Group term life insurance is a popular benefit offered by employers to provide financial security to their employees and their families. However, the tax implications of this insurance can be confusing for many. This paragraph aims to clarify why group term life insurance is taxable. It will discuss the reasons behind the taxation, including the distinction between group and individual policies, the tax treatment of death benefits, and the impact of the insurance's tax-deductible status for the employer. Understanding these factors is essential for both employees and employers to make informed decisions about their insurance coverage and financial planning.

| Characteristics | Values |

|---|---|

| Taxable Income: | Group term life insurance benefits are generally taxable as ordinary income for the recipient. |

| Exemption for Beneficiaries: | However, if the insurance is provided by an employer and the beneficiary is a spouse, dependent, or a child, the benefit may be tax-free. |

| Income Tax: | The amount paid out by the insurance company is considered taxable income for the policyholder or beneficiary. |

| Deductions: | In some cases, the employer may be able to deduct the cost of providing group life insurance from their business expenses, but this varies by jurisdiction. |

| Withholding Taxes: | Employers often withhold taxes on the premiums paid by employees, which can be a factor in the overall tax treatment. |

| Taxable Event: | The key taxable event is the payment of the death benefit, which is considered a form of income. |

| Jurisdictional Variations: | Tax laws can vary by country and region, so it's important to check local regulations. |

| Life Insurance Types: | This tax treatment applies to group term life insurance, which provides coverage for a specific period. |

| Long-Term Care Insurance: | It's different from long-term care insurance, which may have tax advantages in certain circumstances. |

| Planning: | Understanding the tax implications can help individuals and employers plan their financial strategies accordingly. |

What You'll Learn

- Taxable Income: Group term life insurance benefits are considered taxable income for the recipient

- Excess Death Benefit: Only the excess over the basic needs amount is taxable

- Taxable Event: The death of the insured triggers the taxable event

- Employer-Provided: Employers providing insurance may be subject to tax implications

- Deductions and Credits: Tax laws offer deductions and credits for group insurance

Taxable Income: Group term life insurance benefits are considered taxable income for the recipient

Group term life insurance is a type of coverage provided by employers to their employees, offering financial protection to the policyholders' beneficiaries in the event of the insured's death. While this benefit provides valuable financial security, it is important to understand that group term life insurance benefits are indeed taxable income for the recipient. This means that when an individual receives a payout from a group term life insurance policy, they must report this amount as income on their tax return.

The reason for this taxation is rooted in the tax code's definition of income. When an individual receives a payment from an insurance policy, it is generally considered taxable income unless the payment is specifically exempt. Group term life insurance benefits fall into the taxable category because they represent a form of compensation or financial assistance, which is subject to taxation under the Internal Revenue Code. This is in contrast to other types of insurance payments, such as health insurance premiums, which may be tax-deductible or tax-free under certain circumstances.

The taxation of group term life insurance benefits is based on the principle of inclusion. When an individual receives a payout, it is included in their total income for the tax year. This income is then subject to the applicable tax rates, which can vary depending on the recipient's overall income and tax bracket. The tax authorities consider the insurance benefit as a form of additional income, similar to wages or salary, and thus, it is taxed accordingly.

It is essential for policyholders to be aware of this taxation to ensure compliance with tax laws. When filing tax returns, individuals must accurately report the group term life insurance benefits they received during the year. Failure to report this income can result in penalties and interest charges, as it is considered a failure to disclose taxable income. Additionally, employers who provide group term life insurance should also be aware of their tax obligations, as they may need to report the benefits provided to employees for tax purposes.

In summary, group term life insurance benefits are taxable income for the recipient because they are considered a form of financial assistance or compensation. Understanding this taxation is crucial for individuals and employers to ensure proper tax reporting and compliance. By being aware of this requirement, policyholders can manage their finances effectively and fulfill their tax obligations accurately.

Uncover the Ultimate Liability Coverage for Life Coaches: A Comprehensive Guide

You may want to see also

Excess Death Benefit: Only the excess over the basic needs amount is taxable

The concept of taxation on group term life insurance can be a bit complex, especially when it comes to the excess death benefit. To understand why this benefit is taxable, it's essential to first grasp the idea of the "basic needs amount." This term refers to the minimum financial support that an individual's beneficiaries would require to maintain their standard of living in the event of the insured person's death. The basic needs amount is typically calculated based on various factors, including the insured's income, expenses, and the number of dependents they have.

When a group term life insurance policy is in place, the death benefit is designed to provide financial security to the beneficiaries. However, the tax implications come into play when the death benefit exceeds the basic needs amount. Here's why:

The excess death benefit, which is the portion of the death benefit beyond the basic needs amount, is considered taxable income. This is because the insurance company views this excess as a form of additional income that the insured individual would have received if they were alive. In essence, the tax authorities treat the excess death benefit as if it were a regular income source, subject to taxation accordingly. This rule is in place to ensure that insurance benefits are taxed fairly and to prevent potential loopholes in the tax system.

For example, let's say an individual has a group term life insurance policy with a death benefit of $500,000. After calculating the basic needs amount, it is determined to be $200,000. The excess death benefit, in this case, would be $300,000. This excess amount would be taxable, and the beneficiaries would need to report it as income on their tax returns.

It's important to note that the taxation of the excess death benefit can vary depending on the jurisdiction and the specific tax laws in place. Tax regulations often provide for certain exemptions or deductions to ensure that the basic needs of the beneficiaries are met without incurring excessive tax liabilities. Therefore, it is advisable to consult tax professionals or insurance advisors to understand the specific tax implications in your region.

Contacting MetLife: Insurance Claims and Queries

You may want to see also

Taxable Event: The death of the insured triggers the taxable event

The death of the insured individual is a critical point in group term life insurance policies, and it is important to understand why this event can lead to tax implications. When an insured person passes away, the insurance company is obligated to pay out the death benefit to the designated beneficiaries. This payout is a significant financial transaction and is subject to taxation. The primary reason for this is that the death benefit is considered a form of income or gain, and tax laws often treat insurance proceeds as taxable events.

In the context of group term life insurance, the policy is typically owned by an employer or an association, and the employees or members are the insured individuals. When a covered person dies, the insurance company pays out the death benefit, which may be a lump sum or a series of periodic payments. This payment is generally considered a taxable event for the beneficiaries, as it represents a form of income or a gain that may be subject to income tax. The tax authorities view these proceeds as a distribution of assets, similar to receiving a large sum of money from a bank account.

The taxability of the death benefit is often a result of the 'accrual' principle in tax law. This principle suggests that income or gains are taxable in the year they are earned or received, even if the actual payment is made in a subsequent year. In the case of group term life insurance, the death benefit is considered earned income when the insured person dies, and the beneficiaries are required to report this amount in their taxable income for that year. The tax rate applied to this income will depend on the beneficiaries' overall income and tax bracket.

It is essential for policyholders and beneficiaries to be aware of these tax implications to ensure compliance with tax laws. Proper planning and understanding of the tax treatment of insurance proceeds can help individuals manage their finances effectively during and after the insured person's death. Consulting with tax professionals or financial advisors can provide valuable guidance on how to navigate these taxable events and minimize any potential tax liabilities.

Waiving Life Insurance: Good or Bad Decision?

You may want to see also

Employer-Provided: Employers providing insurance may be subject to tax implications

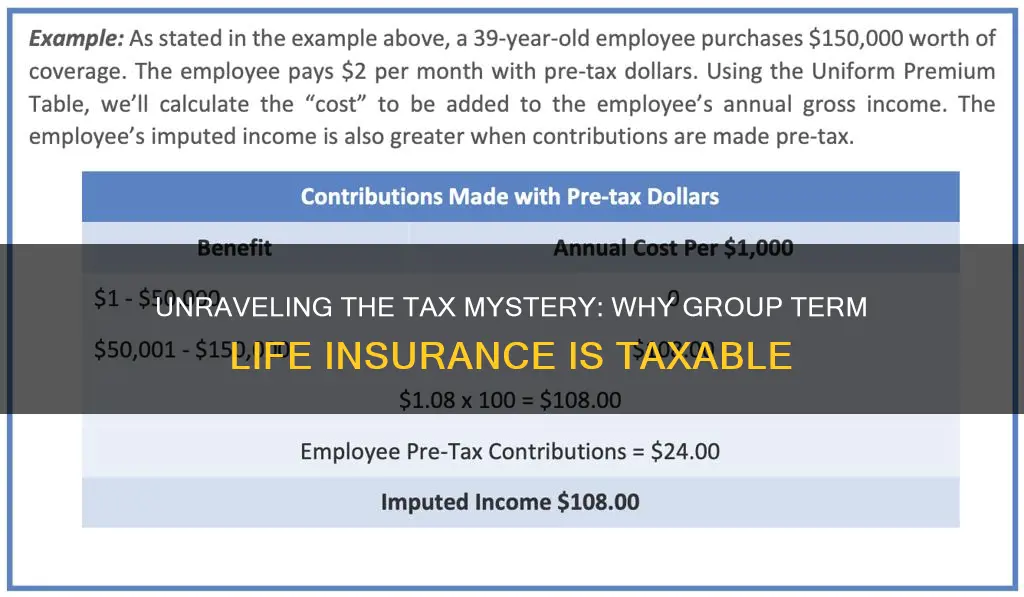

When employers provide group term life insurance to their employees as a benefit, there are specific tax considerations that both the employer and the employee should be aware of. The tax implications arise from the nature of the insurance and the way it is structured. Firstly, the cost of providing this insurance is typically considered a taxable benefit to the employee. This means that the value of the insurance coverage provided by the employer is treated as income and is subject to income tax. The amount of tax owed depends on the individual's tax bracket and the total value of the insurance coverage provided.

Employers are required to report the value of the group term life insurance provided to the tax authorities. This reporting is essential for tax compliance and ensures that the correct amount of tax is withheld from the employees' wages. The tax laws often treat the value of the insurance as a form of compensation, and as such, it is subject to payroll taxes, including Social Security and Medicare taxes. These taxes are levied on both the employer and the employee, with the employer typically responsible for remitting the taxes to the relevant authorities.

The taxability of group term life insurance is an important consideration for employers, especially when structuring employee benefits packages. It is crucial to understand the tax implications to ensure compliance with tax laws and to provide accurate information to employees. Employers may need to consult tax professionals or use online resources to determine the specific tax treatment and reporting requirements for the insurance provided.

Additionally, the tax rules surrounding employer-provided insurance can be complex and may vary depending on the jurisdiction and specific insurance policies. For instance, in some countries, there might be tax-free allowances or thresholds for certain types of insurance benefits. Employers should stay informed about these regulations to ensure they provide the right level of insurance while adhering to tax laws.

In summary, employers providing group term life insurance to employees must navigate the tax implications carefully. This includes understanding the taxable value of the insurance, reporting requirements, and potential tax liabilities for both the employer and the employee. Proper planning and consultation with tax experts can help employers structure their benefits packages while maintaining compliance with tax regulations.

Skydiving: Is Your Northwestern Life Insurance Valid?

You may want to see also

Deductions and Credits: Tax laws offer deductions and credits for group insurance

When it comes to group term life insurance, understanding the tax implications is crucial for both employers and employees. While group term life insurance can provide valuable financial protection, it is essential to know that the premiums paid for this coverage may be taxable income for the recipients. This is primarily because the insurance benefits are considered a form of compensation or income by the tax authorities.

In many countries, tax laws treat group term life insurance as a taxable benefit, especially when the coverage exceeds a certain threshold. This means that the amount of the premium paid by the employer on behalf of the employees can be subject to income tax. The rationale behind this is to ensure that the tax system is fair and treats all forms of compensation equally. When an employer pays for group insurance, it is often seen as a form of additional income or benefit to the employee, which may be taxable.

For employees, this can mean that a portion of their group term life insurance premium may be considered taxable income. This is typically reported on their tax returns, and the employer's contribution to the premium may also be included in their taxable income. However, there are ways to mitigate this taxation. Tax laws often provide deductions and credits to offset the cost of group insurance premiums, making it more manageable for both parties.

Deductions and credits are essential tools in tax legislation to encourage certain behaviors and provide financial relief. In the context of group term life insurance, deductions allow employers to reduce their taxable income by the amount they contribute to the insurance premiums. This deduction can significantly impact the employer's tax liability, especially for businesses with a substantial number of employees. Similarly, employees can claim deductions for the portion of the premium that they personally pay, providing a direct reduction in their taxable income.

Additionally, tax credits are another mechanism to reduce the tax burden. These credits are available for specific expenses, including group insurance premiums. By claiming these credits, employers can further reduce their tax liability, and employees can benefit from a direct reduction in their taxable income. It is important for both parties to understand these deductions and credits to ensure compliance with tax laws and optimize their financial situation.

In summary, while group term life insurance provides valuable coverage, it is taxable for both employers and employees. However, tax laws offer deductions and credits to ease the financial impact. Employers can deduct their contributions, and employees can claim deductions or credits for their share of the premium, ensuring a fair and manageable tax system. Understanding these tax implications is essential for effective financial planning and compliance.

Adding Beneficiaries: Life Insurance Flexibility and Control

You may want to see also

Frequently asked questions

Group term life insurance is generally not taxable for the insured individual. The death benefit received upon the insured's passing is typically tax-free and paid out to the designated beneficiaries. This is because the insurance policy is considered a form of financial assistance, and the government provides tax benefits to encourage such arrangements.

The tax-free status of the death benefit is primarily due to the principle of "incapacity" or "inability to work." When an individual purchases group term life insurance, they are essentially agreeing to pay a premium in exchange for a financial safety net for their beneficiaries in the event of their death. This arrangement is considered a form of financial assistance rather than an income or a gain, hence the tax-free treatment.

Yes, there are a few exceptions. If the insured individual is a key employee in a business and the group term life insurance policy is part of a salary reduction arrangement, the death benefit may be taxable. Additionally, if the policy is considered a form of compensation or a non-qualified plan, the death benefit could be subject to income tax. However, these scenarios are relatively rare and often require specific conditions to be met.

No, the insured individual does not typically claim tax benefits directly from group term life insurance. The tax treatment is focused on the death benefit received by the beneficiaries. However, the insured may be able to claim certain tax deductions or credits related to the insurance premiums they pay, depending on their individual tax situation and the jurisdiction's tax laws.

The tax treatment is generally the same for both group and individual term life insurance. The key difference lies in the ownership and control of the policy. With group term life insurance, the employer or an association typically owns the policy and pays the premiums, making it a non-taxable event for the insured individual. In contrast, individual term life insurance is owned by the insured, and the tax treatment may vary based on the policy type and the individual's tax status.