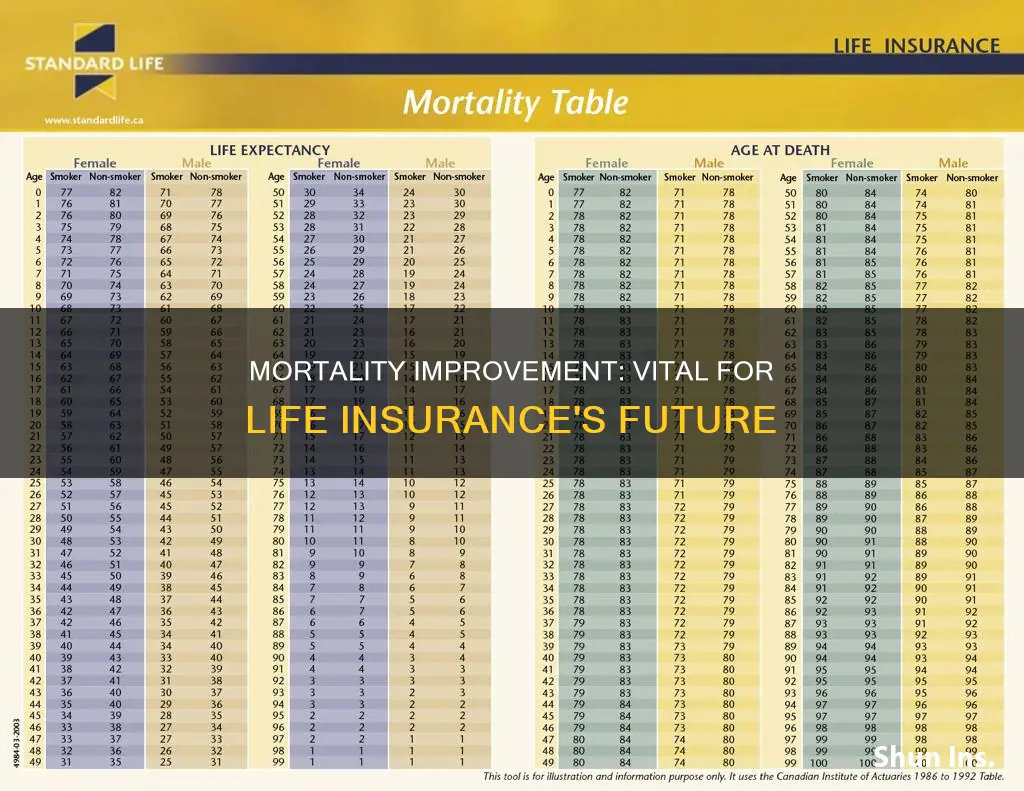

Mortality improvement is essential to the life insurance industry as it directly impacts the pricing and valuation of policies. Life expectancy has historically improved in waves, influenced by advancements in medicine and healthcare, and lifestyle changes. While the last significant wave of improvement ended around 2010, driven by advancements in cardiovascular health and reduced smoking rates, the current trend suggests a plateau or slowdown in mortality improvement. This plateau is attributed to rising obesity and diabetes rates due to poor lifestyle choices. However, future breakthroughs in medicine, particularly in cancer diagnostics and personalized treatments, hold the potential to drive the next wave of improvement. As insurers seek to manage associated risks, accurately forecasting mortality improvement is crucial for setting premiums and ensuring the sustainability of protection.

| Characteristics | Values |

|---|---|

| Importance of mortality improvement in life insurance | To support actuarial assumption setting for both pricing and valuation, and risk management |

| Factors that may produce the next major wave of mortality improvement | Advanced cancer diagnostics, evolution of treatments from generic to personalised, precision medicine |

| Factors that may negatively impact mortality improvement | Rising rates of obesity and diabetes due to poor diet and sedentary behaviour, lifestyle or nutrition-related factors |

| Positive contributors to mortality improvement | Decline in the number of smokers, improved cardiovascular health due to statins and anti-hypertensives |

| Mortality improvement trends | Continuous improvement, deterioration, or stability |

| Impact of mortality improvement on life insurance premiums | Mortality improvement assumptions affect premium rates, with lower premiums when improvement is assumed and higher premiums when deterioration is assumed |

| Role of insurers | Insurers may need to reevaluate product designs to better manage the associated mortality risk |

| Role of policy interventions | Policy interventions can play a key role in improving mortality trends, such as innovations in weight loss drugs and surgery |

What You'll Learn

- Mortality improvement is key to accurate underwriting and risk forecasting

- Lifestyle factors such as obesity and diabetes impact mortality improvement

- Advancements in medicine and healthcare increase life expectancy

- Cardiovascular health improvements have reduced premature deaths

- Innovations in weight loss drugs and surgery may improve mortality trends

Mortality improvement is key to accurate underwriting and risk forecasting

In recent years, there has been a slowdown or plateau in mortality improvement rates in advanced insurance markets such as the US and the UK. This can be attributed to a loss of momentum in areas like cardiovascular health improvements and a rise in obesity and diabetes rates. However, it's important to note that advancements in medicine and healthcare still hold promise for future breakthroughs, particularly in the areas of cancer diagnostics and personalised treatments.

To enhance the accuracy of long-term forecasts, actuaries and underwriters must look beyond historical data and adopt a holistic view that considers future trends in mortality factors. This proactive approach enables them to build long-term mortality improvement assumptions and ensure the sustainability of their protection offerings. For instance, Swiss Re has actively promoted healthier and longer lives by examining the historical and current trends influencing mortality improvement and identifying potential catalysts for future advancements.

Additionally, it's worth noting that mortality improvement rates can vary significantly between different demographic groups, with factors like race, class, and income playing a role. As a result, insurers must carefully consider these variables when setting premiums and managing risk. By sharing the risks and benefits associated with changing mortality rates with policyholders, insurers can introduce innovative products that adapt to evolving life expectancy trends.

In conclusion, mortality improvement is indeed crucial to accurate underwriting and risk forecasting in the life insurance industry. By staying informed about the latest advancements in medicine and healthcare, as well as the broader trends influencing society, insurers can make more effective decisions that ultimately contribute to the sustainability of their business and the well-being of their policyholders.

AAA Life Insurance: Leaving AAA, Losing Coverage?

You may want to see also

Lifestyle factors such as obesity and diabetes impact mortality improvement

Lifestyle factors such as obesity and diabetes have a significant impact on mortality improvement. As the world's population ages, lifestyle behaviours become increasingly crucial in determining health and survival across all age groups. However, the consequences of these behaviours may differ between younger adults and the elderly.

Lifestyle factors, such as obesity and diabetes, can increase the risk of premature death and negatively impact life expectancy. For example, obesity and sedentary behaviour can predispose individuals to heart disease, cancer, and stroke, which are leading causes of death. Similarly, diabetes, often resulting from poor diet and physical inactivity, can lead to various health complications that reduce life expectancy.

The impact of lifestyle factors on mortality improvement is essential to consider in the context of life insurance. Insurers rely on assumptions about future mortality improvement trends to set pricing and manage risk. Lifestyle factors, such as obesity and diabetes, can influence these trends and affect the cost and availability of life insurance products.

To mitigate the potential negative consequences of obesity and diabetes on mortality improvement, policy interventions and innovative solutions are necessary. This may include advancements in weight loss drugs and surgery, as well as public health initiatives that promote healthy diets and physical activity. By addressing these lifestyle factors, individuals can reduce their risk of premature death and improve their overall health and longevity.

Additionally, it is worth noting that the impact of lifestyle factors on mortality improvement may vary across different ethnic and racial groups. Current research on this topic primarily focuses on Caucasian populations, and further studies are needed to understand the impact on other ethnic subgroups.

Life Insurance Dividends: Cashing Out and What to Know

You may want to see also

Advancements in medicine and healthcare increase life expectancy

Advancements in medicine and healthcare have historically been the primary drivers of increased life expectancy. Over the past 60 years, the global average life expectancy has increased by almost 23 years, from 49.4 years to 72.3 years. This represents an average annual gain of 0.5% (or 3.7 months) per person per year.

Medical advances that have contributed to increased longevity include developments in diagnostics, medical devices, procedures, and prescription drugs. For example, the last large wave of high improvement in life expectancy was driven largely by improved diagnosis and treatment of cardiovascular diseases and the cessation of smoking. Additionally, advancements in low-cost sensor technologies, repeatability, low power consumption, and reliability have enabled the boom in portable medical technology and devices, allowing healthcare professionals to deliver medical care and treatment to patients wherever they are.

Innovations in medical treatments and equipment are also contributing to improvements in life expectancy. For example, advancements in surgical precision have led to the development of minimally invasive procedures such as Advanced Laparoscopic Surgery, Hysteroscopic Surgery, and Robotic Myomectomies. Other medical fields benefiting from these advancements include neurology, cardiovascular, and interventional equipment.

However, it is important to note that the rate of improvement in life expectancy has slowed in recent decades, despite frequent breakthroughs in medicine and public health. This suggests that we may be approaching a ceiling for life expectancy, as predicted by Olshansky in his 1990 paper, which argued for a ceiling of around 85 years.

The slowing of life expectancy gains has implications for the insurance industry, which has commonly assumed future mortality improvement in pricing and forecasting. As medical innovations continue to alter life expectancies, insurers may need to reevaluate product designs and consider sharing the risk of mortality improvement with policyholders.

How to Insure Your Girlfriend's Life: All You Need to Know

You may want to see also

Cardiovascular health improvements have reduced premature deaths

Cardiovascular health improvements are essential to reducing premature deaths and have a significant impact on life insurance. Cardiovascular disease (CVD) is a leading cause of premature death worldwide, with tobacco use, unhealthy diets, physical inactivity, and harmful alcohol consumption being key risk factors.

According to the World Health Organization (WHO), addressing these risk factors through initiatives like the SEA HEARTS package can effectively reduce CVD-related deaths. This requires a comprehensive approach involving governments, healthcare providers, and society. Additionally, the WHO Global Action Plan aims for a 25% reduction in premature deaths from CVDs and other non-communicable diseases (NCDs) between 2010 and 2025.

Public health interventions play a crucial role in reducing premature deaths. A Harvard study suggests that lowering blood pressure, reducing sodium intake, and eliminating trans fats from diets could significantly decrease CVD-related deaths over 25 years. This involves increasing access to safe and affordable blood pressure medications and implementing strategies such as improved treatment protocols and patient-friendly services.

Furthermore, advancements in medicine and healthcare technologies offer promising solutions. Innovations in weight loss drugs and surgery, for example, hold potential for reducing obesity-related deaths. However, lifestyle factors, such as rising obesity and diabetes rates due to poor diet and sedentary behaviour, pose challenges to future gains in life expectancy.

In conclusion, cardiovascular health improvements, driven by public health initiatives, medical advancements, and lifestyle changes, have played a pivotal role in reducing premature deaths. These improvements are essential for the life insurance industry, as they influence mortality rates and life expectancy trends, which are critical for pricing, risk assessment, and product design.

Life Insurance Cash Value: An IRA Alternative?

You may want to see also

Innovations in weight loss drugs and surgery may improve mortality trends

Mortality improvement is important to life insurance because it helps insurers set actuarial assumptions for pricing, valuation, and risk management. As medical advancements increase life expectancy, insurers can adjust their products and pricing accordingly.

A recent study by researchers at Brigham and Women's Hospital and Harvard T.H. Chan School of Public Health found a sharp increase in the use of weight-loss drugs, specifically glucagon-like peptide-1 receptor agonists (GLP-1 RAs), with a corresponding decrease in metabolic bariatric surgery. This shift from surgical to pharmacological treatment for obesity is notable, as bariatric surgery is considered the most effective and durable treatment option. However, weight-loss drugs offer a less invasive approach that may be more accessible and preferable to some patients.

The increasing use of weight-loss drugs has the potential to save thousands of lives annually, according to a study by the Yale School of Public Health. If access to these medications were expanded to all eligible individuals, the United States could see up to 42,027 fewer deaths each year, including a significant reduction in deaths among individuals with type 2 diabetes. This highlights the importance of addressing financial and coverage barriers to improve public health outcomes.

While innovations in weight loss drugs show promise, lifestyle factors, such as poor diet and sedentary behavior, continue to contribute to rising obesity and diabetes rates. Therefore, a comprehensive approach that includes policy interventions, improved access to treatment, and lifestyle modifications, is necessary to combat these issues and improve mortality trends in the long term.

Big Life Insurance Blunders: Barbara Marquand's Guide

You may want to see also

Frequently asked questions

Mortality improvement is important to life insurance as it helps insurers accurately set prices and manage risks. It also helps ensure the sustainability of protection by allowing people to live longer, healthier lives.

Factors that contribute to mortality improvement include advancements in medicine and healthcare, and lifestyle changes. For example, the introduction of statins and anti-hypertensives has improved cardiovascular health, and smoking cessation has reduced premature deaths.

Future mortality improvement trends may be impacted by lifestyle factors such as rising rates of obesity and diabetes due to poor diet and sedentary behavior. Additionally, advancements in medicine and healthcare may play a role, with potential breakthroughs in cancer diagnostics and treatments.