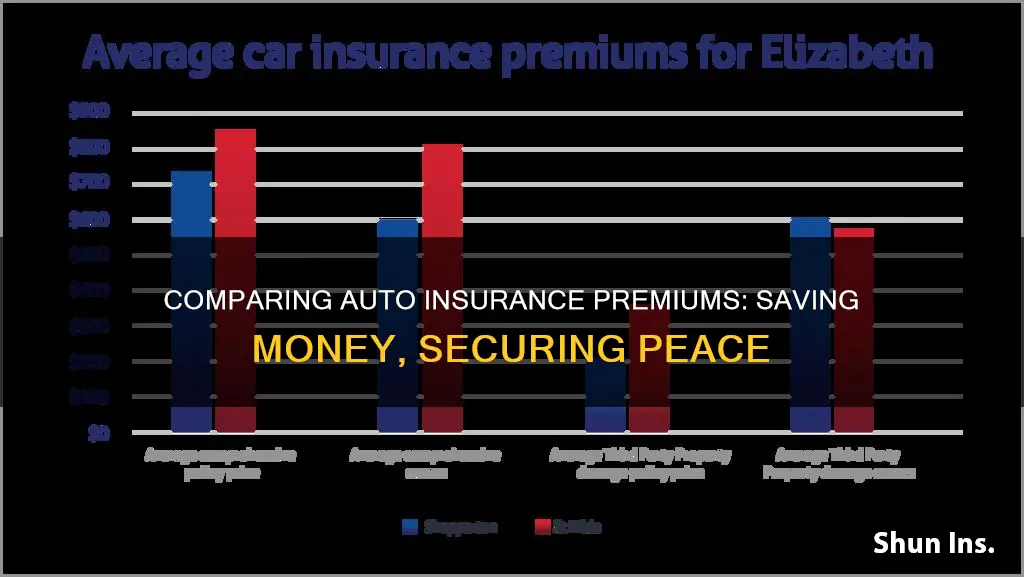

Comparing auto insurance premiums is important because it can save you a lot of money. Auto insurance premiums vary from one insurer to another, and prices can differ significantly based on factors such as your age, gender, driving record, location, and type of car. By comparing rates from multiple insurers, you can find the most affordable option for yourself. This is especially crucial if you have a poor credit history or a less-than-perfect driving record, as you may be offered higher rates than others. Additionally, insurance companies offer various discounts, and by comparing quotes, you can find an insurer that provides discounts suitable for your needs. Comparing insurance premiums ensures you get the best deal and guarantees a more competitive rate.

| Characteristics | Values |

|---|---|

| Age | The younger the driver, the more expensive the insurance premium. Insurance costs tend to decrease for drivers in their mid-50s and rise again for older drivers aged 70+. |

| Driving Record | A history of tickets or violations will increase insurance costs. An at-fault accident can increase insurance costs by 28%. |

| Credit History | Drivers with poor credit pay more for car insurance as they are deemed more likely to file claims. |

| Annual Mileage | Annual mileage has a bearing on insurance premiums, especially in California. |

| Marital Status | Married drivers tend to share driving duties and file fewer individual claims. |

| Insurance History | Lack of continuous coverage is seen as an indicator of higher risk. |

| Level of Coverage | The more coverage, the more expensive the premiums will be. |

| Vehicle Type | Insuring a truck or luxury vehicle is more expensive than insuring a sedan. |

| Location | Insurance costs are higher in areas with more drivers and in locales prone to floods, wildfires, crimes, and other risks. |

What You'll Learn

Comparing quotes can save you money

Secondly, insurance companies offer a range of discounts for drivers who meet certain criteria, and these can lead to significant savings over time. For example, safe driver discounts are offered by some insurers, as well as discounts for students, safety equipment, multiple vehicles, military personnel, and federal employees. By comparing quotes, you can identify which companies offer the most relevant and beneficial discounts for your circumstances.

Thirdly, insurers weigh factors differently when determining the cost of your policy. While your driving history will impact the cost, other factors such as the type of car, your age, gender, and marital status are also considered. Each company will have its own way of weighing these factors, so by comparing quotes, you can find an insurer that offers a more competitive rate based on your personal details.

Lastly, car insurance premiums tend to rise over time, and it is beneficial to compare quotes when your premium is about to expire. By doing so, you can identify if your current insurer is increasing your premium and use that information to find a better deal.

In summary, comparing quotes allows you to find the most competitive rates, take advantage of relevant discounts, benefit from how different insurers weigh factors, and stay ahead of premium increases. All of these factors combined can result in significant monetary savings.

Accidental Death Auto Insurance: What You Need to Know

You may want to see also

Premiums vary from insurer to insurer

Auto insurance premiums vary from one insurer to the next, so it's important to compare rates when shopping for a new policy. The price of car insurance can range dramatically depending on your coverage, the type of car you have, how long you've been driving, where you live, and other factors.

Prices can vary greatly from company to company, which is why it's important to shop around for the best deal on car insurance before committing to an insurer. The biggest factor in determining auto insurance costs is the insurance company you go with. Rates vary substantially from company to company, and while there are other factors that comprise your driving profile, you could be paying too much for car insurance simply because your current company is too expensive.

Insurance companies offer discounts for drivers who meet certain criteria, and select companies may offer discounts that are more fitting for your needs. These discounts can typically save you between 15% and 20% off the cost of your policy, which can lead to significant savings over time.

Each auto insurance company weighs factors differently, so do your research before choosing an insurer. For example, select companies may offer more competitive auto insurance rates for teen drivers, while others are more lenient with drivers with a less-than-stellar driving record.

Your age can also have a big impact on your car insurance rate. Teen drivers have some of the highest car insurance rates on average, but they aren't the only ones. Although your rates will likely decrease once you hit your thirties, most drivers tend to see higher rates once they reach their seventies.

In conclusion, it's important to compare auto insurance premiums because premiums vary from insurer to insurer. By shopping around and comparing rates, you can find the best deal and ensure that you're not paying too much for your car insurance.

How to Negotiate a Total Loss With Your Insurer

You may want to see also

Discounts vary among insurers

Comparing auto insurance premiums is important as it can help you find the best deal and save money. Discounts are a great way to reduce costs, and they vary among insurers, so it's worth shopping around to find the best deal for your needs.

Insurance companies offer a range of discounts for drivers who meet certain criteria. These discounts can typically save you between 15% and 20% off the cost of your policy, which can add up to substantial savings over time. Here are some common types of discounts offered by insurers:

- Safe driver discounts: You are considered a safe driver if you haven't been in an accident in the past three to five years. Some insurers offer additional discounts for drivers who take defensive driving courses.

- Student discounts: Many insurers offer discounts for high school or college students who maintain a certain grade point average (usually a B or above).

- Safety equipment discounts: Insurers may offer discounts for vehicles equipped with safety features such as airbags, anti-lock brakes, anti-theft systems, and daytime running lights.

- Multi-vehicle discounts: This type of loyalty discount is offered to families with multiple cars insured under the same policy.

- Military and federal employee discounts: Many insurers provide discounts for military members, veterans, and other public servants. Some insurers cater exclusively to this demographic.

- Bundling discounts: Insuring your home and vehicle with the same provider can result in significant savings, often up to 30% off your premiums.

In addition to these common discounts, select insurers may offer more tailored discounts. For example, discounts for specific occupations, alumni associations, or professional organizations. It's worth asking your insurance agent or doing some research to find out what discounts you may be eligible for.

When comparing auto insurance premiums, it's important to consider not only the discounts offered but also how insurers weigh other factors such as your driving history, the type of car you own, your age, gender, and marital status. By shopping around and comparing quotes, you can find the most competitive rate for your needs.

Switching Auto Insurance in Louisiana: A Step-by-Step Guide

You may want to see also

Insurers weigh factors differently

When it comes to auto insurance, it's important to remember that no two insurers are the same. Each company has its own way of weighing the various factors that go into determining your premium. While some factors, such as age and gender, are beyond your control, others, such as your driving record and the type of car you drive, can be influenced by your choices. Here's a closer look at some of the key factors that insurers consider when calculating your premium:

- Type of car: Insurers will consider the make, model, and age of your vehicle. Brand-new sports cars or luxury vehicles, for example, may come with higher premiums due to their higher replacement costs. On the other hand, older, more modest cars may be cheaper to insure. Additionally, safety features and collision-warning systems can also impact your premium. While these features make driving safer, they may add to the cost of insurance if they are expensive to repair or replace.

- Driving record: Your driving history is a significant factor in determining your premium. An at-fault accident or a history of moving violations, such as speeding or reckless driving, will likely result in higher insurance costs. Conversely, maintaining a clean driving record can help lower your premium.

- Age and gender: Statistically, younger drivers, especially teens, are considered high-risk and tend to pay higher premiums. Premiums usually decrease as drivers get older and gain more experience. Gender also plays a role, with male drivers, particularly teenagers, often paying more than female drivers due to a higher likelihood of risk-taking behaviour.

- Marital status: Married couples often benefit from lower premiums compared to single individuals. This is because married individuals are seen as more stable and less likely to engage in risky behaviour. Additionally, married couples may qualify for multi-vehicle discounts if they insure multiple cars together.

- Location: Where you live can significantly impact your premium. Insurers consider the number of accidents, insurance claims, and population density in your area. Living in a highly populated metropolitan area will generally result in higher premiums compared to rural areas.

- Credit score: In most states, your credit score is a factor in determining your premium. A higher credit score typically leads to lower premiums, as it demonstrates financial responsibility and a lower likelihood of filing claims.

- Annual mileage: The more you drive, the higher the chances of an accident. As a result, insurers consider your annual mileage, with those driving over 15,000 miles per year typically paying higher premiums. If your annual mileage decreases, be sure to inform your insurance company, as this may lead to a reduction in your premium.

Remember, each insurer weighs these factors differently, so it's essential to shop around and compare quotes from multiple companies. By doing your research, you can find the insurer that offers the most competitive rate for your specific situation. Additionally, don't forget to consider other factors beyond just the premium, such as the insurer's customer service reputation and claims handling process.

Gap Insurance: Protecting Your Car Finance

You may want to see also

Premiums tend to rise over time

Car insurance premiums tend to rise over time due to a variety of factors, and it is beneficial to compare insurance quotes to ensure you are getting the best deal. The cost of auto insurance increased by 47% between 2011 and 2021, according to the Bureau of Labor Statistics. Premiums reset every six months, which is when insurers typically increase rates. There are several reasons for this increase:

Firstly, rising car repair costs contribute to higher premiums. The cost of repairing or replacing a vehicle after an accident has increased due to supply chain issues, parts shortages, and higher wages for mechanics. This has led to insurance companies paying out more in claims, which is reflected in higher premiums for customers.

Secondly, an increase in disaster-related claims is impacting premiums. Natural disasters, such as storms, wildfires, and flooding, have become more frequent and intense due to climate change. These events result in more claims being filed, especially in states prone to such disasters. As insurers pay out more in claims, they pass on the costs to their customers through higher premiums.

Thirdly, the rise of electric vehicles (EVs) is contributing to higher insurance costs. EVs are generally more expensive to repair or replace than traditional vehicles, which leads to higher insurance premiums. The transition to EVs is important for environmental reasons, but it is having an impact on the cost of car insurance.

Finally, societal factors such as age, gender, and location can also influence insurance premiums. Young and inexperienced drivers are often charged higher rates due to their lack of driving experience and the higher risk of accidents. Men typically pay more than women as they are statistically more likely to engage in risky driving behaviours. Additionally, living in an area with high repair costs, a high crime rate, or frequent severe weather can increase premiums.

To manage the rising cost of car insurance, it is important to compare premiums from different insurers and take advantage of any available discounts. Shopping around for insurance can help you find a better deal, as rates vary significantly between companies. You may also be able to save money by bundling your car and home insurance policies or by increasing your deductible. However, it is important to ensure you have adequate coverage to protect yourself financially in the event of an accident.

Colorado Auto Insurance: Affordable Monthly Premiums

You may want to see also

Frequently asked questions

Auto insurance premiums vary from one insurer to the next, so it's important to compare rates when shopping for a new policy. Prices can vary greatly from company to company, and comparing premiums can save you hundreds of dollars per year.

Auto insurance premiums are influenced by a number of personal factors, including age, gender, vehicle type, location, credit history, driving record, and claims history.

You can compare auto insurance premiums by using an insurance comparison website, going directly to insurer websites, or working with an independent insurance agent.

To compare auto insurance premiums, you will need personal information such as your age, gender, vehicle type, location, and driving record. You will also need to know the coverage types and limits you want to purchase.