USAA insurance is known for its high prices, with some people claiming that the company has been getting increasingly expensive. However, USAA's auto insurance rates are still cheaper than those of most competitors. The average USAA car insurance policy is $487 per year, compared to a national average of $2,681 per year. USAA also offers a wide range of discounts, such as for safe driving, low mileage, and vehicle storage.

| Characteristics | Values |

|---|---|

| Average USAA auto policy | $750-800 every six months |

| Average USAA car insurance policy | $487 per year |

| Average USAA car insurance for teenagers | $1,581 per year |

| Average USAA car insurance after an accident | $701 per year |

| USAA's national average rate estimate for full coverage | $1,741 per year |

| Average annual cost of USAA homeowners insurance | $1000 to $2000 per year |

| USAA's average annual premium for homeowners insurance | $2,029 |

What You'll Learn

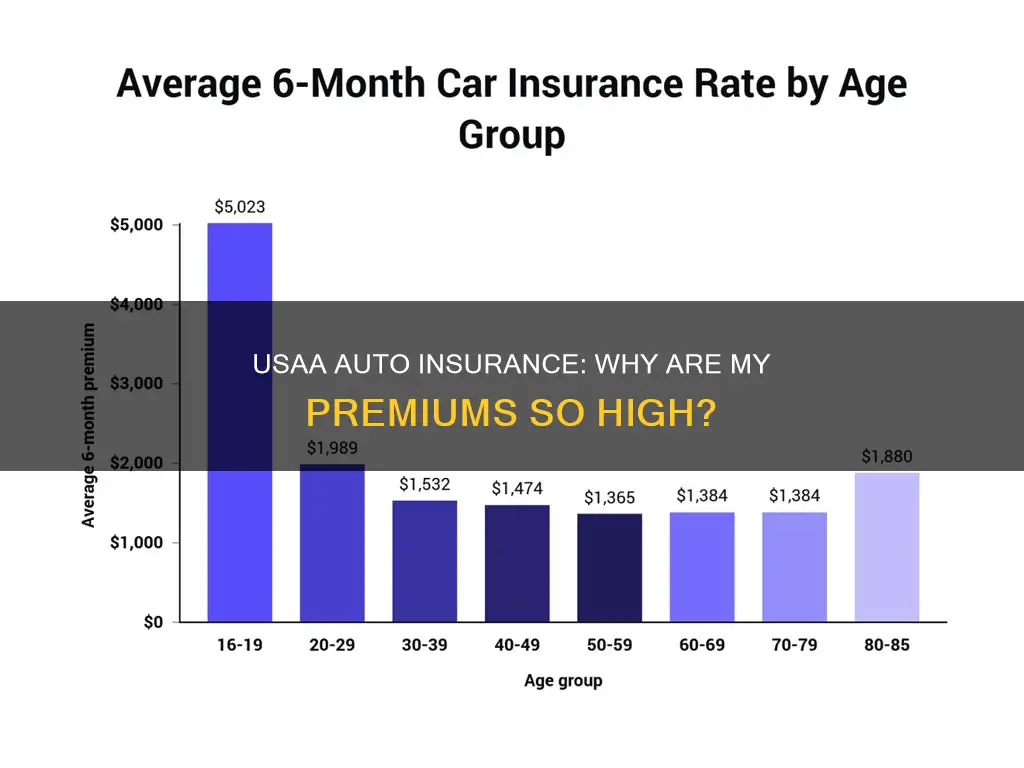

USAA insurance is expensive for young/inexperienced drivers

USAA insurance is expensive for young or inexperienced drivers due to several factors. Firstly, young drivers are considered high-risk by insurers due to their lack of driving experience and history. This lack of experience leads to higher premiums as they are viewed as more prone to accidents and insurance claims. Additionally, teenagers and young adults are more likely to engage in risky behaviours such as street racing, driving under the influence, or distracted driving, which further increases their risk profile.

Another factor contributing to higher insurance rates for young drivers is their age and gender. Statistically, young male drivers are more likely to be involved in aggressive driving and fatal accidents, resulting in higher premiums to offset the increased risk. While young female drivers generally pay less, their rates are still higher than those of older, more experienced drivers due to the overall risk associated with youth.

Furthermore, young drivers often have lower credit scores or no credit history, which insurers consider when determining insurance rates. A poor credit score or lack of credit history is seen as an indicator of higher risk, leading to more expensive insurance.

The cost of USAA insurance for young drivers can also be influenced by the type of vehicle they drive. Sports cars or high-performance vehicles tend to be more expensive to insure due to the increased risk of speeding and accidents associated with these cars.

Lastly, the location of the young driver plays a role in insurance rates. Living in a high-risk ZIP code or an area with a higher cost of living will result in higher insurance premiums.

Mental Health Records: Can Insurers Access?

You may want to see also

Premiums are high for those with poor credit scores

Credit scores can have a significant impact on car insurance rates. In most states, a higher credit score generally leads to lower insurance rates, while poor credit can result in substantially higher premiums. This is because insurance companies believe that drivers with poor credit are more likely to file claims, making them more expensive to insure.

USAA, like most major insurance companies, considers credit scores when determining premiums. While USAA may offer cheaper-than-average rates overall, drivers with poor credit may find that their premiums are higher than average. This is especially true if other factors, such as age, driving experience, vehicle type, and driving record, are also less favourable.

The impact of credit scores on insurance rates varies across states and companies. Some states, including California, Hawaii, Massachusetts, and Michigan, prohibit insurance companies from using credit scores to determine rates. In these states, rates are primarily based on driving records, location, and other factors.

It's worth noting that insurance companies use credit-based insurance scores, which are different from the credit scores used by lenders. These scores are designed to predict the likelihood of filing insurance claims that cost the company more than the collected premiums. While improving your credit score can help, it's not the only factor influencing insurance rates, and shopping around for quotes can still lead to finding a better deal.

Seniors: Higher Auto Insurance Rates?

You may want to see also

USAA's accident forgiveness policy can be a factor

Accident forgiveness is an optional coverage type that can prevent your car insurance rates from increasing in the event of an at-fault accident. USAA offers accident forgiveness for free to policyholders who go five years without an at-fault accident on their driving record. This is the cheapest way to get accident forgiveness from USAA.

You can also purchase accident forgiveness from USAA, which will cover one accident per policy period. This costs anywhere from $15 to $60 per year if you buy it as an optional add-on. However, not all policyholders will qualify for accident forgiveness, and some states don't allow this add-on to be sold.

Without accident forgiveness, your premium could go up by nearly half after an at-fault accident. Accident forgiveness from USAA can help you avoid this steep increase, saving you around 44% on your premium.

It's important to note that accident forgiveness only applies to your first at-fault accident and not to subsequent ones. It also won't keep accidents that you caused from showing up on your overall driving history. Additionally, if you purchase accident forgiveness as an add-on, it won't take effect until your policy renews.

Auto Insurance Exclusion: Understanding the Risks and Consequences

You may want to see also

Location-specific risk factors can increase costs

Location-specific risk factors can increase the cost of car insurance. The area you live in is an important factor for insurers to consider because it affects the likelihood of your vehicle being damaged. For example, your zip code can cause your insurance rates to fluctuate by up to 91% in California.

Depending on where you work and park your car at night, you might get a small discount (or be charged a higher premium) for your street address. Big cities tend to have higher crime rates as well as crowded roads where accidents are commonplace. Rural roads are less congested, and rural areas have less property crime.

Pricing factors driven by location include weather claims (such as hail), accidents, and car theft. Drivers who live in metropolitan areas tend to pay more for coverage than those who live in suburbia due to higher rates of theft, vandalism, and car accidents.

Other location-related factors include the cost of medical care, car repair costs, and the frequency of auto accident lawsuits.

Auto Insurance in Illinois: What You Need to Know

You may want to see also

USAA's high customer service standards are a factor

Additionally, USAA provides its employees with sensory and dramatic experiences during onboarding to help them understand their customer's reality. For example, they bring in a retired drill sergeant to introduce employees to the rigours of basic training and have them eat MREs (meals ready to eat) to experience the challenges of military life. This emphasis on customer empathy and understanding can enhance the quality of their service but may also contribute to higher operating costs.

While some customers have expressed dissatisfaction with USAA's customer service, others have praised the company for its helpfulness and responsiveness. The company's training and onboarding processes aim to empower employees with the tools and mindset to provide effective customer support. However, there are also reviews that mention micromanagement, unrealistic expectations, and a strong focus on sales, which may impact the overall customer experience.

Overall, USAA's high customer service standards, extensive training programs, and focus on customer centricity are likely factors in the pricing of their auto insurance. These standards and the associated costs of providing comprehensive customer support may contribute to the expense of USAA auto insurance.

Bundling Auto and Motorcycle Insurance: Progressive's Comprehensive Guide

You may want to see also

Frequently asked questions

USAA auto insurance is generally not expensive and is, in fact, one of the cheapest car insurance companies in the US. However, certain factors can make your premium more expensive, such as being a young or inexperienced driver, purchasing full coverage, causing an accident, living in a high-risk zip code, driving an expensive vehicle, or having a poor credit-based insurance score.

Teenagers pay an average of $1,581 per year for USAA insurance, compared to $487 per year for older drivers.

Drivers who have recently been in an at-fault accident pay an average of $701 per year for USAA coverage, which is 44% more than drivers with a clean record.

Living in an area with a high risk of natural disasters or a high crime rate can increase your USAA auto insurance premium.