When an accident occurs, it's crucial to understand the importance of contacting your insurance company promptly. However, many drivers might wonder why they should reach out to their insurance provider after a collision, especially if the other driver is not making contact. This paragraph aims to shed light on the significance of insurance communication, emphasizing that even if the other party is not cooperating, your insurance company can guide you through the claims process, provide support, and help you navigate the legal and financial aspects of the accident, ensuring you receive the necessary compensation and assistance.

What You'll Learn

- Policy Coverage: Understand what your insurance policy covers regarding non-contact claims

- Documentation: Gather necessary documents like police reports and witness statements promptly

- Timely Reporting: Report the incident to your insurance company as soon as possible

- Liability: Determine who is at fault and their insurance information

- Claim Process: Follow the insurance company's procedures for filing and handling the claim

Policy Coverage: Understand what your insurance policy covers regarding non-contact claims

When it comes to insurance claims, especially those involving non-contact incidents, understanding your policy coverage is crucial. Many insurance policies have specific provisions and exclusions related to such claims, and being aware of these can significantly impact the outcome of your case. Here's a breakdown of what you need to know:

Review Your Policy Documents: Start by thoroughly reading your insurance policy, especially the sections related to coverage and claims. Look for any mentions of non-contact or accident-related claims. Insurance policies often have distinct sections dedicated to different types of coverage, such as liability, collision, or comprehensive. Pay close attention to these sections to identify the specific terms and conditions related to non-contact incidents.

Liability Coverage: One of the most common types of insurance coverage is liability. This coverage typically applies when you are at fault in an accident, but it can also be relevant in non-contact claims. If the other driver is not contacting you or the insurance company, it might be because they believe you are responsible for the incident. In such cases, your liability coverage could help cover their damages and medical expenses, even if they are not willing to communicate. Ensure you understand the limits and conditions of your liability coverage.

Collision or Comprehensive Coverage: These types of coverage are designed to protect your vehicle in various scenarios, including accidents, theft, or natural disasters. If the other driver is not cooperating or providing contact information, it could be an indication of a comprehensive or collision claim. Review your policy to see if these coverages include non-contact incidents, such as hitting a stationary object or a fallen tree. Understanding the coverage limits and any applicable deductibles is essential.

Exclusions and Limitations: Insurance policies often have exclusions, which are specific situations or events that are not covered. Look for any exclusions related to non-contact claims, such as intentional acts, vandalism, or natural disasters. Additionally, some policies may have limitations on the types of non-contact incidents they cover. For example, they might exclude claims arising from accidents caused by severe weather conditions or acts of nature. Being aware of these exclusions and limitations will help you assess the likelihood of a successful claim.

Documentation and Proof: Insurance companies will require evidence to support your claim. Even if the other driver is not cooperating, you should still gather and document relevant information. This may include police reports, witness statements, photographs of the incident, and any other evidence that supports your version of events. Proper documentation can strengthen your case and increase the chances of a favorable outcome.

Remember, insurance policies can vary significantly, so it's essential to review your specific policy and consult with your insurance provider if you have any doubts. Understanding the coverage details will empower you to navigate the claims process effectively, even in situations where the other party is not cooperating.

Auto Insurance Negotiation: Tips to Lower Your Rates

You may want to see also

Documentation: Gather necessary documents like police reports and witness statements promptly

When it comes to insurance claims, especially those involving vehicle accidents, prompt and proper documentation is crucial. One of the key documents you should aim to gather as soon as possible is the police report. This official document provides a detailed account of the accident, including the date, time, location, and a summary of the events that transpired. It also includes the names and contact information of all involved parties, which is essential for insurance purposes. Obtaining a police report is a standard procedure and can usually be requested from the local law enforcement agency or the police station where the accident occurred.

Along with the police report, witness statements are invaluable. These statements provide an unbiased account of the accident from individuals who saw the incident unfold. It is important to collect these statements promptly as memories can fade over time. Witnesses can offer unique perspectives, describe the actions of the drivers involved, and even provide details about the sequence of events that might not be apparent from the police report alone. Ensure that you obtain witness contact information and, if possible, arrange for them to provide written statements.

The process of gathering these documents can seem daunting, but it is a necessary step to ensure a smooth insurance claim process. Prompt action is vital; the faster you collect these documents, the more accurate and comprehensive your claim will be. Delays in obtaining these records can lead to potential issues with insurance adjusters and may even result in delays in receiving your rightful compensation.

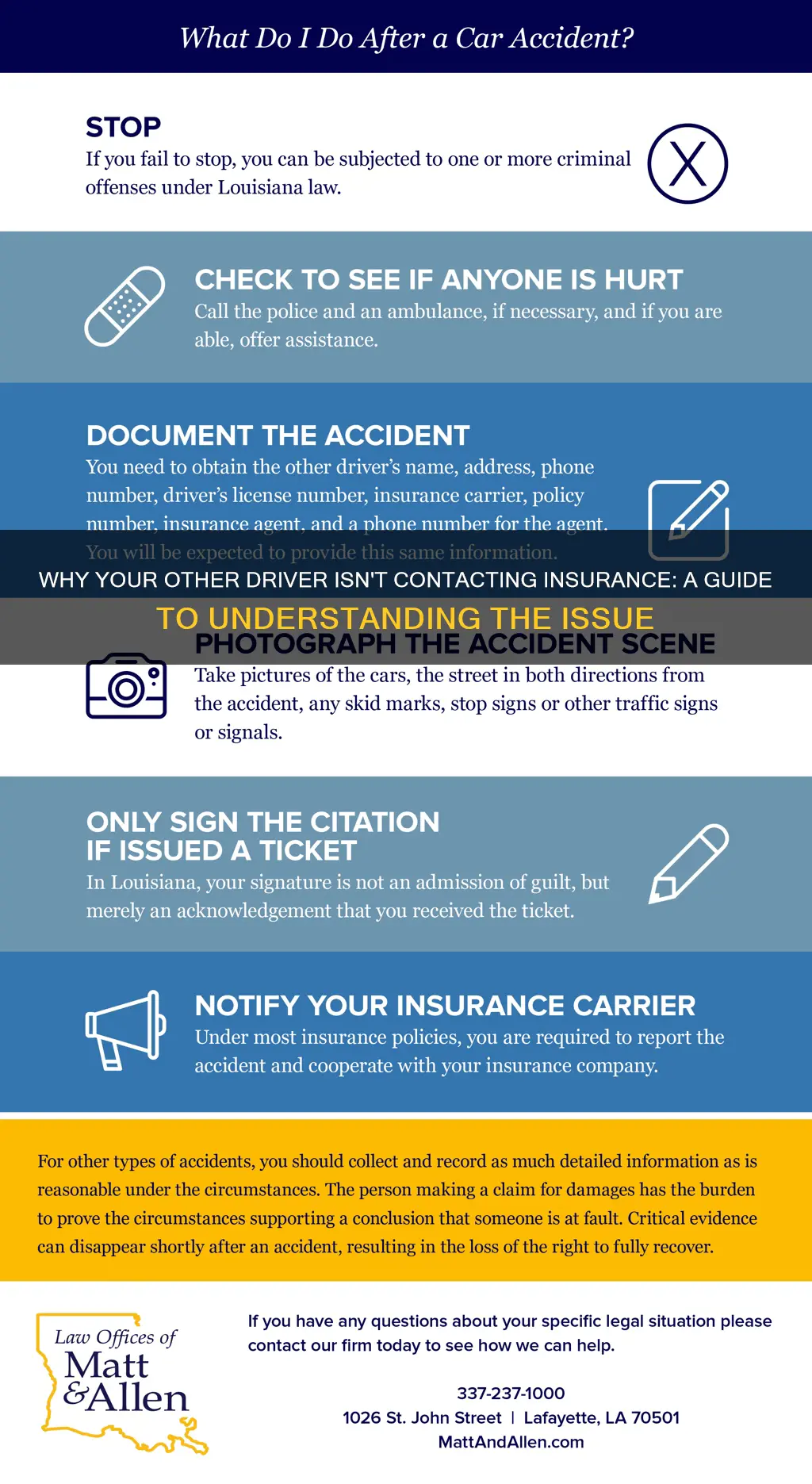

In the event of an accident, it is essential to remain calm and organized. Take the time to gather all relevant information, including photographs of the accident scene, vehicle damage, and any other pertinent details. These additional documents can support your case and provide further evidence to the insurance company. Remember, proper documentation is a critical aspect of the claims process, and it empowers you to have a more efficient and successful outcome.

Lastly, if you are unsure about any part of the documentation process, consider seeking guidance from a legal professional or an insurance claims specialist. They can provide valuable advice and ensure that all necessary steps are taken to protect your interests. Prompt and thorough documentation is a key factor in why the other driver's insurance company should be contacting you, as it demonstrates your commitment to a fair and transparent resolution.

Auto Insurance and Bike Coverage: What Cyclists Need to Know

You may want to see also

Timely Reporting: Report the incident to your insurance company as soon as possible

Timely reporting is a critical aspect of the insurance claims process, and it can significantly impact the outcome of your claim. When you're involved in an accident, it's essential to act promptly and inform your insurance company without delay. Here's why:

Legal and Ethical Obligations: As a policyholder, you have a legal and ethical duty to notify your insurance provider about any incident that may lead to a claim. This obligation is often outlined in your insurance policy, and failing to report it promptly could result in penalties or even the denial of coverage. By reporting the incident quickly, you ensure that your insurance company can take the necessary steps to protect your interests and those of the other parties involved.

Evidence and Documentation: The sooner you report the incident, the better the chances of gathering relevant evidence and documentation. This includes taking photos of the accident scene, exchanging contact and insurance information with the other driver, and collecting witness statements. Timely reporting allows your insurance adjuster to review these details and make an accurate assessment of the claim. Delayed reporting might lead to a loss of crucial evidence, making it harder to prove the facts of the case.

Claim Processing and Settlement: Insurance companies have specific procedures for handling claims, and timely reporting accelerates this process. When you notify your insurer promptly, they can initiate the claims process, which may include assessing the damage, investigating the incident, and determining liability. Quick reporting ensures that your claim is processed efficiently, and you can receive the compensation you deserve faster. Delays can sometimes lead to complications, especially if the other party is uncooperative or if there are disputes over fault.

Preventing Further Issues: Reporting the incident promptly can also help prevent further complications. For instance, if the other driver is uncooperative or provides false information, your insurance company can take legal action or involve law enforcement if necessary. Timely reporting provides your insurer with the necessary tools to address such situations effectively. Additionally, it allows your insurance provider to guide you on the next steps, ensuring you follow the appropriate procedures and avoid any potential legal pitfalls.

In summary, timely reporting of an incident to your insurance company is crucial for legal compliance, evidence preservation, efficient claim processing, and preventing further complications. It empowers your insurance adjuster to take prompt action, ensuring a smoother claims experience and a faster resolution to your case. Remember, acting quickly can make a significant difference in the outcome of your insurance claim.

State Farm Auto Insurance: Hail Damage Protection

You may want to see also

Liability: Determine who is at fault and their insurance information

When it comes to car accidents, determining liability is a crucial step in the aftermath. It involves identifying who is at fault for the incident and gathering their insurance information. This process is essential for several reasons. Firstly, it helps in establishing responsibility, which is fundamental for insurance claims and legal proceedings. Secondly, it ensures that all parties involved receive the necessary compensation and support.

To determine liability, start by examining the circumstances of the accident. Look for evidence such as witness statements, police reports, and any available security camera footage. These sources can provide valuable insights into the sequence of events and help establish who was at fault. For instance, if a witness saw a driver running a red light, this could be crucial evidence in assigning blame.

Once you have gathered the necessary evidence, it's time to contact the insurance companies of all involved parties. In many jurisdictions, drivers are required to report accidents to their insurance provider, and this information is then shared with the other parties' insurers. When contacting the insurance companies, provide them with the details of the accident, including the date, time, location, and a description of what happened. Be prepared to answer questions and provide any additional information they may require.

Insurance adjusters will typically investigate the claim and assess the liability. They may ask for further evidence or statements from witnesses. It is important to cooperate fully with the insurance companies to ensure a fair and efficient resolution. During this process, it is advisable to keep detailed records of all communications and any offers or settlements made.

In cases where liability is disputed, legal action may be necessary. If you believe the other driver is at fault but their insurance company is denying the claim, you can consider hiring a lawyer to represent your interests. A legal professional can guide you through the process, help gather additional evidence, and negotiate on your behalf to ensure you receive the compensation you deserve.

Save Max Auto Insurance: Legit or Scam?

You may want to see also

Claim Process: Follow the insurance company's procedures for filing and handling the claim

When you're involved in a car accident, it's crucial to understand the claim process and follow the insurance company's procedures to ensure a smooth and efficient resolution. Here's a step-by-step guide on how to navigate the claim process:

- Report the Accident: As soon as the accident occurs, contact your insurance company. Provide them with all the necessary details, including the date, time, and location of the incident. Be honest and accurate in your description of what happened. This initial report is essential to initiate the claims process and ensure that the insurance company can start gathering the required information.

- Document Everything: After the accident, it's vital to document all relevant details. Take photographs of the damage to both vehicles, the surrounding area, and any relevant road signs or traffic lights. Obtain contact information from any witnesses and collect their statements. Also, keep records of all medical expenses, repair estimates, and any other costs associated with the accident. These documents will support your claim and help the insurance company assess the damages.

- Contact the Other Driver: If possible, try to contact the other driver involved in the accident. Exchange insurance information, including policy details and contact numbers. Inform them about the accident and encourage them to report it to their insurance company as well. This step is crucial as it ensures that both parties' insurance providers are aware of the incident and can initiate the claims process for their respective parties.

- File the Claim: Follow the instructions provided by your insurance company for filing a claim. This typically involves completing a claim form, providing all the necessary documentation, and submitting it within a specified timeframe. The insurance company will review your claim and may request additional information or evidence. Be responsive and cooperative during this process to expedite the handling of your claim.

- Cooperation and Communication: During the claim process, maintain open communication with your insurance company. Provide any additional information or documentation they request promptly. Be transparent and honest about the events leading up to the accident. Insurance companies often have specific procedures and guidelines, so adhering to their instructions is essential for a successful claim resolution.

- Claim Resolution: The insurance company will investigate the claim, assess the damages, and determine the coverage according to your policy. They may involve adjusters, medical professionals, or other experts to evaluate the situation. Once the investigation is complete, the insurance company will inform you of their decision and provide a settlement offer. This process can vary in duration, but following the company's procedures will ensure a fair and timely resolution.

Remember, each insurance company may have slightly different procedures, so it's essential to familiarize yourself with their specific guidelines. Being proactive, organized, and cooperative throughout the claim process will help ensure a positive outcome and a faster resolution to your insurance claim.

Conquering Old New York Traffic Tickets: Strategies for Success Without Insurance

You may want to see also

Frequently asked questions

Insurance companies typically have specific procedures and timelines for handling claims. If the other driver's insurance company is not contacting you, it could be due to several reasons. They might be investigating the claim, waiting for more information, or following their internal processes. It's important to remain patient and provide any necessary details to both your insurance provider and the other party's insurer to ensure a smooth claims process.

If you've been trying to contact the other driver's insurance company without success, consider sending a formal letter or email outlining the situation, including your policy details, the accident's date and time, and any relevant evidence. You can also try reaching out to your insurance company for guidance on how to proceed. They might be able to intervene and facilitate communication between the two parties.

To expedite the claims process, it's crucial to provide accurate and timely information. Take photos of the accident scene, exchange contact and insurance details with the other driver, and report the incident to your insurance company as soon as possible. Keep all relevant documents organized, and don't hesitate to follow up with the insurance companies if you haven't heard back within a reasonable timeframe.