Liberty Auto Insurance Reviewed: Is It Worth the Switch?

You may want to see also

Frequently asked questions

The average cost of car insurance in Connecticut is $1,826 per year for full coverage and $944 per year for minimum coverage. This translates to $152 per month for full coverage and $79 per month for minimum coverage.

There are several reasons why car insurance is expensive in Connecticut. Firstly, the state has a dense population, a high cost of living, and a higher rate of insurance claims. Secondly, Connecticut has a higher proportion of affluent individuals who tend to purchase more expensive vehicles and comprehensive insurance coverage. Finally, the state's insurance requirements and laws also contribute to higher premiums.

The cost of car insurance in Connecticut is higher than the national average. For full coverage, the national average is around $1,330 per year, while Connecticut residents pay approximately $1,826 per year. For minimum coverage, the national average is about $615 per year, compared to $944 per year in Connecticut.

The cost of car insurance in Connecticut has been increasing steadily and is higher than in previous years. For example, the average annual premium for full coverage rose from $1,900 in 2021 to $2,999 in 2022, representing a 57.8% increase.

Several factors influence the cost of car insurance in Connecticut, including age, gender, driving record, location, type of car, credit history, and coverage level. Younger drivers, those with a poor driving record, and individuals with a low credit score typically pay higher premiums. Additionally, urban areas with higher traffic density and theft rates tend to have more expensive insurance.