Life insurance dividends can be withdrawn as cash, but this is not the only option. Policyholders can also use their dividends to pay for future premiums, purchase additional insurance, or pay down policy loans. Dividends are not guaranteed and are based on the insurer's financial performance. They are considered a return of a portion of the premiums paid for a life insurance policy and are generally not subject to taxes.

What You'll Learn

Dividends as a refund of overpaid premiums

Dividends from life insurance policies are considered a return of a portion of the premiums paid by the policyholder. The insurance company receives premium payments and invests them. If the company keeps expenses down and its investments perform well, it declares a dividend, returning a portion of the surplus to the policyholder. In this sense, a dividend on a life insurance policy is, at least in part, a refund of overcharged expenses.

When premiums are set for whole life insurance policies, the companies estimate future expenses. These estimates are usually much higher than actual expenses turn out to be. Dividends include a refund of these over-charged expenses, as well as a credit of extra interest over what was projected.

Dividends are distributed income-tax-free until the taxpayer's investment in the contract has been reduced to zero. They are treated as refunds for overpayment of the premium. This means that the best option is usually to take the cash or check from dividends and reinvest the proceeds in an investment vehicle that could earn more income.

Dividends from life insurance policies are not subject to income tax. They are treated as tax-free returns of premiums. However, if you are earning interest on your dividends, the interest gain is taxable.

Life Insurance Simplified: Direct Term Coverage Explained

You may want to see also

Dividends as taxable income

Dividends from life insurance policies are generally not considered taxable income. This is because the Internal Revenue Service (IRS) treats them as a return of premiums paid, rather than as income. However, there are a few exceptions to this rule.

Firstly, if your dividends exceed the total amount of premiums you have paid into the policy, the excess amount may be subject to taxation. In this case, any dividends over the amount you paid are considered income, rather than a return of premium. For example, if you pay $1,000 in annual premiums and receive a dividend of $1,250, you may owe taxes on the $250 excess.

Secondly, if you choose to leave your dividends in your policy to earn interest, this interest income may be taxable if it exceeds the amount you have paid in premiums. For example, if you have paid $10,000 in premiums and your dividend earns $1,000 in interest, you may owe taxes on that $1,000 of interest income.

It is important to note that the taxation of life insurance dividends can be complex and may depend on various factors, including the type of policy you have and the specific rules in your jurisdiction. Therefore, it is always recommended to consult with a tax professional or financial advisor to determine the specific tax implications of your life insurance dividends.

Escape Whole Life Insurance: Strategies for Policy Surrender

You may want to see also

Withdrawing dividends as cash

Dividends from life insurance policies can be withdrawn as cash. This is one of the most straightforward and flexible methods of receiving dividends, as the funds can be used for anything.

To withdraw dividends as cash, you can request that your insurance company send you a check or make an ACH payment to your bank account. It is important to note that withdrawing dividends as cash may have tax implications. In most cases, life insurance dividends are not subject to income tax, as they are considered a return of overpaid premiums. However, if you withdraw more than the amount you have paid into the policy, you may have to pay income tax on the excess amount. Additionally, if you choose to leave your dividends in the policy to earn interest, these gains may be taxable. Therefore, it is essential to consult with a tax professional or financial advisor before making any withdrawals to understand the potential tax consequences.

Before making any withdrawals, be sure to review the details of your policy carefully. Understand the potential impact on your death benefit and cash value, as well as any fees or taxes that may apply. Contact your insurance agent or company to get specific information about how withdrawing dividends will affect your policy.

Prudential's Drug Testing: Life Insurance Requirements and Protocols

You may want to see also

Using dividends to pay premiums

Life insurance dividends are considered a return of a portion of the premiums paid for a life insurance policy. Insurance companies invest the premium payments they receive from customers, and if they keep expenses down and their investments perform well, they declare a dividend, returning a portion of the surplus to policyholders. Dividends are not guaranteed and the calculation behind them is not disclosed.

If you're buying a participating policy, you can typically choose a dividend option, and most insurers allow this option to be changed once the policy is in force. Here are some common options for using dividends to pay premiums:

Reduce Future Premium Payments

In this option, the insurance company automatically applies any dividends to reduce your future premiums. As dividends increase, your required premium payments decrease. If the dividends exceed your premium due, you don't need to pay anything out of pocket. Over time, dividends can increase to sufficient levels to offset some costs associated with the premium payments.

Accumulate Dividends Inside the Policy

With certain types of permanent life insurance policies, you can accumulate dividends with the company inside the policy, thereby increasing the cash value, with interest credited at a rate set by the company. These policies have a minimum crediting rate, but the rate can be higher than the minimum.

Purchase Additional Coverage

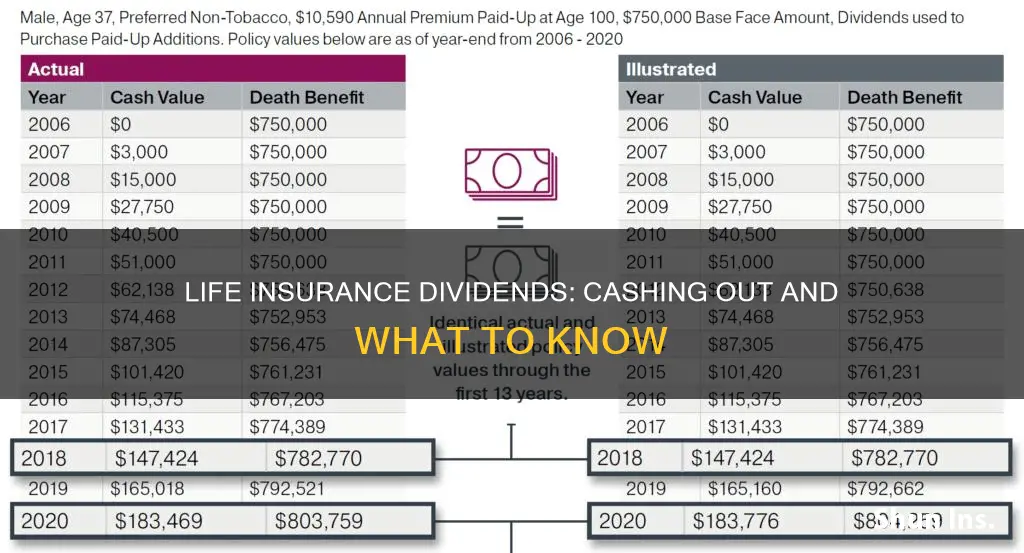

You can use your dividends to buy additional paid-up life insurance. Using dividends in this way can allow the death benefit and cash value of your policy to grow more quickly over time. This growth compounds and is typically tax-deferred.

Surrender the Policy

If you surrender your permanent life policy because of the premium cost, you can consider using the cash value to cover your premium payments. However, with this option, you will no longer have life insurance coverage, and the cash you receive will be lowered by any fees taken out.

Loans

You can typically borrow money through your policy, although the amount varies. The money is provided by the insurer, who uses your policy as collateral. Life insurance loans include interest payments, but it's typically a lower rate than you'd get with personal loans. There's no loan application or credit check, and the credit rating does not impact your interest rate. You can choose not to repay, but the outstanding loan balance will typically be deducted from your death benefit.

Period Problems: Life Insurance Exam Impact

You may want to see also

Dividends as a living benefit

Life insurance dividends are considered a return of a portion of the premiums paid on a policy. The insurance company invests the premium payments, and if the company keeps expenses down and its investments perform well, it declares a dividend, returning a portion of the surplus to the policyholder. Dividends are not guaranteed, and the amount is determined by the insurance company based on its earnings.

Whole life insurance policies can be eligible for dividends if they are "participating" policies. Participating policies charge higher premiums and pay regular dividends to the policyholder. Non-participating policies do not pay dividends and usually have lower premiums.

There are several options for receiving and using life insurance dividends as a living benefit:

- Cash payment: The insurance company sends a check for the dividend amount, typically after each policy anniversary. This option provides a direct cash benefit to the policyholder, which can be used for any purpose.

- Reduce future premium payments: The insurance company automatically applies dividends to reduce future premiums. As dividends increase, required premium payments decrease, and in some cases, dividends can even exceed the amount of the premiums, resulting in no out-of-pocket costs for the policyholder.

- Leave dividends with the insurance company and collect interest: The insurance company retains the dividend, which earns interest in a dividend accumulation account. Policyholders can withdraw cash from this account at any time. The interest earned on these dividends is taxable.

- Purchase additional life insurance: Dividends can be used to buy small amounts of paid-up additional life insurance, which is the same type of coverage as the original policy. This option increases the overall insurance coverage and may generate additional dividends.

- Repay policy loans: If there is an outstanding loan against the policy, dividends can be used to repay the loan amount or reduce the loan balance.

- Pay premiums in advance: Dividends can be used to pay premiums as far in advance as possible, reducing future out-of-pocket costs.

It is important to note that life insurance dividends are not taxable, as they are treated as tax-free returns of premiums. However, if interest is earned on the dividends, the interest gain is subject to taxation.

When considering life insurance policies, individuals should carefully review the details of the policy, including how dividends are calculated, guaranteed, and utilized. The tax implications and the overall financial benefits of the policy should also be taken into account to make an informed decision.

Life Insurance: What's Covered and What's Not

You may want to see also

Frequently asked questions

Yes, you can withdraw cash from your life insurance dividends. This will usually be done by requesting that the insurer send you a check for the dividend amount.

Life insurance dividends are generally not subject to taxes for most uses since they are considered a refund of overpaid premiums rather than a profit. However, if you leave your dividends in the policy to earn interest, these gains may be taxable.

Instead of cashing out your life insurance dividends, you can choose to use them to reduce your future premium payments, purchase additional insurance coverage, or pay down policy loans.

Dividends are typically only available with "'participating' or "dividend-paying" whole life insurance policies. If you have a whole life insurance policy, check with your insurance provider to see if it is a participating policy and if you are eligible to receive dividends.